KOSS (KOSS)·Q2 2026 Earnings Summary

Koss Corporation Q2 FY2026: Revenue Drops 20% as Tariffs Squeeze Margins

January 29, 2026 · by Fintool AI Agent

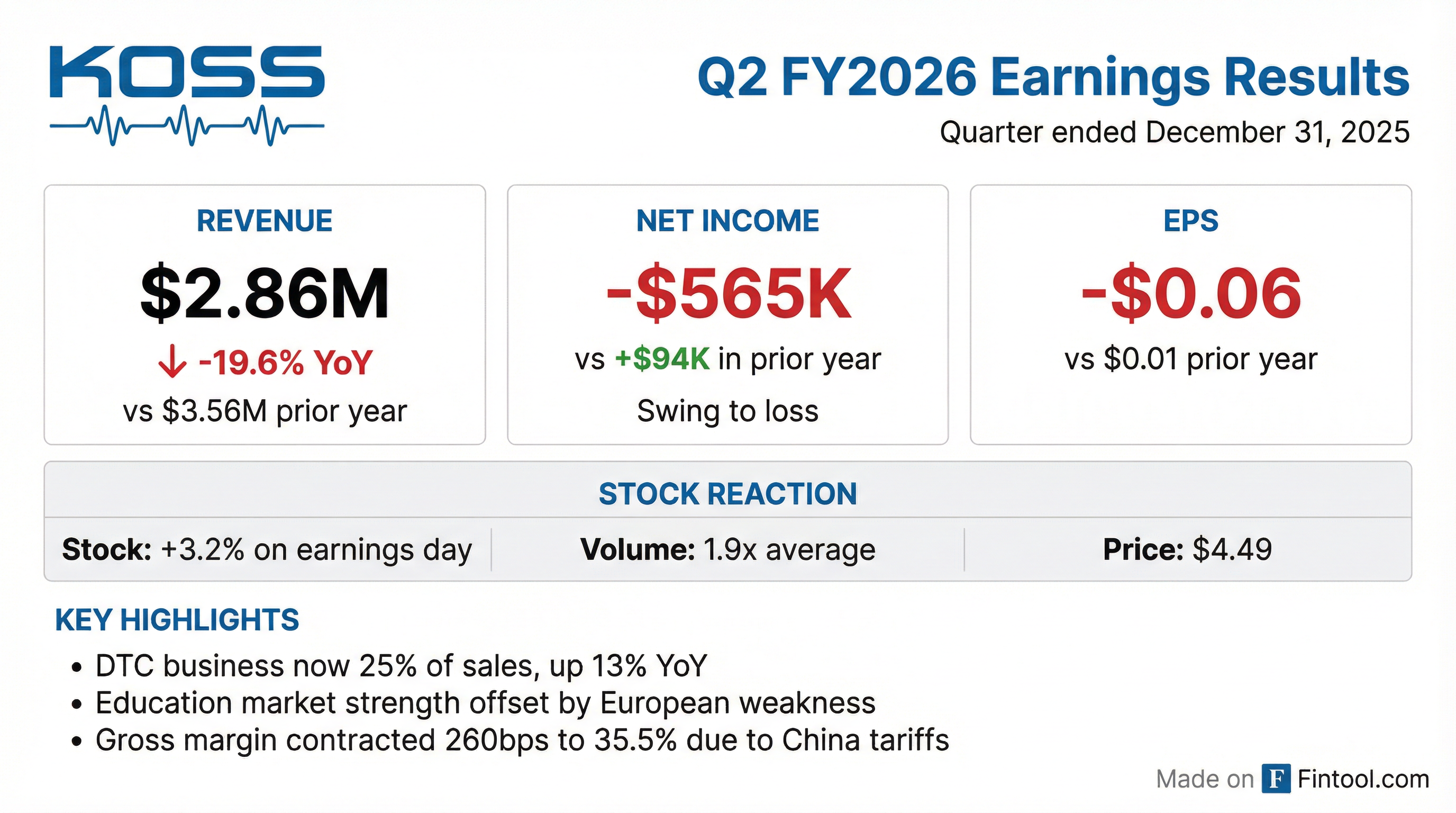

Koss Corporation (NASDAQ: KOSS), the Milwaukee-based headphone maker, reported a challenging Q2 FY2026 with revenue declining 19.6% year-over-year to $2.86 million and swinging to a net loss of $565,407 compared to net income of $94,142 in the prior year period . The company attributed the decline to the absence of European product launches that boosted results a year ago, while also facing significant margin pressure from China tariffs.

Did Koss Beat Earnings?

Koss Corporation does not have Wall Street analyst coverage, so there were no consensus estimates for revenue or EPS. However, the results represented a significant deterioration from both the prior year and the prior quarter:

The six-month (H1 FY2026) picture was more stable, with revenue up 2.6% to $6.93 million and a net loss of $322K comparable to the prior year's $325K loss .

What Drove the Revenue Decline?

CEO Michael J. Koss provided color on the revenue dynamics in the earnings release :

European Weakness (-)

"The Company experienced strong sales gains in the Education market for the first two quarters of fiscal year 2026 compared to the prior year, the growth was mostly offset by the prior year's sales uplift in our European markets resulting from new product launches that didn't recur in this fiscal year."

Direct-to-Consumer Strength (+)

"The Company's direct-to-consumer (DTC) business, which now makes up approximately 25% of the Company's total sales, experienced growth of 13% year-over year."

Key Takeaway: The channel mix is shifting toward DTC (higher margin) but not fast enough to offset wholesale weakness in Europe.

How Did Tariffs Impact Margins?

The most significant story this quarter was margin compression. Gross margin collapsed to 29.0% in Q2 from 39.5% a year ago—a 1,050 basis point decline .

CEO Koss explained the tariff dynamics :

"Gross margins fell by 260 basis points, from 38.1% in the first six months of fiscal year 2025 to 35.5% for the comparable period in fiscal year 2026. The current year margin degradation was primarily due to the sell-through of product purchased from China when tariffs were at a peak rate of 145%."

The tariff headwind should moderate as the company works through high-cost inventory, but this remains a key risk factor given ongoing U.S.-China trade tensions.

What Changed From Last Quarter?

The sharp sequential decline reflects seasonality (education sales are stronger in Q1 back-to-school) combined with the concentrated tariff inventory impact in Q2.

How Did the Stock React?

KOSS shares rose +3.2% on earnings day, closing at $4.49 on volume of 97,033 shares—nearly 2x the 30-day average .

The positive reaction despite weak results suggests the market may have expected worse, or investors are looking through the near-term tariff headwinds.

Historical Earnings Trend

Koss has struggled with profitability, with only two profitable quarters in the past eight:

Pattern: Profitability appears seasonal, with Q2 (back-to-school benefit carrying over) historically the best quarter.

Key Risks and Concerns

-

Tariff Uncertainty — The company called out "trade tensions between the U.S. and China given recently enacted tariffs and their uncertainty" as a risk factor . With products sourced from China, Koss remains vulnerable to trade policy changes.

-

European Dependence — Without new product launches, European sales dropped significantly. The company needs a stronger product pipeline to stabilize this region.

-

Scale Disadvantage — With ~$14M in annual revenue and a $42M market cap, Koss lacks the scale to negotiate favorable supplier terms or absorb tariff impacts like larger competitors.

-

Profitability Struggle — The company has posted losses in 6 of the last 8 quarters, raising questions about the sustainability of the current business model.

Forward Catalysts

- Tariff inventory clearance — As high-cost inventory clears, margins should improve in H2 FY2026

- DTC momentum — 13% growth in DTC (25% of sales) provides a path to higher margins

- Education market — Back-to-school Q1 FY2027 could deliver another strong quarter

- New product launches — Key to reversing European weakness

Bottom Line

Koss posted a difficult Q2 with revenue down 20% and margins collapsing due to tariff impacts on Chinese-sourced inventory. The DTC business (25% of sales) growing 13% is a bright spot, but the company needs to stabilize European sales and work through tariff headwinds to return to profitability. With no analyst coverage and a $42M market cap, KOSS remains a micro-cap stock with limited liquidity and high execution risk.

Data sources: Koss Corporation 8-K filed January 29, 2026, historical 10-Q filings, market data from S&P Global.