LCNB (LCNB)·Q4 2025 Earnings Summary

LCNB Misses EPS on Loan Reserve, But NIM Expansion and Book Value Growth Highlight Transformative Year

January 29, 2026 · by Fintool AI Agent

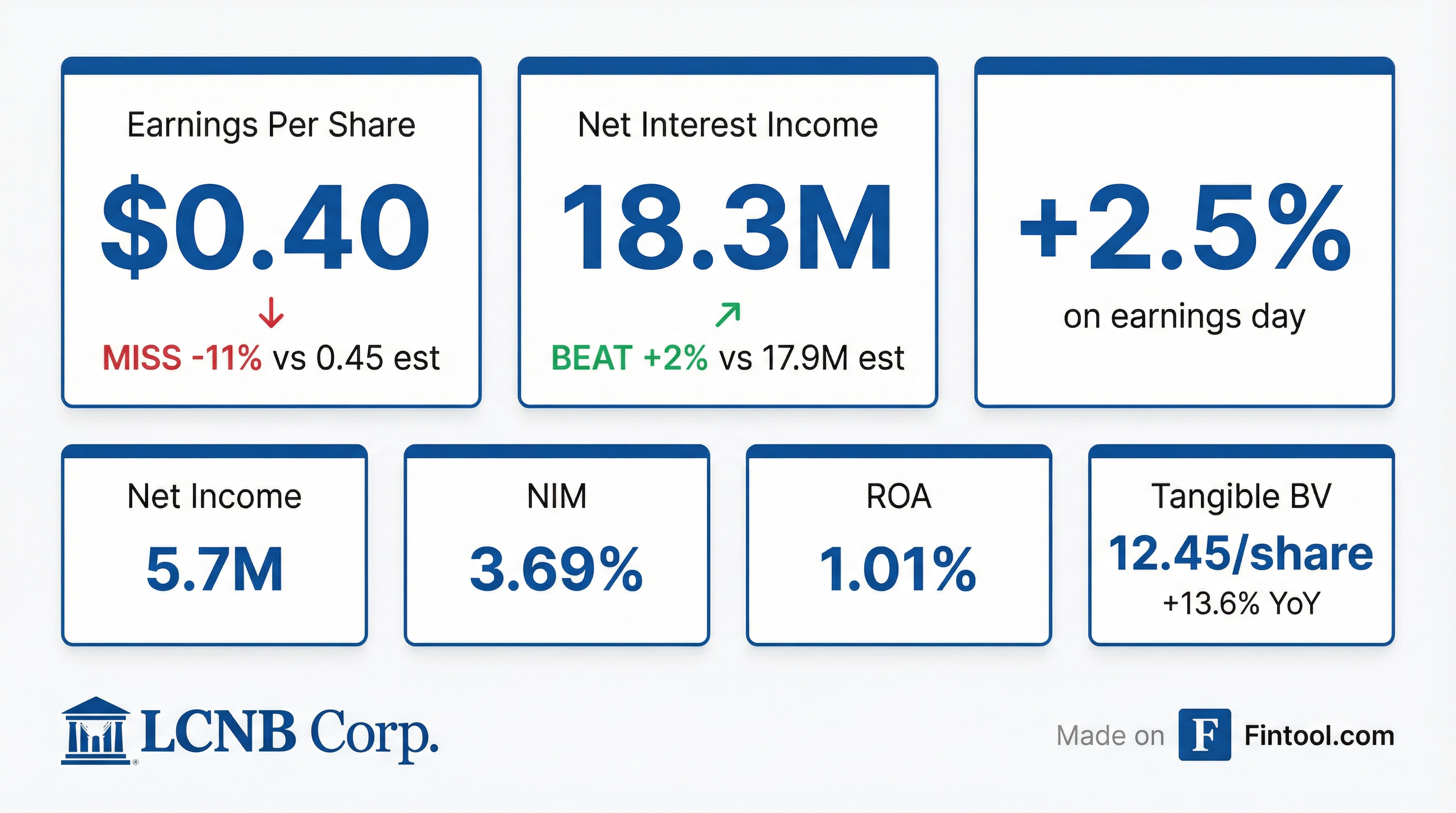

LCNB Corp (NASDAQ: LCNB) reported Q4 2025 results with a mixed picture: EPS of $0.40 missed consensus by 11% due to a one-time loan reserve, while net interest income beat expectations by 2%. The stock rose 2.5% on the news as investors focused on the strong full-year performance and 13.6% growth in tangible book value.

Did LCNB Beat Earnings?

The EPS miss was driven by a $1.5M provision for credit losses, up from $0.6M in Q4 2024. Management specifically called out a $1.4M reserve against a single logistics sector loan, which reduced after-tax EPS by $0.08.

For the full year, LCNB posted record net income of $23.1M (+71% YoY), though FY 2025 EPS of $1.63 came in slightly below the $1.70 consensus.

What Drove the Quarter?

Net Interest Margin Expansion: The headline story continues to be NIM improvement. Tax-equivalent NIM expanded 47 basis points YoY to 3.69% in Q4 2025, compared to 3.22% in Q4 2024. For the full year, NIM was 3.50% vs 2.91% in 2024.

The NIM expansion was driven by:

- Lower funding costs: Average rate paid on interest-bearing liabilities fell to 1.89% from 2.54% YoY

- Strategic deposit mix shift: Runoff of higher-cost CDs and IRAs as part of funding optimization

- Stable loan yields: Average loan yield of 5.48% remained strong

Wealth Management Record: LCNB Wealth Management assets grew 12.9% YoY to a record $1.56 billion, driving record fiduciary income of $9.5M for FY 2025 (+12.9% YoY). Q4 fiduciary income was $2.5M, up 9% YoY.

What Changed From Last Quarter?

The sequential EPS decline was almost entirely driven by the higher credit provision. Core operating trends remained healthy with continued NIM expansion and stable expenses.

How Did the Stock React?

LCNB shares rose +2.5% on earnings day, closing at $17.26.* The positive reaction suggests investors looked past the EPS miss to focus on:

- Tangible book value growth: Up 13.6% YoY to $12.45/share, reflecting strong earnings and improved unrealized losses on the AFS portfolio

- Clean asset quality: NPLs fell to 0.14% of loans from 0.27% YoY

- One-time nature of the provision: Management characterized the logistics loan reserve as isolated

The stock now trades at 1.39x tangible book value and offers a 5.1% dividend yield ($0.88 annual dividend).

What Did Management Say?

CEO Eric Meilstrup emphasized the transformative nature of 2025 following the Eagle Financial and Cincinnati Federal acquisitions:

"2025 was a transformative year for LCNB, reflecting the earnings power of our enhanced platform following the acquisitions... I am pleased to report that these efforts contributed to record annual net income of $23.1 million in 2025, resulting in a 1.02% return on average assets for the full year and a 13.6% increase in tangible book value."

On the credit provision:

"LCNB's exposure to the logistics industry is limited and our overall asset quality remains strong with nonperforming loans to total loans of 0.14% at December 31, 2025... We do not believe there will be any additional reserves associated with this loan and anticipate the loan will be charged off during the first quarter of 2026."

On 2026 outlook:

"As we look ahead to 2026, we remain focused on disciplined growth, including measured loan growth, continued strength in wealth management, and stable asset quality. We believe this balanced approach positions LCNB to deliver another year of consistent returns and continued book value growth."

Balance Sheet Highlights

The balance sheet contraction reflects strategic funding optimization (runoff of high-cost deposits) rather than credit deterioration. Loan originations of $375M were partially offset by $102M in secondary market sales.

Capital Allocation

LCNB paid $0.22 per share in Q4 2025 dividends, maintaining the $0.88 annual rate. The Q4 payout ratio was 55% (vs 50% in Q4 2024), and the full-year payout ratio was 54% vs 91% in 2024 — a significant improvement reflecting stronger earnings.

Forward Estimates

The Street expects modest EPS growth in 2026, with continued NIM normalization as rate cuts work through the funding base.

Key Takeaways

- EPS miss was provision-driven, not operational: The $0.08/share drag from the logistics loan reserve explains the entire miss versus consensus

- NIM expansion continues: 47 bps YoY improvement with more room as high-cost CDs roll off

- Wealth management is a differentiator: Record AUM and fiduciary income diversify revenue

- Balance sheet health: 13.6% TBV growth and 0.14% NPL ratio demonstrate strong fundamentals

- Attractive yield: 5.1% dividend yield with improving coverage

*Values retrieved from S&P Global.

Related: LCNB Company Profile | Q4 2025 Earnings Transcript | Q3 2025 Earnings