SOUTHWEST AIRLINES (LUV)·Q4 2025 Earnings Summary

Southwest Airlines Guides to $4+ EPS in 2026, Stock Jumps 5% After Hours

January 29, 2026 · by Fintool AI Agent

Southwest Airlines (LUV) delivered mixed Q4 2025 results with adjusted EPS of $0.58 beating estimates by 3.6%, while revenue of $7.44B fell 0.9% short of expectations . The real story, however, was the blockbuster 2026 outlook: management guided adjusted EPS of at least $4.00, representing more than 300% growth over 2025 and described as "well above Wall Street consensus" . The stock surged 5% after hours to $43.00, reversing a 1.2% decline during regular trading.

Did Southwest Airlines Beat Earnings?

Southwest beat on the bottom line but narrowly missed on revenue. The EPS beat was driven by continued cost discipline and the early benefits from transformation initiatives. Q4 marked the fifth consecutive quarter of EPS beats, extending a streak that began in Q4 2024 .

Full-year 2025 adjusted EPS came in at $0.93, with adjusted EBIT of $574 million exceeding prior guidance of $500 million .

What Did Management Guide?

The 2026 guidance stole the show:

The $4.00+ EPS guidance implies a dramatic turnaround—a 330%+ increase from 2025's $0.93 adjusted EPS. Management emphasized this represents "the lower end of internal forecasts" and expects to provide range-bound guidance once they have better visibility into assigned seating uptake .

CEO Bob Jordan highlighted the upside potential:

"Just yesterday, assigned and extra legroom seating became operational, and Southwest expects earnings upside based on how booking behavior related to these initiatives unfolds."

On the unprecedented scope of transformation:

"In my 38-year career in this industry, I cannot think of another airline that embarked on so many fundamental changes to their business model and in such a short time, let alone executed so well."

The guidance assumes potential upside from:

- Upsell revenue from close-in bookings (business travelers)

- Growth in business and leisure segments driven by the new product offering

How Did the Stock React?

The stock declined modestly during regular trading before earnings but jumped 5% after hours on the strong 2026 guidance. This reaction validates market enthusiasm for the transformation story—investors are buying into the "new Southwest" thesis that assigns seats, charges for bags, and partners internationally.

What Changed From Last Quarter?

The Q4 results mark the culmination of Southwest's most ambitious transformation year in company history :

Key Transformation Milestones

Revenue Initiatives:

- Assigned & Extra Legroom Seating: Launched January 27, 2026

- Bag Fees: New revenue stream implemented

- Basic Economy Fare: Product diversification

- Rapid Rewards Optimization: Variable earn/burn rates

- Chase Co-Brand Amendment: Improved economics and new benefits

- Free Wi-Fi: For loyalty members via T-Mobile partnership

- Online Distribution: Expedia and Priceline partnerships

Strategic Partnerships: Southwest announced six international partnerships: Icelandair, EVA Air, China Airlines, Philippine Airlines, Condor, and Turkish Airlines .

Cost & Operations:

- Outperformed $370M cost reduction target

- First-ever Company layoff of non-contract and management employees

- Deployed new technology boosting operational reliability

- Discontinued fuel hedging program

Recognition: Southwest ranked #1 in The Wall Street Journal Best U.S. Airlines of 2025 .

Bob Jordan emphasized the operational achievement:

"To be able to win The Wall Street Journal number one ranking at the same time you're changing the company, then to have a winter storm that's historic and manage it incredibly well, come out of that with no hangover at all. And by the way, the next day, do the largest changeover in the history of the company with assigned seating and to have excellent operating metrics on that day."

Quarterly Financial Trends

Q4 2025 represented a strong finish to the year with record quarterly operating revenues of $7.4 billion, up 7.4% year-over-year . Operating income of $391 million was up 40.6% versus Q4 2024 .

Capital Allocation & Shareholder Returns

Southwest returned significant capital to shareholders in 2025:

The company retired $3.3 billion of debt including $1.6 billion of convertible notes and prepaid $1.6 billion of Payroll Support Program obligations . Southwest also issued $1.5 billion in unsecured bonds at "industry-leading terms" in November 2025 .

