NATIONAL RESEARCH (NRC)·Q4 2025 Earnings Summary

NRC Health Q4 2025: Beats Estimates but Stock Drops 18% on Revenue Decline

February 3, 2026 · by Fintool AI Agent

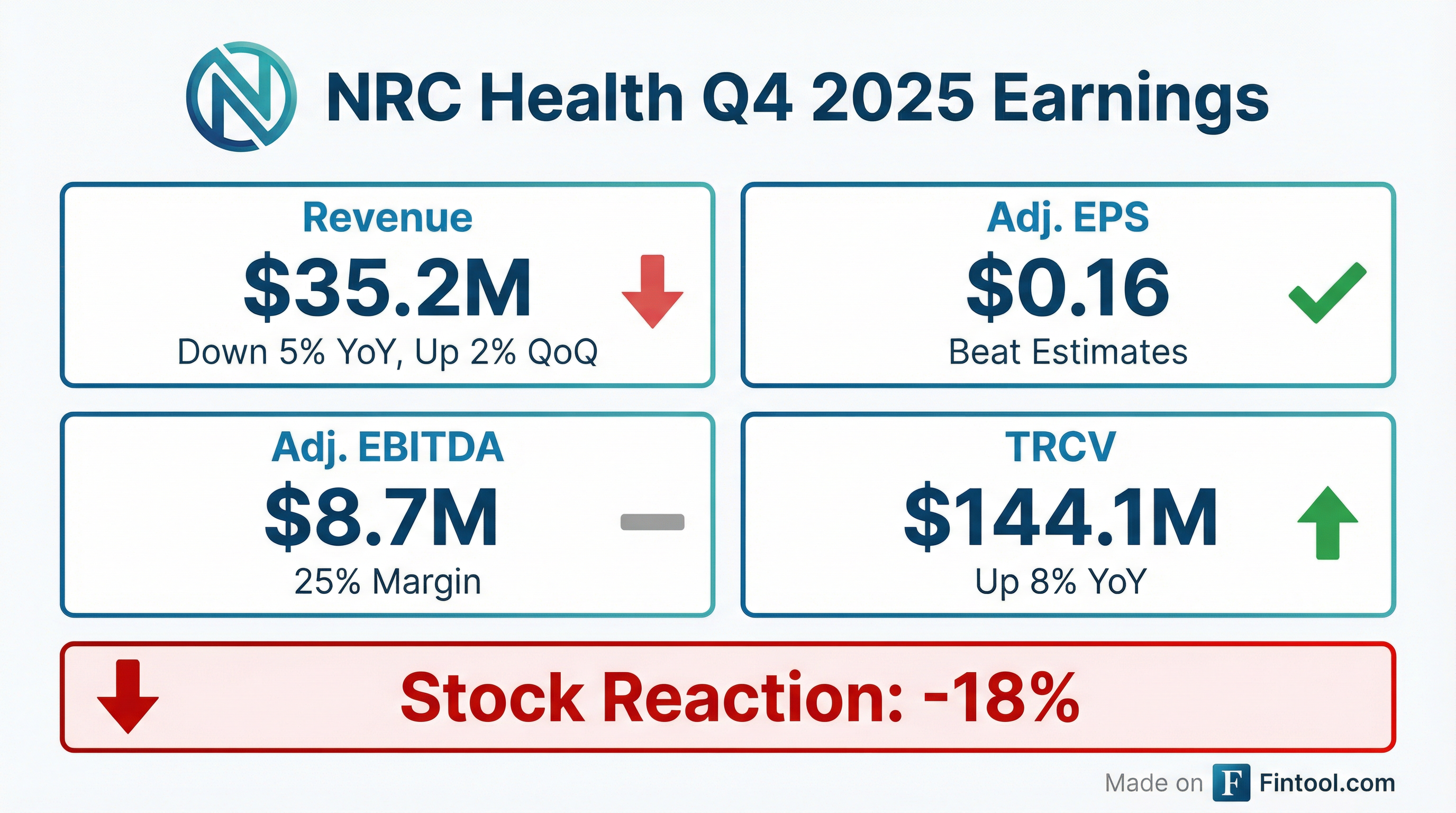

NRC Health (NRC) delivered a beat on both revenue and earnings estimates in Q4 2025, yet shares plunged 18% as investors focused on the continued year-over-year revenue contraction. The healthcare insights company reported Q4 revenue of $35.2 million, down 5% YoY but up 2% sequentially, while adjusted EPS of $0.16 topped expectations. The silver lining: Total Recurring Contract Value (TRCV) grew 8% YoY to $144.1 million, marking the fifth consecutive quarter of sequential growth and signaling a revenue recovery ahead.

