NAPCO SECURITY TECHNOLOGIES (NSSC)·Q2 2026 Earnings Summary

NAPCO Surges 11% on Record Revenue, Recurring Run Rate Hits $99M

February 2, 2026 · by Fintool AI Agent

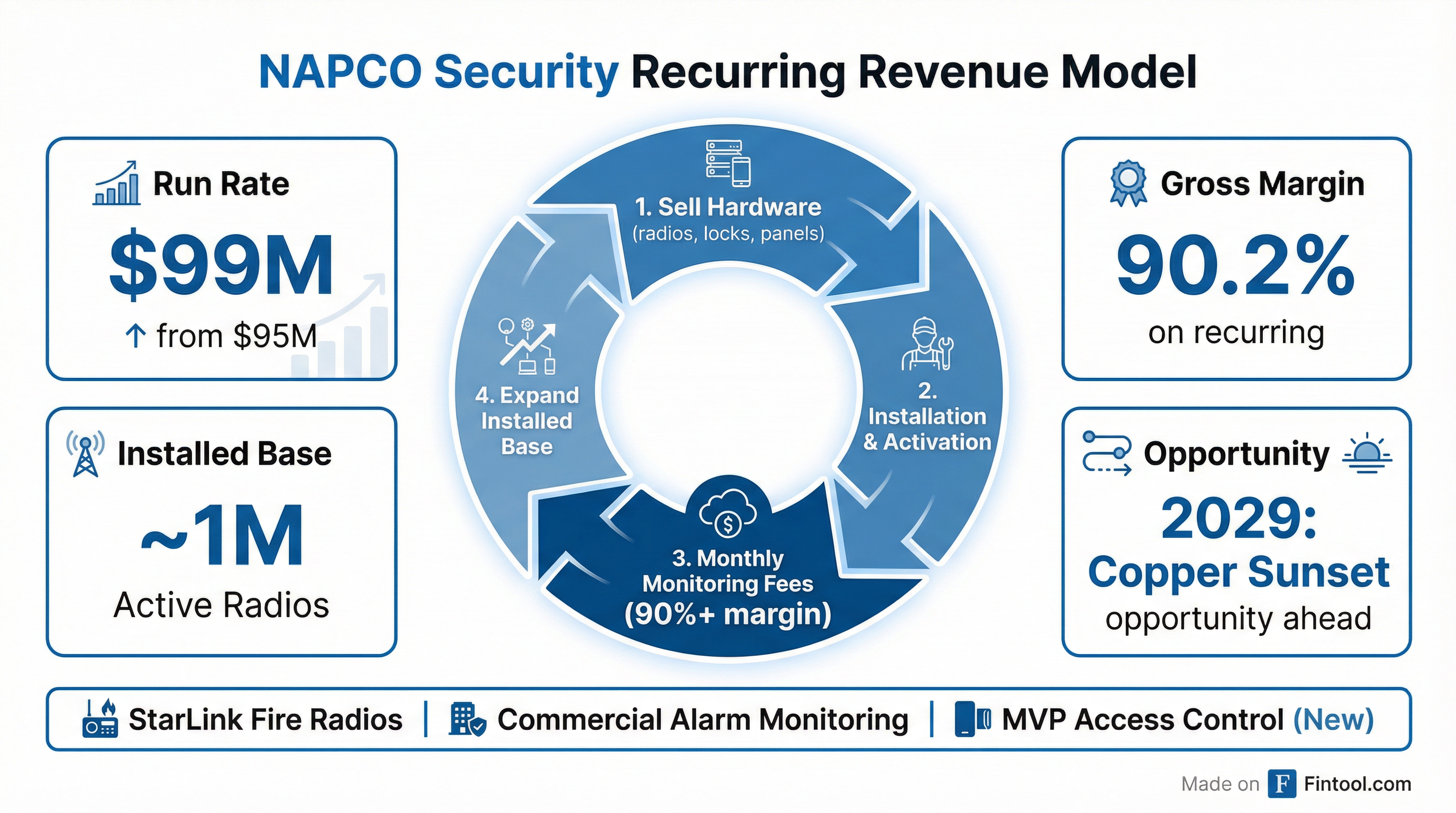

NAPCO Security Technologies delivered a strong Q2 FY2026, posting record quarterly revenue of $48.2M (+12.2% YoY) and crushing EPS estimates with $0.38 per share (+36% YoY). The stock responded emphatically, surging 11% to close at $40.94 as investors rewarded the company's execution on its high-margin recurring revenue strategy.

The headline number: recurring service revenue's prospective annual run rate hit $99M, up $4M sequentially from $95M last quarter. With 90%+ gross margins on this recurring base, NAPCO is steadily transforming into a predictable, cash-generative compounder.

Did NAPCO Beat Earnings?