Balance Sheet at Q4 2025:

- Cash & Equivalents: $3.2B

- Leverage: 2.4x adjusted debt/EBITDAR

- Unencumbered Assets: ~$17.0B net book value

- Revolving Credit: $1.5B available

Fleet & Capacity Outlook

Southwest is gradually modernizing its fleet while maintaining discipline on capacity growth. The removal of six seats from 737-700 aircraft to enable extra legroom seating adds ~1.1 points to Q1 2026 CASM-X .

New route announcements include service to St. Thomas (USVI), Knoxville, St. Maarten, Santa Rosa, and Anchorage .

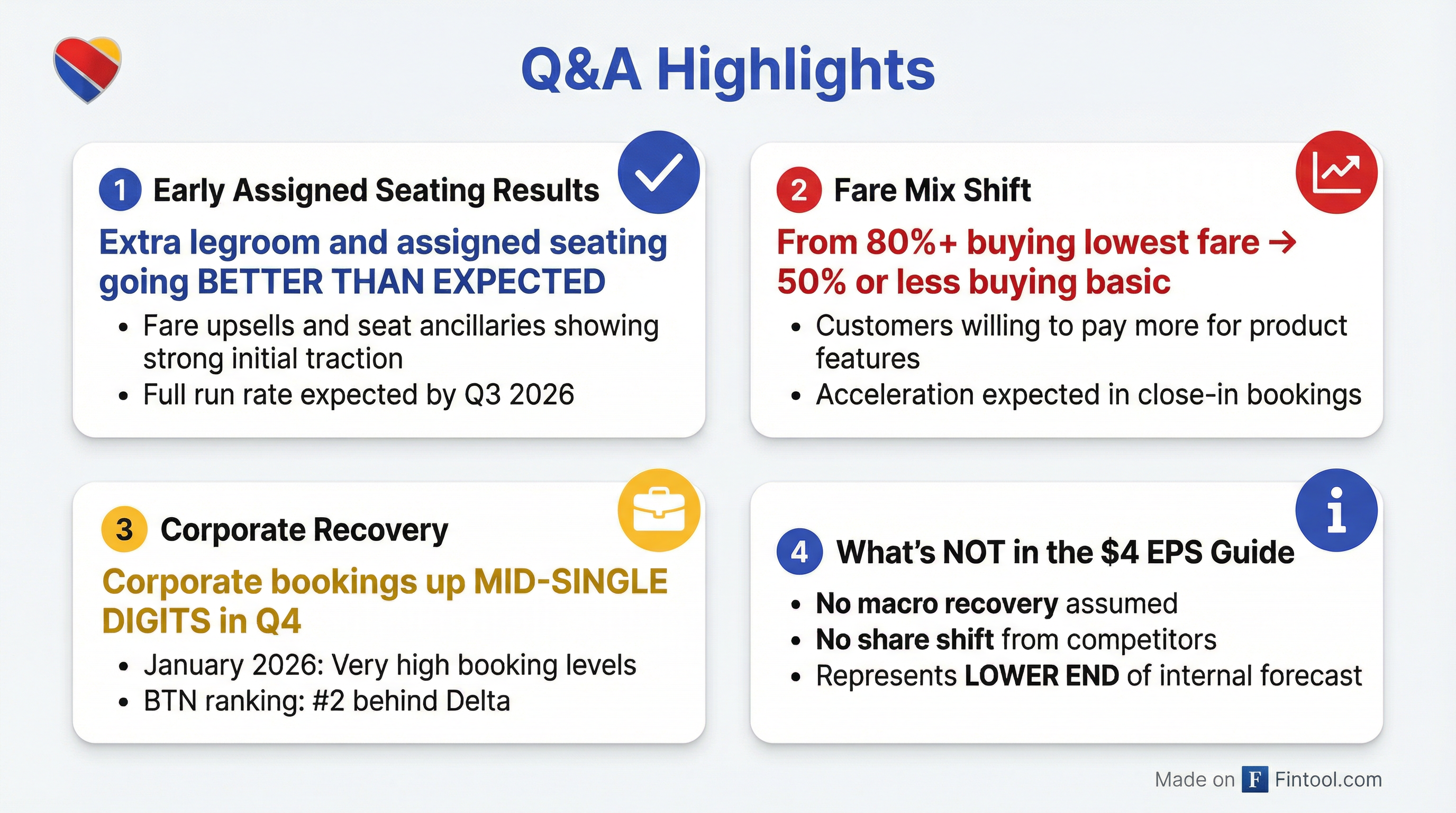

Q&A Highlights: What Analysts Wanted to Know

The earnings call Q&A session provided critical details not in the press release:

Early Assigned Seating Results: "Better Than Expected"

Management confirmed that extra legroom and assigned seating uptake is exceeding expectations just two days after launch :

"Yes, the ELR and the preferred seats and assigned seats in general is going better than expected." — Andrew Watterson, COO

Key dynamics driving the early success:

- Fuller flights = higher ancillary take rates: "The fuller the flight, the higher the ancillary benefit" as passengers pay to change seats at the gate

- Book-away from competitors: Southwest continues capturing passengers when other carriers have reliability issues

- Standalone ancillary acceleration: Seat selection revenue expected to accelerate in close-in bookings

Fare Mix Revolution: From 80% Basic to Under 50%

Andrew Watterson outlined a dramatic shift in customer purchasing behavior :

"We expect to go from, like, 80%+ buying the lowest fare product down to something, you know, half or less buying the very basic product."

The key insight: existing Southwest customers wanted to buy up but couldn't before. Now with product segmentation, they're choosing premium options even early in the booking curve .

Corporate Momentum Building

Corporate revenue trends are encouraging:

- Q4 2025: Corporate bookings up mid-single digits (excluding volatile government segment)

- January 2026: "Very high bookings" reported

- BTN Ranking: Southwest is #2 in Business Travel News rankings, just behind Delta

The new product offering is the missing piece:

"What's missing is a product that the corporate travelers want to buy, and frankly, that the companies let them expense." — Andrew Watterson

What's NOT in the $4 EPS Guide

CEO Bob Jordan was explicit about the conservative assumptions :

- No macro recovery assumed: "There's no assumption of a big snapback in the macro"

- No share shift: "There is no assumption of a big share shift"

- Lower end only: The $4+ represents "the lower end of our forecast"

This means the guidance is based purely on initiative performance with existing customers—corporate share gains and economic recovery would be upside.

No Aircraft RFPs in Market

When asked about fleet diversification, CFO Tom Doxey confirmed: "No, we do not have any active aircraft RFPs in the market" . Southwest remains committed to its all-Boeing 737 strategy.

Cost Discipline Continues

Management signaled more cost takeout ahead :

- Management headcount will be flat to 2025 levels in 2026

- No "victory lap"—the transformation is ongoing

- Additional efficiency opportunities in network optimization

Key Risks & Considerations

Management flagged several risks in their forward-looking statements :

- Winter Storm Fern Impact: Q1 2026 guidance includes the negative impact from the storm

- Assigned Seating Execution: Systems and consumer response remain key unknowns

- Boeing Dependence: Continued reliance on Boeing for deliveries and MAX 7 certification

- Fuel Price Volatility: Q1 2026 fuel assumed at ~$2.40/gallon

- Labor Relations: Ongoing negotiations with various workgroups

- Competitive Response: Industry-wide capacity and pricing dynamics

The Bottom Line

Southwest's Q4 2025 results were solid but overshadowed by the transformational 2026 outlook. The $4.00+ EPS guidance—more than 4x current levels—represents management's confidence that the strategic pivot away from Southwest's traditional "bags fly free" model will pay off handsomely.

The 5% after-hours rally suggests investors are buying the story. Early transcript insights are bullish:

- Assigned seating going "better than expected" just days after launch

- Fare mix shift underway: Customers actively choosing to buy up

- Corporate momentum: "Very high" January bookings

- Conservative guidance: No macro or share shift assumptions baked in

Bob Jordan's closing message captures the cultural confidence:

"Our people and their heart for serving our customers—that is and always will be the greatest competitive advantage that Southwest has. That was true on Monday with open seating, and it was true on Tuesday with assigned seating, and nobody, no other airline can copy the heart and the soul and the service of our people."

The key questions for the coming months:

- How much upside exists beyond $4 EPS? Management expects clarity in 1-2 months

- Can Southwest capture meaningful business traveler share? The product now appeals; execution is next

- Will cost discipline continue? More headcount reductions and efficiency gains are planned

Related Research: