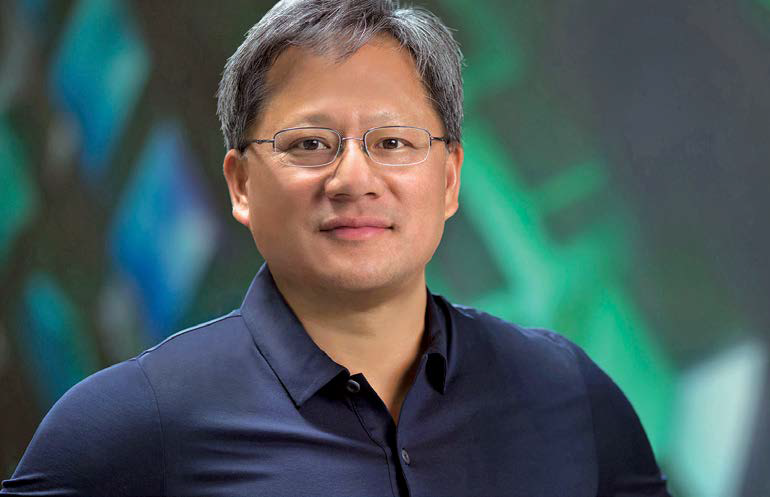

Jen-Hsun Huang

About Jen-Hsun Huang

Jen-Hsun Huang (Age: 62) is NVIDIA’s founder (1993), President & CEO, and a director since 1993. He holds a BSEE from Oregon State University and an MSEE from Stanford University . Fiscal 2025 performance: revenue rose 114% to $130.5B, gross margin reached 75.0%, operating income rose 147% to $81.5B, and diluted EPS increased 147% to $2.94; NVIDIA’s 3-year TSR ranked at the 100th percentile vs. the S&P 500, which maximized long-term performance awards .

Past Roles

| Organization | Role | Years | Strategic Impact |

|---|---|---|---|

| LSI Logic | Engineer/Manager (semiconductor/software) | — | Early semiconductor and systems experience that informed accelerated computing strategy |

| Advanced Micro Devices (AMD) | Engineer/Manager (semiconductor) | — | Exposure to CPU/GPU ecosystems prior to founding NVIDIA |

External Roles

| Organization | Role | Years | Strategic Impact |

|---|---|---|---|

| Other public company boards | None | — | Full-time focus on NVIDIA; no external board interlocks |

Fixed Compensation

| Metric (USD) | FY 2023 | FY 2024 | FY 2025 |

|---|---|---|---|

| Base Salary | $996,832 | $996,514 | $1,486,199 |

| Non-Equity Incentive (Cash Bonus) | $0 | $4,000,000 | $6,000,000 |

| All Other Compensation | $693,710 | $2,494,973 | $3,568,746 |

Notes:

- FY25 saw the first increases in CEO base salary and target variable cash in years to align with peers and internal equity; CEO pay remains highly at-risk with 100% equity in PSUs .

Performance Compensation

- Architecture and payout mechanics:

- Variable Cash Plan: 1-year Revenue (payout 50–200% of target)

- Single-Year PSUs (SY PSUs): 1-year Non-GAAP Operating Income (CEO cap 150%; others 200%); vest over 4 years (25% ~1 year after grant, then 6.25% quarterly for 3 years)

- Multi-Year PSUs (MY PSUs): 3-year relative TSR vs. S&P 500 (CEO cap 150%; others 200%); vest at end of 3-year period

| Program (FY25) | Metric | Weighting (if disclosed) | Threshold | Target (Base) | Stretch | Actual (FY25) | Payout as % of Target |

|---|---|---|---|---|---|---|---|

| Variable Cash | Revenue | — | $45.0B | $90.0B | $110.0B | $130.5B | 200% |

| SY PSUs | Non-GAAP Operating Income | — | $16.0B | $56.0B | $72.0B | $86.8B | CEO 150% |

| MY PSUs | 3-yr TSR vs. S&P 500 | — | 25th pct | 50th pct | 75th pct | 100th pct | CEO 150% |

Equity grant and performance outcomes (shares):

- SY PSUs (FY25 grant): Estimated at Base 190,900 shares; Actual eligible 286,350 shares (payout scaling achieved)

- MY PSUs (FY23 grant cycle measured through FY25): Estimated at Base 446,750 shares; Actual eligible 670,130 shares

Equity grant date fair values (ASC 718):

| Metric | FY 2023 | FY 2024 | FY 2025 |

|---|---|---|---|

| Stock Awards (Fair Value) | $19,666,382 | $26,676,415 | $38,811,306 |

Vesting cadence:

- SY PSUs: 25% approx. one year after grant; 6.25% quarterly thereafter over next 3 years

- MY PSUs: 100% vest after the 3-year performance period ends

Recent realized activity (liquidity/pressure indicators):

| Activity | FY 2023 | FY 2024 |

|---|---|---|

| Options Exercised (Shares) | 2,917,340 | 475,000 |

| Value Realized on Exercise | $442,805,513 | $217,327,151 |

| Shares Acquired on Vesting (All Stock Awards) | 286,412 | 211,384 |

| Value Realized on Vesting | $61,847,146 | $64,013,433 |

- Shares were withheld to cover taxes on vesting (e.g., 104,190 shares withheld for CEO in FY24), which can create regular selling pressure around vest dates but is primarily administrative for tax obligations .

Equity Ownership & Alignment

Ownership, guidelines, and pledging/hedging policy:

- Beneficial Ownership (as of Mar 24, 2025): 922,922,938 shares; 3.77% of outstanding

- Prior year (as of Mar 25, 2024): 93,463,791 shares; 3.79% of outstanding

- Ownership guidelines: CEO must hold shares equal to 6x base salary; policy prohibits hedging and pledging; company states CEO and non-employee directors meet/exceed ownership requirements

- Prohibited: pledging or hedging NVIDIA stock by directors/executives under Insider Trading Policy

| Category | Detail |

|---|---|

| Total Beneficial Ownership (3/24/25) | 922,922,938 shares; 3.77% of outstanding |

| Unvested Equity (for CoC sensitivity, 1/26/25) | 1,967,190 unvested RSUs/PSUs (see CoC table below) |

| Ownership Guidelines | 6x base salary (CEO); compliant |

| Hedging/Pledging | Not permitted for directors/executives |

Employment Terms

- Employment: At-will; no individual employment, severance, or change-in-control agreements for executives .

- Change-in-Control (plan-based): Under the 2007 Equity Plan, awards may be assumed/continued/substituted by acquirer; if not, awards held by service providers accelerate in full prior to the effective time and terminate if unexercised (i.e., acceleration if not assumed; no separate CEO “golden parachute” multiples) .

- Clawback: Company maintains a compensation recovery (clawback) policy permitting recovery/forfeiture after certain restatements and misconduct (policy has existed since at least 2009 and is reviewed for regulatory compliance) .

Potential payments upon Change-in-Control (illustrative, assuming acceleration, per proxy methodology):

| As of Date | Unvested RSUs/PSUs (#) | Estimated Benefit ($) |

|---|---|---|

| Jan 26, 2025 (stock $142.62) | 1,967,190 | $280,560,638 |

| Jan 28, 2024 (stock $610.31) | 263,049 | $160,541,435 |

Board Governance and Service

- Board Service: Director since 1993; current role President & CEO; other current public company boards: none .

- Committee roles: None (CEO is not on audit/compensation/NCGC) .

- Independence: Board determined all directors are independent except Mr. Huang; committee members are independent under Nasdaq standards .

- Leadership structure: No chairperson; Board uses an independent Lead Director (Stephen C. Neal) who sets agendas with the CEO, presides over executive sessions, and engages with stockholders; structure designed to balance CEO/Board oversight without CEO serving as Chair .

- Attendance: Each Board member had ≥75% attendance at Board and applicable committees .

Dual-role implications:

- NVIDIA separates the CEO and chair roles and utilizes an empowered Lead Director, mitigating typical CEO/Chair concentration risks; nonetheless, CEO is a non-independent director and central to strategy, so robust lead-director authority and fully independent committees are key investor protections .

Performance & Track Record

| Metric / Highlight | Detail |

|---|---|

| FY2025 Operating Results | Revenue $130.5B (+114% y/y); Gross Margin 75.0%; Operating Income $81.5B (+147% y/y); Diluted EPS $2.94 (+147% y/y) |

| Strategic Execution | Significant data center growth (Hopper, Blackwell), Ethernet for AI (Spectrum-X), RTX 50 Series launch, automotive growth, Omniverse/industrial digitalization initiatives |

| TSR Alignment | 3-year TSR at 100th percentile vs. S&P 500 drove maximum outcomes for long-term PSUs (CEO capped at 150%) |

Say-on-Pay & Shareholder Feedback

- NVIDIA holds annual say-on-pay votes; Board endorses program emphasizing pay-for-performance and at-risk equity .

- At the 2022 Annual Meeting, ~93% of votes cast supported NEO compensation for FY2022 (context for program support) .

Compensation Structure Analysis

- Mix and risk: CEO compensation is >90% performance-based with 100% of equity in PSUs; aligns with long-term value creation and minimizes windfalls; caps apply (CEO 150%) .

- FY25 changes: Increased CEO base salary and target variable cash for the first time in years to align with peers/internal equity; continued emphasis on long-term MY PSUs (greater for non-CEO NEOs), reinforcing multi-year performance focus .

- Metric rigor: FY25 goals set above prior strong results; FY25 achievements maxed annual cash and SY PSUs; MY PSUs paid at cap driven by top-tier TSR .

Director Compensation (CEO as Director)

- CEO receives executive compensation; no separate public director board fees are disclosed for Mr. Huang; director compensation program applies to non-employee directors (details in proxy’s director compensation section) .

Risk Indicators & Red Flags

- Hedging/Pledging: Prohibited for executives/directors (alignment positive) .

- Clawback: In place (alignment positive) .

- Option Repricing/Modifications: Not indicated in retrieved disclosures (no evidence of repricing; continue monitoring).

- Insider Liquidity: Significant option exercises in FY23–FY24 created realized values; vesting-related tax withholding causes routine share dispositions around vest dates .

Compensation Peer Group and Benchmarking (context)

- Historical disclosure indicated targeting market competitiveness; e.g., FY2018 target CEO pay positioned at the 50th percentile of peers (illustrative historical context; current peer methodology not reproduced here) .

Equity Ownership Detail (Historical context)

- Beneficial ownership increased materially over time adjusting for stock splits (e.g., 21.4M shares in 2018; 93.5M in 2024; 922.9M in 2025 post-split), reflecting long-held founder ownership and trust structures .

Investment Implications

- Alignment and retention: Founder-CEO with substantial long-term ownership (3.77%), prohibited pledging/hedging, and a robust clawback suggests strong stockholder alignment and lower misalignment risk; absence of individual severance/CoC multipliers reduces “golden parachute” concerns .

- Pay-for-performance credibility: Consistent ties to Revenue, Non-GAAP Operating Income, and 3-year TSR with capped payouts, rigorous thresholds, and heavy PSU mix support confidence that incentive outcomes reflect business value creation; FY25 outperformance and 100th percentile TSR justify elevated payouts .

- Selling pressure watchpoints: Large scheduled PSU vesting cadence (quarterly after first-year cliff for SY PSUs) and occasional option exercises can create episodic supply; however, vest-related share withholding is tax-driven, not discretionary selling .

- Governance quality: Independent Lead Director, fully independent committees, and annual say-on-pay with strong historical support offset typical dual-role concerns from a founder-CEO; continued outreach and removal of supermajority provisions further strengthens governance posture .

- Execution risk: Program now more leveraged to multi-year TSR and operating results; NVIDIA’s scale-up in AI compute (Blackwell, Ethernet for AI, NVLink) raises operational/geo supply-chain dependencies, but incentive design should keep management focused on sustainable performance .