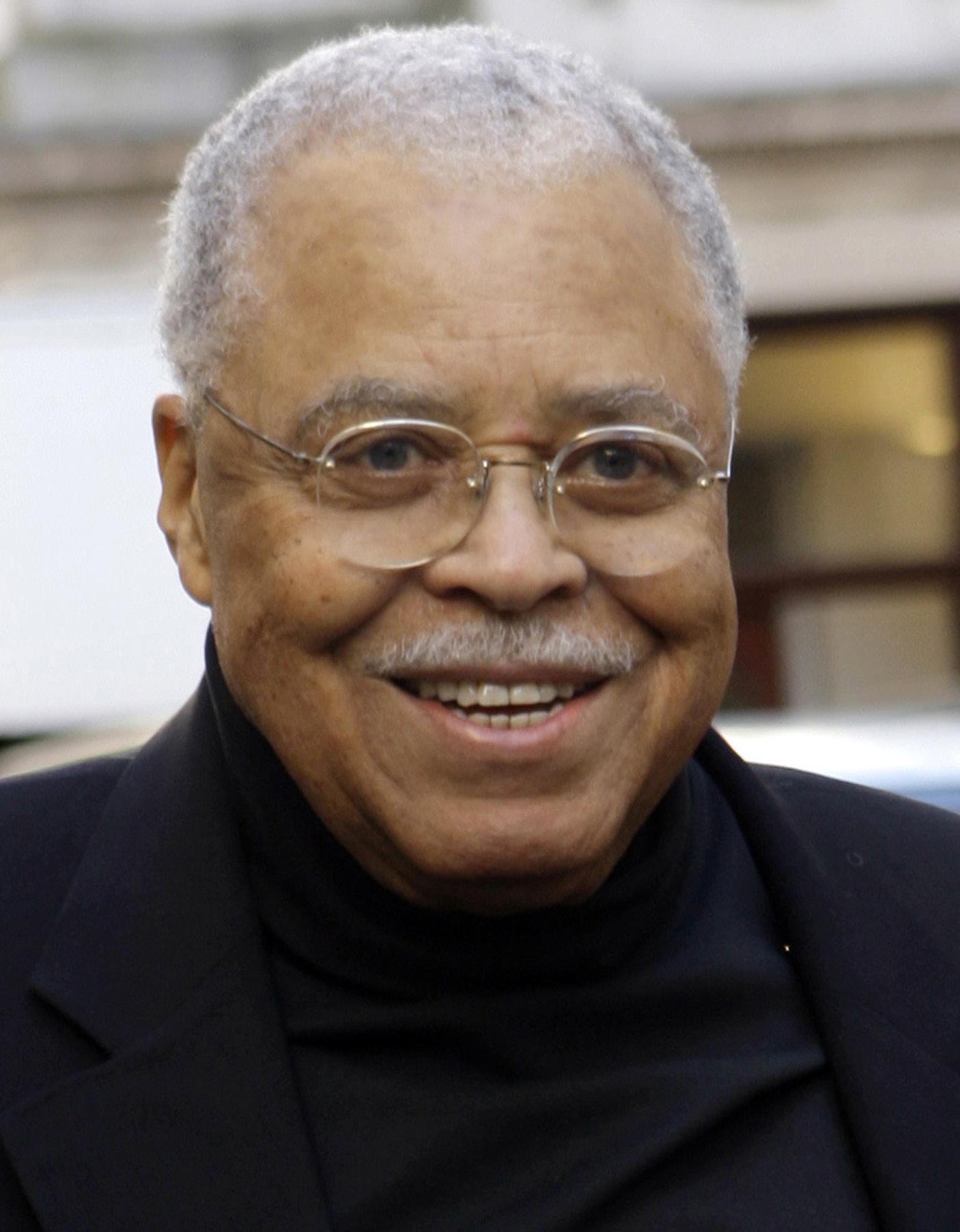

Stephen Lear

About Stephen G. Lear

Stephen G. Lear, age 69 as of March 24, 2025, is Chairman, President and Chief Executive Officer of NSTS Bancorp, Inc. and has served as Chairman of North Shore Trust and Savings since 2012; he was CEO of the Bank from 1997–2022 and has been a director since 2003. He holds a Finance/Business Administration degree from the University of Illinois at Urbana-Champaign and an MBA from Lake Forest Graduate School of Management; he previously served as Chairman of the Illinois League of Financial Institutions . Under his leadership, NSTS completed its mutual-to-stock conversion in January 2022 and grew total assets to $278.7 million as of December 31, 2024, with non-performing assets at 0.00% of assets at year-end 2024, reflecting strong credit quality management . The Company trades on Nasdaq (NSTS), initiated a 5% share repurchase authorization in Dec-2023, and remains a single operating segment focused on community banking in Lake County, IL and surrounding areas .

Past Roles

| Organization | Role | Years | Strategic Impact |

|---|---|---|---|

| North Shore Trust and Savings | Chief Executive Officer | 1997–2022 | Led Bank through growth and stability; separated Chairman/CEO roles at Bank in Jul-2022 |

| North Shore Trust and Savings | Chairman of the Board | 2012–present | Governance leadership at Bank |

| NSTS Bancorp, Inc. | Chairman, President & CEO | 2012–present | Led mutual-to-stock conversion (Jan-2022) and public listing |

| North Shore Trust and Savings | Director | 2003–present | Long-tenured board service and oversight |

External Roles

| Organization | Role | Years | Strategic Impact |

|---|---|---|---|

| Illinois League of Financial Institutions | Board member; Chairman | Not disclosed | Industry leadership and advocacy |

Fixed Compensation

Multi-year reported compensation for Stephen G. Lear:

| Metric | 2022 | 2023 | 2024 |

|---|---|---|---|

| Salary ($) | 212,498 | 214,451 | 214,451 |

| Bonus ($) | 40,000 | 32,000 | 24,595 |

| All Other Compensation ($) | 61,838 | 83,883 | 84,623 |

| Total ($) | 314,336 | 987,604 | 323,668 |

All Other Compensation breakdown (latest available detail):

| Component | 2024 ($) |

|---|---|

| 401(k) Match | 14,343 |

| Board Fees | 32,000 |

| ESOP (Employee Stock Ownership Plan) | 26,208 |

| Perquisites (club dues) | 12,072 |

| Total | 84,623 |

Notes:

- Mr. Lear deferred 50% of Board fees into the Director Deferred Compensation Plan in 2023 .

- As an emerging growth company, NSTS provides reduced executive compensation disclosures and is exempt from say-on-pay requirements .

Performance Compensation

2023 equity awards and outstanding equity awards; vesting schedules are time-based (no disclosed performance metrics):

| Instrument | Grant Year | Grant Amount ($ fair value) | Units/Options | Exercise Price | Expiration | Vesting |

|---|---|---|---|---|---|---|

| Restricted Stock (RSUs) | 2023 | 336,960 | 36,000 unvested as of 12/31/2023; 28,800 unvested as of 12/31/2024 | N/A | N/A | 20% per year beginning in 2024 |

| Stock Options | 2023 | 320,310 | 90,000 granted; 18,000 exercisable and 72,000 unexercisable as of 12/31/2024 | $9.36 | 6/15/2033 | 20% per year beginning in 2024 (plan disclosure) |

Additional valuation reference:

- Market value of unvested RSUs at 12/31/2024: $339,840 (based on $11.80 closing price) .

Discretionary cash bonus:

- Discretionary annual bonuses were paid ($40k in 2022; $32k in 2023; $24.6k in 2024); no formulaic performance metrics disclosed .

Equity Ownership & Alignment

Beneficial and unvested holdings (record dates):

| Ownership Metric | 2024 (Record: 3/25/2024) | 2025 (Record: 3/24/2025) |

|---|---|---|

| Beneficial Shares | 34,694 (incl. 4,694 ESOP) | 62,139 (incl. 6,939 ESOP) |

| Percent of Outstanding | <1% | 1.2% |

| Unvested Restricted Stock (Voting, no investment power) | 36,000 (excluded from beneficial total) | 28,800 (excluded from beneficial total) |

| Unvested Options | 90,000 (excluded from beneficial total) | 72,000 (excluded from beneficial total) |

Alignment policies and practices:

- Anti-hedging policy prohibits hedging transactions by directors/officers/employees .

- Insider Trading Policy requires pre-clearance, imposes quarterly blackout periods, and prohibits margin accounts and pledging without advance approval; short sales and buying/selling derivative instruments (puts/calls) are prohibited .

- No pledging by Mr. Lear is disclosed; no related-party transactions >$120,000 other than ordinary-course lending consistent with regulations .

Employment Terms

Key provisions in Mr. Lear’s amended and restated employment agreement (March 2024):

| Term | Provision |

|---|---|

| Initial Term and Auto-Renewal | 3-year initial term; automatically extends one year at each anniversary unless nonrenewal notice given ≥90 days prior |

| Base Salary | May be increased but not decreased at Board discretion |

| Annual Bonus Eligibility | Eligible at Board’s discretion; no formulaic metrics disclosed |

| Severance (without cause or for “good reason”) | Salary continuation equal to base salary for remainder of then-current term; requires release |

| “Good Reason” Definition | Material reduction in base salary; material adverse change in responsibilities/titles/powers; failure to appoint/nominate as director; relocation >25 miles; material breach by Company |

| Change-in-Control (CIC) Severance | 2.5× (base salary + average annual bonus over prior 3 years), lump sum; requires release; applies if qualifying termination occurs within 24 months post-CIC |

| Benefits Continuation | Medical/dental/health coverage continuation for 18 months post-termination (other than for cause) |

| Restrictive Covenants | One-year non-solicitation post-termination |

| Perquisites | Reimbursement for monthly membership dues at a country club or similar club; potential auto allowance/cell phone reimbursement at Board discretion |

| Clawback | Company adopted clawback policy to recover incentive-based compensation upon required restatement |

Board Governance

- Role: Chairman, President & CEO of NSTS Bancorp, Inc.; Chairman of North Shore Trust and Savings .

- Independence: Not independent under Nasdaq standards due to CEO role; other non-independent directors noted due to familial relationships; independent directors comprise committee leadership .

- Board leadership structure: Company combines Chairman and CEO roles; Bank separated Chairman and CEO roles in July 2022; Compensation Committee conducts CEO performance evaluation .

- Committees and chairs (2025 proxy): Audit (Chair: Apolonio Arenas; members: Emily E. Ansani, Rodney J. True); Nominating & Corporate Governance (Chair: Emily E. Ansani; members: Apolonio Arenas, Rodney J. True); Compensation (Chair: Emily E. Ansani; member: Apolonio Arenas) .

- Attendance and meetings: 12 regular and 1 special Board meetings in 2024; no director attended fewer than 75% of meetings of the Board and committees on which they served .

- Nasdaq compliance: Temporary non-compliance in early 2025 due to a director’s death; regained compliance upon appointment of independent director John S. Pucin to the Board and Audit Committee on June 18, 2025 .

Director compensation structure and Mr. Lear’s director fees:

- Bank director retainer: $18,000 annually; $1,000 per meeting; Company director additional retainer: $2,000 annually .

- Mr. Lear’s Board fees included in his All Other Compensation ($32,000 in 2024) .

Performance & Track Record

- Conversion and listing: Stock began trading on Nasdaq Capital Market (NSTS) on Jan 19, 2022 at $10.00 per share .

- Assets and credit quality: Total assets $278.7 million; total loans $130.9 million at 12/31/2024; non-performing assets were 0.00% of assets and non-accrual loans were $0 at 12/31/2024 (versus $200k in 2023) .

- Lending focus: 91.2% of loans in 1–4 family residential mortgages as of 12/31/2024; secondary market loan sales ramped in 2024 ($53.1 million sold) .

Compensation Structure Analysis

- Shift toward equity in 2023: RSUs ($336,960) and options ($320,310) granted with 5-year, 20% annual vesting beginning 2024—time-based, not performance-based .

- Discretionary bonuses: Paid annually without disclosed financial metrics, indicating limited formulaic pay-for-performance linkage .

- Clawback adopted: Aligns with SEC/Nasdaq rules for erroneous incentive compensation recovery .

- No disclosed tax gross-ups or golden parachute tax provisions; no disclosed performance metric targets (e.g., revenue, EBITDA, TSR) tied to pay .

Related Party Transactions and Red Flags

- Related-party loans to directors/executives were made in ordinary course on market terms and compliant with banking regulations; no transactions >$120,000 since 2020 beyond such loans .

- Hedging prohibited; pledging disallowed without pre-approval; short sales and derivatives trading restricted—reducing misalignment risks .

- Legal proceedings: None material disclosed .

- Governance event: Shareholder non-binding proposal in 2025 to pursue sale/merger; Board took no position and encouraged stockholder input—potential strategic overhang .

Equity Incentive Plan

- 2023 Equity Incentive Plan authorized up to 755,714 shares: 539,796 for options and 215,918 for restricted stock awards .

- Timing policy: Company does not time option grants around MNPI; no options were granted in 2024 to executive officers .

External Roles and Qualifications

- Education: B.S. Finance/Business Administration (University of Illinois at Urbana-Champaign); MBA (Lake Forest Graduate School of Management) .

- Industry leadership: Former Chair, Illinois League of Financial Institutions .

Investment Implications

- Alignment and potential selling pressure: Mr. Lear’s unvested RSUs (28,800) and options (72,000) vest 20% annually through 2028, creating periodic supply; hedging and pledging restrictions mitigate misalignment risk .

- Pay-for-performance risk: Bonuses are discretionary without disclosed financial metrics; equity awards are time-based, which may decrease direct performance linkage; however, clawback adoption provides downside governance protection .

- Governance considerations: Combined CEO/Chairman structure at the holding company, independence gaps previously noted (since cured), and an active shareholder proposal to explore strategic alternatives could influence valuation and event risk .

- Credit quality strength: Zero non-performing loans at year-end 2024 and conservative underwriting in core mortgage lending underpin stability; emphasis on 1–4 family loans and secondary market sales supports liquidity and fee generation .