KEY TRONIC (KTCC)·Q2 2026 Earnings Summary

Key Tronic Takes $10.5M Restructuring Hit as China Manufacturing Winds Down

February 3, 2026 · by Fintool AI Agent

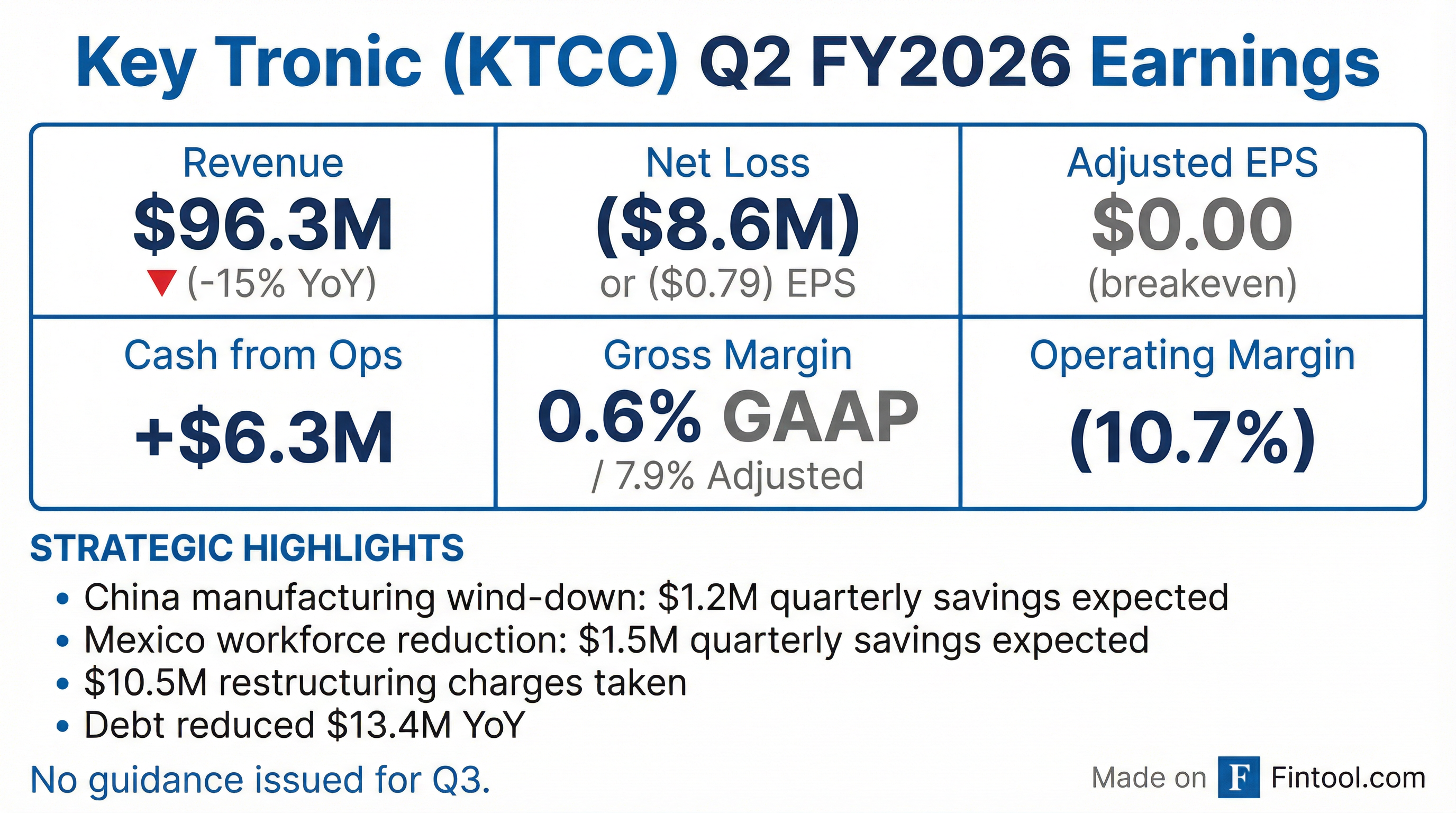

Key Tronic Corporation (NASDAQ: KTCC) reported Q2 FY2026 results reflecting the pain of a major restructuring. Revenue declined 15% year-over-year to $96.3 million as the electronic manufacturing services provider executes a strategic pivot away from China manufacturing toward US and Vietnam operations .

The quarter included $10.5 million in restructuring charges related to winding down the China manufacturing facility and further Mexico workforce reductions. On an adjusted basis, the company achieved breakeven—a notable improvement from the $4.1 million adjusted loss in the year-ago period .

Did Key Tronic Beat Earnings?

Limited analyst coverage prevents a traditional beat/miss calculation. Key Tronic is a small-cap EMS company (~$31M market cap) with minimal Wall Street coverage.

The adjusted metrics tell a different story than GAAP: excluding restructuring charges, gross margin improved 110 basis points year-over-year, and the company swung from an adjusted loss to breakeven.

What Drove the Revenue Decline?

Revenue fell 15% to $96.3 million due to multiple headwinds :

- Reduced demand from a longstanding customer — ~$20 million impact from product maturation requiring a design refresh

- End-of-life program transition — ~$7 million revenue loss from a program rolling off

- Delayed new program launches — Customers facing macroeconomic and trade policy uncertainty

- Consigned materials program ramp — Revenue recognition timing shift

These declines were partially offset by increased demand from approximately 6 longstanding customers and new program ramps .

Revenue Trend (Last 8 Quarters)

Revenue has declined for six consecutive quarters. The company's near-shoring strategy and new program wins have yet to offset customer demand weakness.

