MARSH & MCLENNAN COMPANIES (MRSH)·Q4 2025 Earnings Summary

Marsh Beats on EPS and Revenue, Posts 18th Straight Year of Margin Expansion

January 29, 2026 · by Fintool AI Agent

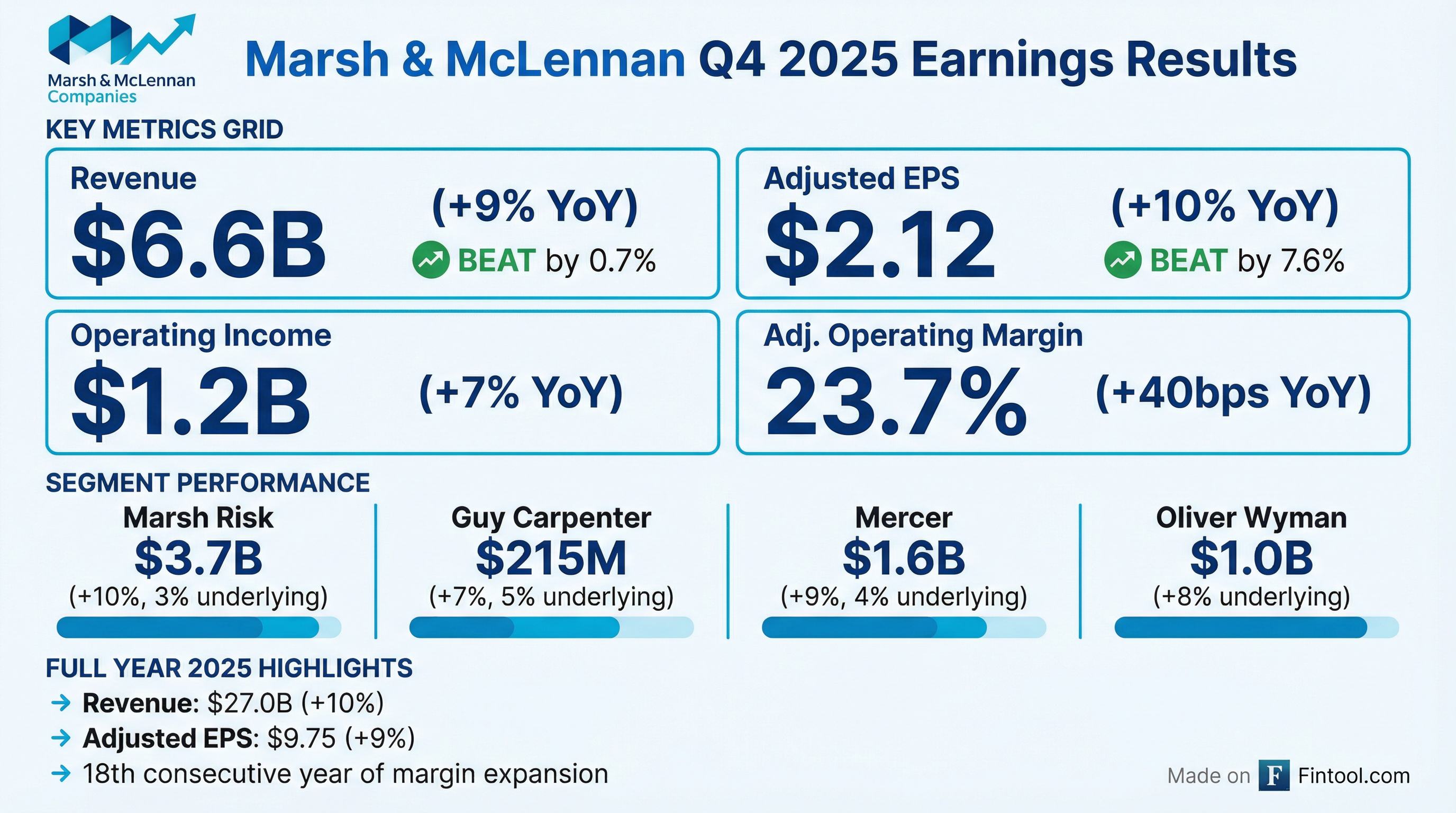

Marsh & McLennan Companies (NYSE: MRSH) reported Q4 2025 results that exceeded Wall Street expectations on both the top and bottom line, capping off a strong full year that included the successful integration of McGriff and a rebranding initiative.

Did Marsh Beat Earnings?

Yes — a double beat. Marsh delivered solid Q4 results:

Q4 adjusted EPS of $2.12 included a benefit of 7 cents per share from favorable discrete tax items and 2 cents from foreign exchange tailwinds.

The company has now beaten EPS estimates for 9 consecutive quarters, demonstrating remarkable consistency across varying economic conditions.

What Changed From Last Quarter?

Several notable developments distinguish Q4 from prior quarters:

1. Brand Transformation Complete The company rebranded from Marsh & McLennan to simply "Marsh" and changed its NYSE ticker from MMC to MRSH on January 14, 2026. Results now reflect new segment naming:

- "Marsh Risk" (formerly Marsh)

- "Marsh Management Consulting" (formerly Oliver Wyman Group)

2. Thrive Program Launched In Q3 2025, the company launched "Thrive" — a three-year transformation program focused on brand strategy, client value delivery, accelerated growth, and operational efficiency. Q4 restructuring charges of $126M were primarily severance and lease exit costs.

3. McGriff Integration Progressing McGriff contributed to strong U.S./Canada growth (21% GAAP for full year) and is expected to become "more meaningfully accretive" in 2026 and beyond.

How Did Each Segment Perform?

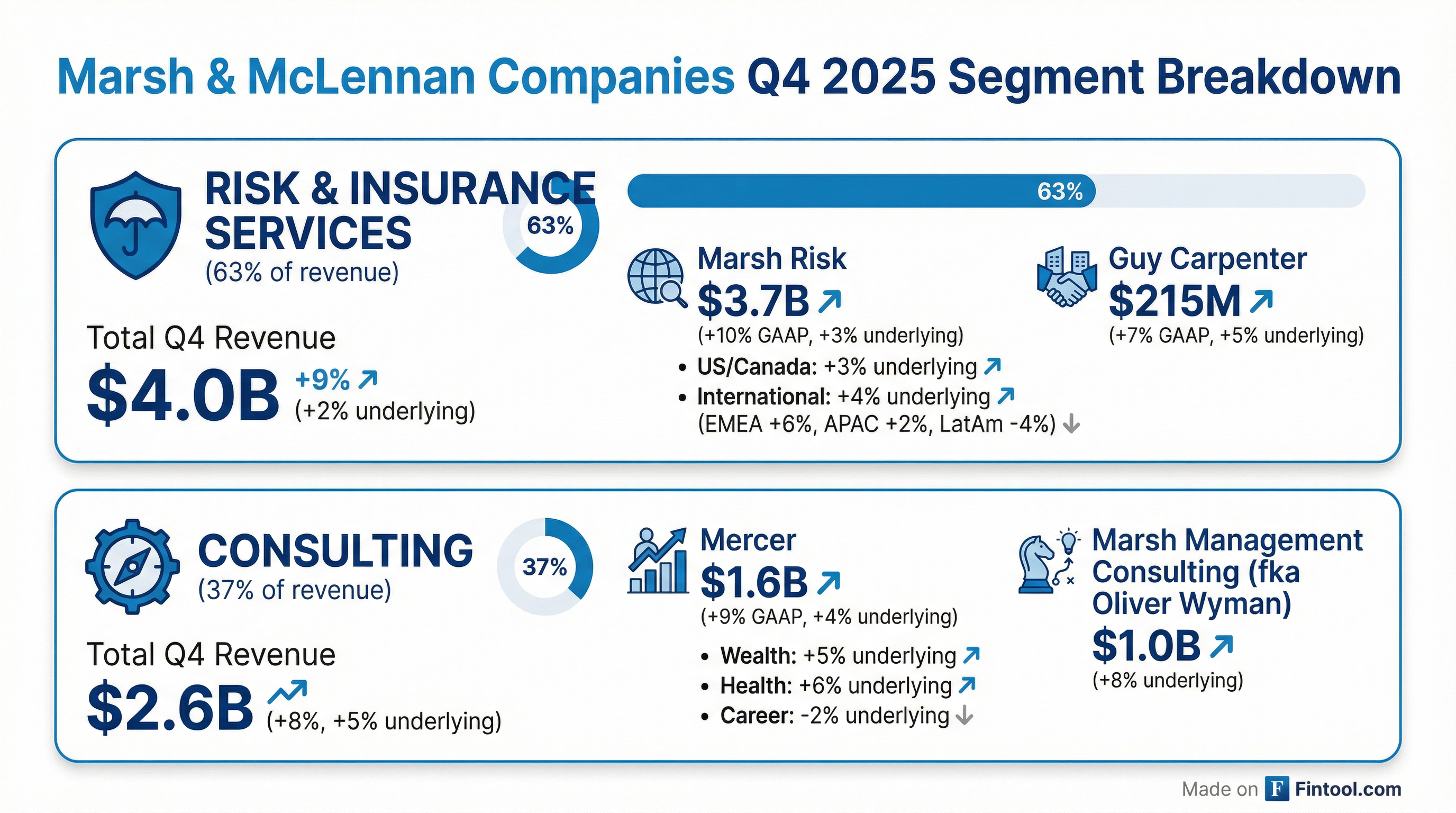

Risk & Insurance Services ($4.0B, +9% YoY)

Marsh Risk's underlying growth of 3% reflects solid execution despite moderating P&C pricing. U.S./Canada grew 3% underlying while International delivered 4% underlying growth, led by EMEA at 6%. Latin America contracted 4%, attributed to "idiosyncratic issues."

Guy Carpenter's reinsurance brokerage business delivered 5% underlying growth despite a soft pricing environment — a testament to its analytics capabilities and market position.

Consulting ($2.6B, +8% YoY)

Within Mercer, Health (+6% underlying) and Wealth (+5%) performed well, while Career contracted 2% on softer project demand in the U.S.

Marsh Management Consulting (Oliver Wyman) was the standout with 8% underlying growth — the strongest among all segments.

Full Year 2025 Results

This marks 18 consecutive years of reported margin expansion — a remarkable track record that few professional services firms can match.

What Did Management Say?

CEO John Doyle struck an optimistic tone:

"Our fourth quarter results capped another solid year for Marsh. For the full year, we generated 10% revenue growth, 4% underlying revenue growth, double-digit adjusted NOI growth, 9% adjusted EPS growth and our 18th consecutive year of reported margin expansion. We also launched our new brand, successfully completed the integration of McGriff and announced our Thrive program."

