PLAINS ALL AMERICAN PIPELINE (PAA)·Q4 2025 Earnings Summary

Plains All-American Completes Strategic Pivot to Pure-Play Crude, Raises Distribution 10%

February 6, 2026 · by Fintool AI Agent

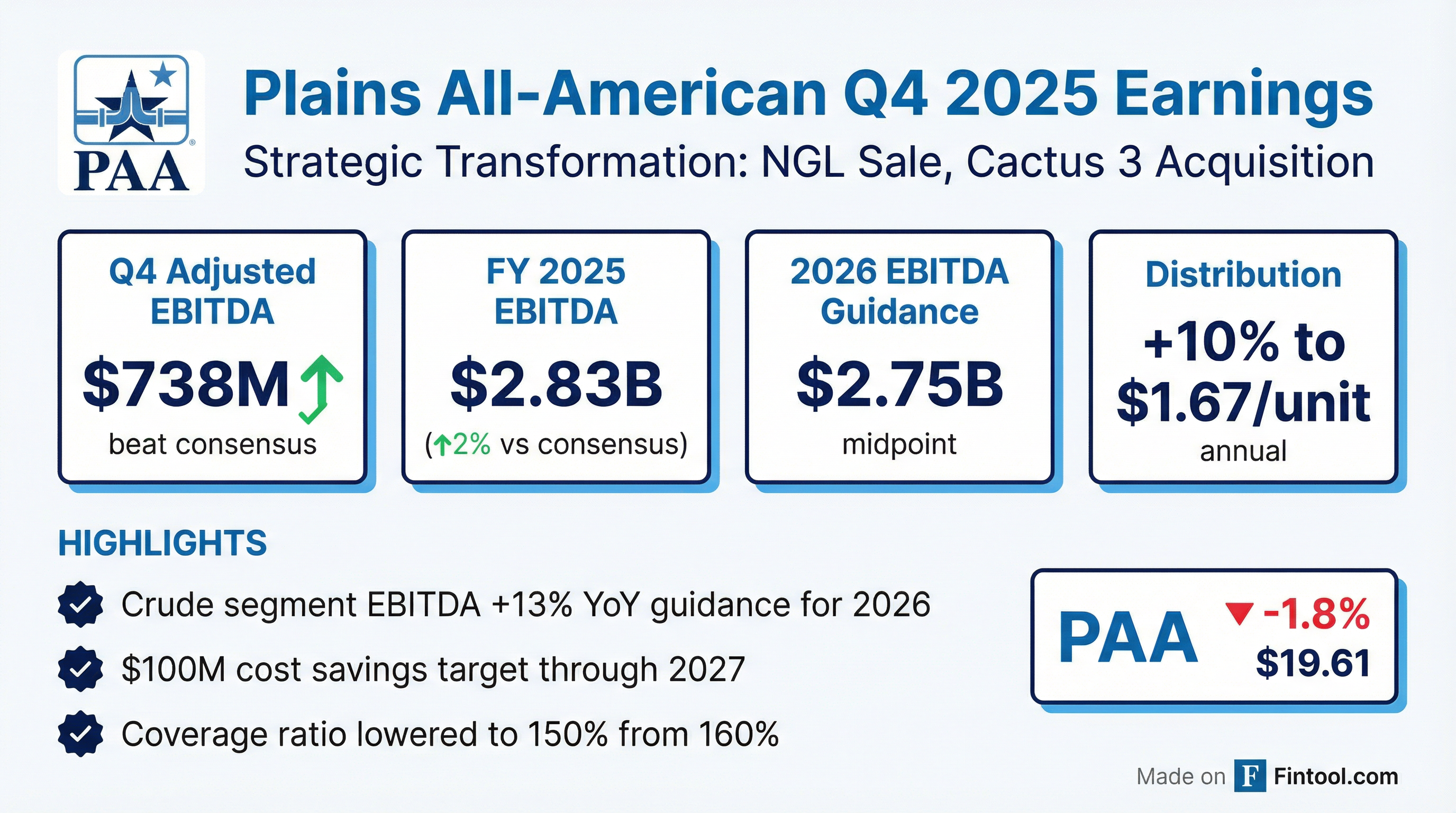

Plains All-American (PAA) reported Q4 2025 adjusted EBITDA of $738 million and full-year 2025 EBITDA of $2.833 billion, beating consensus expectations by approximately 2% . The results cap a transformational year that saw Plains divest its NGL business, acquire the EPIC pipeline (now Cactus 3), and position itself as a pure-play crude oil midstream company.

Management raised the quarterly distribution 10% to $0.4175 per unit ($1.67 annualized), lowered the coverage ratio threshold from 160% to 150%, and outlined $100 million in cost savings through 2027 . Shares traded down approximately 1.8% to $19.61 following the report, as 2026 EBITDA guidance of $2.75 billion came in slightly below Street consensus of $2.85 billion—primarily reflecting the NGL sale impact.*

Did Plains All-American Beat Earnings?

Yes. Plains delivered solid results that exceeded consensus on an adjusted EBITDA basis:

*Values retrieved from S&P Global

The Q4 crude segment included two months of contribution from the Cactus 3 acquisition, partially offset by recontracting impacts on long-haul systems . NGL performance reflected seasonal uplift moderated by warm weather and weak frac spreads .

What Did Management Guide for 2026?

