Kimball Electronics (KE)·Q2 2026 Earnings Summary

Kimball Electronics Beats on EPS as Medical Segment Surges 15%; Raises FY2026 Guidance

February 5, 2026 · by Fintool AI Agent

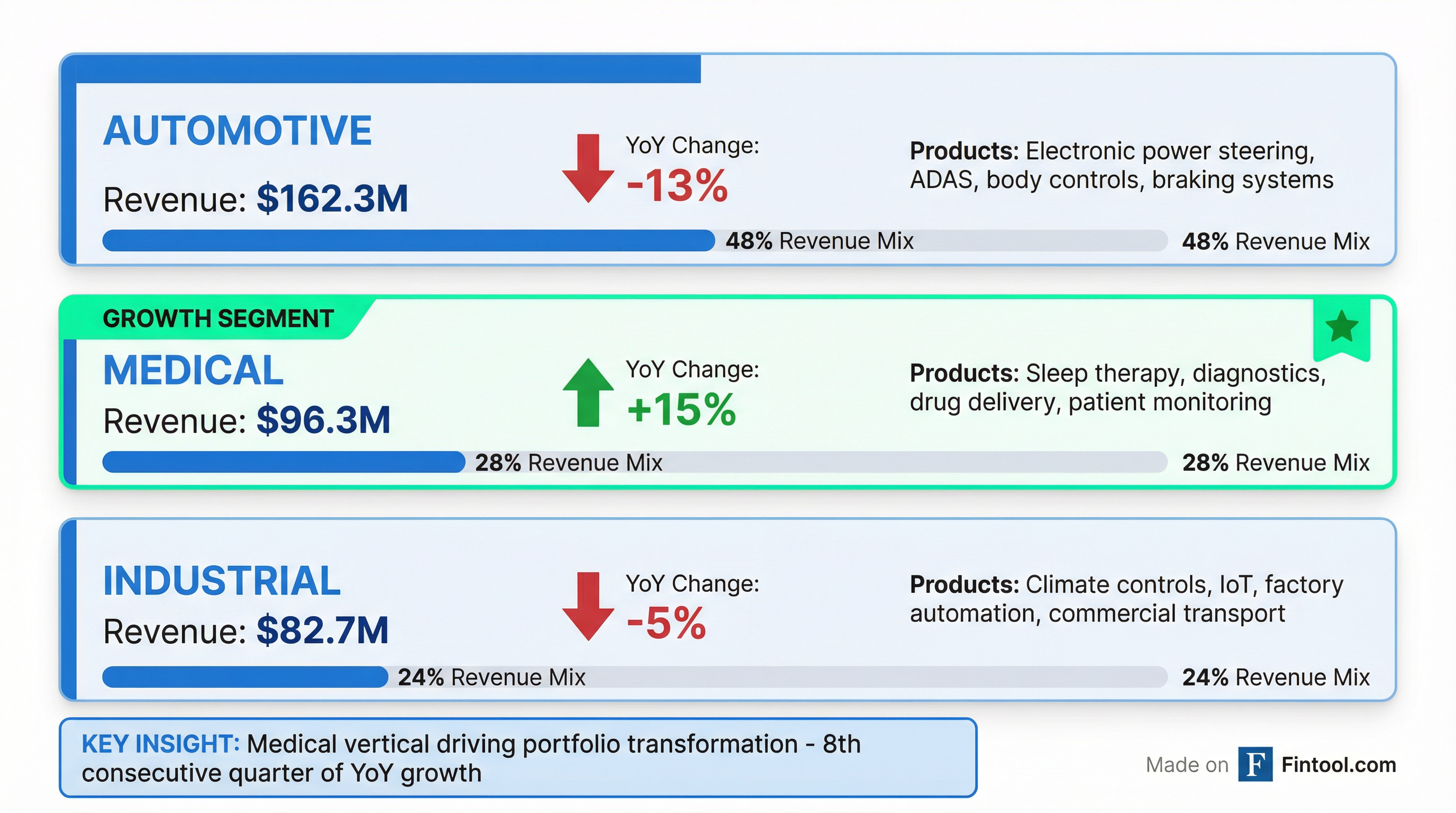

Kimball Electronics (NASDAQ: KE) delivered a solid Q2 FY2026, beating both revenue and EPS estimates while raising full-year guidance. The standout was the medical vertical, which grew 15% year-over-year and now represents 28% of total revenue. However, shares fell 13.5% following the February 5th earnings call after CFO Jana Croom warned that the new Indianapolis medical facility will create margin drag for "2-3 quarters." The company continues its strategic pivot toward higher-margin medical contract manufacturing, highlighted by a recent rebranding to "Kimball Solutions" and the 300,000 sq ft Indianapolis CMO facility.

Did Kimball Electronics Beat Earnings?

Yes — KE beat on both revenue and EPS.

*Consensus estimates from S&P Global

Revenue declined 5% year-over-year (from $357.4M in Q2 FY2025), but this was expected given automotive and industrial headwinds. The beat was driven by:

- Medical outperformance: +15% YoY, offsetting declines elsewhere

- Margin expansion: Gross margin improved 160bps YoY to 8.2%; adjusted operating margin up 80bps to 4.5%

- Cash generation: Eighth consecutive quarter of positive operating cash flow ($6.9M)

What Did Management Guide?

Guidance raised on both sales and margins.

The raised guidance reflects confidence in continued medical momentum and margin improvement. CEO Richard Phillips emphasized: "Our focus as a medical CMO continues to gain momentum as we leverage our unique capabilities in the industry. We expect top-line growth in medical to outpace our other two verticals as we balance our portfolio across the markets we serve."

H2 Revenue Outlook: With $707M in the books, the midpoint of $1,430M implies $723M in H2, suggesting Q3/Q4 revenue roughly in line with Q1's $366M. Key callouts from CFO Jana Croom:

- Medical Q3 comp note: Q3 FY2025 included a $24M consigned inventory sale — management will report growth both including and excluding this item

- Automotive recovering: Q3 should be flat to up as EB100 is anniversaried and European programs ramp

- Industrial remains uncertain: North America focus area as macro headwinds persist

What Changed From Last Quarter?

Several notable developments from Q1 FY2026:

Positive Changes:

- Medical mix increased to 28% of sales (up from 27% in Q1)

- Cash Conversion Days improved to 91 (16-day improvement vs. prior year)

- Company rebranded to "Kimball Solutions" to reflect expanded service offerings

- New Indianapolis medical manufacturing facility opened

Areas of Concern:

- Automotive segment declined 13% YoY, representing ongoing weakness

- Total revenue still contracting (-5% YoY) despite medical strength

- Restructuring charges of $1.8M this quarter

Segment Performance

Medical continues to be the star, with double-digit growth for multiple consecutive quarters. The segment includes sleep therapy, respiratory care, diagnostics, drug delivery, AEDs, and patient monitoring equipment.

Automotive weakness reflects broader EV and traditional auto industry challenges. Products include electronic power steering, ADAS, body controls, and braking systems.

Industrial saw modest decline. Products include climate controls, automation, IoT, and commercial transportation (recently reclassified from automotive).

How Did the Stock React?

KE shares fell sharply following the earnings call, dropping -13.5% to $26.56 on February 5th despite the beat and raised guidance.

The selloff likely reflects investor concerns about:

- Near-term margin drag: CFO Jana Croom explicitly warned the new Indianapolis facility will be "a drag for the next 2-3 quarters" as they run dual facilities and absorb higher depreciation

- Revenue trajectory: H2 requires $723M in revenue, with Q3 medical facing a tough comp from a $24M consigned inventory sale last year

- Automotive/Industrial uncertainty: Continued macro headwinds in North America auto and industrial

Financial Trends (8 Quarters)

Key trends:

- Revenue: Declining from peak levels in FY2024, stabilizing in FY2026

- Margins: Meaningful expansion from trough in Q1 FY2025

- EPS: Recovery from Q3 FY2024 loss driven by goodwill impairment

Balance Sheet & Cash Flow

The company maintains a healthy balance sheet with substantial borrowing capacity and continues generating positive operating cash flow for the eighth consecutive quarter.

Capital Allocation

- Share Repurchases: $4.3M invested to repurchase 149,000 shares in Q2

- CapEx Guidance: $50-60M for FY2026 (unchanged)

- ROIC: 6.7% (trailing 12 months)

Key Takeaways

- Medical pivot gaining traction: 15% growth and now 28% of revenue supports the strategic transformation story

- Margin expansion continues: Gross and operating margins both improved YoY despite revenue decline

- Guidance raised: Confidence in FY2026 outlook with higher sales and margin targets

- Stock sold off -13.5%: Despite the beat, investors reacted to warnings of 2-3 quarters of margin drag from Indianapolis facility ramp

- Indianapolis facility is 300K sq ft: Significant growth capacity for CMO strategy, but dual-facility operations weighing on near-term results

- Automotive stabilizing: EB100 headwind finally lapping; Q3 expected flat to up with European programs ramping

Q&A Highlights

Key analyst questions and management responses from the February 5th earnings call:

On Nexteer and Automotive Customers (Mike Crawford, B. Riley):

- Nexteer remains KE's largest customer at 20% of Q2 revenue (up from 19% in Q1)

- Steer-by-wire programs expanding across Nexteer, ZF, and HL Mando

On Automotive Outlook (Derek Soderberg, Cantor Fitzgerald):

- Q3 automotive expected to be flat to slightly up as EB100 braking program is finally anniversaried

- Europe rebounding nicely with new programs in steering and braking

On Indianapolis Facility Capacity (Mike Crawford, B. Riley):

- New CMO facility is 300,000 sq ft — "considerably larger than our current footprint"

- Revenue capacity depends on product mix but represents "significant opportunity for growth"

- Philips content unlikely in new facility; focus is on new customers

On Margin Impact of New Facility (Anja Soderstrom, Sidoti):

- CMO space expected to be margin accretive long-term

- Near-term drag for 2-3 quarters due to dual facility operations, higher depreciation, and startup costs

- CFO: "The operating income margin that we produced in Q2, considering the fact that we had $16 million less sales and the impact of the grand opening of the Indy facility... is a testament to our commitment as a leadership team"

On EPP Program & ADAS (Max McAuliffe, Lake Street):

- Electronic Power Pack (EPP) program is exciting as KE's first automotive high-level assembly combining motor and PCB

- EPP size is approximately 2/3 of the prior EB100 braking program

- Future strategic interests include ADAS central compute units

On "Lift and Shift" Opportunities (Rick Phillips, CEO):

- Seeing increased interest from customers wanting to exit in-house manufacturing

- These tend to be larger programs — potentially an entire plant's worth of production

On M&A Strategy (Andy Regrut, VP IR):

- Strategic interest in expanding into in vitro diagnostics and cardiology

- Would consider adjacencies that bring new customers or manufacturing capabilities

Conference Call

The Q2 FY2026 earnings call was held on Thursday, February 5, 2026. A replay is available at investors.kimballelectronics.com.

Data sources: Kimball Electronics 8-K filing (February 4, 2026), Q2 FY2026 earnings call transcript (February 5, 2026), S&P Global estimates

Related Links: