MARINE PRODUCTS (MPX)·Q4 2025 Earnings Summary

Marine Products Beats on Revenue as MasterCraft Merger Sends Stock Down 12%

February 5, 2026 · by Fintool AI Agent

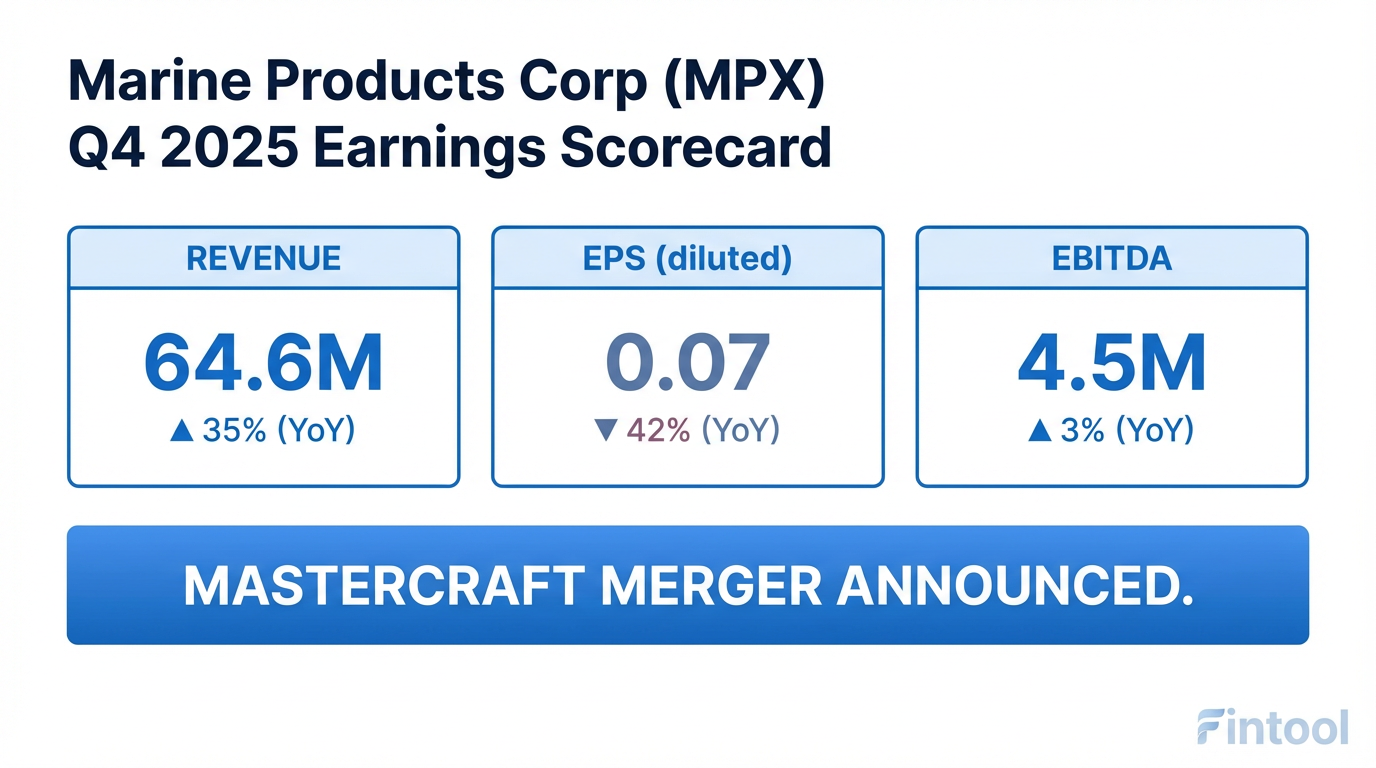

Marine Products Corporation (NYSE: MPX) reported Q4 2025 results with a revenue beat — up 35% year-over-year to $64.6 million — but overshadowing the earnings was a major M&A announcement: MasterCraft Boat Holdings (NASDAQ: MCFT) will acquire Marine Products in a $232 million cash-and-stock deal . The implied per-share value of $7.79 represents a significant discount to pre-announcement levels, sending MPX shares down 12% in after-hours trading.

Did Marine Products Beat Earnings?

Revenue beat, earnings missed. Q4 2025 net sales of $64.6 million exceeded the prior year by 35%, driven by a 22% increase in boats sold and 12% improvement in price/mix .

The EPS decline was driven by:

- SG&A surge: Up 61% to $8.9M (13.9% of sales vs. 11.6% prior year)

- Tax headwind: 42.5% effective tax rate vs. a benefit in Q4 2024, due to company-owned life insurance liquidation from the retirement plan dissolution

Excluding the COLI tax impact, adjusted net income was $3.4 million and adjusted EPS was $0.10 .

What Changed From Last Quarter?

Revenue momentum accelerated. After a soft Q3 2025 with $53.1M in sales, Q4 rebounded strongly with $64.6M — the highest quarterly revenue of the year.

Full year 2025 results:

- Net sales: $244.4M (+3% YoY)

- Net income: $11.4M (-36% YoY)

- Diluted EPS: $0.32 vs. $0.50 prior year

- EBITDA: $17.2M (-18% YoY)

What Is the MasterCraft Merger Deal?

MasterCraft Boat Holdings announced a definitive agreement to acquire Marine Products for approximately $232 million net of acquired cash .

Deal Terms:

Strategic Rationale: The combined company will operate five boat brands — MasterCraft, Crest, Balise, Chaparral, and Robalo — creating a diversified portfolio across premium performance, leisure, recreation, and sport fishing categories .

- Pro forma combined net sales: ~$560 million

- Pro forma adjusted EBITDA: ~$64 million

- Expected annual cost savings: ~$6 million from eliminating MPX public company costs

- Expected to be accretive to adjusted EPS in fiscal 2027

LOR, Inc., Marine Products' majority shareholder, has entered a voting agreement to support the transaction .

How Did the Stock React?

MPX dropped 12% after-hours on deal value disappointment.

The deal implies a 22% discount to where MPX traded before the announcement. This is unusual for an acquisition — typically targets see a premium. The stock is now trading between the deal value ($7.79) and prior levels as investors assess merger completion risk.

MasterCraft (MCFT) rose 3.9% to $23.12 during regular trading, with after-hours trading at $23.98 (+3.7%).

What Did Management Say?

Ben Palmer, CEO of Marine Products:

"This transaction marks an exciting new chapter for Chaparral and Robalo, and is a testament to the hard work and dedication of our employees. We believe that MasterCraft will be a great steward of the combined business and an enthusiastic partner to our exceptional dealers and suppliers."

Brad Nelson, CEO of MasterCraft:

"We have long admired Marine Products and the success its team has achieved in creating a leading brand for recreational boaters with Chaparral and a leader in sport fishing boats with Robalo. Supported by both companies' proven category leadership, the combined company will serve an expanded customer base with diversified offerings, drive differentiated innovation, and deliver greater value for dealers and consumers."

Note: Marine Products did not host an earnings call due to the merger announcement .

Balance Sheet and Cash Flow

The company maintains a $20 million revolving credit facility with no borrowings .

Key Risks and Concerns

Merger-Related:

- Deal value below market: Shareholders receive less than prior trading levels

- Approval risk: Requires stockholder and regulatory approvals

- Integration uncertainty: Synergy realization and cultural fit

- Tariff exposure: Forward-looking statements cite trade policy as a risk

Operational:

- Margin compression: EBITDA margin fell 220 bps YoY despite revenue growth

- SG&A inflation: 61% increase in selling, general and administrative costs

- Discretionary spending sensitivity: Boat sales depend on consumer confidence and interest rates