Plains issued 2026 guidance that reflects the strategic transformation—lower headline EBITDA but improved cash flow quality:

*Values retrieved from S&P Global

Key Assumptions:

- NGL divestiture closes at end of Q1 2026 (pending Canadian Competition Bureau approval)

- Permian crude production relatively flat YoY at ~6.6 million barrels/day at year-end

- Full-year contribution from Cactus 3 and BridgeTex acquisitions

- $50 million in cost savings realized in 2026 (half of $100M target)

Importantly, while headline EBITDA declines slightly from the divestiture, distributable cash flow is expected to increase approximately 1% driven by lower corporate taxes and maintenance capital .

How Did the Stock React?

Plains units traded down approximately 1.8% following the earnings release, closing at $19.61 versus the previous close of $19.97.

The modest pullback likely reflects 2026 EBITDA guidance coming in below Street expectations, even as management emphasized the improved quality and durability of cash flows post-transformation.

What Changed From Last Quarter?

This was a pivotal quarter for Plains' strategic repositioning:

Major Transactions Completed/Announced

- Cactus 3 (EPIC) Integration: Two months of contribution in Q4; $50M synergies already at run rate

- Mid-Continent Lease Marketing Sale: Sold for ~$50M, minimal EBITDA impact, removes working capital needs

- Wildhorse Terminal Acquisition: ~4M barrels Cushing storage for $10M net (plus $65M adjustment at NGL close)

- Debt Refinancing: $750M senior notes issued ($300M at 4.7%, $450M at 5.6%), paid off $1.1B EPIC term loan

Capital Allocation Evolution

Management emphasized the reduced coverage threshold reflects "improved visibility for our business, better aligns us with peers, and paves the way for future distribution growth" .

Key Management Quotes

On the Strategic Pivot:

"2025 was a pivotal year for Plains... we remain focused on transitioning to a pure-play crude company, which also serves as a catalyst to streamline our operations and better position Plains for the future." — Willie Chiang, Chairman & CEO

On Cost Savings:

"The sale of our NGL business in Canada really creates a unique opportunity for us to rethink how our company is structured and organized... It's really an across-the-board look that you don't get the opportunity to do very often." — Chris Chandler

On Cactus 3 Synergies:

"Roughly half of that was associated with G&A and OPEX reductions... Those are gone, so half the synergies were achieved in the fourth quarter. We would imagine during the first quarter, we'll be substantially there on the run rate for the $50 million." — Jeremy Goebel

On Permian Outlook:

"We expect growth to resume in 2027, underpinned by more constructive oil market fundamentals driven by ongoing global energy demand growth and diminishing OPEC spare capacity." — Willie Chiang

Segment Breakdown

Crude Oil Segment (Future Core Business)

Key drivers for 2026 include full-year contributions from acquisitions, efficiency gains, partially offset by recontracting impacts .

NGL Segment (Pending Divestiture)

Balance Sheet & Capital Position

Management confirmed the majority of NGL sale proceeds will be used to reduce debt, with leverage expected to trend toward the middle of the target range post-closing .

Q&A Highlights

On Venezuela Impact: Jeremy Goebel noted that recent Venezuelan sanctions created "widening of Canadian differentials in the Gulf Coast... that creates more opportunities for quality optimization, cross-border flows, and other movements." Near-term benefits, but material pipeline repurposing would require 1M+ bpd of new supply .

On Cactus 3 Expansion: Management is evaluating "capital-efficient ways to optimize upstream connectivity, downstream connectivity, and incremental expansions" with options that "don't require new pipe" as well as larger investments. The approach is "not a binary expansion at one time" but phased growth matching demand .

On Weather Impacts: Back-to-back freezes in late January caused 7-10 days of disruption, with the basin losing an estimated 10-12 million barrels of crude production. "We're out of that trough and have been for a few days... That impact has been considered in our guidance."

On Multi-Year Distribution Growth: When asked about coverage supporting multiple years of $0.15/unit increases, Willie Chiang confirmed: "The message we wanted to send is we have the ability to continue to grow beyond 2026... self-help chews up easily half of [the NGL EBITDA loss]. Our comments earlier about additional growth in the Permian gives us confidence in that."

Forward Catalysts

Risks & Concerns

-

Permian Production Plateau: Management expects flat Permian volumes in 2026, with growth resuming in 2027 contingent on improved oil fundamentals

-

Commodity Price Sensitivity: While the business is largely fee-based, $60-65 WTI assumptions underpin producer activity levels and basis differentials

-

Recontracting Pressure: Full-year impact of long-haul system recontracting will weigh on 2026 results

-

Execution Risk: Integration of Cactus 3, cost savings initiatives, and organizational restructuring create execution complexity

The Bottom Line

Plains All-American delivered a clean quarter that closed out a transformational year. The 2% EBITDA beat, 10% distribution hike, and $50M Cactus 3 synergies already at run rate demonstrate execution. While 2026 EBITDA guidance disappointed versus Street expectations, the composition of earnings is materially better—more contracted, more crude-focused, and with a clearer path to multi-year distribution growth.

The investment case now hinges on:

- NGL sale closing cleanly (Q1 gate)

- Permian growth resuming in 2027 as management forecasts

- Cost savings delivering the targeted $100M by year-end 2027

At an 8.5% yield with visible distribution growth, Plains offers an attractive risk/reward for income-oriented midstream investors comfortable with crude oil exposure.

Disclaimer: This analysis was generated by Fintool AI Agent using publicly available information. It is not investment advice. Please consult a qualified financial advisor before making investment decisions.