National Bank Holdings (NBHC)·Q4 2025 Earnings Summary

National Bank Holdings Q4 2025: Vista Deal Closes as Management Cleans House on Problem Loans

January 28, 2026 · by Fintool AI Agent

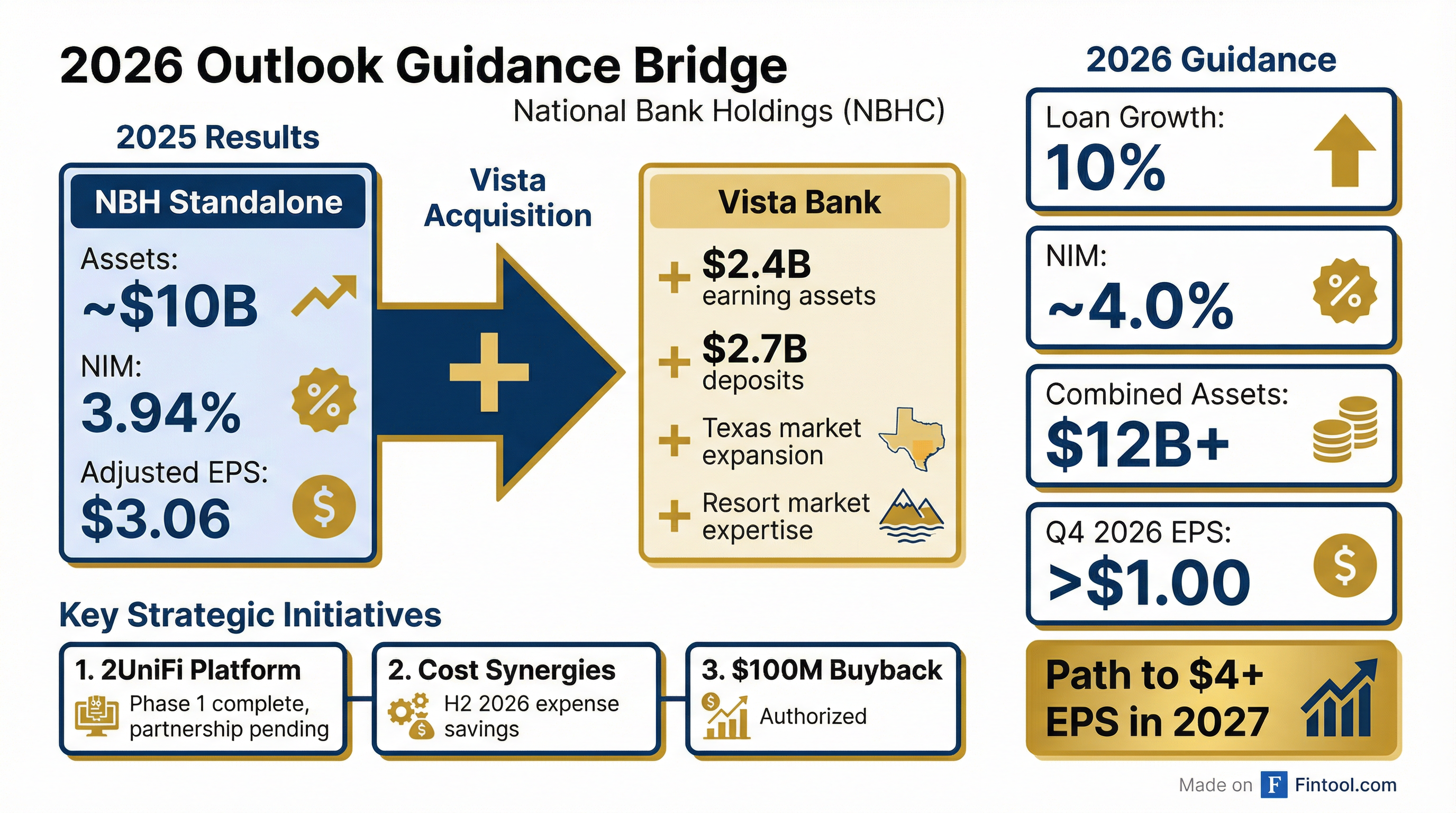

National Bank Holdings (NBHC) delivered a "noisy" Q4 2025, with adjusted EPS of $0.60 missing consensus by 27% as management took aggressive action to address lingering problem loans and absorbed one-time acquisition costs. Despite the headline miss, the stock recovered from early losses to trade up 2.7% intraday as investors focused on the Vista Bank acquisition closure and bullish 2026 guidance calling for 10% loan growth and a path to $4+ EPS in 2027.

Did National Bank Holdings Beat Earnings?

No. Q4 2025 results missed on both revenue and EPS, but context matters.

The quarter was intentionally messy. CEO Tim Laney stated the goal was to "enter 2026 with a clean slate" . One-time impacts included:

- $4.1M after-tax acquisition costs (Vista deal)

- $2.6M after-tax loss on strategic securities sale to stay under $10B in assets

- $9.1M provision expense related to charge-offs and specific reserves on problem loans

CFO Nicole Van Denabeele emphasized: "We addressed a specific set of problem loans during the quarter... For the full year 2025, on an adjusted basis, net income totaled $117.6 million, or $3.06 of earnings per diluted share."

