MAXIMUS (MMS)·Q1 2026 Earnings Summary

Maximus Beats on EPS as Federal Margins Hit 16.5%; Raises FY26 Guidance

February 5, 2026 · by Fintool AI Agent

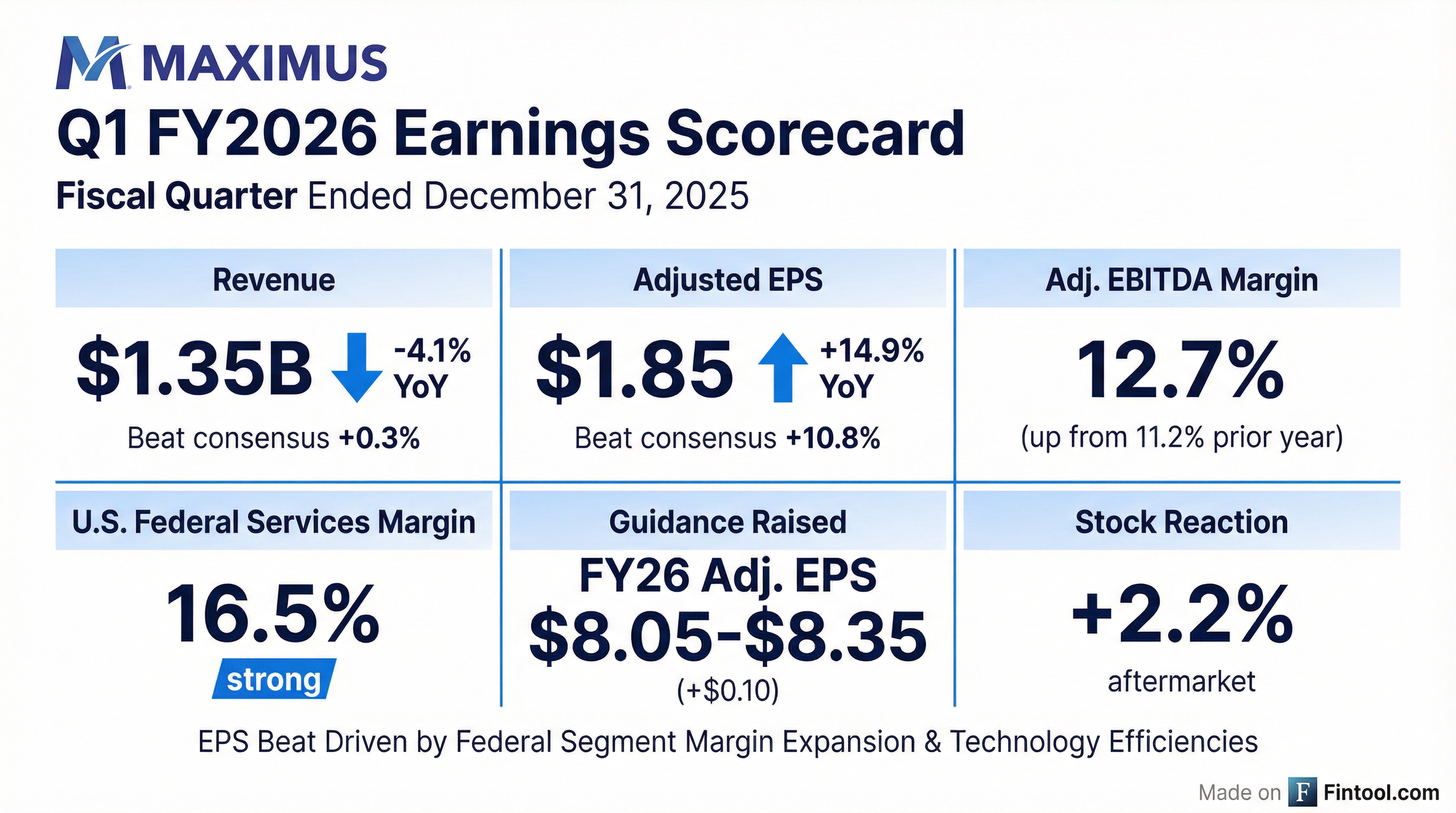

Maximus (NYSE: MMS) delivered a strong Q1 FY2026 with adjusted EPS of $1.85 beating consensus by 10.8%, driven by exceptional margin expansion in the U.S. Federal Services segment which hit 16.5%. Revenue of $1.35B was essentially in-line with expectations but down 4.1% YoY due to divestitures and lower volumes in state programs. The company raised full-year earnings guidance, signaling confidence in sustained margin performance and technology-driven efficiencies.

Did Maximus Beat Earnings?

Yes — EPS beat decisively while revenue was in-line.

*Values retrieved from S&P Global for consensus estimates.

The EPS beat was the story of the quarter. While revenue declined 4.1% YoY (with ~1.5% from divestitures), the company's margin expansion more than offset top-line pressure.

What Drove the Beat?

U.S. Federal Services Segment: The Margin Story

The standout was the U.S. Federal Services segment, which delivered a 16.5% operating margin — up from 12.7% in Q1 FY25.

Key drivers of Federal margin expansion:

- Stable volumes across multiple program areas

- Wider adoption of technology initiatives enhancing staff productivity

- Operating leverage from prior capacity investments in clinical portfolio

The U.S. Services segment margin of 7.1% was expected to be lower in Q1 (seasonal pattern from open enrollment costs) and is guided to recover to 10.5-11% for the full year.

What Did Management Guide?

Guidance was raised for earnings while revenue guidance was narrowed.

Revenue guidance narrowed by ~$50M at the high end due to:

- $25M impact from divested child support business

- Some new work shifting out to later periods

Segment margin guidance for FY26:

- U.S. Federal Services: 16.5% - 17%

- U.S. Services: 10.5% - 11%

- Outside the U.S.: 1% - 3%

How Did the Stock React?

MMS rose ~2.2% in aftermarket trading to $94.45, up from the prior close of $92.38.

The stock has been on a strong run, up from lows of ~$64 in early 2024 to the current level near $94. The 52-week range is $63.77 - $100.00.

What Changed From Last Quarter?

Positive Developments

-

Federal margins accelerated — Q1 FY26 margin of 16.5% exceeded Q4 FY25's implied ~12.5% run rate, suggesting technology investments are paying off faster than expected

-

Pipeline expanded significantly — Total pipeline reached $59.1B with $6.2B in active proposals (submitted + in prep), up 55% from a year ago

-

AI adoption progress — Recent contract wins are scoring high on technical points (98% in one international win) driven by AI-powered clinical claim tools

-

New work opportunities — Working Families Tax Cut legislation (Medicaid work requirements, SNAP accuracy requirements) creates medium-term growth opportunities, though primarily an FY27 driver

-

SNAP Accuracy Assistant receptivity — Management reported "really positive" reception from states, with the tool helping identify root causes of error rates and enabling real-time case intervention

Concerns to Monitor

-

Low book-to-bill — Q1 FY26 book-to-bill was just 0.2x (TTM 0.5x), impacted by the government shutdown slowing award activity

-

Cash flow timing — Q1 free cash flow was negative $251M (typical Q1 seasonality plus collection delays in Federal segment); DSO spiked to 78 days from 62 days at quarter-end

-

U.S. Services pressure — Revenue down 8.2% YoY with several programs experiencing lower volumes; positive organic growth not expected until Q4 FY26

-

Outside the U.S. losses — $1.4M operating loss in the quarter as new work revenue came in lighter than expected

-

Federal comps challenging — ~$100M of natural disaster support revenue in FY25 (primarily Q1-Q2) creates tough year-over-year comparisons

Key Management Commentary

"Our ability to deliver consistent performance is evidenced in our first quarter results and enables us to raise earnings guidance and narrow our revenue guidance for the full fiscal year 2026. Maximus operates in a resilient sector of government spend, and the delivery of essential services in a high quality and efficient manner is a hallmark of our business."

— Bruce Caswell, President & CEO

"Our strategic expansion of automation, including the use of AI, is impacting the way we work, the technology solutions we offer our customers, and the delivery of customer outcomes and the public experience through the programs we administer."

— Bruce Caswell, President & CEO

"We could create a high single to low double-digit organic growth opportunity for U.S. Services... We continue to believe that this is a reasonable estimate for the ultimate revenue run rate from this work once it's fully ramped."

— David Mutryn, CFO (on combined Medicaid/SNAP opportunity)

AI and Technology Highlights

Management emphasized technology as a key margin driver:

- Agentic AI in production — Practical applications of agentic AI are being deployed in controlled environments

- 45% autonomous dispute resolution — One program implemented AI-based solution for payment disputes, leading to 45% autonomous resolution and material financial improvement

- GSA gXCC BPA win — Selected as single awardee for GSA's Government Experience Contact Center (gXCC) Services transformation; 5-year BPA with no ceiling amount

- Accuracy Assistant™ — Launched new SNAP tool to help states detect data inconsistencies and prevent errors in real-time

- Forbes recognition — Named to Forbes' America's Best Employers 2026 list

GSA gXCC Platform Use Cases

The GSA contract leverages Maximus's TXM platform — a cloud-based, multi-channel contact center with natural language processing and AI. Management illustrated the platform's capabilities with a compelling example:

"Think of the FDA, where somebody needs to report a food product they think might be contaminated. They may begin by calling in, and the system may push to them a request for an image of the barcode... The real power is that contact centers are the front lines for understanding broader public health issues. You start seeing calls surging in certain areas related to an event."

— Bruce Caswell, President & CEO

GSA anticipates awarding 5 task orders within 2 months of the BPA award, with potential for other agencies to place orders under the vehicle.

Q&A Highlights

Revenue Visibility

Q: How much revenue is in-hand vs. new work?

"There's virtually no new work remaining in the forecast. Even entering the year, it was already modest — about 3% of not yet new work in the midpoint of the guidance. So with the narrowing of the revenue range, that's very small now."

— David Mutryn, CFO

U.S. Services Recovery Timeline

Q: Can U.S. Services grow for the year?

Management indicated likely not for the full year, but expects positive organic growth to resume by Q4 FY26. The Q1 margin pressure is structural (contract seasonality around open enrollment), not driven by population trends.

PACT Act Volume Outlook

Q: What's the outlook for PACT Act volumes?

Volumes are expected to remain "pretty steady" for the rest of FY26 from Q1 run rate. Management noted the government shutdown had no meaningful impact on VA case flow. The real surge period was earlier in calendar 2025.

VA Contract Timing

Q: When does the VA contract come up for rebid?

Current contract performance period runs through December 31, 2026 — not impacting FY26 guidance. The company has been making technology investments to improve the veteran experience ahead of the rebid.

Natural Disaster Comparisons

Q: How should we think about FEMA/natural disaster comps?

Natural disaster support was approximately $100 million (~2% of revenue) in FY25, primarily in Q1-Q2 (hurricane season and aftermath). This creates challenging year-over-year comparisons for the Federal segment.

Medicaid Work Requirements Timing

Management clarified an important timing nuance: while community engagement requirements are effective January 1, 2027, the actual semiannual redetermination activity won't begin until July 2027 (since someone newly determined eligible in January wouldn't need redetermination for 6 months). This is why FY27 is a "building year" with full run rate in FY28.

Capital Allocation & Balance Sheet

Net leverage increased to 1.8x from 1.5x due to seasonal working capital needs, but remains well below the 2-3x target range. Management expects leverage to fall to 1.0x or below by Sept 30, 2026 absent M&A or share repurchases.

DSO spiked due to:

- Administrative delays on one Federal program

- Lingering effects from government shutdown

DSO expected to remain elevated through H1 FY26 and improve in H2. Full-year free cash flow guidance of $450M-$500M is unchanged.

Beat/Miss History (8 Quarters)

*Values retrieved from S&P Global.

Maximus has beaten EPS estimates in 7 of the last 8 quarters. The two misses (Q4 FY24 and Q4 FY25) were both narrow.

Forward Catalysts

- Federal Services momentum — 16.5%+ margins suggest durable productivity gains from technology investments

- Medicaid work requirements — Community engagement effective January 2027, but actual redetermination volume builds from July 2027; full run rate in FY28

- SNAP accuracy requirements — 43 states (including D.C.) have error rates >6%; states have strong incentive to act now as FY26 measurement period determines FY28 cost share

- Award activity recovery — Government shutdown impacted Q1 book-to-bill (0.2x); management expects pickup across remaining quarters

- GSA gXCC expansion — Single-award BPA with 5 initial task orders expected within 2 months; potential for additional agency adoption

- VA contract rebid preparation — Technology investments underway to enhance veteran experience ahead of December 2026 performance period end

Key Takeaways

- EPS beat was the headline — $1.85 vs $1.67 consensus (+10.8%) driven by 16.5% Federal segment margins

- Revenue was in-line — $1.35B (-4.1% YoY) as expected, with divestitures contributing ~1.5% of decline

- Guidance raised — FY26 adjusted EPS raised $0.10, EBITDA margin raised 30bps to ~14%

- Technology paying off — AI and automation investments driving measurable productivity gains; 45% autonomous dispute resolution in one program

- Pipeline strong — $59.1B total pipeline with $6.2B in active proposals (+55% YoY); book-to-bill should recover as government award activity normalizes

- U.S. Services inflection coming — Positive organic growth expected by Q4 FY26; full benefit from Medicaid/SNAP in FY27-28

- VA contract runway — Current performance period through December 2026; technology investments ongoing ahead of rebid

Related: Maximus Company Page | Q1 FY2026 Transcript | Q4 FY2025 Earnings