"Our team performed well in a complex environment, and we are positioned for sustained momentum in 2026."

Capital Allocation

The company remains disciplined on capital deployment:

In 2025, the company repurchased 10.1 million shares for $2.0 billion. The lower acquisition spending reflects the prior year's $8.5B McGriff deal.

Balance Sheet Health

The company expects to repay $600M of senior notes maturing in Q1 2026.

How Did the Stock React?

The stock showed a muted positive reaction to the earnings beat:

The stock has declined ~28% from its 52-week high, potentially pricing in concerns about slowing organic growth and margin pressures from the Thrive restructuring program.

What Are the Key Risks?

Management highlighted several forward-looking risks:

- Geopolitical Uncertainty: Multiple global conflicts, tariffs, and trade policy changes could impact client spending

- US Tort Environment: Rising litigation costs and "nuclear verdicts" driving liability insurance costs higher

- Cyber Risk: Increasing ransomware and supply chain attacks

- Integration Execution: McGriff and Thrive program execution risks

- Career Segment Softness: Discretionary HR consulting demand remains challenged in the U.S.

Forward Catalysts

Near-term (Q1-Q2 2026):

- McGriff becoming "meaningfully accretive" to adjusted EPS

- Thrive program generating initial efficiency savings

- Q1 2026 seasonally strongest quarter for RIS

Medium-term (2026+):

- Full brand integration benefits

- Operating leverage from automation and process improvements

- Potential acceleration if macro uncertainty subsides

The Bottom Line

Marsh delivered a solid Q4 that exceeded expectations and closed out an impressive FY 2025 — 10% revenue growth, 9% adjusted EPS growth, and an 18th consecutive year of margin expansion. The McGriff integration is progressing well, the brand transformation is complete, and the Thrive program positions the company for continued efficiency gains.

While underlying growth of 4% reflects moderation from prior years, management's track record of execution through cycles provides confidence. At current levels (~28% below 52-week highs), the risk/reward appears balanced for long-term investors seeking quality exposure to the insurance brokerage and consulting sectors.

View MRSH Company Page | Read Q4 2025 Earnings Call Transcript | View Prior Earnings