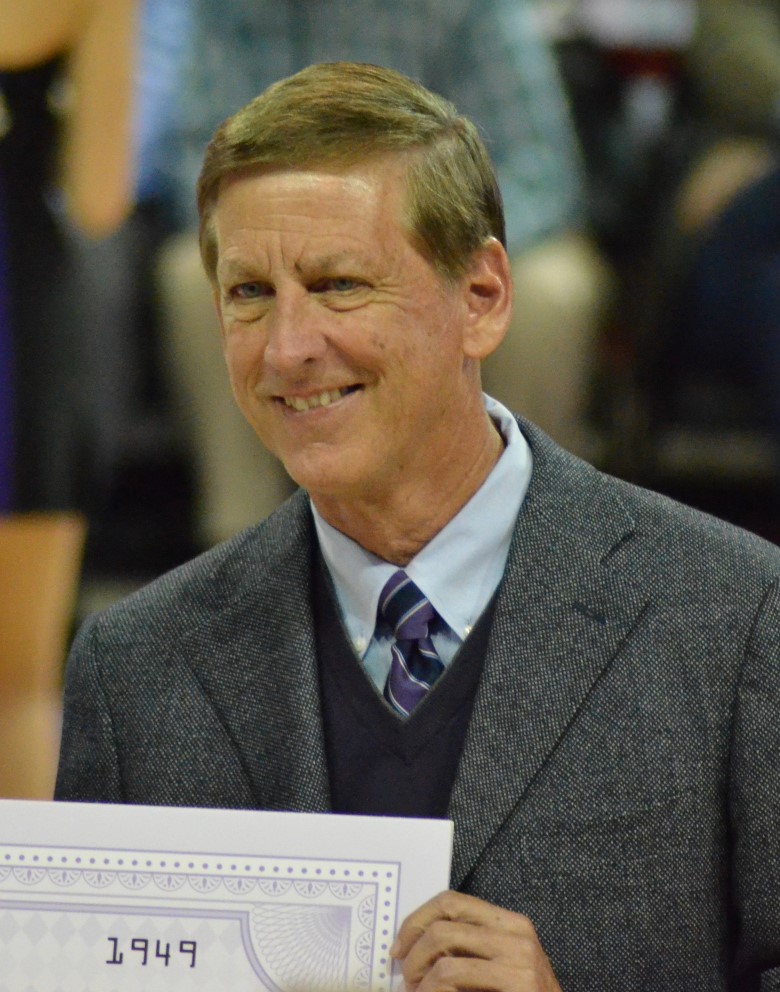

Brian E. Mueller

About Brian E. Mueller

Brian E. Mueller (age 71) is Chairman and Chief Executive Officer of Grand Canyon Education, Inc. (GCE) since January 2017 and July 1, 2008, respectively, and has served as President of Grand Canyon University (GCU), GCE’s largest university partner, since July 1, 2018; he holds BA and MA degrees in Education from Concordia University . Under his leadership, 2024 Revenue was $1,033.0 million and Adjusted EBITDA was $340.0 million, both above maximum plan targets, and the SEC pay-vs-performance framework shows a company TSR “Value of Initial Fixed $100” of $171.00 for 2024, aligning incentive outcomes with financial performance . The Board recognizes the dual role (CEO + Chair + GCU President) and has formal conflict-mitigation structures that prohibit him from the GCU board and from participating in negotiations on the GCU Master Services Agreement; his GCE base salary was reduced to $321,000 in 2018 reflecting dual employment .

Past Roles

| Organization | Role | Years | Strategic impact |

|---|---|---|---|

| Grand Canyon Education, Inc. | Chief Executive Officer | 2008–present | Day-to-day leadership with deep industry knowledge; complex regulatory navigation |

| Grand Canyon Education, Inc. | Chairman of the Board | 2017–present | Combined Chair/CEO structure with a Lead Independent Director for balance |

| Grand Canyon University (owned by GCE pre-2018) | President | 2012–2018 | Led on-ground and online expansion; transition to independent nonprofit |

| Grand Canyon University (independent nonprofit) | President | 2018–present | External partner leadership; conflict mitigation structures in place |

| Apollo Education Group, Inc. | President and Director | 2006–2008 | Led large postsecondary provider; executive governance experience |

| Apollo Education Group, Inc. | COO | 2005–2006 | Enterprise operations leadership |

| University of Phoenix Online | CEO | 2002–2005 | Scaled online education platform |

| University of Phoenix Online | COO & SVP | 1997–2002 | Operations and growth roles |

| Apollo Education Group, Inc. | Operations management roles | 1987–1997 | Multi-year operating responsibility |

| Concordia University | Professor | 1983–1987 | Academic experience and teaching credentials |

External Roles

| Organization | Role | Years | Notes |

|---|---|---|---|

| Grand Canyon University | President | 2018–present | Not permitted on GCU board; excluded from day-to-day management and negotiations with GCE per governance/Master Services Agreement provisions |

Fixed Compensation

| Metric | 2022 | 2023 | 2024 |

|---|---|---|---|

| Base Salary ($) | $321,000 | $321,000 | $321,000 |

2024 cash incentive opportunity (Annual Cash Incentive Plan):

- Threshold: 50% of base salary; Target: 100%; Maximum: 150% .

- Components: Revenue (50%) and Adjusted EBITDA (50%) .

Performance Compensation

| Metric | Weighting | Plan thresholds | Plan target | Plan maximum | Actual result | Payout basis |

|---|---|---|---|---|---|---|

| Revenue | 50% | $1,015.0m | $1,023.0m | $1,031.0m | $1,033.0m | Max component payout (150%) but CEO elected 145.7% overall to align with Senior Mgmt plan cycle outcome |

| Adjusted EBITDA | 50% | $314.755m | $322.755m | $330.755m | $340.0m | Max component payout (150%) but CEO elected 145.7% overall to align with Senior Mgmt plan cycle outcome |

2024 bonus paid: $467,597 (145.7% of target) .

Equity incentives:

- Restricted stock grants vest 20% annually over 5 years; no stock options are outstanding .

Equity Ownership & Alignment

- Beneficial ownership: 293,413 shares; 1.0% of outstanding (based on 28,496,165 shares at March 31, 2025) .

- Stock ownership guideline: CEO required to hold ≥5x base salary; as of Dec 31, 2024 all covered persons are in compliance .

- Anti-hedging/pledging: Hedging prohibited; pledging prohibited except rare pre-approved exceptions; margin accounts barred .

Unvested restricted shares and vesting schedule:

| Vesting date | Shares scheduled to vest |

|---|---|

| March 1, 2025 | 12,622 |

| March 1, 2026 | 9,741 |

| March 1, 2027 | 6,922 |

| March 1, 2028 | 4,002 |

| March 1, 2029 | 1,856 |

| Total unvested as of 12/31/2024: 35,143 shares (market value $5,756,423 at $163.80) . |

2024 vesting realized value:

| Shares vested | Value realized |

|---|---|

| 13,384 | $1,802,959 |

Employment Terms

- Agreement term: Five years for named executive officers .

- Severance (without Cause or for Good Reason): 12 months base salary + 100% of target bonus, paid over 12 months; 12 months COBRA premiums; partial acceleration to next annual vesting tranche .

- Change in Control: Double trigger; same cash/benefits plus full acceleration of all unvested equity if terminated without Cause or for Good Reason within 12 months post-transaction .

- Non-compete/non-solicit: 12 months post-termination; prohibits competitive education services and solicitation of employees/customers .

- Clawback: Nasdaq-compliant policy adopted Oct 25, 2023; mandatory recovery of erroneously-awarded incentive compensation after material restatements .

Estimated severance economics (as of 12/31/2024):

| Scenario | Cash payment | Benefits (COBRA) | Equity acceleration value |

|---|---|---|---|

| Termination w/o Cause or for Good Reason | $642,000 | $21,354 | $2,067,484 (to next annual vest date) |

| Same, following Change in Control | $642,000 | $21,354 | $5,756,423 (full acceleration) |

Board Governance

- Board service: Director since 2009; Chairman since 2017; not independent under Nasdaq rules .

- Committees: None (CEO/Chair); key committees (Audit, Compensation, Nominating & Corporate Governance) are fully independent .

- Lead Independent Director: Sara Ward; responsibilities include agendas, executive sessions, liaison role, and chairing meetings when Chair absent .

- Attendance: Board met four times in 2024; all directors attended 100%; all committee meetings attended 100% .

- Executive sessions: Independent directors meet regularly without management .

Director compensation program (non-employee directors):

| Component | Amount |

|---|---|

| Annual cash retainer | $50,000 |

| Annual restricted stock grant (value) | $75,000; vests ~1 year |

| Initial restricted stock (new director) | $20,000 |

| Lead Independent Director cash retainer | $33,333 |

| Committee membership cash | $5,000 |

| Committee chair cash | $10,000; Audit Chair $15,000 |

Compensation Structure Analysis

| Item | Detail |

|---|---|

| Pay-for-performance | Annual cash incentives tied 100% to revenue and Adjusted EBITDA for named executive officers . |

| Mix shift | Time-based RS only since 2011; five-year vesting supports retention; no stock options outstanding . |

| Guaranteed pay | No guaranteed bonuses; CEO/COO/CFO have not accepted base salary increases in over nine years . |

| Change-in-control | Double-trigger only; no single-trigger acceleration . |

| Tax gross-ups | None on severance/change-in-control payments . |

| Clawback | Mandatory recovery policy under SEC/Nasdaq rules . |

| Peer benchmarking | Committee’s analyses indicate named executive compensation well below peers; Mercer not utilized in 2024 . |

Related Party Transactions

- Dual role with GCU: Governance provisions prohibit Mueller from GCU board; structures and Master Services Agreement terms prevent his participation in management or negotiations between GCE and GCU; his GCE base salary was reduced by 50% at July 1, 2018 to reflect dual employment .

Risk Indicators & Red Flags

- Hedging/pledging prohibited; exceptions require pre-approval; margin accounts barred (mitigates alignment risks) .

- Strong Say-on-Pay approval: 96.0% in 2024 indicates shareholder support for pay design .

- No single-trigger CIC; no tax gross-ups; five-year vesting discourages short-termism .

- Conflict mitigation around GCU reduces related-party risk exposure .

Compensation & Ownership (multi-year)

| Metric | 2022 | 2023 | 2024 |

|---|---|---|---|

| Salary ($) | $321,000 | $321,000 | $321,000 |

| Stock awards grant-date fair value ($) | $1,211,488 | $1,211,643 | $1,211,483 |

| Non-equity incentive ($) | $460,495 | $481,500 | $467,597 |

| All other comp ($) | $4,130 | $2,744 | $6,699 |

| Total ($) | $1,997,113 | $2,016,887 | $2,006,779 |

Pay-vs-Performance context:

| Measure | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Company TSR (Value of $100) | $122.18 | $92.11 | $90.83 | $100.46 | $113.82 (Peer TSR) / $171.00 (Company TSR) |

| Net Income ($mm) | $257.196 | $260.344 | $184.675 | $204.985 | $226.234 |

| Adjusted EBITDA ($mm) | $323.830 | $327.354 | $291.336 | $302.302 | $340.013 |

Employment Terms Summary

| Provision | Details |

|---|---|

| Severance (no Cause/Good Reason) | 12 months salary + 100% target bonus; 12 months COBRA; partial equity acceleration to next annual vest date |

| CIC (double trigger) | Same cash/benefits; full equity acceleration if terminated within 12 months post-CIC |

| Non-compete/Non-solicit | 12 months; education services competitors restricted; employee/customer non-solicit |

| Clawback | Mandatory for material restatements per SEC/Nasdaq |

Say-on-Pay & Shareholder Feedback

- Annual Say-on-Pay vote; 96.0% approval in 2024; Compensation Committee maintained approach into 2025 reflecting strong support .

Expertise & Qualifications

- Degrees: BA and MA in Education, Concordia University .

- Extensive executive experience across higher education and online learning; prior executive roles at Apollo Education Group and University of Phoenix Online .

Compensation Committee Analysis

- Committee: Independent directors; Chair Chevy Humphrey; members Jack A. Henry, Sara Ward, Lisa Graham Keegan, Kevin F. Warren .

- Independent consultant (Mercer) historically engaged; not utilized in 2024 .

- Oversight of succession planning and pay-for-performance architecture .

Investment Implications

- Strong alignment: Cash incentives strictly tied to revenue and Adjusted EBITDA; five-year RS vesting and anti-hedge/pledge policies support long-term focus and mitigate forced selling pressure from margin or hedging programs .

- Retention and continuity: Double-trigger CIC and modest severance (1x salary+bonus) reduce “golden parachute” risk while providing stability; scheduled vesting through 2029 creates predictable supply that investors can monitor for potential Form 4-related selling cadence .

- Governance balance to dual role: Combined Chair/CEO offset by a robust Lead Independent Director and fully independent committees; formal conflict controls around GCU mitigate related-party risk, but investors should continue to evaluate GCE–GCU contract dynamics as a sensitivity .

- Shareholder-friendly posture: No tax gross-ups or single-trigger CIC, majority voting, executive sessions, and high Say-on-Pay support signal disciplined compensation governance and reduced headline risk .