How Did the Stock React?

NBHC shares opened down ~3% at $38.82 but staged a recovery throughout the day, reaching $40.61 before settling at $39.87—up 2.7% from the open but essentially flat versus the prior close of $40.06.

The intraday reversal reflects the market's forward-looking view: Q4 was a "kitchen sink" quarter, while 2026 guidance was strong.

Trading Stats (Jan 28, 2026):

What Did Management Guide for 2026?

Management provided comprehensive 2026 guidance that reflects the combined NBH + Vista organization:

The key guidance points:

- Q4 2026 EPS exceeding $1.00 — Sets up for annualized $4+ run rate

- 2027 EPS exceeding $4.00 — Explicit long-term target

- December NIM came in at 3.97%, with Vista's December margin at 4.0%

What Changed From Last Quarter?

Vista Bank Acquisition Closed — The transformational deal closed in early January, adding:

- $2.4B in earning assets

- Combined loan portfolio of ~$9.4B

- Expanded Texas presence and resort market expertise

2UniFi Platform Milestone — The digital banking initiative completed Phase 1 with the launch of fully automated SBA loans. John Finn noted: "Now that our foundational infrastructure is in place, we are shifting gears from constructing systems to activating services."

2UniFi 2026 expectations:

- Revenue: $2M-$4M (vs. minimal in 2025)

- Expense: Flat at $22M (includes full year depreciation)

- Partnership discussions ongoing that could move expenses off NBH financials

$100M Buyback Authorized — Laney called buybacks "a priority at this point."

What Did Management Say About Credit?

The credit discussion dominated Q&A. Management took a decisive approach to legacy problem loans:

"We literally were dealing with less than a handful of relationships that had emerged as problems [in early 2025]. We really were in the belief that over the course of 2025, they would work their way through the judicial process... The decision, we believe a prudent decision, was to address these as aggressively as we could in 2025 and have a clean runway for 2026." — Tim Laney, CEO

Credit Metrics:

President Aldis Berkans expects "asset quality metrics will continue their positive trends, returning to top quartile performance in 2026."

Capital and Balance Sheet

NBHC maintains robust capital levels:

The strong capital position enables both the Vista integration and share repurchases.

Loan Production Highlights

Q4 2025 was a record quarter for commercial lending:

- $591M total loan originations — second-highest quarter ever

- $429M commercial loan originations — new record

- ~8% annualized commercial loan portfolio growth

- 127% non-owner occupied CRE to capital ratio (improved)

The combined entity starts 2026 "comfortably below the 200% threshold" for CRE concentration, providing "meaningful runway for growth."

Q&A Highlights

On 2UniFi Partnership Timeline: Laney acknowledged being "perhaps too optimistic" on the October call about partnership timing, but reiterated focus on finding the right partner: "We are highly motivated to see something happen there... Imagine what that looks like if we're pulling those expenses of 2UniFi, in all or in part, off of our income statement."

On Texas Growth Opportunity: Vista's John Steinmetz: "Texas's diversified, high-growth economy provides unlimited opportunities... we have consistently put up a 23% CAGR in loan growth without the balance sheet that NBH provides us."

On Resort Markets Strategy: Steinmetz noted these communities "once seen as primarily secondary home destinations, are now primary residents for wealthy baby boomers"—creating opportunity for "white-glove, concierge, private client, and wealth management services."

On Hiring: "The opportunities and the inbound calls that we're receiving, not from recruiters, but from bankers at the organizations in Texas and beyond, to be a part of a culture that puts their people first, is something like I've never seen." — John Steinmetz

Historical EPS Trend

*Values retrieved from S&P Global

NBHC has beat EPS estimates 5 of the last 8 quarters. The Q4 2025 miss was the largest in recent history, driven by the intentional credit clean-up.

Forward Catalysts

- Vista Integration Synergies — H2 2026 expense savings following system integration

- 2UniFi Partnership — Could materially reduce NBH's expense base if completed

- Texas Expansion — Steinmetz bringing "people first" recruiting approach

- Resort Market Growth — Three new market presidents added with 45+ years combined experience

- Share Buybacks — $100M authorization with management indicating it's "a priority"

Key Risks

- Integration Execution — System conversion and expense synergies depend on smooth Vista integration

- 2UniFi Monetization — Platform still burning $22M/year with partnership timing uncertain

- CRE Exposure — Private credit and alternative lenders continuing to pressure commercial real estate payoffs

- Rate Sensitivity — Asset-sensitive balance sheet means margin pressure if rates fall faster than deposits reprice

The Bottom Line

NBHC's Q4 2025 was intentionally messy—management cleaned house on problem credits and absorbed acquisition costs to "enter 2026 with a clean slate." The Vista deal transforms NBH into a $12B+ bank with Texas growth runway and enhanced capabilities. With NIM at ~4%, 10% loan growth guidance, and a path to $4+ EPS in 2027, the forward story is compelling. The stock's intraday reversal suggests the market agrees.