KKR & Co. (KKR)·Q4 2025 Earnings Summary

KKR Beats on Revenue and EPS, Announces $1.4B Arctos Acquisition and Targets $100B Solutions Platform

February 5, 2026 · by Fintool AI Agent

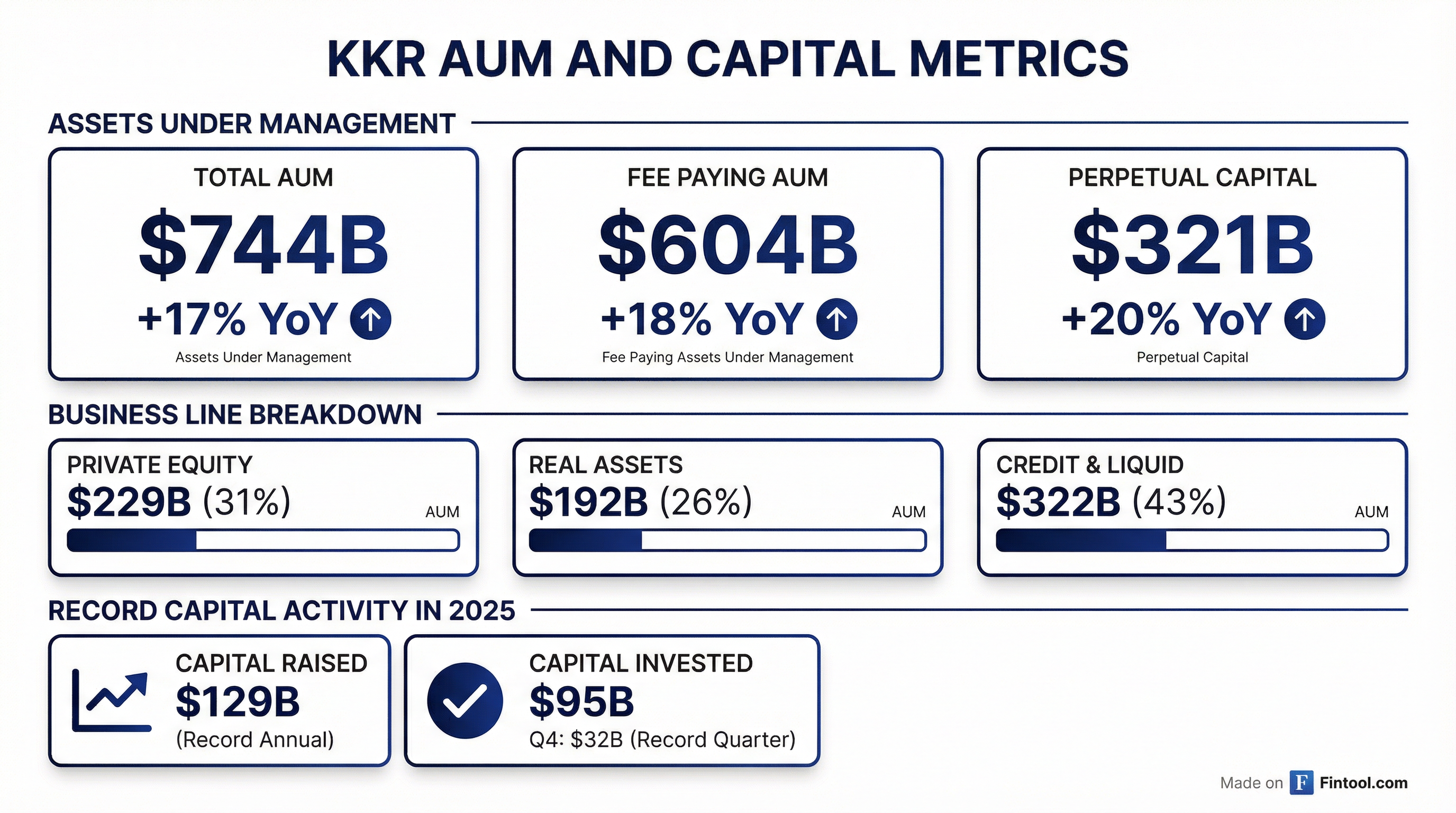

KKR delivered strong Q4 2025 results, beating consensus on both revenue and EPS while announcing record annual capital raising of $129 billion and a $1.4 billion acquisition of Arctos Partners to create KKR Solutions — a new platform targeting $100B+ AUM in sports, GP solutions, and secondaries. Fee Related Earnings grew 15% year-over-year to $972 million ($1.08/share), with management expressing "high confidence" in exceeding 2026 FRE and fundraising targets.

Did KKR Beat Earnings?

Yes — KKR beat on all key metrics.

For the full year 2025, KKR reported:

- Fee Related Earnings: $3.7 billion ($4.13/adjusted share), up 14% YoY

- Total Operating Earnings: $5.0 billion ($5.54/adjusted share), up 14% YoY

- Adjusted Net Income: $4.4 billion ($4.87/adjusted share)

Note: Adjusted Net Income per share of $1.12 in Q4 was impacted by a previously disclosed carried interest repayment obligation. Excluding this impact, ANI/adjusted share would have been $1.30 for the quarter and $5.05 for the year.

How Did the Stock React?

KKR shares traded lower on earnings day despite the beat, down -4.6% to $99.94 amid broader market volatility:

The stock weakness despite strong fundamentals reflects broader market concerns. On the earnings call, management addressed this directly, noting this is the 10th time in 16-17 years as a public company that KKR stock has fallen 20%+ in a month. Co-CEO Scott Nuttall pointed out that historically these periods have been "great entry points" with strong 1-2 year returns for investors.

What Changed This Quarter?

Capital Metrics Set Records

Q4 2025 marked KKR's most active investment quarter in the firm's history:

Arctos Partners Acquisition — $1.4B Deal Creates KKR Solutions

KKR announced a definitive agreement to acquire Arctos Partners, a $15 billion AUM platform:

Arctos brings three businesses:

- Sports Investing — Largest institutional investor in professional sports franchise stakes, approved for multi-team ownership across all five major U.S. leagues

- GP Solutions — Rapidly growing asset class focused on providing liquidity to alternative asset managers

- Secondaries Expertise — Led by Ian Charles, one of the industry's pioneers in structured secondaries

Management emphasized they've "evaluated most of the Secondaries asset managers that have traded over the last decade" but waited for the right cultural fit. They expect Arctos to be "accretive per share across key financial metrics immediately post-closing."

Q&A Highlights: Tariffs, AI, and Monetization Pipeline

The earnings call Q&A addressed investor concerns about tariffs, AI disruption, and the exit environment. Here are the key takeaways:

On Tariff Exposure

"We got a little bit of a look-see as to what could be coming during the first Trump administration... We have single-digit % of our portfolio and a lot of our business is low single-digit % that we've got any anxiety about tariffs. So we feel very comfortable and relaxed on that front."

— Scott Nuttall, Co-CEO

On AI and Software Exposure

"Software is about 7% of our AUM, and that is with a highly inclusive definition of software. Our concentration is well below our industry, well below broad equity and credit indices... When we took an inventory of our portfolio and said 'is AI an opportunity, a threat, or a question mark?' — where it was a threat or question mark, we started selling assets several years ago."

— Scott Nuttall, Co-CEO

Management highlighted the recent sale of OneStream at a 30% premium and 4.5x invested capital as an example of disciplined software investing.

On Monetization Visibility

"We've got roughly $900 million of visibility from signed deals or deals that have already happened of monetization-related revenue coming... I would contrast that to where we were at this time last year on this call where that number was approximately $400 million. So our momentum on the monetization front continues to really accelerate."

— Rob Lewin, CFO

On 2026 Guidance Confidence

"We are highly confident in our ability to meaningfully exceed our fundraising and FRE per share targets. Presuming a constructive monetization environment, we also continue to feel confident that we can achieve $7+ per share of adjusted net income."

— Rob Lewin, CFO

On Private Wealth Momentum

January 2026 private wealth capital raise was ~$1.3 billion, up ~20% from January 2025, despite market volatility. K-Series AUM has grown from $18 billion a year ago to $35 billion today.

On Global Atlantic Insurance Earnings

Management guided to $250+ million per quarter for insurance operating earnings, but noted that $250 million of accrued income is not currently showing up in the P&L due to cash accounting. This figure is expected to reach $300-350 million in 2026 and begin converting to cash earnings in 2027-2028.

What Did Management Say?

"2026 is a special year at KKR, as we will be celebrating our 50th anniversary on May 1st. While we have been in this business for five decades, we still feel like a very young firm, with our three growth engines: asset management, insurance, and strategic holdings positioning us extremely well over the long term."

— Rob Lewin, CFO

"Volatility always creates opportunity in our business. Our focus is making sure we don't waste it. We got a better part of $120 billion [of dry powder]. How do we make sure we invest it well and take advantage of what's on offer?"

