MESA LABORATORIES INC /CO/ (MLAB)·Q3 2026 Earnings Summary

Mesa Labs Delivers Strong Margin Expansion, Stock Jumps 8% After-Hours

February 3, 2026 · by Fintool AI Agent

Mesa Laboratories reported Q3 FY2026 results that exceeded expectations on profitability metrics, sending shares up nearly 8% in after-hours trading. Revenue grew 3.6% YoY to $65.1M while operating income surged 38% to $8.0M. The standout metric was adjusted operating income (AOI) margin, which expanded 270 basis points to 26.2% of revenue.

Did Mesa Labs Beat Earnings?

Mesa Labs delivered a solid beat on profitability metrics despite modest top-line growth:

The return to profitability on a GAAP basis (after a net loss in Q3 FY25) and the significant margin expansion were the key drivers of the positive market reaction.

What Did Management Say?

CEO Gary Owens struck an optimistic tone, highlighting execution despite challenging macro conditions:

"Steady execution and relatively stable markets across Europe and North America helped deliver 3.6% organic revenues growth in 3Q26 versus the prior year, or 5.7% when excluding CG China revenues."

On margin expansion:

"Profitability for the quarter, using our preferred metric of AOI excluding unusual items as a percentage of revenues, was very robust at 26.2% versus 23.5% for both 3Q25 and the whole of FY25."

Management noted that improving volumes, favorable product mix, and cost realignment benefits more than offset 120 bps of FX headwinds and negligible tariff impacts.

Which Segments Drove Results?

