MONARCH CASINO & RESORT (MCRI)·Q4 2025 Earnings Summary

Monarch Casino Posts Record Q4 as EBITDA Margin Hits 37%

February 4, 2026 · by Fintool AI Agent

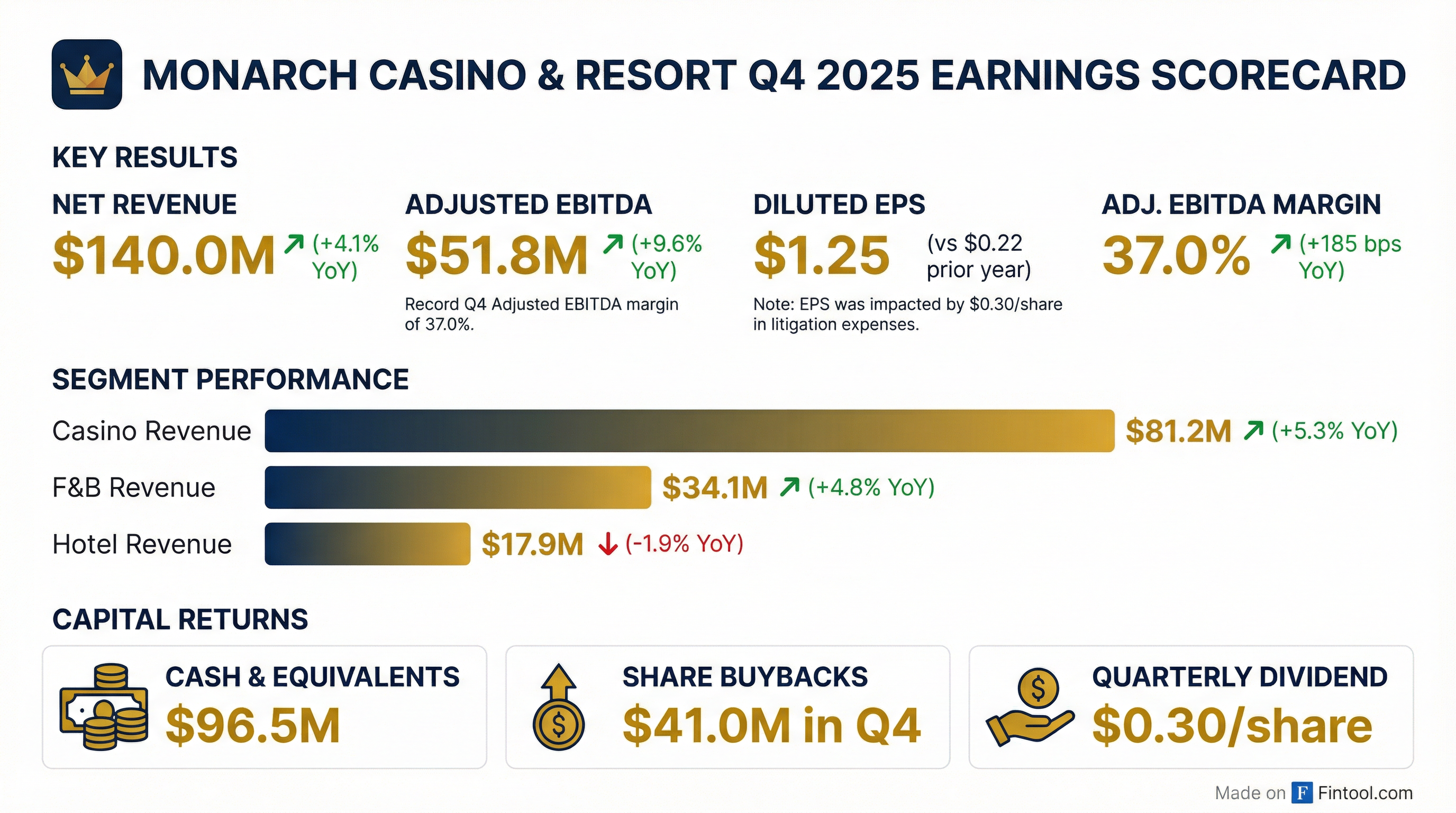

Monarch Casino & Resort (NASDAQ: MCRI) delivered record fourth quarter and full year 2025 results, with net revenue reaching $140.0 million and Adjusted EBITDA margin hitting an all-time high of 37.0%. The company increased market share at both its Atlantis (Reno) and Monarch Black Hawk (Colorado) properties while returning $41.0 million to shareholders through buybacks in Q4 alone.

Did Monarch Casino Beat Earnings?

Monarch Casino has limited sell-side coverage, making direct beat/miss analysis unavailable. However, the company delivered record Q4 performance across key metrics:

Note on EPS: Q4 2024 EPS was depressed by a $27.6 million ($1.14/share) accrued loss related to the PCL Construction litigation. Q4 2025 EPS includes a $0.30/share negative impact from ongoing litigation expenses.

What Changed From Last Quarter?

The margin expansion story continued in Q4. Key operational improvements:

- Casino operating expense as a percentage of casino revenue decreased to 35.8% from 36.8% YoY, driven by improved labor management and operational efficiencies

- F&B operating expense ratio improved to 70.0% from 73.4% YoY due to labor efficiencies and higher revenue per cover

- SG&A as % of revenue declined to 19.9% from 20.7% in Q4 2024

Segment Performance

Casino remained the growth driver while hotel faced modest headwinds:

The hotel revenue decline was attributed to lower average cash rates at Monarch Black Hawk, though this was offset by strength in gaming and dining.

Full Year 2025 Results

Monarch delivered record annual performance across all key metrics:

Capital Returns and Balance Sheet

Monarch's capital allocation remained shareholder-friendly with a fortress balance sheet:

Share Buybacks:

- Q4 2025: Repurchased 445,715 shares for $41.0 million

- Full Year 2025: Repurchased 797,279 shares for $72.2 million

- Remaining authorization: 1.15 million shares

Dividend:

- Declared $0.30/share quarterly dividend, payable March 16, 2026

- Annualized dividend of $1.20/share

Balance Sheet:

- Cash & equivalents: $96.5 million

- Total debt: $0 (no borrowings under credit facility)

- Total stockholders' equity: $537.7 million

Litigation Update

The PCL Construction Services litigation continues to impact results. Key developments:

Q4 2025 litigation impact ($0.30/share total):

- $2.75 million ($0.12/share) accrued interest on PCL judgment

- $0.4 million ($0.01/share) legal and consulting costs

- $3.9 million ($0.17/share) other litigation expenses

The company is appealing the $74.6 million judgment from the Colorado District Court related to construction disputes at Monarch Black Hawk.

CEO Commentary

CEO John Farahi emphasized the record-setting performance and market share gains:

"With all-time high fourth quarter financial results, we delivered another record year in 2025. Fourth quarter net revenue and adjusted EBITDA increased year-over-year by 4.1% and 9.6%, respectively... We remain committed to the ongoing capital investment and enhancement at both properties and setting the standard for luxury resorts in each market."

Management highlighted continued opportunities to grow revenue while deploying technology to reduce operating costs.

How Did the Stock React?

MCRI closed at $93.31 on February 4, 2026, down 0.5% on the day. The stock trades near its 50-day moving average of $95.03 and above its 200-day average of $93.49.

Key trading data:

- 52-week high: $113.88

- 52-week low: $69.99

- Market cap: $1.70 billion

The earnings were released after market close, so the full market reaction will be reflected in the next trading session.

Forward Catalysts & Risks

Catalysts:

- Continued margin improvement from operational efficiencies

- Market share gains at both Atlantis and Monarch Black Hawk

- M&A opportunities management is actively evaluating

- Potential resolution of PCL litigation appeal

Risks:

- Ongoing litigation exposure and potential additional costs

- Regional gaming competition in Reno and Black Hawk markets

- Tariff impacts on operating costs

- Labor cost inflation and minimum wage increases

- Potential expansion of iGaming in key markets

Property Overview

Atlantis Casino Resort Spa (Reno, Nevada):

- 817 guest rooms and suites

- ~61,000 sq ft casino space

- ~1,200 slot/video poker machines, 33 table games

- 30,000 sq ft health spa with enclosed pool

Monarch Casino Resort Spa Black Hawk (Colorado):

- 516 guest rooms and suites

- ~60,000 sq ft casino space

- ~1,000 slot machines, 43 table games

- Includes fine dining (Monarch Chophouse), spa, and 1,500-space parking structure

Monarch Casino & Resort (NASDAQ: MCRI) reports Q1 2026 earnings in late April 2026.