Earnings summaries and quarterly performance for NORTHEAST BANCORP /ME/.

Research analysts covering NORTHEAST BANCORP /ME/.

Recent press releases and 8-K filings for NBN.

Northeast Bank Reports Q2 2026 Results with Strong Loan Growth

NBN

Earnings

Revenue Acceleration/Inflection

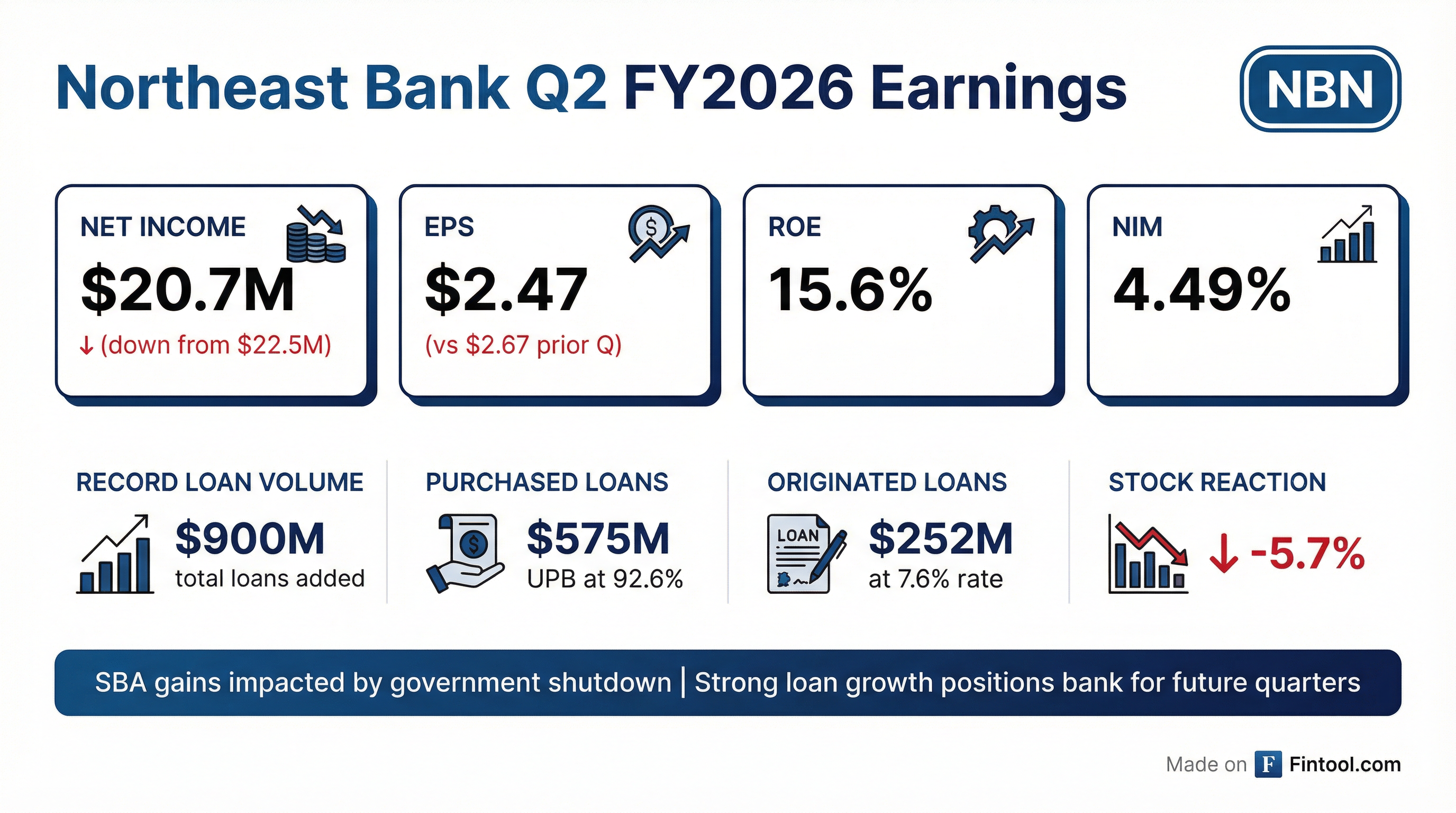

- Northeast Bank reported net income of $20.7 million or $2.47 per diluted share for Q2 2026, with a return on average assets of 1.87% and return on average equity of 15.6%.

- The bank achieved significant balance sheet growth, with total assets reaching $4.95 billion and loans increasing to $4.4 billion by quarter-end, driven by nearly $900 million in total loan volume, including $532 million in purchased loans and $252 million in originated loans.

- Net interest margin (NIM) was 4.49% for the quarter, and management expects a future lift as approximately $1.25 billion in CDs mature over the next six months at a weighted average rate of 4.05%.

- SBA activity was heavily impacted by a government shutdown, resulting in $2.1 million in gains from sold SBA loans, a decrease from the prior quarter's $8 million, which affected EPS by $0.50 after-tax. The bank anticipates increased SBA loan originations and sales in subsequent quarters.

Jan 27, 2026, 4:00 PM

Northeast Bank Reports Q2 Fiscal Year 2026 Earnings with Strong Loan Growth Despite SBA Headwinds

NBN

Earnings

Revenue Acceleration/Inflection

- Northeast Bank reported net income of $20.7 million and diluted earnings per share of $2.47 for Q2 Fiscal Year 2026, with a return on average assets of 1.87% and return on average equity of 15.6%.

- The bank achieved significant loan growth, with total loans ending the quarter at $4.4 billion (up from $3.7 billion as of September 30th), including $532 million in purchased loans and a record $252 million in originated loans.

- The Net Interest Margin (NIM) was 4.49% , and is expected to lift in subsequent quarters due to $1.25 billion in CDs maturing over the next six months at a weighted average rate of 4.05%.

- SBA loan activity was impacted by a government shutdown, resulting in $2.1 million in gains on sold SBA loans for the quarter, significantly lower than the previous quarter's $8 million. However, future SBA loan volume is projected at $20 million a month.

Jan 27, 2026, 4:00 PM

Northeast Bank Reports Strong Q2 2026 Results Driven by Significant Loan Growth

NBN

Earnings

Revenue Acceleration/Inflection

New Projects/Investments

- Northeast Bank reported net income of $20.7 million or $2.47 per diluted share for Q2 2026, with a return on average assets of 1.87% and return on average equity of 15.6%.

- Total loans grew significantly to $4.4 billion from $3.7 billion in the prior quarter, driven by $533 million in purchased loans and $252 million in originated loans.

- The bank's Net Interest Margin (NIM) for the quarter was 4.49%, and net interest income was $48.8 million. The substantial loan volume added late in the quarter is expected to provide tailwinds for net interest income in subsequent quarters.

- SBA loan activity was impacted by a government shutdown, resulting in $2.1 million in gains from sales, down from $8 million in the previous quarter. However, the bank anticipates SBA loan volume to increase to approximately $50-$60 million per quarter going forward.

- Northeast Bank launched a new small balance insured business loan program, originating $70 million in loans, and is actively working to establish a secondary market for these loans to generate future spread income.

Jan 27, 2026, 4:00 PM

NBN Announces Q1 FY26 Results

NBN

Earnings

- NBN reported net income of $22.5 million and diluted earnings per share (EPS) of $2.67 for Q1 FY26.

- The company's total loan volume for Q1 FY26 was $320.5 million, with a loan capacity of $1.4 billion as of September 30, 2025.

- Total revenue for Q1 FY26 was $52.9 million, while noninterest expense stood at $21.9 million.

- Total deposits increased by 4.02% to $3,250,385 thousand as of September 30, 2025, compared to September 30, 2024.

- The Net Interest Margin (NIM) for Q1 FY26 was 4.59%.

Oct 29, 2025, 2:00 PM

Northeast Bank Reports Strong Q1 2026 Earnings and Announces CFO Departure

NBN

Earnings

CFO Change

Management Change

- Northeast Bank reported strong financial results for Q1 fiscal year 2026, with net income of $22.5 million, diluted earnings per share of $2.67, a return on equity of 17.64%, and a return on assets of 2.13%.

- Loan activity was robust, with $144.6 million in purchased loans and $134 million in originations during the quarter. The purchase pipeline is described as "as large now as we have seen in quite some time," and the origination pipeline is "quite robust".

- Gains on sales of SBA loans were $4.2 million, down from $8.2 million in the prior quarter, primarily due to rule changes and a government shutdown impacting new originations. This difference amounted to $0.34 diluted EPS.

- Richard Cohen, Chief Financial Officer, is departing the bank after almost two years, with Santino Delmolino, Corporate Controller, stepping into a new role.

Oct 29, 2025, 2:00 PM

Northeast Bank Reports Strong Q1 2026 Results and CFO Transition

NBN

Earnings

Management Change

- Northeast Bank reported strong Q1 fiscal year 2026 financial results, including net income of $22.5 million, diluted earnings per share of $2.67, a Net Interest Margin (NIM) of 4.59%, Return on Equity (ROE) of 17.64%, and Return on Assets (ROA) of 2.13%.

- Loan activity was robust, with $152.7 million in purchased loans and $134 million in originated loans, and both purchase and origination pipelines are described as strong.

- SBA activity generated $4.1 million in gains on sales, a decrease from the prior quarter attributed to rule changes and a government shutdown, though volumes are expected to ramp up once the government reopens.

- Chief Financial Officer Richard Cohen is departing at the end of October 2025, with Corporate Controller Santino Delmolino taking over.

- The bank maintains strong asset quality, particularly in its lender finance portfolio, due to comprehensive underwriting and monitoring.

Oct 29, 2025, 2:00 PM

Northeast Bank Reports Strong Q1 2026 Earnings Amidst Robust Loan Activity and CFO Transition

NBN

Earnings

CFO Change

New Projects/Investments

- Northeast Bank reported strong financial results for Q1 fiscal year 2026, with net income of $22.5 million and diluted earnings per share of $2.67. The bank achieved a return on equity of 17.64% and a return on assets of 2.13%.

- Loan purchase activity was robust, with $144.6 million invested in loans with a principal balance of $152.7 million. The purchase pipeline is currently "as large now as we have seen in quite some time," driven by M&A activity and balance sheet repositioning. Originations totaled $134 million.

- Gains on SBA loan sales decreased to $4.2 million from $8.2 million in the prior quarter, primarily due to rule changes at the SBA in May and a government shutdown impacting new originations since October 1.

- Richard Cohen, the Chief Financial Officer, is departing after almost two years, with Corporate Controller Santino Delmolino stepping into the role.

- The bank expressed comfort with its asset quality, particularly in its lender finance portfolio, citing rigorous underwriting, independent verification of lien positions, and daily monitoring of collateral.

Oct 29, 2025, 2:00 PM

Quarterly earnings call transcripts for NORTHEAST BANCORP /ME/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more