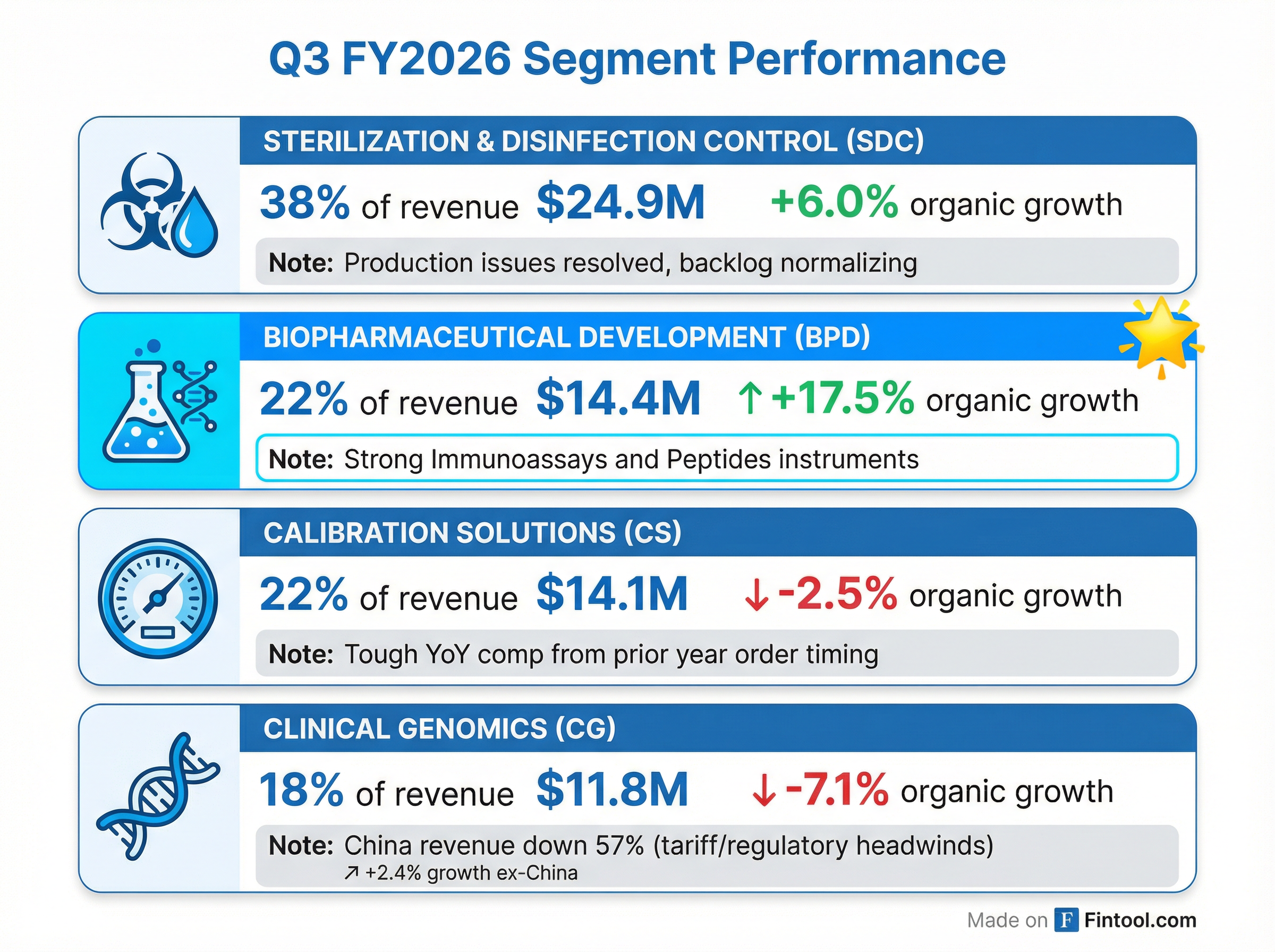

The four business segments delivered divergent results:

Segment Performance Detail

Biopharmaceutical Development (BPD) was the clear winner with 17.5% organic growth driven by strong Immunoassays and Peptides instrument sales. Gross profit margin expanded 50 bps, and would have been up 320 bps excluding FX and tariff impacts.

Sterilization & Disinfection Control (SDC) returned to normalized production after Q2 issues, with backlog decreasing modestly by ~$0.5M. Gross margin was down 50 bps on USD weakness but would have expanded 30 bps to 70.3% excluding FX.

Clinical Genomics (CG) remained the drag with China revenues collapsing 57% YoY due to regulatory and tariff headwinds. However, revenue outside China grew 2.4%, and management expects the division to return to positive organic growth in Q4 as comps ease. Gross margin actually expanded 560 bps on mix shift away from lower-margin China business.

How Did the Stock React?

MLAB shares closed at $80.50 on February 3, 2026 (pre-earnings) and jumped to $85.00 in after-hours trading — a gain of approximately 7.9%. This represents one of the stronger post-earnings reactions for the stock over the past two years.

*Values retrieved from S&P Global

The stock remains well off its 52-week high but has recovered significantly from the $55.45 low reached earlier in the fiscal year.

What Changed From Last Quarter?

Several key developments since Q2 FY26:

-

Production Issues Resolved: SDC returned to normal production after encountering issues in Q2, with backlog starting to normalize

-

Margin Step-Up: AOI margin improved to 26.2% from 25.1% in Q2 (AOI excluding unusual items basis)

-

Debt Paydown Continues: Repaid $8.7M of debt, reducing Total Net Leverage Ratio to 2.62x from 2.70x

-

Sequential Revenue Acceleration: Revenue grew 7.2% sequentially (vs. +2.0% QoQ in Q2), within management's expected growth range

-

China Headwinds Stabilizing: China revenue roughly flat sequentially, suggesting the step-function decline from early FY26 has bottomed

Balance Sheet & Capital Allocation

Mesa Labs continues to prioritize debt reduction:

Management remains committed to driving the Net Leverage Ratio below 2.5x, having reduced total liabilities by $25M YTD through the first nine months of FY26.

What Did Management Guide?

While Mesa Labs does not provide formal quantitative guidance, management offered several qualitative outlooks:

- Q4 FY26: Expects "positive momentum to continue" with less impactful China comparisons

- Margins: AOI margin expected to "moderate slightly over the next several quarters" as cost realignment benefits are fully realized while SDC investments continue into H1 FY27

- Leverage: Committed to driving Net Leverage Ratio below 2.5x

- Market Conditions: "Encouraged that end markets are stabilizing" and expect to accelerate growth as conditions improve

Key Risks to Monitor

-

China Exposure: Clinical Genomics China business down 57% YoY with ongoing regulatory and tariff headwinds

-

FX Headwinds: USD weakness created 120 bps margin headwind in Q3; continued dollar strength could pressure international margins

-

Macro Sensitivity: End markets in life sciences and healthcare remain "challenging" despite stabilization signals

-

Leverage: At 2.62x, the company remains more leveraged than many peers and needs to execute on debt paydown

The Bottom Line

Mesa Labs delivered a solid Q3 with the highlight being substantial margin expansion to 26.2% AOI margin — up 270 bps YoY — driven by cost actions and favorable mix. While top-line growth remained modest at 3.6%, excluding China headwinds organic growth was a healthier 5.7%. The Biopharmaceutical Development segment's 17.5% organic growth demonstrates the company's exposure to high-growth end markets. With China headwinds stabilizing, production issues resolved, and continued debt paydown, the setup for Q4 and FY27 appears constructive. The 8% after-hours move reflects investor appreciation for the profitability improvements and stabilizing fundamentals.

Earnings call transcript not available for this report.

Related Links: