MGM Resorts International (MGM)·Q4 2025 Earnings Summary

MGM Beats on Revenue and EPS as MGM China Drives 20% EBITDA Growth

February 05, 2026 · by Fintool AI Agent

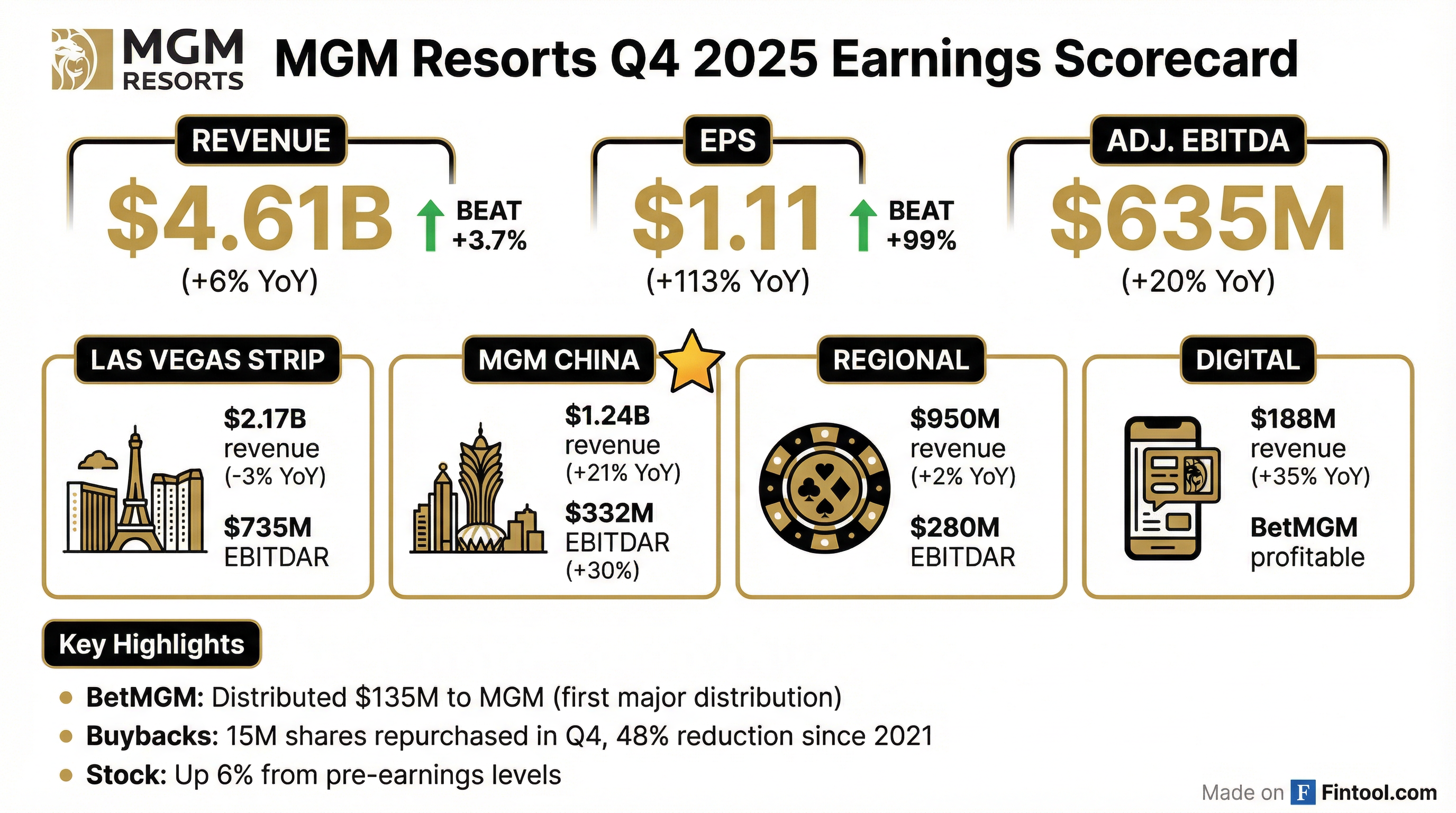

MGM Resorts International (NYSE: MGM) reported Q4 2025 results that beat Wall Street expectations on both revenue and earnings. The company delivered consolidated net revenues of $4.61 billion (+6% YoY) and diluted EPS of $1.11, nearly double consensus estimates . Consolidated Adjusted EBITDA grew 20% to $635 million, driven by MGM China's continued outperformance (+30% EBITDAR) and BetMGM's first profitable quarter .

"MGM Resorts once again saw the benefit of a diversified operational strategy, delivering Consolidated Adjusted EBITDA growth of 20% in the fourth quarter despite headwinds in Las Vegas," said Bill Hornbuckle, President and CEO .

Did MGM Beat Earnings?

Yes—decisively. MGM beat on both revenue and earnings, with a massive EPS surprise:

*Consensus estimates from S&P Global

The EPS beat was amplified by a $277 million non-cash tax benefit from a decrease in the valuation allowance on foreign tax credit carryforwards . Excluding the tax impact, operating performance was still strong: Consolidated Adjusted EBITDA grew 20% year-over-year .

Beat/Miss Track Record (Last 8 Quarters):

MGM has beaten EPS estimates in 6 of the last 8 quarters.

What Did Management Say?

CEO Bill Hornbuckle opened the call with optimism about the diversification strategy and 2026 outlook :

"MGM Resorts is the leading global integrated resort operator across gaming and hospitality with entertainment and sports, and this diversity helped us once again to achieve [strong results for the] quarter and the full year 2025."

On Las Vegas, Hornbuckle emphasized the unique value proposition :

"At the end of the day, there is nothing compared to Las Vegas. People are visiting to have unforgettable experiences, and their exceptional value is the optionality of what our guests can enjoy and discover on any particular visit."

CFO Jonathan Halkyard highlighted the multiple sources of cash flow now generating returns :

"I want to remind everyone of our various sources of cash flow spanning the business, including cash generated from our Las Vegas and regional operations, our MGM China branding fees and distributions, and now our BetMGM distributions. The cash sources from MGM China and BetMGM [are] recurring sources of income, and should be assessed accordingly."

In closing, Hornbuckle struck a confident tone :

"Diversification is clearly working. Our consolidated EBITDA growth was up 20% in the fourth quarter... We've seen strong signs of stabilization in Vegas, and obviously, we believe that. We see stimulus coming and helpful, both in leisure and particularly in our regionals."

What Changed From Last Quarter?

Q3 2025 was a challenging quarter—EPS missed by 20% ($0.24 actual vs $0.30 expected), driven by goodwill impairments. Q4 2025 marked a significant turnaround:

The Q3 2025 loss was driven by a $279 million goodwill impairment , which reduced to just $23 million in Q4 . The combination of lower impairments, a large tax benefit, and stronger Macau performance created the dramatic earnings swing.

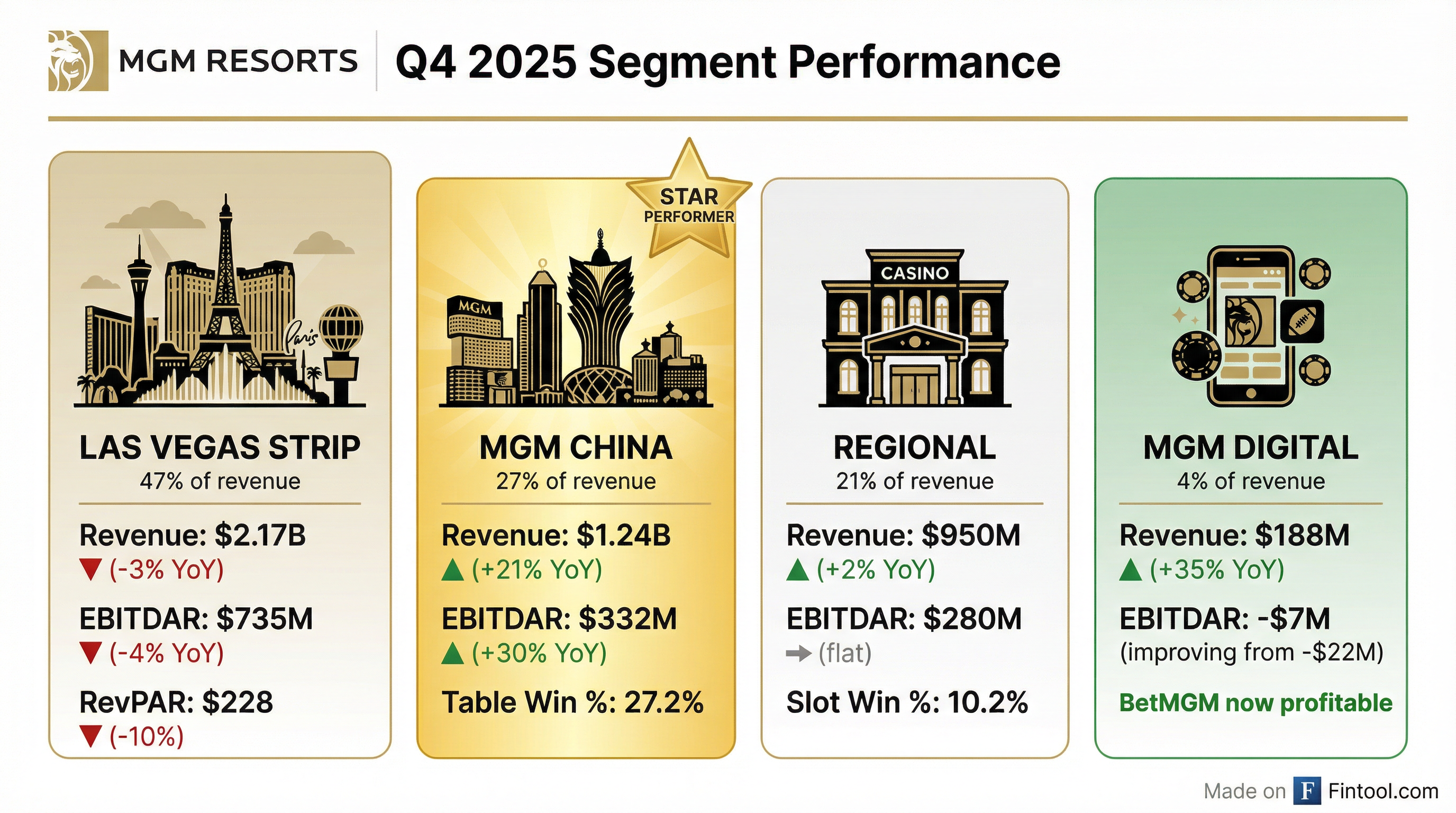

Segment Breakdown: MGM China Steals the Show

MGM China was the clear growth driver, delivering the highest segment margin improvement:

Las Vegas Strip: Rooms Weakness, Casino Strength

Las Vegas Strip revenue declined 3% to $2.17 billion, driven by rooms revenue weakness :

However, casino revenue rose 13% to $569 million on strong table games performance :

The 340bps improvement in table games win percentage drove the casino revenue beat despite flat slot volumes.

MGM China: Premium Mass Leadership

MGM China delivered 21% revenue growth to $1.24 billion, with Adjusted EBITDAR up 30% to $332 million :

The company achieved 16.5% market share in Q4 and maintained >16% for the full year—impressive given MGM's limited room inventory . Hornbuckle noted that MGM China trades at a "sub-7x forward EBITDA multiple versus an industry average of over 8.5x" and appears "significantly discounted" .

The branding fee increase from 1.75% to 3.5% is notable—secured through the life of the concession and worth >$50M annually to MGM. Management defended the increase: "The brand has proven its value over time, helping drive MGM China's market share and EBITDA, both of which have almost doubled since 2019" .

BetMGM: First Profitable Quarter

The BetMGM joint venture (50/50 with Entain) turned profitable, contributing $29 million to operating income versus a $42 million loss in Q4 2024 . Key highlights:

- $135 million distributed to MGM in Q4 2025, returning over 20% of MGM's cash investment

- Monthly player volumes +24%, active player days +14% in 2025

- 2026 guidance: $300-$350M Adjusted EBITDA, $50M CapEx

- 2027 target: $500 million Adjusted EBITDA

CFO Halkyard noted that BetMGM and MGM China distributions are now "recurring sources of income, and should be assessed accordingly" .

MGM Digital (LeoVegas and consolidated subsidiaries) grew revenue 35% to $188 million, with losses narrowing from $22 million to $7 million . The company expects 2026 losses to be "approximately half" of 2025 levels .

How Did the Stock React?

MGM stock had a volatile week around earnings:

The stock initially spiked 11% on February 4 when preliminary results were inadvertently posted, but gave back some gains on the official release day. The aftermarket decline to $35.01 suggests some investors may be taking profits after the run-up.

Full Year 2025 Review

For the full year 2025, MGM delivered modest revenue growth but saw earnings pressure from impairments:

The decline in net income was driven by:

- $279M goodwill impairment (vs $0 in FY 2024)

- $126M property transaction costs (vs $81M in FY 2024)

- Higher depreciation from new property investments (+$187M YoY)

Despite these headwinds, Adjusted EBITDA—management's preferred metric—held flat at $2.43B .

Capital Returns: 48% Share Reduction Since 2021

MGM continues aggressive share buybacks :

The company has reduced shares outstanding from ~500 million at the start of 2021 to 258 million today—a 48% reduction .

Balance Sheet Health

The company has $315 million in assets held for sale at quarter-end, related to the announced Northfield Park divestiture .

