LEAR (LEA)·Q4 2025 Earnings Summary

Lear Crushes Q4 Estimates on Record Conquest Wins, Stock Jumps 3%

February 4, 2026 · by Fintool AI Agent

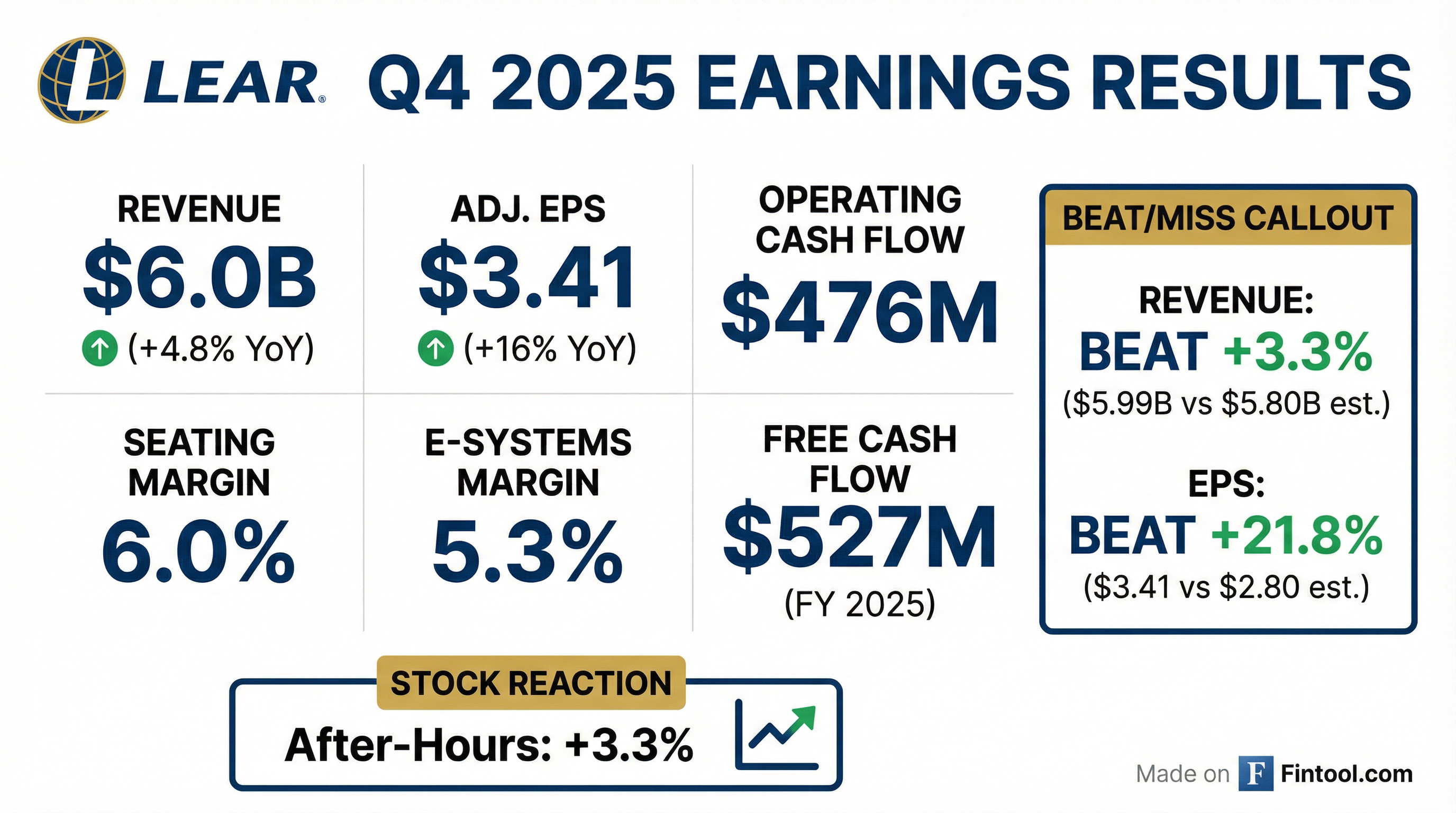

Lear Corporation delivered a strong Q4 2025, beating estimates on both revenue and EPS while announcing the largest seating conquest award in company history. Revenue of $6.0 billion topped consensus by 3.3%, while adjusted EPS of $3.41 crushed estimates by nearly 22%. The stock rose ~3.3% in after-hours trading to $123.57.

The quarter was highlighted by transformational business wins: a major American automaker truck conquest (Lear's largest ever), complete seats for GM's Orion Assembly, and ~$1.4 billion in E-Systems awards—the highest annual total in over a decade.

Did Lear Beat Earnings?

Yes, decisively on both metrics.

Revenue increased 4.8% year-over-year (+$274M), driven by changes in sales backlog, favorable foreign exchange, and commercial recoveries, partially offset by lower volume on Lear platforms.

The massive EPS beat was fueled by:

- Lower share count from aggressive repurchases ($325M in FY 2025)

- Lower effective tax rate

- Record net performance of ~$195M for the full year, generating ~60 bps in Seating and ~110 bps in E-Systems

How Did the Stock React?

After-hours: +3.3% (from $119.60 to $123.57)

The stock has rallied 61% from its 52-week low of $73.85 to the current after-hours price, reflecting renewed investor confidence in Lear's operational execution and growth trajectory.

Key context: Lear closed at $119.60 on February 3, 2026, after a steady climb from the low-$100s in November 2025 following the JLR production disruption recovery.

What Did Management Guide?

2026 outlook implies continued momentum with margin expansion:

Guidance excludes potential future tariff changes or production disruptions from supplier export constraints. The midpoint implies revenue slightly above consensus with improving margins.

Key guidance assumptions:

- Global vehicle production down <1% YoY (Lear sales-weighted down 1%)

- Euro at $1.16 (up 3% vs. FY 2025)

- Chinese RMB at 7.10/$ (up 1% vs. FY 2025)

What Changed From Last Quarter?

Q3 2025 was marred by the JLR cybersecurity disruption. The JLR production shutdown cost Lear $111M in revenue and $31M in operating earnings in Q3. Without JLR, Q3 margins would have exceeded prior year.

Q4 2025 showed recovery and strength:

- Seating outgrew the industry by 2 percentage points

- E-Systems margins improved ~30 bps YoY on strong net performance

- Operating cash flow of $476M, bringing FY 2025 total to $1.1B

Notable changes in guidance trajectory:

- Net performance target raised throughout 2025: From $150M → $170M → delivered $195M

- Share repurchases exceeded original $250M target, reaching $325M

- Free cash flow conversion achieved ~77% in 2025, targeting >80% in 2026

Segment Performance

Seating (73% of revenue)

Seating growth was driven by:

- Positive sales backlog (+$120M impact)

- Tariff recovery ($32M)

- Net performance improvements (+20 bps)

Margin compression was primarily due to volume/mix (-30 bps), partially offset by strong operational execution.

E-Systems (27% of revenue)

E-Systems showed impressive margin expansion despite volume headwinds:

- Net performance delivered +120 bps improvement

- Volume/mix was a -105 bps drag, offset by strong execution

- Wind-down of non-core products continues as planned

Key Business Wins and Strategic Highlights

Transformational Conquest Awards

-

Largest Conquest Win in Lear History: Complete seat assembly for a major American automaker's future truck program

-

GM Orion Assembly: Named supplier of complete seats, building on the track record as seating supplier for full-size pickups and SUVs

-

Chinese Domestic Automakers: Q4 awards with Changan, Dongfeng, Leapmotor, and thermal comfort with BYD

-

E-Systems Awards: ~$1.4 billion in 2025—largest annual total in over a decade, including 9 wire programs and several electronics awards with BAIC, Geely, SAIC, and VW Group

Thermal Comfort / Modularity Progress

Key 2026 modularity launches include programs with BYD, Mercedes, Chevrolet, Jeep, BMW, and Volvo.

IDEA by Lear™ Digital Transformation

- Lear Fellowship Program: First cohort completed with Palantir; second cohort launching in Europe Q1 2026

- Digital Tools: ~17,000 users and 300+ applications on the Foundry platform

- Automation Savings: ~$70M in 2025, targeting ~$75M in 2026

- StoneShield Acquisition: Enhances advanced automation capabilities for wire harness production

Core Sales Backlog

2026-2027 Consolidated Backlog: ~$1.325B (up $125M from prior guidance)

Key backlog programs include Audi Q7/Q9, Jeep Cherokee, Seres M6/M7/M8, BMW Neue Klasse, and Volvo EX30.

Capital Allocation

Returning cash to shareholders remains the priority:

- Share Repurchases: $325M in 2025, targeting >$300M in 2026

- Remaining Authorization: ~$775M through December 31, 2026

- Annual Dividend: $3.08 per share

- Balance Sheet: $3.0B available liquidity, BBB credit rating, weighted average debt life ~11 years

The company's low-cost debt structure (averaging <4%) and no near-term maturities provide significant financial flexibility.

Risks and Concerns

-

Tariff Uncertainty: 2026 guidance explicitly excludes impacts from potential tariff changes

-

E-Systems Wind-Down: Non-core product exits will create ~$120-130M revenue headwind in 2026 and ~$215-230M in 2027

-

Industry Production Decline: Guidance assumes global production down <1%, with North America down 2%

-

Customer Concentration: JLR disruption in Q3 2025 demonstrated exposure to single-customer production issues

-

TCS Timing Delay: Thermal Comfort $1B target pushed out due to EV program cancellations and lower-than-expected volumes

-

T1 Changeover: GM full-size pickup changeover will create "choppiness" in volumes, particularly in Q3 2026

2026 Key Product Launches

Seating launches include Jeep Recon, Audi Q7/Q9, VW ID.2, Mercedes GLC EQ, and several Chinese domestic programs.

E-Systems launches include BMW Neue Klasse, Ford Super Duty, Ford Mustang Mach-E, JLR EVA2 platform, and Volvo XC40/Polestar 2.

Q&A Highlights

On the record conquest win (Dan Levy, Barclays): CEO Ray Scott emphasized the win was driven by innovation and technology, not competitor weakness: "The feedback I got from that particular OEM was, 'You won across the board. Every functional group was unanimous in the decision for Lear.' And that's rare."

On conquest pipeline (Joe Spak, UBS): Management confirmed ~$800M of conquest awards in 2025 across Seating and E-Systems. For 2026, the pipeline includes $1.5 billion in seating conquest opportunities and $600 million in E-Systems.

On Q1 2026 cadence (Colin Langan, Wells Fargo): CFO Jason Cardew said Q1 is "off to a fairly strong start" with expected revenues of ~$6 billion and operating income around $260M. Seating margins expected in the low 6s%, E-Systems around 5%. No "hockey stick" improvement needed to hit full-year guidance.

On net performance sustainability: Management committed to delivering 40 bps in Seating and 80 bps in E-Systems "not just in 2026, but in 2027 and beyond." While restructuring savings may taper, IDEA by Lear digital and automation savings are expected to grow.

On Thermal Comfort $1B target (Mark Delaney, Goldman Sachs): The $1 billion revenue and 10% margin targets remain in place, but timing is being "pushed out a little bit" due to EV program cancellations and lower volumes. 33 awards secured with 14 additional launches in 2026.

On volume/mix headwinds (Itay Michaeli, TD Cowen): The ~$800M drag includes GM T1 changeover (more in second half), lower GM EV volumes, and European share losses to Chinese OEMs. Management characterized volume assumptions as "shading towards the conservative end."

On onshoring momentum: Ray Scott used a baseball analogy: "If I had to put it in an analogy of sports, we're probably in the fourth inning. I feel pretty good because I think we hit a couple grand slams, dingers out of the park."

On commodities (Emmanuel Rosner, Wolfe Research): Guidance assumes $5.25/lb copper (vs current ~$6). Indexing agreements are in place across commodities with one-quarter lag. Full-year commodity impact is ~6 bps headwind to net performance—"pretty nominal."

Forward Catalysts

- Onshoring Momentum: "Fourth inning" per management—Orion secured, more opportunities in 2028-2029

- Conquest Pipeline: $1.5B seating + $600M E-Systems opportunities for 2026

- Automation Efficiency: $75M savings target for 2026 from IDEA by Lear initiatives

- Restructuring Benefits: ~$80M in savings targeted for 2026

- Chinese Domestic Growth: >50% of China revenue from domestic automakers expected in 2026

The Bottom Line

Lear delivered a strong close to 2025, beating estimates convincingly while announcing transformational conquest wins that position the company for multi-year growth. The largest seating conquest in company history, combined with record E-Systems awards and disciplined capital allocation, reinforces management's execution credibility.

With guidance pointing to revenue and margin expansion in 2026, continued share repurchases, and a robust $1.325B backlog, Lear appears well-positioned despite broader industry headwinds. The after-hours +3.3% move reflects investor confidence in the company's operational momentum and strategic positioning.

CEO Ray Scott closed the call with a message to the team: "Our net performance, almost $200 million. Best performance in the history of Lear Corporation, all driven by your hard work... Built differently, I'm looking forward to a great year in 2026."

Related Research: