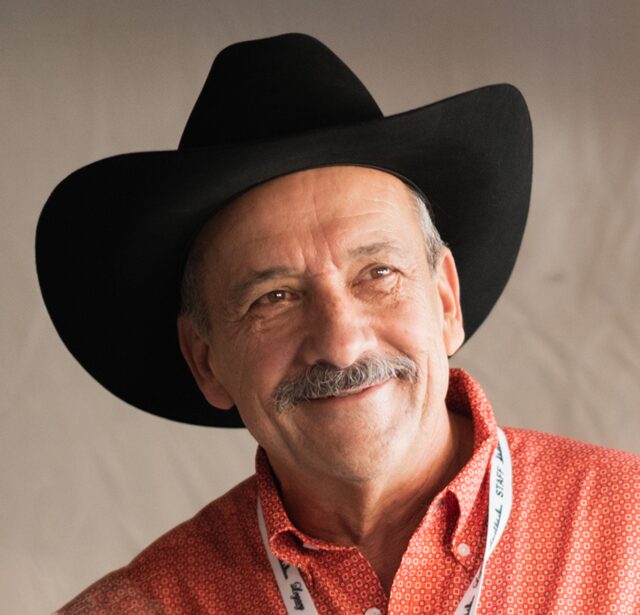

Kenneth Shipley

About Kenneth Shipley

Kenneth E. Shipley, age 66, is Co‑Founder, Chairman of the Board, and Interim Chief Executive Officer of Legacy Housing (LEGH). He has served on the Board since the IPO (2018), previously as Co‑CEO (Jan 2018–Feb 2019), President & CEO (Feb 2019–Jun 2022), and Executive Vice President (Jun 2022–Oct 2025). He also owns and operates Bell Mobile Homes (since 1981), bringing 30+ years of manufactured housing experience to LEGH . In 2024, LEGH generated $184.2m revenue (down 2.6% YoY) and $61.6m net income (up 13.2% YoY), while the Pay‑versus‑Performance table shows cumulative TSR value of $93.24 on a $100 base from Dec 31, 2022 to Dec 31, 2024 .

Past Roles

| Organization | Role | Years | Strategic Impact |

|---|---|---|---|

| Legacy Housing (LEGH) | Co‑Chief Executive Officer | Jan 2018 – Feb 2019 | Co‑led company through public listing period; maintained vertical integration strategy . |

| Legacy Housing (LEGH) | President & Chief Executive Officer | Feb 2019 – Jun 2022 | Oversaw operations and profitability during expansion of financing and community initiatives . |

| Legacy Housing (LEGH) | Executive Vice President | Jun 2022 – Oct 2025 | Senior executive during period of internal control remediation and product mix evolution . |

| Legacy Housing (LEGH) | Chairman of the Board | Dec 2024 – Present | Board leadership and governance; majority‑independent committees . |

| Legacy Housing (LEGH) | Interim Chief Executive Officer | Oct 2025 – Present | Assumed CEO duties with no additional compensation pending CEO search . |

| Legacy Housing, Ltd. (predecessor) | Partner | Pre‑2018 | Co‑founded and scaled predecessor entity; deep operating expertise . |

External Roles

| Organization | Role | Years | Strategic Impact |

|---|---|---|---|

| Bell Mobile Homes (Lubbock, TX) | Owner/Operator (Manufactured Home Retailer) | Since 1981 | Channel expertise; retail operations insight; related‑party customer to LEGH . |

Fixed Compensation

| Metric | 2023 | 2024 |

|---|---|---|

| Base Salary ($) | 50,000 | 50,000 |

| Target Bonus (%) | Not disclosed | Not disclosed |

| Actual Bonus Paid ($) | 0 | 0 |

| Additional Comp for Interim CEO | N/A in 2023 | No additional comp for interim CEO (appointed Oct 2025) |

Notes:

- LEGH states it does not have a formal executive compensation plan; co‑founders’ cash pay is “nominal” given significant equity positions .

Performance Compensation

| Incentive Type | Metric(s) | Weighting | Target | Actual | Payout | Vesting |

|---|---|---|---|---|---|---|

| Annual Cash Bonus | Discretionary (no disclosed formula) | N/A | Not disclosed | 0 (2023, 2024) | 0 | N/A |

| Equity Awards (RSU/PSU) | N/A for Shipley (none disclosed) | — | — | — | — | — |

| Stock Options | N/A for Shipley (none disclosed) | — | — | — | — | — |

Pay‑versus‑Performance context: 2024 CAP/TSR disclosure shows cumulative TSR value $93.24 (base $100 from Dec 31, 2022), and net income of $61.6m in 2024, indicating profitability despite softer product sales .

Equity Ownership & Alignment

| Item | Detail |

|---|---|

| Beneficial Ownership | 2,993,610 shares (12.5% of 23,868,727 outstanding as of Oct 29, 2025) . |

| Indirect Holdings | Includes 100,000 shares held by Shipley Bros., Ltd., controlled by K.E. Shipley; disclaims beneficial interest in brothers’ holdings (William: 2,865,953; Douglas: 2,885,978) . |

| Options/RSUs | None disclosed for Shipley (no 2023–2024 awards) . |

| Ownership Guidelines | Not disclosed in proxy . |

| Hedging/Pledging | Company has not adopted a hedging policy; no pledging disclosure provided (governance risk) . |

Related‑party sales (alignment risk flag):

- Sales to Bell Mobile Homes (owned by K.E. Shipley): $5,748,000 (FY 2024); $2,715,000 (9M 2025) .

- Sales to Shipley Bros./Crazy Red’s (owned by K.E. Shipley and brothers): $2,545,000 (FY 2024); $1,521,000 (9M 2025) .

Employment Terms

| Term | Summary |

|---|---|

| Agreement | Employment agreement dated Nov 27, 2018; auto‑renews annually on Dec 31 . |

| Role & Pay | Base salary $50,000; standard officer benefits . |

| Termination (Without Cause) | Base salary for remainder of current annual term period . |

| Change‑of‑Control | If terminated within 12 months after a CoC for specified reasons: 24 months base salary (double‑trigger) . |

| Non‑Compete | 12 months post‑employment . |

| Non‑Solicit | 24 months post‑employment . |

| Confidentiality/IP | Customary covenants . |

| Clawback | Executive compensation clawback adopted Dec 2023 . |

| Release Requirement | Not required for Shipley (unlike other NEOs) . |

Potential Payments Table (as of Dec 31, 2024)

| Scenario | Salary Continuation ($) | Equity Acceleration ($) |

|---|---|---|

| Change of Control (CoC + qualifying termination) | 100,000 | — |

| Involuntary Termination Without Cause | 45,835 | — |

Board Governance

- Role and independence: Shipley is Executive Chairman and currently Interim CEO; the Board states it generally prefers to separate Chair/CEO, and plans for Shipley to step down as Interim CEO upon appointing a permanent CEO (independence and oversight considerations) .

- Board composition and committees: Majority independent; all three standing committees (Audit, Compensation, Nominating & Corporate Governance) are fully independent .

- Audit: Jeffrey K. Stouder (Chair), Brian J. Ferguson, Skyler M. Howton; Stouder is an “audit committee financial expert” .

- Compensation: Skyler M. Howton (Chair), Brian J. Ferguson, Jeffrey K. Stouder .

- Nominating & Governance: Brian J. Ferguson (Chair), Skyler M. Howton .

- Meetings and attendance: Board met four times in 2024; all directors attended .

- Director pay: Employee directors (incl. Shipley) receive no additional Board fees; non‑employee director fees are $10,000/quarter plus ~$10,000 in annual RSUs .

Performance & Track Record

| Metric | 2023 | 2024 |

|---|---|---|

| Revenue ($000s) | 189,144 | 184,191 |

| YoY Revenue Growth | — | (2.6%) |

| Net Income ($000s) | 54,460 | 61,642 |

| YoY Net Income Growth | — | 13.2% |

| Total Shareholder Return ($100 base from 12/31/2022) | 95.28 (2023) | 93.24 (2024) |

Qualitative notes:

- 2024 product sales softened on lower unit volumes; mix shift offset by interest income growth from loan portfolios; other revenue aided by land sales; margins protected via cost controls .

- Internal control over financial reporting remains under remediation; auditor reported material weaknesses in 2024 (control activities, accounting staffing, ITGCs) — governance risk to monitor .

Director Compensation (as Director)

- As an employee director, Shipley receives no incremental board compensation beyond his executive pay; non‑employee director compensation details provided for context .

Say‑on‑Pay & Shareholder Feedback

- 2024 vote results: Say‑on‑Pay For 19,951,629; Against 351,806; Abstain 42,346 (strong support). Say‑on‑Frequency showed preference for “1 year” cadence .

Compensation Structure Analysis

- Cash/equity mix: For Shipley, compensation is almost entirely fixed cash ($50k) with no annual bonus or equity grants in 2023–2024; alignment is via large personal shareholding (12.5% stake) .

- Plan design: No formal performance plan or disclosed metric weightings; bonuses discretionary; co‑founder pay philosophy emphasizes ownership alignment over cash comp .

- Incentive modifications/repricings: None disclosed for Shipley .

Related‑Party Transactions (Governance Red Flags)

- Significant product sales to entities owned/controlled by Shipley and family:

- Bell Mobile Homes: $5.748m (FY 2024) and $2.715m (9M 2025) .

- Shipley Bros./Crazy Red’s: $2.545m (FY 2024) and $1.521m (9M 2025) .

- Board policy requires disclosure and Board review; discretion is plenary .

Risk Indicators & Red Flags

- Internal controls: Auditor adverse opinion on ICFR with material weaknesses (control activities, accounting staffing, IT general controls) .

- Hedging policy: Company has not adopted a policy restricting hedging by insiders (alignment risk) .

- Section 16 timeliness: 2024 proxy listed some late Section 16 filings (not attributed to Shipley), indicating process discipline risk .

- Leadership transition: Interim CEO status (Shipley) following CEO/CFO resignations in Oct 2025; stability under active search .

Compensation Peer Group (Benchmarking)

- Not disclosed; Company notes absence of a formal compensation plan .

Expertise & Qualifications

- 30+ years in manufactured housing operations and distribution; founder credentials; retail ownership (Bell Mobile Homes) .

- Board asserts majority‑independent committees with relevant audit/financial expertise on Audit Committee .

Investment Implications

- High ownership alignment: Shipley’s 12.5% stake (and broader family stakes) strongly align incentives; minimal cash pay removes “pay inflation” risk .

- Governance watch‑items: Related‑party sales (ongoing magnitude), lack of hedging policy, and repeat ICFR weaknesses warrant a governance discount until remediated .

- Transition optics: Dual role (Chair + Interim CEO) is framed as temporary; committees remain independent; no extra pay for interim CEO role (shareholder‑friendly) .

- Performance context: 2024 profitability improved despite revenue softness; TSR modestly below $100 base over 2022–2024 window; execution on internal controls and consistent sales growth are key stock catalysts .

All data above sourced from LEGH’s 2025 and 2024 DEF 14A filings, 2024 Form 10‑K, and 8‑Ks cited inline.```