Forward Catalysts

Looking ahead to 2026, management highlighted several growth drivers on the call:

-

MGM Grand Renovations Complete: The $65M EBITDA headwind from 2025 is behind them, with "tremendous positive feedback on the refreshed product"

-

Convention & Group Strength: Mid-single-digit revenue growth in 2026, with "more group and convention room nights on the books for future years than we've ever had"

-

BetMGM Path to $500M: 2027 EBITDA target of $500M, with regular distributions expected

-

MGM China Branding Fee Increase: 1.75% → 3.5%, adding >$50M annual cash flow

-

World Cup Visitation: Major international visitation expected from matches in Los Angeles and Southern California

-

Las Vegas Airport Recovery: ~50% of lost capacity from Value Airlines has been backfilled by other carriers

-

Potential Tax Tailwinds: Management mentioned potential benefits from "no tax on overtime and tips, and other stimulus benefiting consumers"

Key Risks to Monitor

- Las Vegas Strip Softness: RevPAR down 10%, ADR down 7%—though RevPOR was actually up slightly

- Value Customer: Luxor/Excalibur seeing pressure, though only 6% of Las Vegas EBITDA

- Canada/Leisure Travel: Still need to "solve for Canada and leisure travel" per Hornbuckle

- 90% Gaming Loss Deductibility: New rule in effect, being watched closely and advocated against

What Did Management Guide?

Management provided several key forward-looking details on the earnings call:

BetMGM 2027 Target: The venture is targeting $500 million of Adjusted EBITDA by 2027, up from $300-350M guidance for 2026 . Monthly player volumes increased 24% and active player days rose 14% during 2025 .

MGM China Branding Fee: Increased from 1.75% to 3.5%, secured through the life of the concession (up to 20 years upon renewal). Based on 2025 results, this represents >$50 million in incremental annual cash flow to MGM .

Japan Funding: Expecting 2026 funding commitment of approximately $350-$400 million USD for MGM Osaka, mostly addressed with proceeds from the yen-denominated credit facility .

Las Vegas Renovations: The ARIA room renovation begins mid-2026, but with minimal disruption (mostly a 2027 impact). Unlike MGM Grand, bathrooms are not being renovated, requiring fewer rooms offline at any given time .

Expense Management: Corporate expense run-rate normalized at $110-$115 million. Overall expense growth will be held to "very, very low single digits" through FTE reductions and technology initiatives .

Q&A Highlights

Path to Las Vegas Growth (J.P. Morgan)

Dan Politzer asked about the timeline for normalized EBITDA growth in Las Vegas. CEO Hornbuckle cited multiple tailwinds :

- ConAg returning with expectations of 140,000 attendees and "more than our fair share"

- MGM Grand renovation complete — the remodel had "never seen" such impact on a property, with 700-1,000 rooms offline per day throughout 2025

- Group/convention room nights at record levels for future years

- High-end gaming remains "alive and well" with Holiday Gift Shop the second-highest ever

"Generally speaking, we feel very positive, positive enough to think that we're going to exit 2026 on an up." — Bill Hornbuckle

Renovation EBITDA Impact (Barclays)

Brandt Montour pressed on the MGM Grand renovation disruption. CFO Halkyard confirmed the impact was approximately $65 million in EBITDA during 2025 . This is now fully behind them, with potential upside from the refreshed product.

Table Hold Sustainability (Bank of America)

Shaun Kelley asked if the 24%+ table hold (above pre-COVID levels) is the new normal. Hornbuckle attributed it to high-end activity and market share gains :

"We see a lot of high-end activity... our book rush here, we're well into the high 40s. That, more than anything, is driving it." — Bill Hornbuckle

CFO Halkyard noted the favorable table hold contributed approximately $20 million to the bottom line in Q4 Las Vegas .

Value Customer Dynamics (CBRE)

John DeCree asked about the value-conscious customer at Luxor and Excalibur. Management noted these properties represent only 6% of Las Vegas segment EBITDA . While they don't see immediate changes to value customer habits, they're "working towards creative concepts on marketing our value proposition" .

Macau Chinese New Year (Macquarie)

Chad Beynon asked about Lunar New Year bookings. Kenneth Feng, CEO of MGM China, was bullish :

"We are very, very optimistic. We see very strong trend for Chinese New Year. We even have a long waiting list for our top players. The player quality is very high... We are very focused on quality over quantity." — Kenneth Feng

Feng also confirmed MGM China margins have consistently stayed in the "mid- to high-20s" as guided, with "rational competition" in the current marketplace .

Regional Outlook (Deutsche Bank)

Steve Fazella asked about regional performance. COO Ayesha Molino highlighted the segment's steadiness and investments in high-limit table rooms at Borgata . Hornbuckle added excitement about a potential Sphere coming to Maryland near National Harbor, which could deliver "a couple million more customers a year" .

Key Metrics From the Call

Several additional data points emerged during the earnings call:

Conference Call

MGM's Q4 2025 earnings call took place on February 5, 2026 at 5:00 PM ET. The full transcript is now available.

For more on MGM Resorts, visit the company research page or read the full Q4 2025 transcript.