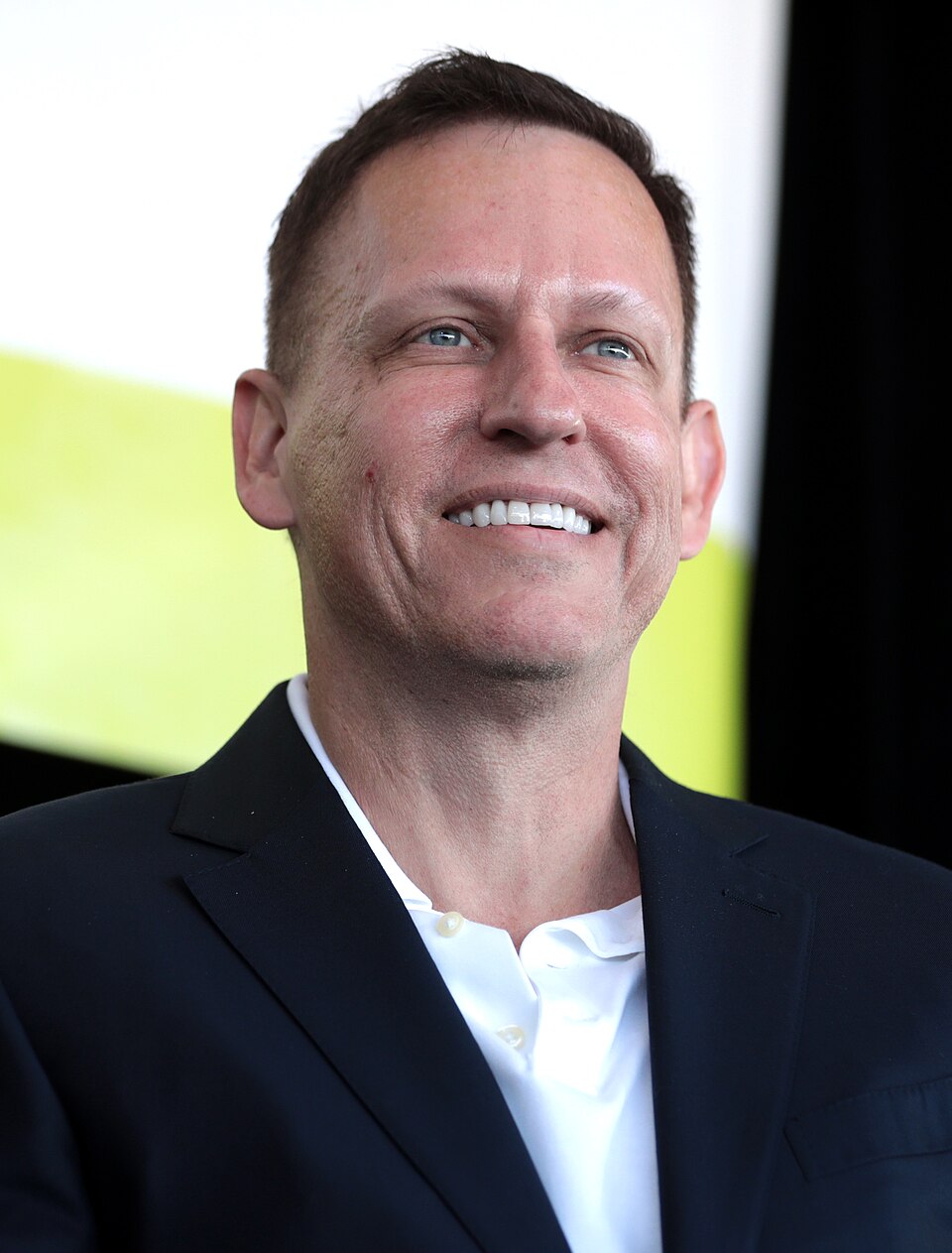

Peter Sack

About Peter Sack

Peter Sack (born 1989) is Chief Executive Officer of Chicago Atlantic BDC, Inc. (NASDAQ: LIEN) and a Managing Partner at Chicago Atlantic Group, LP; he became CEO in March 2025 after serving in senior credit investing roles at BC Partners Credit and Atlas Holdings, and he holds a BA from Yale and an MBA from Wharton as a Fulbright Scholar . LIEN is an externally managed BDC; during Sack’s tenure, the company reported Q2 and Q3 2025 total gross investment income of $13.1m and $15.1m, respectively, net investment income (NII) of $7.7m ($0.34/sh) and $9.5m ($0.42/sh), maintained no loans on non-accrual, and modestly increased NAV/share from $13.23 to $13.27, while continuing a $0.34 quarterly dividend declaration cadence . His ownership in LIEN common stock is 3,468 shares (<1%), with broader economic exposure primarily via his partnership interest in the external adviser that earns management and performance fees tied to assets and income .

Past Roles

| Organization | Role | Years | Strategic Impact |

|---|---|---|---|

| BC Partners Credit | Principal | 2018–2021 | Sourced/underwrote across opportunistic and senior lending, including cannabis-related direct lending . |

| Atlas Holdings LLC | Associate | 2012–2016 | Private equity focus on distressed manufacturing/distribution; operational value creation . |

External Roles

| Organization | Role | Years | Strategic Impact |

|---|---|---|---|

| Chicago Atlantic Real Estate Finance, Inc. (NASDAQ: REFI) | Director | Current | Oversight of a commercial mortgage REIT affiliated with the platform . |

| Ability Insurance Company | Director | Current | Insurance sector board experience . |

| New York City Charter School of the Arts | Director | Current | Non-profit governance/education sector engagement . |

Company Performance During Tenure (select KPIs)

| Metric | Q2 2025 | Q3 2025 |

|---|---|---|

| Total Gross Investment Income ($m) | 13.1 | 15.1 |

| Net Investment Income ($m) | 7.7 | 9.5 |

| NII per Share ($) | 0.34 | 0.42 |

| Investment Portfolio Fair Value ($m) | 307.5 | 311.4 |

| NAV per Share ($) | 13.23 (6/30/25) | 13.27 (9/30/25) |

| Dividend Declared ($/sh) | 0.34 (for Q3’25) | 0.34 (for Q4’25) |

| Gross Originations (par, $m) | 39.1 (Q2) | 66.3 (Q3) |

| Non-Accrual Loans | None | None |

| Shares Outstanding (basic & diluted) | 22,820,408 (6/30/25) | 22,820,590 (9/30/25) |

| Subsequent Fundings (post-qtr, $m) | 17.2 | 5.0 |

CEO commentary emphasized LIEN’s differentiated BDC positioning, record quarterly originations, zero non‑accruals, and disciplined leverage/liquidity posture to capitalize on pipeline opportunities .

Fixed Compensation

As an externally managed BDC, LIEN does not pay base salary, bonus, or equity directly to executive officers (including the CEO). The Company reimburses the Adviser only for an allocable portion of compensation related to the CFO and CCO (and their staffs), based on estimated time devoted to LIEN . Independent directors receive cash retainers; interested directors and executive officers do not receive director fees from LIEN .

| Component | Peter Sack (CEO) | Source/Notes |

|---|---|---|

| Base Salary (Company-paid) | Not paid by LIEN | Executive officers are not directly compensated by the Company . |

| Target/Actual Bonus (Company-paid) | Not paid by LIEN | No direct executive cash comp at Company level . |

| Company Equity Awards (RSU/PSU/Options) | Not granted by LIEN | No executive equity program disclosed for officers; externally managed model . |

| Benefits/Perquisites (Company-paid) | Not applicable | No direct Company-paid executive compensation . |

Performance Compensation

Economic upside for Sack is primarily via his partnership interest in the external Adviser, which earns fees tied to assets and performance under LIEN’s Investment Advisory Agreement .

| Incentive Mechanism (Adviser) | Metric Linkage | Terms/Formula | Who Benefits | Vesting |

|---|---|---|---|---|

| Base Management Fee | Asset scale | 1.75% of gross assets (ex‑cash equivalents) . | Adviser partners (incl. Sack) via profit interests . | N/A |

| Incentive Fee on Income | Pre‑incentive fee NII | 20% of “Pre‑Incentive Fee NII,” subject to a preferred return (hurdle) and catch‑up; payable quarterly . | Adviser partners . | N/A |

| Incentive Fee on Capital Gains | Realized gains | 20% of cumulative realized capital gains net of losses/depreciation; payable annually/in arrears . | Adviser partners . | N/A |

| Expense Limitation Agreement | Operating cost discipline | Adviser capped certain operating expenses at 2.15% of net assets through 9/30/25; clarified on 2/14/25 that financing/raising costs are excluded . | Indirectly supports NII to shareholders; Adviser absorbs capped items . | N/A |

Implication: Compensation is tied to asset growth and NII realization (subject to hurdle/catch-up), aligning with dividend coverage but creating potential incentives to grow gross assets; the expense cap mitigates some shareholder cost burden near‑term .

Equity Ownership & Alignment

| Item | Detail |

|---|---|

| Total Beneficial Ownership | 3,468 common shares; less than 1% of outstanding . |

| Shares Outstanding Reference | 22,820,408 shares outstanding as of 4/25/25 record date used for ownership table . |

| Vested vs. Unvested Shares | Not disclosed in proxy for executive officers . |

| Options (Exercisable/Unexercisable) | Not disclosed; no Company option program reported for officers . |

| Shares Pledged as Collateral | Not disclosed in proxy . |

| Stock Ownership Guidelines (Executives) | Not disclosed in proxy . |

| Hedging/Pledging Policies | Company states it has not adopted practices/policies regarding employee/director hedging transactions; pledging not addressed . |

Employment Terms

| Term | Detail |

|---|---|

| Employment/Officer Start Date | CEO since March 2025 . |

| Contract Term/Expiration | Executive officers hold office until successors are duly elected/qualified or earlier resignation/removal; no individual employment contract disclosed . |

| Severance/Change‑of‑Control | Not disclosed for executive officers in proxy . |

| Clawback Provisions | Not disclosed for executive officers; general Code of Conduct in place . |

| Indemnification | Company has indemnification agreements with directors and executive officers (incl. CEO) to the maximum extent permitted under Maryland law/1940 Act . |

| Non‑Compete/Non‑Solicit/Garden Leave | Not disclosed in proxy . |

| Advisory/Administration Structure | Advisory Agreement sets fees (1.75% base; 20% income and capital gains fees); Administration Agreement provides for reimbursement of specified admin costs . |

Expertise & Qualifications (selected)

- Credit investor and portfolio manager with cross‑capital‑structure expertise; prior roles at BC Partners Credit and Atlas Holdings .

- Education: BA, Yale; MBA, Wharton; Fulbright Scholar; speaks Mandarin Chinese and Spanish .

- CEO certifications under SOX 302/906 confirm principal executive responsibilities in 2025 filings .

Risk Indicators & Governance Considerations

- External management model creates potential conflicts in opportunity allocation and fee incentives; mitigated by an SEC co‑investment order and an Adviser allocation policy overseen by independent directors .

- No Company anti‑hedging policy adopted, which is a governance red flag versus common market practice; pledging policy not disclosed .

- Expense cap through 9/30/25 supports NII but is temporary and excludes financing/raising costs per 2/14/25 clarification .

- Section 16 reporting compliance affirmed for FY2024; no disclosed legal proceedings involving officers .

Investment Implications

- Pay-for-performance alignment exists primarily through the Adviser’s incentive fees on NII and realized gains; this supports dividend coverage but can bias toward asset growth and income maximization—monitor leverage, underwriting quality, and fee realization versus shareholder returns .

- Sack’s direct share ownership is modest (<1%), making Adviser economics his primary incentive; lack of anti‑hedging policy and no disclosed ownership guidelines weaken traditional “skin‑in‑the‑game” signals, though zero non‑accruals and record originations in Q3’25 indicate disciplined execution to date .

- With NAV per share stable to slightly rising ($13.23 → $13.27) and consistent $0.34 dividends declared, continuity in credit quality and originations under Sack’s leadership supports a carry/dividend thesis; watch for any changes to expense caps, fee terms, or pipeline conversion that could affect NII durability .

Note: LIEN does not disclose Company-level executive salary/bonus/equity, severance, CoC, clawbacks, pledging, or ownership guidelines for executives due to its externally managed structure; insider trading/vesting specifics should be monitored via Form 4 filings as they are not detailed in the proxy .