LIQUIDITY SERVICES (LQDT)·Q1 2026 Earnings Summary

Liquidity Services Beats on Profitability as Adj. EBITDA Surges 38%

February 5, 2026 · by Fintool AI Agent

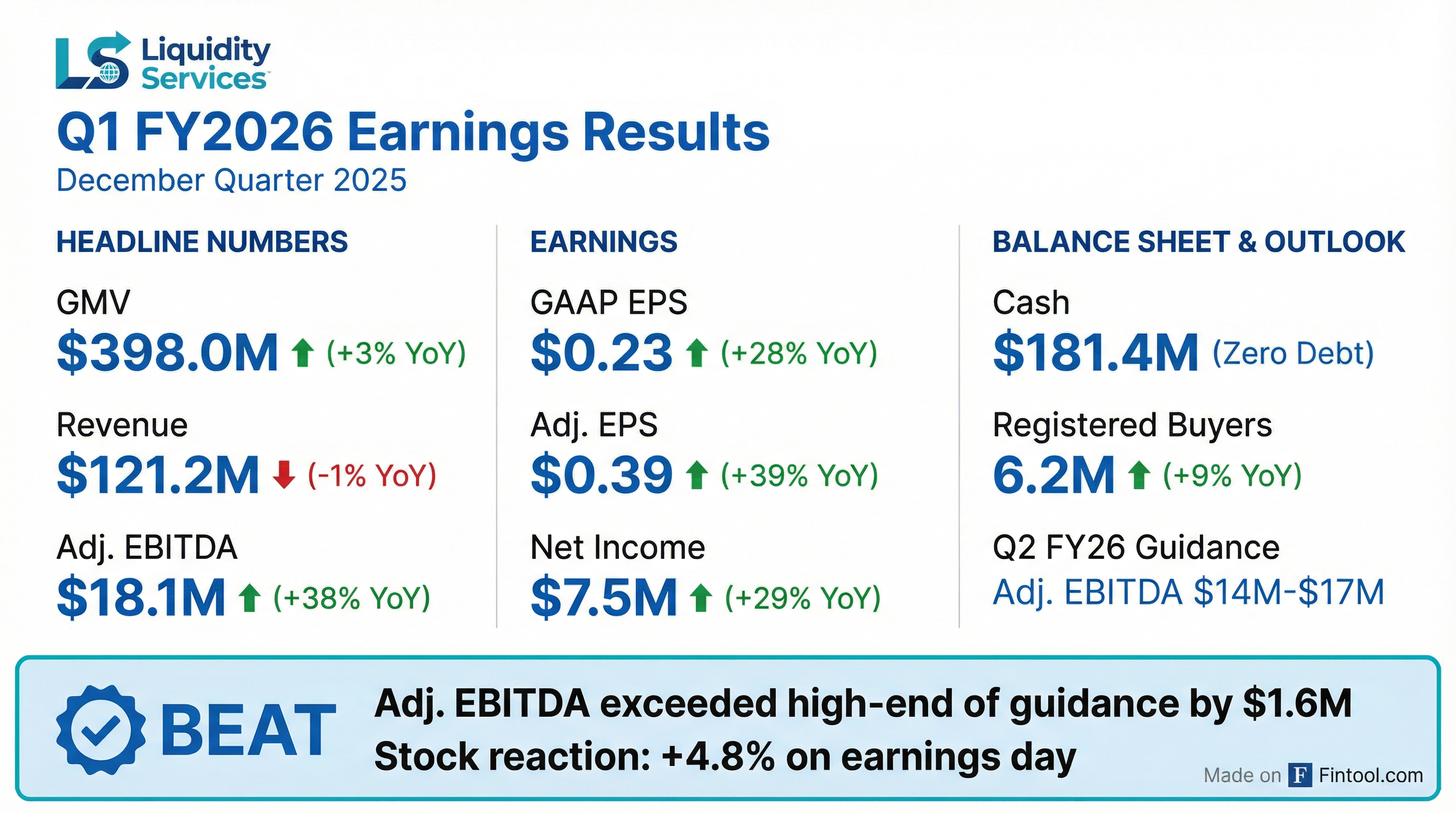

Liquidity Services (NASDAQ: LQDT) delivered a strong start to fiscal 2026 with profitability well above expectations. While revenue came in essentially flat year-over-year, the circular economy marketplace operator posted Non-GAAP Adjusted EBITDA of $18.1 million—exceeding the high end of guidance by $1.6 million and rising 38% versus the prior year. The stock rallied 4.8% on the results.

Did Liquidity Services Beat Earnings?

Yes—decisively on profitability. Liquidity Services beat across all key profit metrics while GMV grew modestly and revenue dipped slightly:

The standout number is Adjusted EBITDA margin expansion. At $18.1M on segment direct profit of $57.0M, the company delivered a 31.7% margin—well above the 26.2% achieved in Q1 FY25.

What Drove the Beat?

CEO Bill Angrick attributed the outperformance to three factors :

-

Strong buyer and seller participation — Registered buyers reached 6.2 million (+9% YoY), auction participants hit 983,000 (+2%), and completed transactions rose to 264,000 (+4%)

-

Operating leverage from AI and automation — Direct profit per labor hour surged over 48% YoY in Q1, reflecting improved productivity from AI-driven asset categorization, automated listing descriptions, and predictive lead scoring

-

Mix shift to higher-margin consignment — Consignment represented 81% of GMV in Q1, up from 80% a year ago, driving better segment direct profit margins

The newly launched Retail Rush consumer auction channel, powered by the Auction Software acquisition, is now operational and contributed to RSCG segment improvements.

How Did Each Segment Perform?

GovDeals (57% of GMV): Continued market share expansion with record new seller additions and strong vehicle/equipment volumes. Heavy equipment GMV rose 27% YoY.

RSCG (29% of GMV): Despite a 6% revenue decline from lower purchase volumes, segment direct profit hit a new quarterly record of $21.5M driven by multi-channel buyer participation and the D2C channel growing 40% YoY.

CAG (14% of GMV): GMV declined 10% as heavy equipment strength was offset by lower industrial/energy project volume versus a tough prior-year comp. Revenue still rose 17% due to mix.

What Did Management Guide?

Management issued Q2 FY2026 guidance reflecting continued double-digit profitability growth:

Key guidance themes:

- Beneficial product mix with slightly higher consignment proportion

- Solid buyer demand and margins expected to continue

- One-time costs of $300K-$400K for streamlining a retail operating location to enhance processing productivity

- Retail segment margins may compress slightly sequentially due to modest seasonal logistics cost increases post-holiday

- Tax rate expected in mid- to high-20s with ~32.5-33M diluted shares

How Did the Stock React?

LQDT shares rallied +4.8% to $33.00 on the earnings release, outperforming the broader market. The stock is now:

- +6% from 50-day moving average ($31.07)

- +23% from 200-day moving average ($26.85)

- -17% from 52-week high ($39.72)

- +52% from 52-week low ($21.67)

This marks nine consecutive quarters of beating earnings expectations, extending the company's strong execution streak since the post-pandemic normalization.

What Changed From Last Quarter?

Despite typical Q1 seasonality (fiscal Q2-Q4 are stronger quarters historically), the company maintained strong profitability and continues to execute on its "Rule of 40" target—measuring the sum of direct profit growth and Adj. EBITDA margins.

Balance Sheet and Capital Allocation

Liquidity Services maintains a fortress balance sheet:

- Cash & Short-term Investments: $181.4M

- Total Debt: $0

- Available Credit Facility: $26M

- Share Repurchase Authorization: $15M remaining

The company repurchased $1.5M in shares during Q1 and has $15M of authorization remaining after a recent board refresh.

What Did Analysts Ask About?

The Q&A session with George Sutton (Craig-Hallum) and Gary Prestopino (Barrington) focused on growth durability and operational leverage:

On AI/Tech-Enabled Growth:

"The investments we've made in machine-driven systems and intelligent signaling of when's the right time to show the buyer a particular asset has boosted results. The fact that that's happening in an automated way without a high content of labor makes it more productive."

CEO Angrick highlighted three areas of automation: (1) buyer conversion optimization through intelligent asset signaling, (2) asset scanning/listing automation reducing labor content and errors, and (3) predictive lead scoring for sales outreach.

On Heavy Equipment Opportunity:

"We think that can be a $1 billion GMV business. And, you know, call it, we're at, you know, $110 million GMV run rate, so there's plenty of room there."

Heavy equipment is growing at nearly 30% CAGR with competitive advantages including lower take rates, lower transportation costs, seller flexibility on terms, and data-driven reserve pricing.

On New Client Momentum: Management signed an all-time record of 500+ new agency clients in GovDeals (including PA DOT, NY HUD, NY Port Authority, City of Malibu) and 100+ new seller clients in CAG during Q1.

On Retail Rush Launch:

"We're live in the first prototype with Retail Rush... The pickup location is in Columbus, Ohio. And the really important point is that we're seeing the uptick in recovery rate for the same assets sold in the Retail Rush channel versus the wholesale channel."

Management envisions eventually licensing the B2C auction platform to their B2B buyers on Liquidation.com, enabling them to set up pickup locations across the U.S. and eventually Canada.

Key Takeaways for Investors

Bulls will highlight:

- 9-quarter beat streak continues with accelerating profitability

- Operating leverage materializing: direct profit per labor hour up 48% YoY

- Heavy equipment category on path to $1B GMV business (currently ~$110M run rate, ~30% CAGR)

- Retail Rush launch in Columbus showing recovery rate improvement vs. wholesale

- Record 500+ new GovDeals agency clients including major state-level wins

- Fraud risk management as competitive moat vs. peers facing returns fraud issues

- $181M cash with zero debt enables opportunistic M&A

Bears will watch:

- Revenue declined 1% YoY despite GMV growth—revenue/GMV mix dynamics

- CAG segment GMV down 10% on industrial weakness

- Q2 guidance embeds sequential margin compression from seasonality

- Macro risks from tariffs and trade policy uncertainty could impact cross-border transactions

Additional Resources

- Liquidity Services Company Page

- Q1 FY2026 Earnings Call Transcript

- Q1 FY2026 Earnings Slides

- Q4 FY2025 Earnings Call Transcript

Data sources: Company press release, earnings slides, SEC filings, and S&P Global.