MDU RESOURCES GROUP (MDU)·Q4 2025 Earnings Summary

MDU Resources Posts Record Pipeline Earnings, Guides Above Consensus for 2026

February 5, 2026 · by Fintool AI Agent

MDU Resources Group (NYSE: MDU) reported Q4 and full year 2025 results that marked its first complete year as a pure-play regulated energy delivery business following the October 2024 spinoff of Everus. The stock rose 2.7% after-hours to $21.48 on guidance that exceeded Street expectations and record pipeline segment performance.

Did MDU Resources Beat Expectations?

MDU delivered solid year-over-year growth across key metrics:

Q4 2025 specifically showed EPS from continuing operations of $0.37 vs $0.34 in Q4 2024, driven by improved natural gas distribution earnings and higher retail sales in the electric segment.

What Did Management Guide?

MDU initiated 2026 guidance of $0.93 to $1.00 EPS, with the midpoint of ~$0.965 running approximately 5% above the Street consensus of $0.92.* The company reaffirmed its long-term targets:

- 6-8% long-term EPS CAGR

- 60-70% annual dividend payout ratio

- 1-2% annual customer growth

- $560M capital investment planned for 2026

CEO Nicole Kivisto emphasized confidence in the outlook: "With earnings guidance of $0.93 to $1.00 per share and continued customer growth, along with our employees' commitment to operational excellence, we are well positioned to meet rising demand while delivering long-term value for stockholders, customers and the communities we serve."

How Did Each Segment Perform?

Electric Utility: Data Center Growth Offset by Higher Costs

Electric earnings declined due to higher O&M expense (payroll, Coyote Station outage costs, software, insurance), though partially offset by higher retail sales volumes driven by a data center near Ellendale, North Dakota.

Key development: MDU acquired a 49% ownership interest in Badger Wind Farm (122.5 MW of the 250 MW project) on December 31, 2025, for a final payment of $264.6M. This shifts MDU's generation mix from 40% renewables to 35% following the acquisition.

Natural Gas Distribution: Rate Relief Drives Earnings

Natural gas was the strongest segment, benefiting from rate relief across four states (Washington, Montana, South Dakota, Wyoming). Customer base grew 1.6% year-over-year.

Pipeline: Record Earnings from Expansion Projects

Pipeline delivered record earnings driven by:

- Expansion projects placed in service (Minot Expansion live Nov 2025)

- Higher demand for short-term firm capacity contracts

- Partially offset by higher O&M and absence of 2024 one-time benefits

What Changed From Last Quarter?

Several key developments differentiate Q4 2025 from prior quarters:

-

Badger Wind Farm Completed: The $264.6M acquisition closed Dec 31, adding 122.5 MW of renewable capacity

-

Data Center Pipeline Expanding: Now 580 MW under signed agreements: 180 MW online since May 2023, 100 MW currently ramping, 150 MW expected later in 2026, and 150 MW in 2027. MDU uses a "capital-light business model" that benefits earnings/returns while sharing margin with retail customers.

-

Bakken East Open Season Launched: Binding open season for the major western-to-eastern North Dakota pipeline began Feb 2, 2026

-

Equity Raise Completed: 10.15M shares in the public offering plus 1.5M from underwriter option exercise (11.7M total) at $19.70/share. Forward sale agreements can be settled prior to December 6, 2027, meeting "all of the company's 2026 equity issuance needs and a significant portion of 2027 equity needs."

-

Balance Sheet Impact: Debt-to-capitalization ratio rose to 49.1% following the Badger Wind Farm acquisition; management expects this to decline as forward sale agreements are settled.

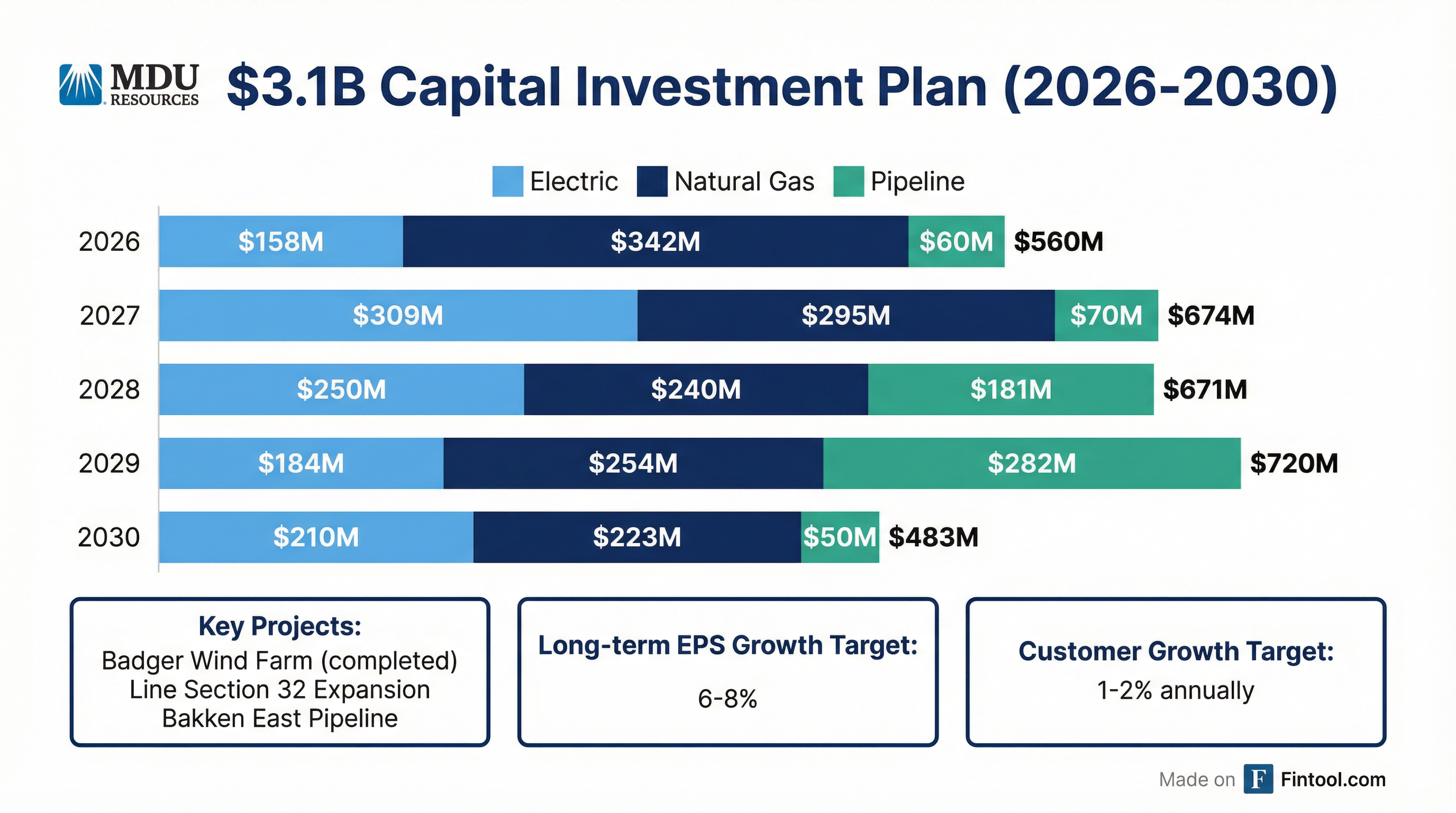

What's the $3.1B Capital Plan?

MDU outlined a substantial capital investment program for 2026-2030:

Key pipeline projects driving the 2028-2029 capex spike:

- Line Section 32 Expansion: Natural gas service to new electric generation facility in NW North Dakota, FERC filing March 2026, completion late 2028

- Bakken East Pipeline: Western to eastern North Dakota, pre-filing submitted Dec 2025, open season through March 13, 2026

- Minot Industrial Project: ~90-mile pipeline from Tioga to Minot, development support secured through Q2 2026

How Did the Stock React?

MDU shares closed the regular session at $21.03 (+0.57% on the day) and rose to $21.48 after-hours following the earnings release — a +2.7% gain from the prior close of $20.91.

The stock is trading near its 52-week high of $21.49, up 40% from the 52-week low of $15.04. The current price represents a 143.8% price-to-book ratio.*

Regulatory Updates

MDU has multiple rate cases pending or recently approved:

Electric:

- Wyoming: Settlement filed Jan 23, 2026 for $5.8M annual increase, rates effective April 1, 2026

- Montana: Rate case filed Sept 30, 2025; PSC has 9 months to rule. Interim rate relief was denied; MDU filed for reconsideration on Dec 26, which went before the PSC on Feb 3 with no action taken.

Natural Gas:

- Washington: Year 2 rates ($10.8M increase) effective March 1, 2026

- Oregon: $16.4M rate case filed Nov 2025, rates expected Oct 2026

- Idaho: $13.0M settlement approved, rates effective Jan 1, 2026

Q&A Highlights

During the earnings call Q&A, Jefferies analyst Tanner (filling in for Julian Dumoulin-Smith) pressed management on why 2026 guidance doesn't meet the 6-8% long-term growth target:

On 2026 Guidance Below 6% Growth: CFO Jason Vollmer explained: "We will have years where we exceed that [6-8% growth]. We will have years where we probably don't meet that full amount. As we look into 2026...certainly, some of that growth has taken some equity issuance on our side as well." Management emphasized that over the long term, the 6-8% target will hold.

On Bakken East Pipeline Timeline: CEO Nicole Kivisto outlined the path to FID: The binding open season runs through March 13, 2026. Following that, MDU will finalize project design, execute customer agreements, and then be prepared for a final investment decision. A 7C FERC filing is targeted for Q3 2026. Kivisto noted: "This is really a demand pull type of project versus producer push...we continue to be pleased with the level of interest and the discussions we're having with customers."

Key Risks and Concerns

-

Cost Pressure: Higher O&M expense impacted all segments, particularly payroll-related costs, insurance, and software expenses

-

Weather Sensitivity: Natural gas volumes declined 6.2% in Q4 due to warmer weather, though partially offset by weather normalization mechanisms

-

Regulatory Execution: Montana electric rate case interim relief was denied; Montana represents meaningful exposure

-

Capital Intensity: $3.1B capex plan requires continued equity issuance; forward sale agreements meet "substantial portion" of 2026-27 needs but beyond 2027 is TBD

The Bottom Line

MDU Resources delivered a solid first full year as a pure-play regulated utility, with FY 2025 EPS of $0.93 up 5.7% from the prior year. The company guided 2026 above consensus ($0.93-$1.00 vs $0.92 Street) and reaffirmed 6-8% long-term EPS growth. Key catalysts ahead include the Bakken East open season (closes March 13), multiple pending rate cases, and continued data center load additions. The stock's 2.7% after-hours gain reflects investor approval of the outlook.

*Values retrieved from S&P Global