PRO DEX (PDEX)·Q2 2026 Earnings Summary

Pro-Dex Beats on Revenue and EPS as Next-Gen Handpiece Drives 11% Growth

January 29, 2026 · by Fintool AI Agent

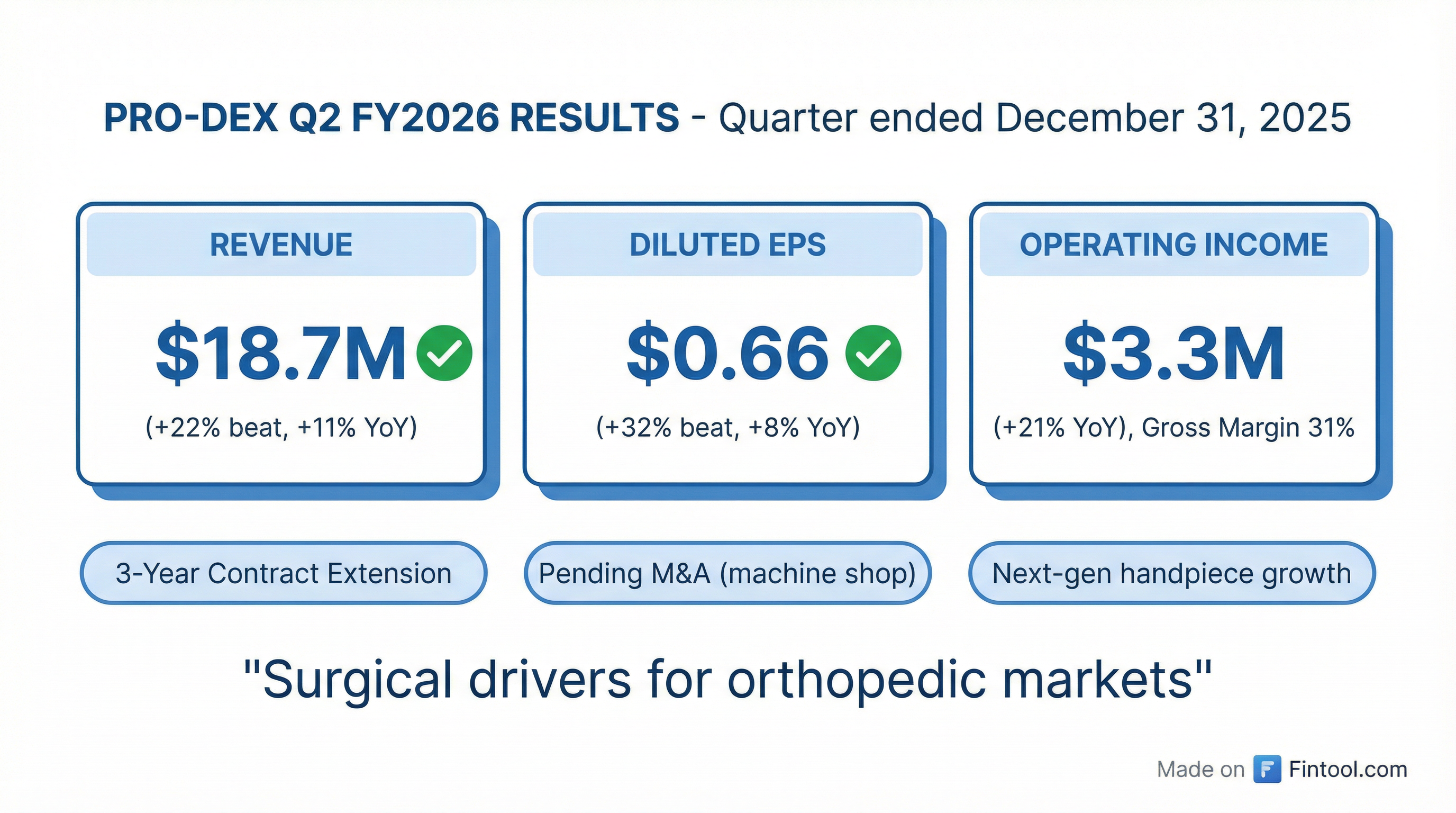

Pro-Dex (PDEX) delivered a double beat in Q2 FY2026, with revenue of $18.7 million topping consensus by 22% and diluted EPS of $0.66 exceeding estimates by 32%. The surgical device manufacturer benefited from accelerating shipments of its next-generation orthopedic handpiece to its largest customer, while also securing a three-year contract extension that provides revenue visibility through fiscal 2029.

Did Pro-Dex Beat Earnings?

Pro-Dex exceeded expectations on both the top and bottom line:

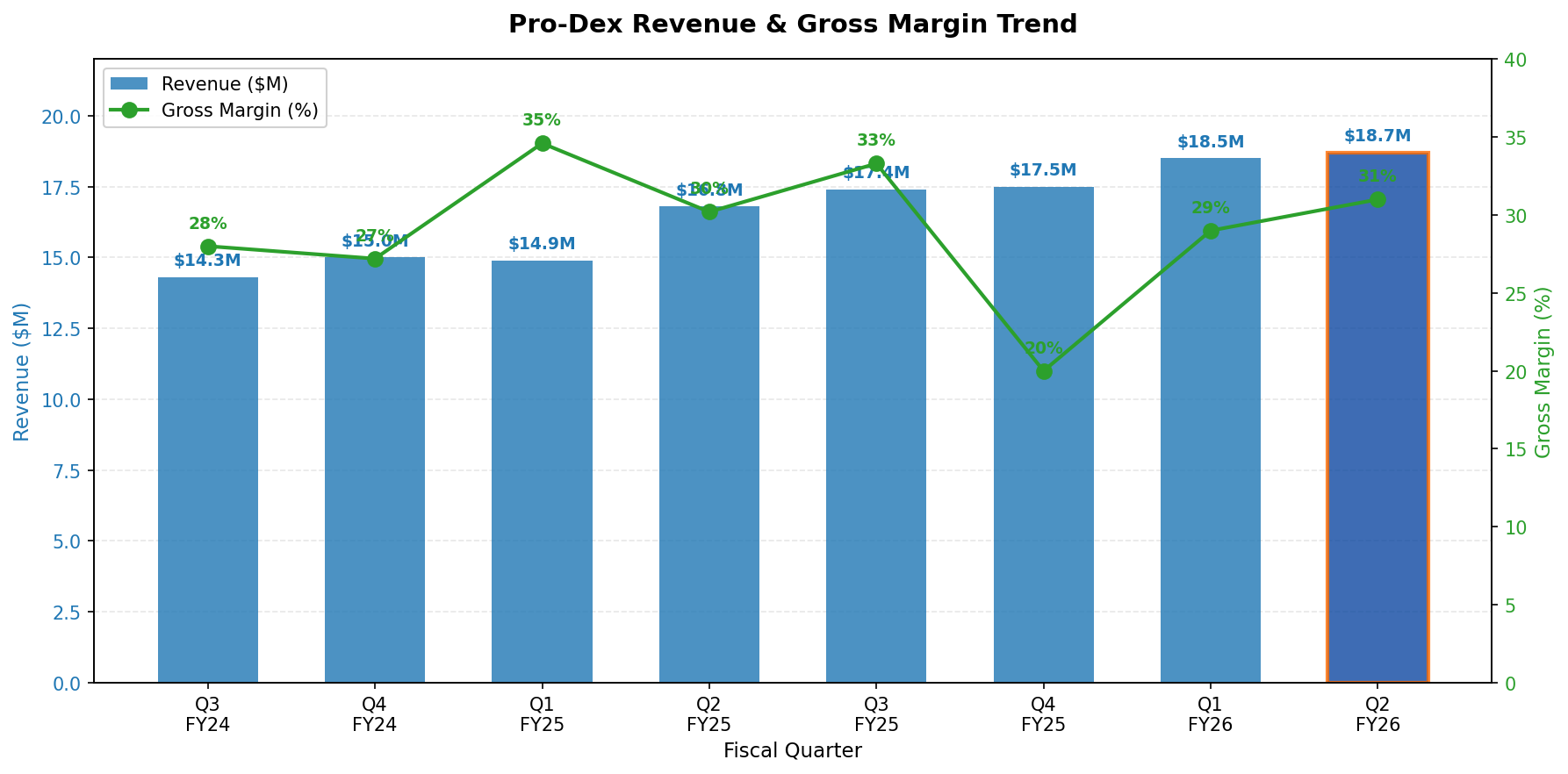

Gross margin expanded 100 basis points to 31% from 30% in the year-ago quarter, driven by increased sales volume and favorable product mix.

What Drove the Revenue Growth?

The revenue beat was fueled by the ongoing transition to next-generation surgical handpieces:

The product transition is progressing as expected, with next-gen handpiece shipments more than offsetting legacy product declines. This suggests Pro-Dex is successfully migrating its largest customer to the newer platform.

What Did Management Say?

CEO Richard L. Van Kirk expressed confidence in the company's trajectory:

"We are pleased with our second quarter and year-to-date results. Additionally, as we previously announced, our three-year contract extension with our largest customer provides the foundation for our continued future growth for the next three years and beyond."

On the pending acquisition:

"We expect to complete an acquisition of a local machine shop which is also a current significant supplier of ours in the near term and, while it may not be immediately accretive to our earnings, it will secure additional capacity and manufacturing technology as we continue to grow."

What Changed From Last Quarter?

*Q1 FY26 EPS included a $3.2M unrealized gain on Monogram Technologies investment, which reversed in Q2 and was replaced by a $6.8M realized gain from the Zimmer Biomet acquisition of Monogram.

Key sequential improvements:

- Gross margin recovered 200bp from Q1's 29% to 31%, reflecting better product mix

- Operating expenses remained controlled at $2.5M vs $2.3M in Q1

- Product transition momentum continued with strong next-gen handpiece volumes

Six-Month Performance

Year-to-date results show sustained momentum:

Note: H1 FY26 net income includes a net $3.6M gain ($6.8M realized less $3.2M unrealized reversal) related to the Monogram Technologies investment, which was acquired by Zimmer Biomet.

How Did the Stock React?

The earnings report was released after market close on January 29, 2026. Pre-release trading:

The stock has traded in a wide range over the past year, reaching highs above $70 in mid-2025 before pulling back. At current levels, shares trade roughly 44% below the 52-week high.

What Are the Key Risks?

Customer Concentration: Pro-Dex derives significant revenue from its largest customer. While the three-year contract extension provides visibility, concentration risk remains a concern for investors.

Product Transition Execution: The shift from legacy to next-gen handpieces is progressing, but any delays or quality issues could disrupt revenue. Repair revenue associated with legacy products continues to decline.

Integration Risk: The pending machine shop acquisition, while strategic for capacity and technology, may face integration challenges and is expected to be dilutive initially.

Forward Catalysts

- Machine Shop Acquisition Close — Expected in near term; will add manufacturing capacity and technology

- Q3 FY26 Earnings — Will show continued product transition progress and margin trajectory

- Next-Gen Handpiece Ramp — Full transition should drive operating leverage as legacy wind-down costs subside

Key Takeaways

- Double Beat: Revenue +22% vs consensus, EPS +32% vs consensus

- Product Transition: Next-gen handpiece shipments (+$7.3M) more than offset legacy declines (-$4.8M)

- Margin Expansion: Gross margin improved 100bp Y/Y to 31% on better mix

- Strategic Visibility: Three-year contract extension with largest customer secures revenue base

- M&A: Pending acquisition of machine shop supplier to add capacity