La Rosa Holdings (LRHC)·FY 2025 Earnings Summary

La Rosa Holdings FY 2025 Earnings: $79M Revenue, 14% Organic Growth

January 23, 2026 · by Fintool AI Agent

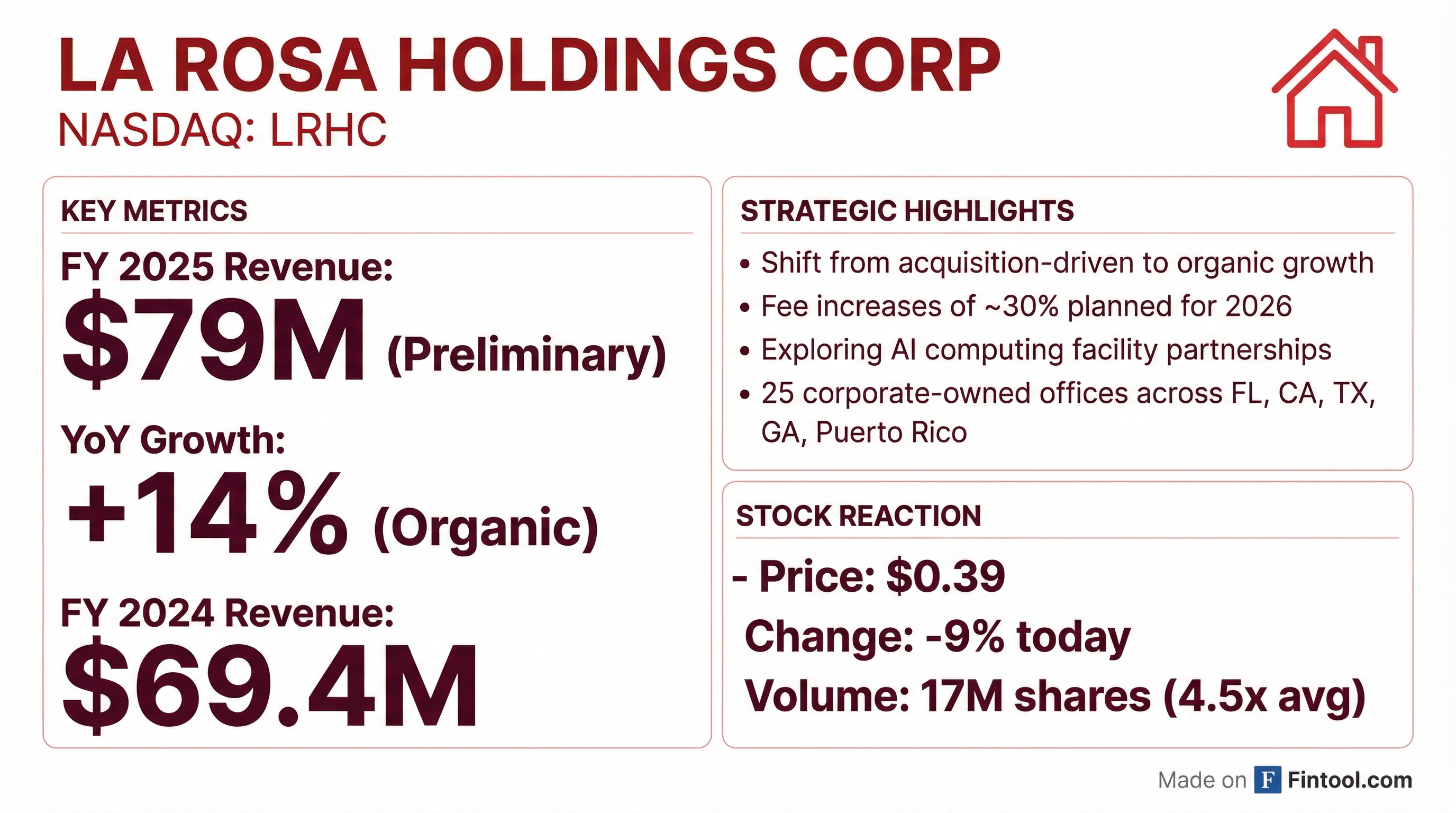

La Rosa Holdings Corp. (NASDAQ: LRHC) announced preliminary unaudited revenue of approximately $79 million for fiscal year 2025, representing 14% year-over-year organic growth compared to FY 2024 revenue of $69.4 million. The results mark a strategic pivot from acquisition-driven expansion to organic growth, achieved despite historically weak housing market conditions.

How Did Revenue Perform?

La Rosa delivered strong top-line growth in a challenging environment:

The FY 2025 growth is particularly notable because:

- 100% organic: No acquisitions contributed to the revenue increase

- Market headwinds: U.S. existing home sales fell 0.2% in 2025 to 4.06 million homes—the lowest since 1995

- Agent momentum: Higher transaction activity and growing agent count drove performance

Is La Rosa Holdings Profitable?

No. La Rosa remains deeply unprofitable despite revenue growth:

*Values retrieved from S&P Global

The operating loss widened in absolute terms with scale, though margins improved slightly. Management is taking decisive actions to address profitability:

- Fee increases of ~30% planned for 2026

- Significant operating expense reductions

- Focus on operating leverage across the platform

What Did Management Say?

CEO Joe La Rosa provided extensive commentary on the strategic shift and path forward:

"In 2024, our growth strategy was largely acquisition-driven, as we focused on building scale and expanding our revenue base. In 2025, we deliberately shifted our focus toward organic growth, and we are particularly pleased that this year's revenue increase was achieved organically."

On market conditions:

"Despite these historically suppressed market conditions, our unique business model continues to perform well in down-cycle environments."

On the path to profitability:

"We have also taken decisive actions to significantly reduce operating expenses while increasing fees by nearly 30% in 2026, strengthening operating leverage across the platform."

On new growth initiatives:

"We are actively evaluating several high-potential partnership and joint venture opportunities with established technology and infrastructure firms to develop advanced AI computing facilities, which we believe can further expand our revenue base and accelerate our path toward cash flow positivity."

How Did the Stock React?

The stock declined sharply despite the positive revenue announcement:

The stock has collapsed from the $28-95 range in January 2025 to under $0.40 today—a decline of over 99%. Today's announcement came with heavy volume (4.5x average), suggesting significant investor repositioning.

The negative stock reaction despite positive revenue growth likely reflects:

- Continued operating losses with no clear profitability timeline

- Preliminary/unaudited nature of the results

- Broader concerns about micro-cap real estate exposure

What's the Business Model?

La Rosa provides agents with flexible compensation—either revenue-sharing or a fee-based structure with 100% commission. The company operates:

- 25 corporate-owned offices across Florida, California, Texas, Georgia, and Puerto Rico

- 5 franchised offices in the U.S. and Puerto Rico

- 3 affiliated brokerage locations

- International expansion beginning in Spain

- Full-service title company in Florida

What Changed From Last Quarter?

The key new development is the AI computing facility initiative—management is actively evaluating partnerships with technology and infrastructure firms, signaling a potential diversification beyond traditional real estate brokerage.

What to Watch

- FY 2025 10-K filing — Full audited financials will reveal true profitability trajectory

- Fee increase impact — Will 30% higher fees in 2026 hurt agent retention?

- AI partnership announcements — Any concrete deals could reframe the investment thesis

- Cash position — With $1.4M cash and $4.8M debt (FY 2024), liquidity is tight

- Housing market recovery — Improvement in home sales could accelerate organic growth

Note: FY 2025 revenue figures are preliminary and unaudited, subject to customary adjustments. The company expects to file audited results with the SEC in due course.