NUCOR (NUE)·Q4 2025 Earnings Summary

Nucor Misses Q4 Estimates But Guides Higher on Strong Backlogs

January 27, 2026 · by Fintool AI Agent

Nucor Corporation (NUE) reported Q4 2025 results that missed analyst expectations on both revenue and earnings, with the stock falling ~3% in after-hours trading. However, management struck a constructive tone, guiding for higher Q1 2026 earnings on 40% year-over-year backlog growth and expectations for reduced steel imports in 2026.

Did Nucor Beat Earnings?

No — Nucor missed on both lines in Q4 2025:

Values retrieved from S&P Global

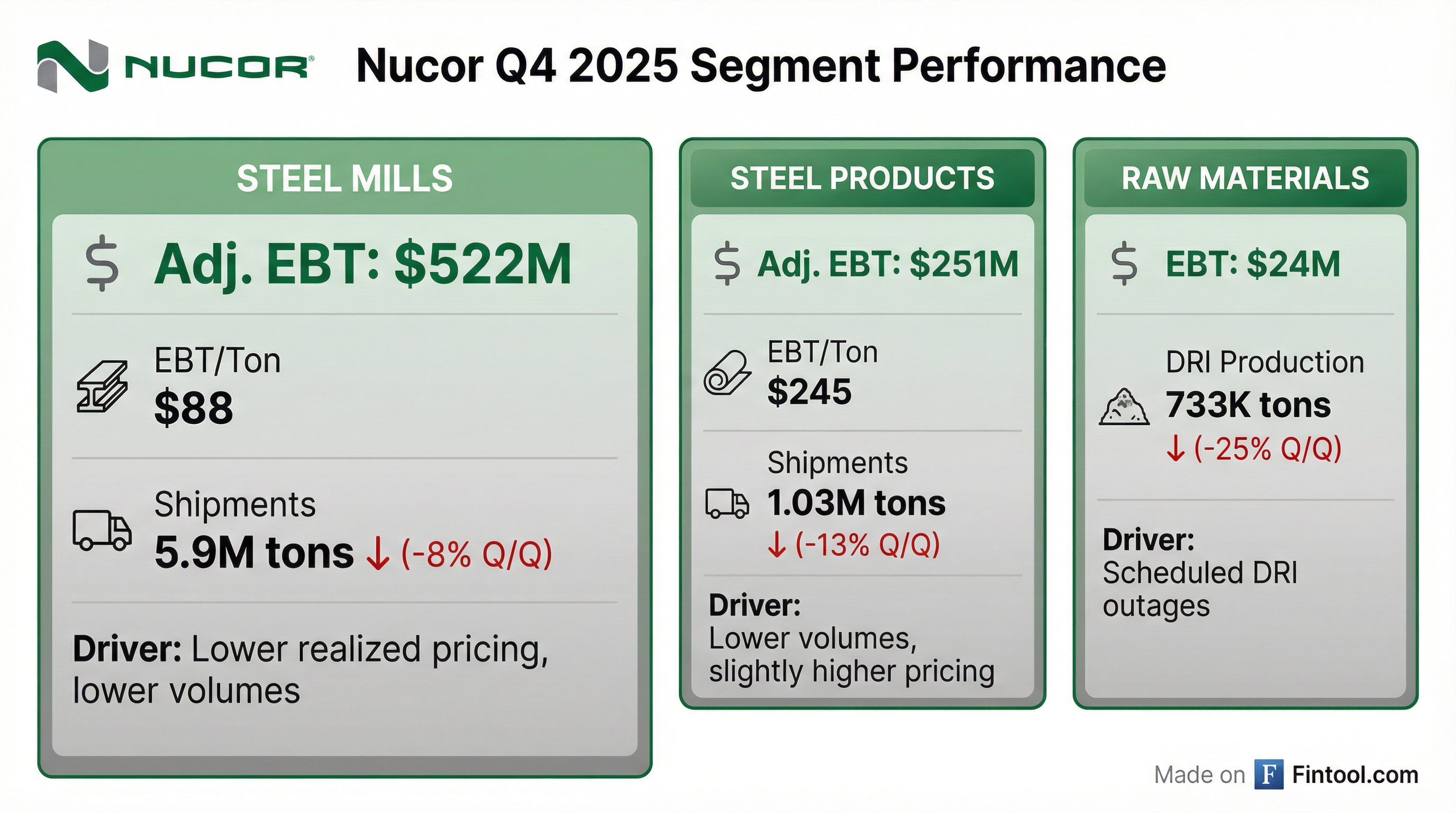

The miss was driven by lower realized pricing and lower volumes across the Steel Mills segment, combined with lower volumes in Steel Products.

For the full year 2025, Nucor generated:

What Changed From Last Quarter?

Q4 2025 saw sequential declines across all three segments versus Q3 2025:

Steel Mills — Pretax earnings of $516 million, down ~35% from Q3. Shipment volumes declined 8%, reflecting seasonal effects, fewer shipping days, and both planned and unplanned outages. Average realized pricing improved in bar and structural but was more than offset by lower sheet and plate pricing.

Steel Products — Pretax earnings of $230 million, down from $319 million in Q3. Volumes declined across the portfolio, with rebar fabrication accounting for roughly half of the Q/Q decline in line with seasonal trends.

Raw Materials — Pretax earnings of approximately $24 million vs. $43 million in Q3, primarily due to two scheduled DRI outages.

How Did the Stock React?

NUE closed at $177.66 on January 26, 2026, and fell to $172 in after-hours trading — a decline of approximately 3.2%. The stock had rallied significantly heading into the print, trading near 52-week highs ($183.32 high vs. $97.59 low).*

Values retrieved from S&P Global

What Did Management Guide?

Nucor expects Q1 2026 earnings to be higher than Q4 2025, with improvements across all segments:

2026 Capital Expenditure: Nucor plans ~$2.5 billion in capex, down from $3.4 billion in 2025. Major projects include:

Pre-Operating & Startup Costs: For 2025, pre-operating and startup costs totaled $496 million. These costs are expected to remain elevated in 2026 as several projects move beyond startup, offset by higher expenses from bringing West Virginia online.

Free Cash Flow: Management expects improved FCF in 2026. 2025 saw negative free cash flow — a rare occurrence for Nucor — driven by aggressive growth investments. With lower CapEx, incremental EBITDA from projects, and improved market conditions, Nucor expects "meaningfully higher free cash flow in the year ahead."

Management Changes: Effective January 1, 2026, Steve Laxton was promoted to President and COO (retaining CFO duties until successor named). Dave Sumoski, COO since 2021, will retire in June after 30+ years at Nucor.

Why Is Nucor Constructive on 2026?

Management highlighted several tailwinds supporting the outlook:

Strong Mill Backlogs: Backlogs are ~40% higher year-over-year in the steel mill segment and ~15% in steel products, providing strong visibility into Q1 demand. The structural backlog entering 2026 is more than 15% above the record set in Q1 2025, reflecting sustained demand across non-residential and infrastructure markets.

5% Shipment Growth Target: Management expects steel mill shipments to increase approximately 5% in 2026 compared to 2025, supported by strong demand and capacity to capture import share (mill utilization currently at 82-84%).

Lower Imports Expected: Trade enforcement is having an impact. Foreign import share of the U.S. finished steel market has dropped from approximately 25% last year to 16% in October 2025, and an estimated 14% in November 2025:

- Corrosion resistant sheet imports: -48% in 2H 2025 vs. 2H 2024

- Hot rolled sheet imports: -52% in 2H 2025 vs. 2H 2024

- Cold rolled sheet imports: -44% in 2H 2025 vs. 2H 2024

Management expects 2026 to see the full-year impact of 232 tariffs plus benefits from CORE and rebar trade cases.

Balanced End Markets: Data centers, CHIPS manufacturing plants, energy infrastructure, and border fence construction provide growth vectors, while traditional office and heavy equipment remain challenged.

Capital Allocation & Returns

Nucor returned $1.2 billion to shareholders in 2025:

This represented approximately 70% of net earnings returned to shareholders in 2025, above the company's commitment of at least 40%.

Dividend Increase Announced: In December, the board approved an increase in the quarterly dividend to $0.56 per share, extending Nucor's record of paying and increasing its regular quarterly dividend for 53 consecutive years.

Balance Sheet Remains Strong:

- Total Debt: $7.1B (1.7x EBITDA, 24% of capital)

- Cash & Equivalents: $2.7B

- Net Debt: $4.4B (1.1x EBITDA)

- Credit Ratings: A-/A-/A3 (S&P/Fitch/Moody's) — highest in the industry

What About Safety?

Nucor set a new safety record in 2025, achieving the lowest injury and illness rate in company history — the eighth consecutive year of improvement:

- Final two months of 2025 were the safest two months ever recorded

- CEO Topalian: "We see a day and time where Nucor will go an entire year without a single injury to any of our team members"

Q&A Highlights

Incremental EBITDA from Growth Projects: Management quantified the EBITDA uplift from recently completed projects at approximately $500 million in 2026 vs. 2025, from four major projects completed plus continued progress at Brandenburg.

Maintenance CapEx Guidance: CFO Steve Laxton guided investors to ~$800 million annually for maintenance capital (safety, environmental, smaller efficiency projects), up from prior $600 million guidance due to inflation and larger company size.

Lexington & Kingman Ramp: Both new facilities are ramping well, hitting production milestones weekly. Management expects both to be EBITDA positive by end of Q1 and fully ramped by year-end.

Plate Market Strength: Plate backlogs are up 40% from this time last year, with 2025 domestic plate consumption the best since 2019 (up 15% Y/Y). Cut-to-length plate imports ended 2025 down 20%. Key end markets (energy, line pipe, wind, non-res construction, bridge infrastructure) remain robust.

West Virginia Mill Capabilities: The new sheet mill will enable Nucor to enter exposed automotive (a first for EAF production in the U.S.) and consumer durables — markets where Nucor has historically lacked presence. About one-third of production will serve automotive.

Mill Utilization: Current utilization across major product groups is approximately 82-84%, with sheet mills specifically at ~85% — leaving room to capture import share.

M&A Strategy Shift: CEO Topalian signaled a pivot from heavy core steelmaking investments toward adjacencies and "expand beyond" opportunities in data centers, energy infrastructure, and towers & structures. Topalian noted Nucor supplies approximately 95% of the steel demand for data centers and is looking for "next step" growth opportunities in that space.

Investor Day EBITDA Target: When asked about the $6.7 billion through-cycle EBITDA target from the November 2022 Investor Day, management confirmed the framework remains valid as a mid-cycle guide once all projects are completed. However, they cautioned against using it as specific 2027 guidance, noting West Virginia won't be at full run-rate EBITDA in 2027.

Key Risks to Watch

- Pricing Pressure: Average realized prices declined sequentially across most product categories in Q4

- Volume Sensitivity: Shipments declined 8% Q/Q in Steel Mills despite healthy backlogs

- Execution on West Virginia: The $2.8B+ sheet mill is the company's largest project and remains critical to 2026-2027 growth

- Scrap Cost Volatility: Nucor's metal margins are ~80% correlated with scrap costs; rising scrap could compress margins

The Bottom Line

Nucor missed Q4 2025 estimates as lower pricing and volumes pressured results across all segments. However, the setup for 2026 looks more favorable: backlogs are up 40% Y/Y, imports are declining sharply, capex is stepping down by ~$900 million, and recently completed growth projects should contribute incrementally. The after-hours decline of ~3% appears to reflect disappointment on the miss rather than concern about the forward outlook.

More on Nucor: Company Overview | Q3 2025 Earnings | Transcripts