LANDMARK BANCORP (LARK)·Q4 2025 Earnings Summary

Landmark Bancorp Posts Record Year with 44% Earnings Growth, NIM Expansion Continues

January 28, 2026 · by Fintool AI Agent

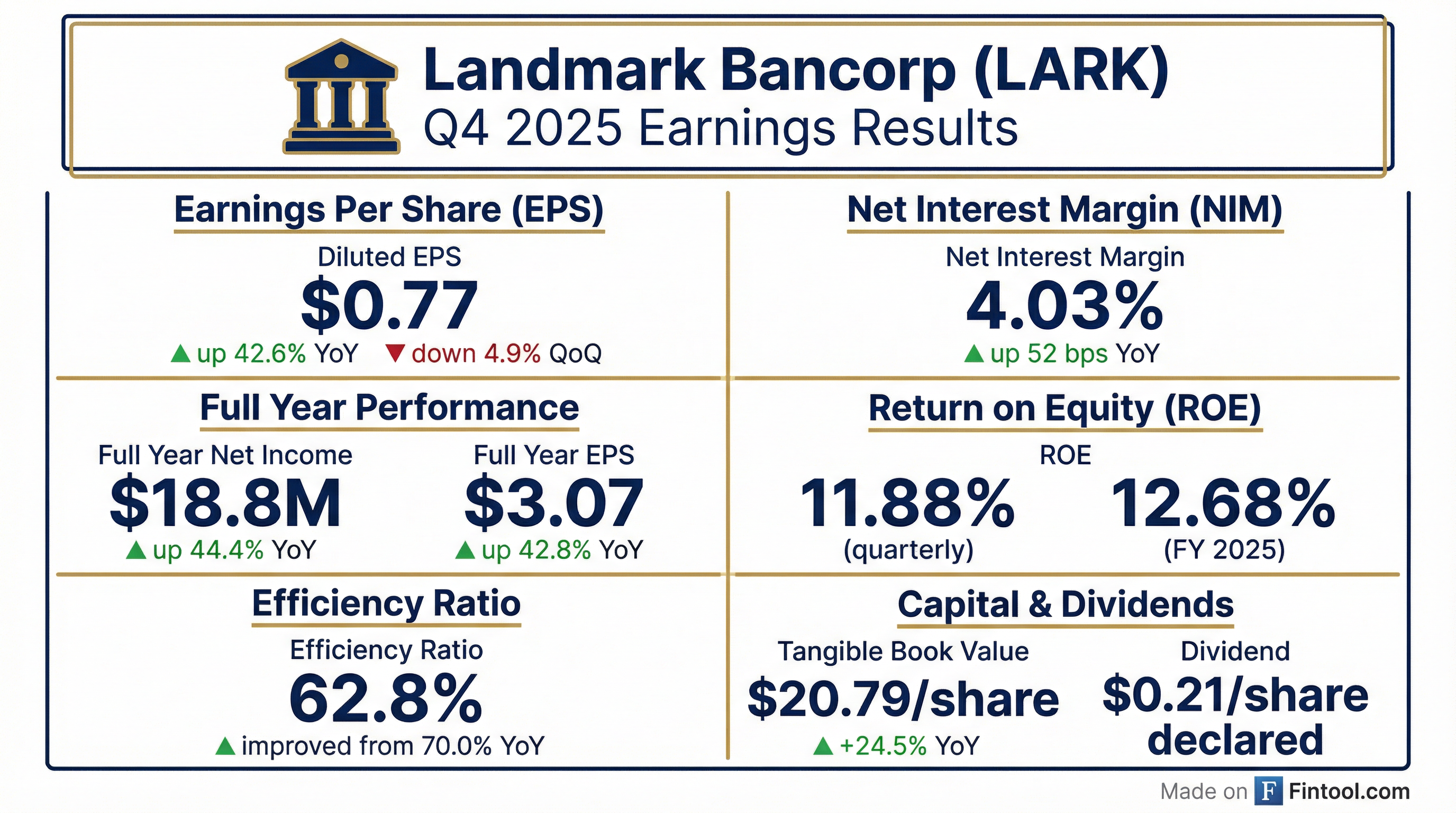

Landmark Bancorp (NASDAQ: LARK) capped off a transformational 2025 with fourth quarter diluted EPS of $0.77 and full year earnings growth of 44.4%. The Manhattan, Kansas-based community bank delivered four consecutive quarters of net interest income expansion, meaningful efficiency gains, and accelerating tangible book value growth, reflecting successful execution on deposit repricing and disciplined expense management.

Did Landmark Beat Earnings?

Landmark Bancorp does not have broad analyst coverage, so there is no consensus estimate to compare against. However, the results demonstrate strong sequential and year-over-year improvement:

The sequential EPS decline from Q3 ($0.81) to Q4 ($0.77) was driven primarily by higher compensation costs (+$511K), a $356K valuation allowance on repossessed assets, and higher professional fees (+$173K).

What Did Landmark Report for the Full Year?

Full year 2025 represented a step-change in profitability for Landmark:

Net interest income grew $10.0 million year-over-year, driven by higher interest on loans coupled with lower funding costs.

What Drove the Margin Expansion?

Net interest margin expanded 20 basis points sequentially to 4.03% and 52 basis points year-over-year, driven by both asset repricing and liability cost reduction:

Asset Yields:

- Loan portfolio yield increased 3 bps QoQ to 6.40%

- Investment securities yield grew to 3.39%

Funding Costs:

- Interest-bearing deposit costs declined 12 bps QoQ to 2.06%

- Total deposit costs improved to 1.50%

- Other borrowing costs decreased 16 bps to 4.93%

Interest on deposits decreased $272K quarter-over-quarter due to lower rates, partially offset by increased average balances. Interest on other borrowed funds decreased $325K from lower rates and average balances.

How Did the Stock React?

LARK shares closed at $26.40 on the day of the earnings release, down 2.2% on the session. However, the stock has been a strong performer over the past year:

The stock trades at approximately 1.0x tangible book value ($20.79) and 8.6x trailing earnings ($3.07 FY25 EPS).*

What Changed From Last Quarter?

Positives:

- Net interest margin expanded 20 bps to 4.03% — fourth consecutive quarter of NIM expansion

- Total deposits grew $63.4 million (19% annualized) driven by money market and checking accounts

- Tangible book value per share grew at 16.4% annualized rate to $20.79

- Net charge-offs normalized to $341K from $2.3M in Q3 (which included a single commercial credit charge-off)

- Total borrowings decreased $79.8 million as deposit growth funded loan portfolio

Headwinds:

- Gross loans declined $6.3 million as commercial and 1-4 family residential paydowns offset CRE and agriculture growth

- Non-interest expense increased $1.0 million QoQ (+9.0%) due to higher compensation, professional fees, and a valuation allowance on repossessed assets

- Non-interest income declined $169K due to $101K loss on investment securities sales

What Did Management Say?

CEO Abby Wendel highlighted the year's accomplishments:

"Our fourth quarter results capped off a year of outstanding revenue growth, increased profitability, and solid growth in diluted earnings per share and tangible book value per share. For the year, we delivered four consecutive quarters of net interest income expansion, average loan growth of 11.5% year-over-year, reduced deposit costs and an improved efficiency ratio."

On investments and strategy:

"While we maintained solid expense discipline throughout 2025, we also made investments in our people and enhanced our capabilities to better serve our customers and prospects."

What Is the Balance Sheet Position?

Capital ratios strengthened meaningfully, with tangible common equity to assets improving 145 bps year-over-year to 8.03%.

What Is the Credit Quality Picture?

Non-performing loans declined $3.1 million (23.8%) from year-end 2024 to $10.0 million. Full year net charge-offs totaled 0.25% of average loans.

What About the Dividend?

Landmark's Board declared a cash dividend of $0.21 per share, payable February 26, 2026, to stockholders of record as of February 12, 2026.

This represents the 98th consecutive quarterly cash dividend since the parent company's formation in 2001 — a notable milestone reflecting the bank's long-term commitment to shareholder returns.

The dividend represents a 10.5% increase from the $0.19 quarterly dividend paid in Q4 2024. Full year 2025 dividends totaled $0.80 per share versus $0.76 in 2024.

What Are the Key Risks?

Management highlighted several risk factors in the forward-looking statements:

- Interest rate sensitivity: Changes in interest rates and prepayment rates could impact asset yields and funding costs

- Credit risk: Concentrations in commercial real estate loans and large borrowers

- Deposit concentration: Large deposits from clients with balances above FDIC insurance limits

- Competition: Increased competition from non-bank competitors including fintech companies and credit unions

- Economic conditions: Local, state, and national economic conditions including effects of inflation and tariffs

Earnings Call Details

Landmark will host a conference call on Thursday, January 29, 2026 at 10:00 a.m. Central time. Dial-in: (833) 470-1428, access code 980662. A replay will be available through February 5, 2026 at (866) 813-9403, access code 974716.

*Values retrieved from S&P Global and market data as of January 28, 2026.

Related: LARK Company Page | Q3 2025 Earnings | Latest Transcript