— Scott Nuttall, Co-CEO

On Stock Price Volatility

"Every time the market gets anxious about virtually anything, our space and our stock trade off... This is the 10th time we've seen our stock down more than 20% in a month. Looking back, it tends to be a great entry point for our stock. The 1-2-year average returns, if you invest in that period of time, have been really strong."

— Scott Nuttall, Co-CEO

Dividend Increase Announced

Beginning with Q1 2026, KKR intends to increase its regular annualized dividend from $0.74 to $0.78 per share. This marks the seventh consecutive year of dividend increases since C-Corp conversion.

Segment Breakdown

Asset Management Segment

Key segment highlights:

- Private Equity: Deployment driven by traditional PE in Europe/Americas and core PE; traditional PE portfolio appreciated 14% for the year

- Real Assets: Infrastructure portfolio up 11%, opportunistic real estate up 5% for the year; nearly $15 billion invested in infrastructure in 2025 — a record

- Credit & Liquid: AUM breakdown includes $145B leveraged credit, $85B asset-based finance, $50B direct lending; $44 billion deployed in credit in 2025 (+14% YoY)

Regional Deployment Highlights

Asia emerged as a major growth driver:

- Investment activity up 70%+ vs 2024

- 9 offices and ~1,000 employees in region, 200+ in Japan

- Recent deals include digital infrastructure (announced this week) and Sapporo real estate carve-out

Global Take-Private Activity:

- ~30 take-privates executed since 2022 globally

- 2025 take-privates in Japan, Germany, UK, India, and Sweden

- "We've been as active as anybody in our industry" in this category

Insurance Segment (Global Atlantic)

Strategic Holdings Segment

Strategic Holdings Operating Earnings increased to $44 million in Q4 and $162 million for the year, with KKR's share of LTM Adjusted EBITDA of $1.1 billion across the portfolio. Management expects Strategic Holdings Operating Earnings to reach:

- $350M+ by 2026

- $700M+ by 2028

- $1.1B+ by 2030

Balance Sheet and Financial Position

Key balance sheet highlights:

- Embedded gains: $3.0 billion of unrealized gains on the balance sheet

- Gross unrealized performance income: $10.2 billion as of December 31, 2025

- Undrawn revolver: $2.75 billion corporate credit facility

Forward Catalysts

- Arctos Acquisition Close (Q2 2026) — Will establish KKR Solutions platform targeting $100B+ AUM in sports, GP solutions, and secondaries

- KKR's 50th Anniversary — May 1, 2026, likely to be accompanied by investor engagement and strategic announcements

- Dividend Increase — $0.78 annualized starting Q1 2026 (7th consecutive increase)

- Record Embedded Gains — $19 billion in unrealized gains (+19% YoY, +50% vs 2 years ago) positions firm for future monetizations

- Insurance Accrued Income Conversion — $250-350M of accrued income expected to begin converting to cash earnings in 2027-2028

- Fundraising Momentum — Already raised $240B of $300B+ target (80%+ complete) with flagship funds tracking above predecessors

Historical Earnings Performance

Values retrieved from S&P Global

KKR has beaten EPS consensus in 8 of the last 8 quarters, demonstrating consistent execution and conservative guidance.

Key Risks and Concerns

- Carried Interest Repayment: The Q4 2025 results were negatively impacted by a previously disclosed carried interest repayment obligation that reduced net realized performance income by $207 million. Excluding this, ANI per share would have been $1.30 vs reported $1.12.

- Stock Price vs 52-Week High: Trading at $99.94 vs $155.61 high (36% below peak) reflects market concerns about alt-asset valuations, though management notes this pattern has historically been a "great entry point"

- Perpetual Capital Duration Risk: While 43% of AUM is perpetual capital, it "can be subject to material reductions and even termination" under certain conditions

- Integration Risk: Arctos $1.4B acquisition adds complexity; KKR intends to build secondaries from scratch rather than acquire existing platforms, which carries execution risk

- Monetization Environment Dependency: Management noted if monetization environment deteriorates, they "may delay some monetization activity" which would reduce 2026 earnings but "be in service of more earnings in 2027 and beyond"

What Management Says Is NOT a Risk

Related Resources

Data sourced from KKR 8-K and Q4 2025 earnings call transcript filed February 5, 2026, and S&P Global/Capital IQ. Stock prices as of market close February 5, 2026.