What's the China Strategy?

Key Tronic is exiting manufacturing in China, shifting to a sourcing-only model :

- Wind-down completion: End of FY2026 (June 2026)

- Expected savings: ~$1.2 million per quarter post-completion

- Remaining China function: Sourcing and procurement to support global facilities

- Production shift: Moving to US and Vietnam facilities

CEO Brett Larsen explained the rationale: "Due to ongoing geopolitical tensions and tariff uncertainties, we chose to cease manufacturing operations at our China facility while maintaining a strategic sourcing presence" .

Mexico Workforce Reduction

In parallel, the company reduced its Mexico workforce :

- Headcount reduction: ~40% over the past 18 months

- Additional quarterly savings: ~$1.5 million (phasing in Q3 FY2026)

- Production shift: Transferring to US and Vietnam

Management expects approximately half of manufacturing to occur in US and Vietnam facilities by end of FY2026 .

Vietnam Expansion

The Vietnam facility now offers new capabilities :

- Doubled manufacturing capacity

- Medical device manufacturing certification — Shipped first medical products from Da Nang

- Positioned as the low-cost, high-quality alternative to China

Tariff Mitigation Strategy

On the earnings call, CEO Larsen explained Key Tronic's competitive positioning for customers navigating tariff uncertainty :

"We can easily quote from all three locations—US, Mexico, Vietnam—and offer our customer the lead time required, pricing, and pros and cons from building in each location. We really offer that suite of answers to our customers regardless of where tariffs end up."

This multi-location quoting capability is driving increased customer engagement, with management noting an "influx of new customer visits and audits of our Juarez campus" as pricing becomes more competitive .

Key uncertainty: The USMCA trade agreement is up for mid-year 2026 review. Management expressed hope the trilateral agreement continues, which would preserve Mexico's tariff advantages .

How Did the Stock React?

The stock closed flat on the day at $2.89, with after-hours trading showing a 3.1% decline to $2.80 as investors digest the results. KTCC trades 27% below its 52-week high and 31% above its 52-week low.

What Did Management Guide?

No guidance was issued for Q3 FY2026 .

Management cited:

- Uncertainty in timing of new program ramps

- Continued macroeconomic uncertainty

- Volatile trade policies

However, CEO Larsen provided directional commentary: "We expect to see our revenue gradually begin to rebound, improved operating efficiencies to take hold and a return to profitability by the end of fiscal 2026" .

On the earnings call, management confirmed they still expect to achieve breakeven by the June quarter (Q4 FY2026) . This requires both revenue growth and margin expansion, with the consignment program in Mississippi playing a key role in improving gross margin percentage.

Q&A Highlights

Key exchanges from the investor call:

On gross margin pressure — George Melis (MKH Management) asked about the sequential adjusted margin decline. Management cited: (1) program transfers from Mississippi to Arkansas incurring extra costs, (2) holiday production loss (Mexico closed a full week, US sites half a week), and (3) unfavorable mix changes .

On the China savings flow-through — The $1.2 million quarterly savings is a net number that flows primarily through COGS with some OpEx reduction .

On Mexico outlook — Management described Mexico as hitting "bottom" after the 40% headcount reduction, with increased quoting volume and customer visits suggesting the facility is now price-competitive. Growth is expected over the longer term .

On the consignment program — The Mississippi-based program is ramping slower than hoped due to equipment lead times and an ice storm, but management expects it to reach peak contribution by Q4 FY2026 .

What Changed From Last Quarter?

The biggest change: China exit is now official and underway. This quarter crystallized $10.5 million in restructuring charges that should unlock ~$2.7 million in combined quarterly savings (China + Mexico) by Q1 FY2027.

Balance Sheet and Cash Flow

Positive cash generation continues despite operational challenges :

Cash from operations of $6.3 million enabled debt reduction. The company has paid down $13.4 million in debt year-over-year despite revenue headwinds—a sign of working capital discipline.

New Program Wins

Despite demand weakness, Key Tronic continued winning new business with specific scale and location details from the earnings call :

Additionally, the consignment program with a data processing OEM in Corinth, Mississippi continues ramping. Management noted this program could reach $25 million in annual revenue—roughly equivalent to a $100 million turnkey program due to the improved margin profile . An ice storm in Mississippi delayed the ramp by 1-2 weeks but management expects momentum to continue .

Key Tronic also expects double-digit growth in its Arkansas facility during the latter half of FY2026 .

Key Risks and Concerns

- Revenue trajectory: Six consecutive quarters of YoY decline with no near-term visibility

- Customer concentration: "Longstanding customer" demand reduction suggests key account weakness

- Tariff uncertainty: Trade policy volatility continues to delay customer decisions

- Restructuring execution: China wind-down and Mexico right-sizing must execute on time

- Liquidity: Minimal cash cushion ($0.8M) though positive cash generation continues

The Bottom Line

Key Tronic is in the middle of a painful but necessary transformation. The $10.5 million restructuring charge looks ugly on the income statement, but the underlying business showed improvement—adjusted gross margin expanded and the company achieved adjusted breakeven versus a loss last year.

The strategic bet: trading China manufacturing exposure for a simplified US/Mexico/Vietnam footprint that better serves customers navigating tariff uncertainty. If new program ramps materialize and cost savings flow through, management's target of profitability by FY2026 end is achievable.

For now, investors get a $31 million market cap company with improving adjusted margins, positive cash generation, and a clear (if uncertain) path to profitability.

This analysis is based on Key Tronic's Q2 FY2026 8-K filing and related financial data. For the full earnings call, see the transcript.