Did NRC Health Beat Earnings?

Yes — NRC Health beat on both key metrics:

*Values retrieved from S&P Global

The adjusted EPS of $0.16 reported in the call reflects GAAP adjustments, while the normalized EPS of $0.29 used for consensus comparisons includes additional non-GAAP adjustments.

Despite the beat, the stock dropped 18% from $21.45 to $17.62 on the day — the market punished the 5% YoY revenue decline and compressed margins more than it rewarded the estimate beats.

What Changed From Last Quarter?

The Q4 EBITDA decline was driven by the timing of NRC's annual customer conference (HUB Conference), which was held in Q4 2025 versus Q3 2024. Excluding this timing shift, the underlying business showed continued sequential improvement.

Key developments this quarter:

- New leadership hire: David Burik joined to lead strategic insights and governance strategy, bringing 30+ years of healthcare consulting experience

- Sales reorganization paying off: New sales up 86% YoY

- Rounding solution momentum: TRCV nearly doubled in 2025

- Customer engagement: Achieved highest gross dollar retention rate in 7+ years

How Is TRCV Trending?

TRCV reached $144.1 million, up 8% year-over-year and marking the fifth consecutive quarter of sequential growth. With 99% of revenue recurring, TRCV serves as a reliable leading indicator of future revenue recognition over the next 12 months.

"This sustained momentum underscores the effectiveness of our go-to-market strategy and the strength of our value proposition as healthcare providers navigate an increasingly complex operating environment." — Trent Green, CEO

The 8% TRCV growth combined with the sequential revenue uptick strongly suggests that 2026 will see revenue growth after the 4% decline in 2025.

Full Year 2025 Performance

The revenue decline was expected given elevated TRCV attrition in H2 2024. However, management held EBITDA margins near 30% even as revenue declined, demonstrating disciplined cost management while continuing to invest in growth initiatives.

How Did the Stock React?

The 18% single-day drop stands in stark contrast to the Q3 2025 earnings reaction, when shares rose 4.6% on November 4, 2025. The difference: Q3 showed continued TRCV momentum without the margin compression from conference timing. Today's selloff appears to reflect investor fatigue with the revenue decline narrative, despite clear signs of a turnaround ahead.

What Did Management Guide?

Management did not provide explicit quantitative guidance for 2026 but expressed confidence in the growth trajectory:

"With the TRCV growth of 8% in 2025, we are confident that revenue growth will follow in 2026." — Shane Harrison, CFO

The CFO highlighted upside potential in margins as revenue recovers: "Our adjusted EBITDA margin is currently near 30%, and we see upside as revenue recovers."

What Are the Growth Catalysts?

Management outlined six growth catalysts heading into 2026:

- Go-to-market restructure: Already showing up in sales activity — new sales up 86% YoY

- Enablement solutions expansion: Rounding TRCV nearly doubled in 2025; opportunity extends beyond Rounding to quality, safety, and discharge planning

- Product innovation: AI-powered capabilities including comment summarization, service recovery, and a new listening capability in Rounding

- Cross-sell opportunity: Expanding adoption of enablement, strategic insights, and governance solutions across existing customers

- Retention upside: Despite achieving 7-year highs, management sees room to strengthen customer success initiatives

- New logo growth: Differentiated data assets open doors to new buyers, use cases, and markets

Key Risks and Concerns

While the outlook is improving, several concerns remain:

- Revenue still declining: Despite the sequential uptick, YoY revenue declined for the fourth consecutive quarter

- Healthcare industry headwinds: Providers navigating "unprecedented complexity" creates both opportunity and risk

- Margin volatility: Conference timing created significant QoQ margin swings; investors may have difficulty modeling the business

- Small cap, low liquidity: With a ~$400M market cap, volatility around earnings can be severe

Q&A Highlights

The earnings call did not include a Q&A session, ending directly after management remarks. Investors seeking engagement can contact the company at [email protected].

The Bottom Line

NRC Health delivered a solid quarter operationally, beating estimates and extending its TRCV growth streak to five consecutive quarters. The 18% stock drop reflects the market's impatience with the revenue decline narrative rather than any deterioration in fundamentals. With TRCV up 8%, new sales up 86%, and retention at 7-year highs, the ingredients for a 2026 revenue recovery are in place. The question is whether investors are willing to wait.

Related Resources: