LANTRONIX (LTRX)·Q2 2026 Earnings Summary

Lantronix Q2 FY2026: Beats Estimates, Raises Drone Outlook — Stock Falls 14% on Profit-Taking

February 4, 2026 · by Fintool AI Agent

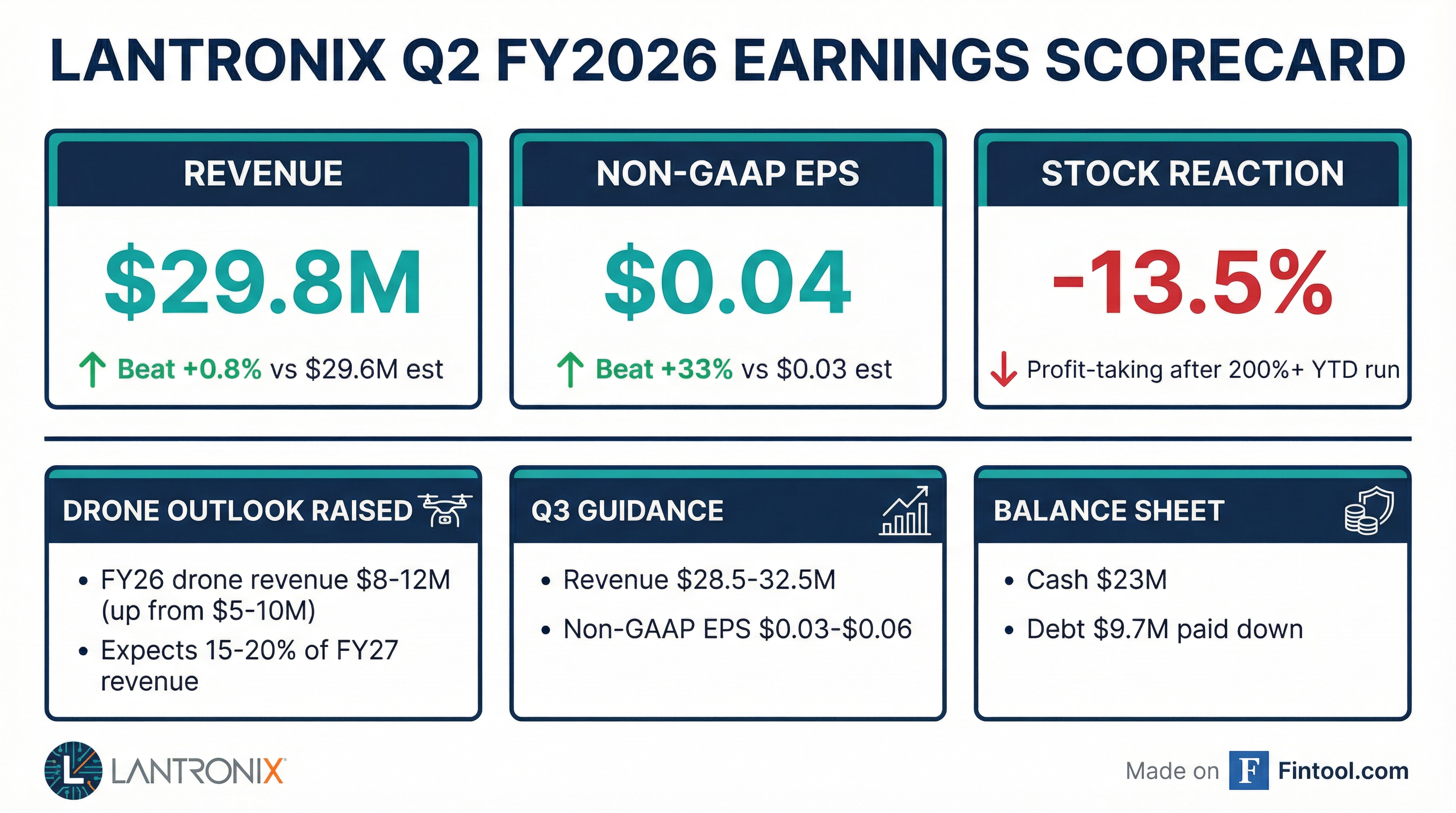

Lantronix (NASDAQ: LTRX) delivered a solid Q2 FY2026 earnings beat with revenue of $29.8M (+0.8% vs consensus) and Non-GAAP EPS of $0.04 (+33% vs $0.03 expected), while raising its FY26 drone revenue outlook to $8-12M from the prior $5-10M range . Despite the beat and positive drone momentum, shares fell 14% on heavy volume as investors locked in profits following a remarkable 225%+ rally from the 52-week low of $1.91.

Did Lantronix Beat Earnings?

Yes — Lantronix beat on both the top and bottom line:

Management highlighted that results came in "well within guidance range" with 17% year-over-year growth when excluding the European smart grid customer Gridspertise .

8-Quarter Beat/Miss History

Values retrieved from S&P Global

What Did Management Guide?

Q3 FY2026 Outlook:

- Revenue: $28.5M - $32.5M (midpoint $30.5M)

- Non-GAAP EPS: $0.03 - $0.06

Updated FY2026 Drone Revenue:

- Raised to $8M - $12M (previously $5M - $10M)

- Drones expected to represent 15-20% of FY27 revenue (~$20-30M)

The Q3 guidance implies relatively flat sequential performance at the midpoint, which appears conservative given the drone momentum. Management's confidence in the drone trajectory is reflected in both the raised FY26 outlook and the longer-term FY27 revenue mix target.

How Did the Stock React?

The 14% decline despite a beat-and-raise quarter reflects profit-taking after an extraordinary run. LTRX had rallied over 225% from its July 2025 lows near $1.91 to recent highs of $8.24, driven by growing enthusiasm around the drone and Edge AI opportunity. The stock remains up substantially from year-ago levels (~$4.00).

Notably, aftermarket trading showed the stock recovering to $6.50, suggesting the selloff may be overdone.

What Changed This Quarter?

Drone Business Accelerating

The standout development is the acceleration in Lantronix's drone and unmanned systems business. Key developments:

- Raised FY26 drone revenue to $8-12M from prior $5-10M

- Working with 15+ OEMs in unmanned systems

- Working with a "sizable amount" of the 25 DoD Drone Dominance vendors (directly or through partners)

- Sequential growth from Q1 to Q2 with "a big bump up" in drone revenue

CEO Saleel Awsare emphasized the company's strategic evolution:

"Our evolution within unmanned systems positions Lantronix squarely in the value-creation layer of the ecosystem... we've moved up the stack—from initially providing general purpose compute modules, to delivering intelligent imaging platforms, and now to enabling integrated system-level workflows."

Key Customer Wins

- Trillium Engineering: Powering gimbaled imaging systems for ISR, infrastructure inspection, and wildfire operations

- Flock Safety: First design win in Drone-as-First-Responder (DFR) category for public safety—a new commercial/government market opening up as Chinese drones are banned

- Safe Pro Group: AI-enabled threat detection for landmines and ground hazards, combining SafePro's detection models with Lantronix compute modules

- Red Cat/FlightWave: Expanded partnership including next-gen platform development; FlightWave selected Lantronix Open-Q SoM for new drone

CES 2026 Product Launches

Lantronix debuted several new Edge AI solutions:

- Drone Reference Kit: Designed to accelerate time-to-market for defense and commercial UAV developers, reducing integration complexity

- SmartEdge.ai / SmartSwitch.ai: Edge AI gateway and AI-powered fiber switch creating a unified platform for real-time video analytics and intelligent connectivity

Financial Trends

Key observations:

- Revenue has stabilized in the $28-30M range after the Gridspertise decline

- Gross margins remain elevated at 44%+ on non-GAAP basis

- Consistent non-GAAP profitability at $0.03-$0.04 EPS

Revenue by Segment

Embedded IoT (which includes drones/A&D) drove significant growth, while IoT System Solutions declined due to the Gridspertise customer roll-off. Software & Services grew 47% YoY as the recurring revenue strategy gains traction.

Balance Sheet Strength

The company generated positive operating cash flow of nearly $2.2M in Q2 and paid down approximately $1M of debt . Total debt is down from $14.7M a year ago to $9.7M today.

Key Management Quotes

On Drone Momentum:

"Drones are scaling faster than we initially expected. We are seeing strong execution, expanding customer engagement, and clear momentum as programs move into broader deployment."

On Platform Strategy:

"Our diversified growth vectors—unmanned systems, critical infrastructure monitoring, and enterprise connectivity—are increasingly converging around a common Edge AI platform. This convergence enables efficient scaling, deeper customer relationships, and positions Lantronix to capture long-term secular tailwinds."

On Competitive Position:

"In many deployments, our AI edge compute modules serve as the 'brains' of the drone, enabling autonomous operation and real-time decision-making independent of a network connection."

On FY27 Outlook:

"I see fiscal 2027 to be a good year. The numbers that the analysts have us at are what we're working to, and we're not allergic to what the numbers are out there right now."

Q&A Highlights

Drone Dominance Program Participation: Management confirmed Lantronix is working with a "sizable amount" of the 25 vendors selected for the DoD's Drone Dominance initiative, either directly or through gimbal partners. The first tranche covers 30,000 drones, with up to 300,000 total over 18 months .

FY27 Revenue Quantification: When asked about the 15-20% revenue mix target, CEO Awsare confirmed this implies $20-30 million in drone revenue for FY27 .

ASP Expansion Opportunity: Current ASPs are in the $400-500 range for Group 2 drone modules. Moving to turnkey system solutions would add "hundreds of dollars more" to ASPs. The company is also pursuing the FPV drone market at lower ASPs, creating a diversified product portfolio .

Operating Expense Guidance: CFO Stringham guided OpEx of $11.8-12.3 million per quarter for Q3 and Q4, consistent with recent levels and reflecting the benefits of prior cost optimization .

Memory Shortage Impact: On the well-publicized memory shortage, management stated they are "proactively working with customers" and have prepared supply for key drone programs. No major supply disruptions expected in the near-to-medium term .

FCC Chinese Drone Ban: The December 23 FCC ruling banning new Chinese drones is "gonna be helpful for all American manufacturers." Lantronix is seeing increased engagement as a result .

M&A Strategy: Management is actively exploring M&A in two areas: (1) drone subsystems and software to enhance the SOM platform, and (2) critical infrastructure monitoring companies with ARR to accelerate the recurring revenue strategy .

Risks and Concerns

-

Government shutdown impact: Management noted a short-term slowdown in federal agency purchasing during the December government shutdown

-

Gridspertise customer concentration: The European smart grid customer continues to roll off, masking underlying growth

-

Tariff uncertainty: Supply chain risks from "changes in U.S. trade policy, including recently increased or future tariffs" noted in forward-looking statements

-

Program execution risk: Drone revenue depends on customer programs moving from development to production

-

Memory shortage: While currently manageable, ongoing DRAM/NAND supply constraints could impact cost or availability

Forward Catalysts

Bottom Line

Lantronix delivered a clean beat-and-raise quarter, demonstrating continued execution on its Edge AI pivot. The raised drone guidance and 15-20% FY27 revenue mix target signal management's growing confidence in the unmanned systems opportunity. While today's 14% selloff is notable, it appears driven by profit-taking after an exceptional run rather than fundamental concerns. The aftermarket recovery to $6.50 suggests investors remain constructive on the story.

Key Takeaways:

- Revenue and EPS both beat consensus

- Drone revenue guidance raised to $8-12M for FY26

- Drones expected to be 15-20% of FY27 revenue

- Balance sheet improving with positive operating cash flow

- Stock selloff appears profit-taking after 225%+ rally

See the full Lantronix Q2 FY2026 earnings transcript for complete management commentary.

Explore more: LTRX Company Profile