Yes — a clean double beat with significant upside.

Revenue beat was driven by 12% equipment growth (pricing actions + locking strength) and 12.5% recurring revenue growth. The EPS beat reflects operating leverage — operating income grew 32% on 12% revenue growth.

Margin expansion across the board:

How Did the Stock React?

NSSC surged +10.98% to close at $40.94, its best single-day gain in recent quarters.

The stock is now up 107% from its 52-week low of $19.82, though still 15% below its 52-week high of $48.12. Today's move reflects investor confidence in the durability of the recurring revenue model and management's execution on margin expansion.

What Changed From Last Quarter?

Key sequential improvements:

-

Recurring run rate accelerated: $99M vs $95M (+$4M QoQ) — the strongest sequential add in recent quarters

-

Equipment margins continued climbing: 28% vs 26% last quarter, on track toward management's 30%+ target

-

Dividend raised again: 7% increase to $0.15/share quarterly, signaling cash flow confidence

-

New CRO hired: Joseph Pipczynski (35+ years experience) appointed Chief Revenue Officer to accelerate growth

-

Distribution channel normalized: More stable buying patterns, less quarter-end discounting

What Makes NAPCO's Business Model Work?

NAPCO's strategy centers on selling hardware (fire radios, locks, alarm panels) that generates recurring monthly monitoring fees at 90%+ gross margins.

The flywheel:

- StarLink fire radios have become the industry standard for commercial fire communicators

- ~1 million active radios in the installed base, with millions more buildings to convert before the 2029 copper sunset

- Now launching MVP cloud-based access control — a new subscription revenue stream for the locking segment

As COO Kevin Buchel explained: "Locking guys are next. The opportunity is tremendous. There's many more doors than there are buildings."

What Did Management Guide?

NAPCO doesn't provide explicit quantitative guidance, but management struck a confident tone:

"We are confident in our ability to continue the momentum through the end of fiscal 2026, and to execute on our plan to provide enhanced shareholder value and growth." — CEO Dick Soloway

Key forward indicators:

Segment Performance

Equipment Revenue: $24.3M (+12% YoY)

Recurring Service Revenue: $23.8M (+12.5% YoY)

The slight margin dip reflects one-time credits in the prior year and incremental data costs, not structural deterioration.

Balance Sheet & Capital Allocation

NAPCO's balance sheet remains a fortress:

Capital allocation priorities:

- Organic investment: R&D expanded to 80 engineers, automation, infrastructure

- Dividends: Raised 7% to $0.15/share quarterly

- M&A optionality: Looking for accretive deals that fit Dominican Republic manufacturing footprint

CEO Soloway on M&A: "When we do an acquisition, we want to make sure it fits our criteria, of being accretive from day one... and that the company is buttoned up enough so that it doesn't cause disruption."

Q&A Highlights

On dealer channel normalization (Kevin Buchel):

"The channel is much more normalized... one of the things we did see in Q2 was a more normal buying pattern. They would buy throughout the quarter, not wait until the very end. What that does for us is that helps reduce the discounting."

On MVP access control timing:

"Maybe by Q1 and Q2 of fiscal 2027, we'll start to see more meaningful contributions... locking guys are gonna love it because now they're gonna get recurring revenue like the alarm people get."

On tariff exposure:

"Our manufacturing facility in the Dominican Republic remains a key competitive advantage, providing cost efficiency, stable logistics, and low tariff exposure compared to many competitors operating in higher tariff regions."

On ADI partnership:

"ADI relationship been great... they've made introductions to some of the largest dealers in the world, and they continue to do that. We want to get ADI to the point where they're a locking contributor also."

Risks & Concerns

-

MVP adoption curve: New product, new concept for locking dealers — meaningful revenue still 6-12 months out

-

Copper sunset execution: Conversion opportunity is real, but timing depends on carrier enforcement of 2029 deadline

-

Margin ceiling: Equipment margins at 28%, targeting 30%+ — limited room beyond that

-

Tax rate normalization: Effective rate rose to 14.2% (vs 13.4% prior year) due to One Big Beautiful Deal Act changes

-

School project lumpiness: Large projects can create difficult comps, though management says none expected

Forward Catalysts

The Bottom Line

NAPCO delivered exactly what investors want: accelerating recurring revenue, expanding margins, and a clean balance sheet funding organic growth and dividends. The 11% stock pop reflects renewed confidence in a business model that's working — hardware sales drive installation, installation drives 90%+ margin recurring revenue, and cash generation funds the next cycle.

The key debates heading into Q3: Can equipment margins sustain 28%+ as pricing fully laps? Will MVP access control inflect faster than expected? And how much upside remains in the copper-to-cellular conversion?

For now, NAPCO is executing on a playbook that's delivering — record revenue, expanding margins, and a recurring revenue base approaching $100M.

Related: