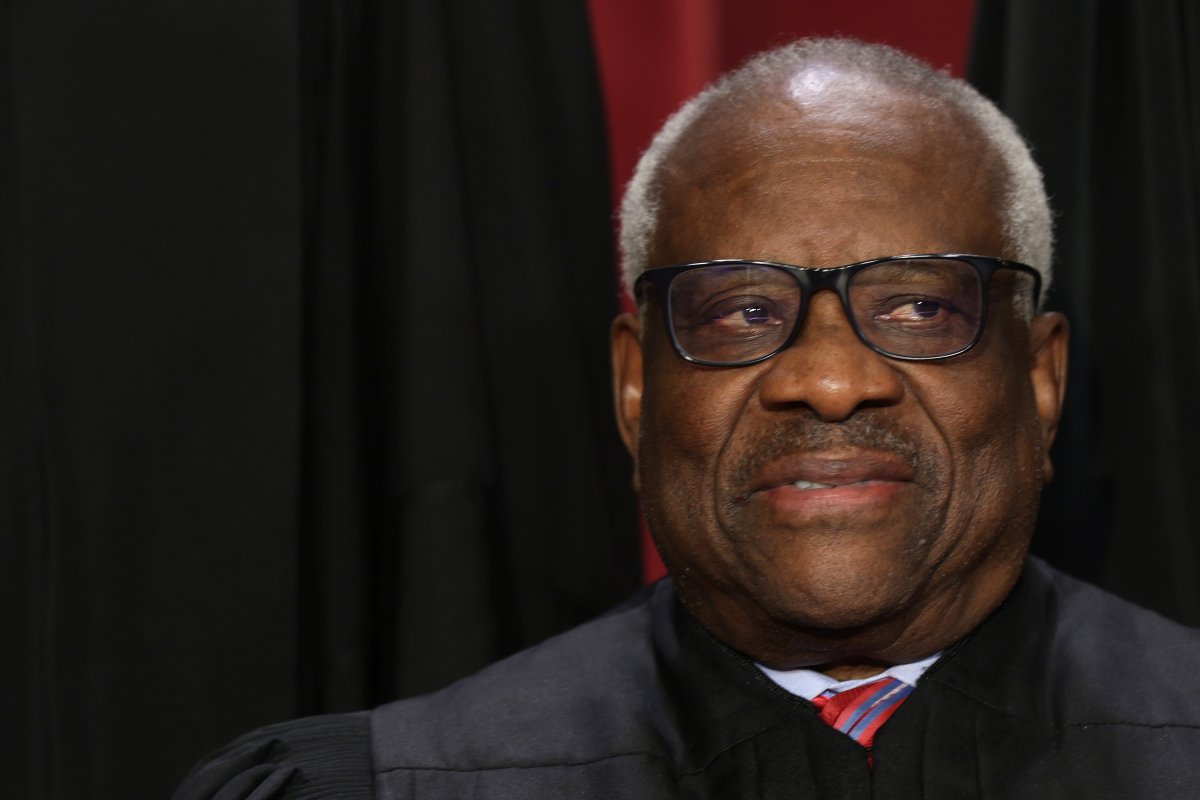

Clarence E. Smith

About Clarence E. Smith

Clarence E. Smith served as Chairman, President, and Chief Executive Officer of ProtoKinetix, Inc. from February 19, 2015 until his death on November 13, 2025; he joined the Board on June 1, 2014 and was age 61 as of March 28, 2025 . His background spans oilfield services and energy operations, including founding and selling Arvilla Well Service, leading Trans Energy, Inc. as Chairman and CEO (2005–2006), and managing private entities Tombstone Resources and Smith Equipment; education disclosed as St. Marys High School (West Virginia, 1981) . PKTX remained pre-revenue with negative EBITDA; annual OTC trading ranges during 2023–2024 indicate micro-cap volatility and constrained liquidity . Smith beneficially owned approximately 28–29% of PKTX common stock in 2025, aligning him materially with shareholders but concentrating control .

Past Roles

| Organization | Role | Years | Strategic impact |

|---|---|---|---|

| ProtoKinetix, Inc. | Chairman, President & CEO; Director | Director since 2014; CEO since 2015–2025 | Led clinical-stage development; significant insider ownership; combined Chair/CEO role . |

| Tombstone Resources; Smith Equipment, LLC; Smith Equipment Company | Managing member/manager | Prior to and concurrent with PKTX | Private operating interests in oil and gas wells and equipment leasing . |

| Arvilla Well Service / Arvilla Pipeline Construction Co., Inc. | Founder; merged and sold | Founded 1981; sold 2008 | Built regional oilfield services; executed merger and eventual sale . |

| Arrow Oilfield Services / Arvilla Oilfield Services, LLC | Acquirer/Operator; merged with Trans Energy | Renamed and merged 2004 | Consolidated oilfield services into a public company platform . |

| Trans Energy, Inc. | Chairman & CEO | 2005–2006 | Led a publicly traded energy company . |

External Roles

| Organization | Position | Years | Notes |

|---|---|---|---|

| Trans Energy, Inc. (public) | Chairman & CEO | 2005–2006 | Public company leadership experience . |

| Tombstone Resources; Smith Equipment (private) | Managing member/manager | Various | Private business operations in energy and equipment leasing . |

Fixed Compensation

- Employment structure: consulting agreement dated December 30, 2016 (effective January 1, 2017), one-year term with auto-renewal since September 1, 2017; base salary set at $1.00 per year .

- No traditional cash salary or cash bonus reported for CEO in 2023–2024 (option awards also not reported in those years) .

Multi-year CEO compensation (reported amounts)

| Year | Salary ($) | Bonus ($) | Stock Awards ($) | Option Awards ($) | Total ($) |

|---|---|---|---|---|---|

| 2019 | — | — | — | 941,688 | 941,688 |

| 2020 | — | — | — | 1,920,866 | 1,920,866 |

| 2021 | — | — | — | 131,494 | 131,494 |

| 2022 | — | — | — | 1,037,384 | 1,037,384 |

| 2023 | — | — | — | — | — |

| 2024 | — | — | — | — | — |

Notes: “—” denotes not reported or zero as disclosed.

Performance Compensation

- Annual incentive structure: the 2017 Smith Agreement entitles Smith to a bonus equal to 2.5% of the aggregate value of any application sale or license of patent rights/products effected during the term; no revenue/EBITDA/TSR-based AIP metrics are disclosed .

- Equity incentives: program was option-heavy, including notable cancel-and-regrant actions in 2021 and 2022 at reduced strike prices with accelerated/fully vested terms .

Annual incentive design

| Metric | Weighting | Target | Actual | Payout | Vesting/Timing |

|---|---|---|---|---|---|

| IP monetization (sale/license value) | Not disclosed | 2.5% of transaction value | Not disclosed | Pays only upon qualifying transactions | Cash bonus paid if/when transaction occurs |

Equity option awards (recent structure)

| Grant/Action | Securities | Exercise Price | Vesting | Expiration |

|---|---|---|---|---|

| Aug 4, 2021 cancel-and-replace + new grant | 25,000,000 replacement + 2,600,000 new options | $0.11 | Immediate vesting acceleration prior to a change in control; otherwise per plan | Aug 3, 2028 |

| Dec 7, 2022 cancel-and-replace | 32,350,000 replacement options | $0.028 | Fully vested on grant | Dec 6, 2028 |

Equity Ownership & Alignment

Beneficial ownership and components

| As-of Date | Total Beneficial Ownership (shares) | % of Shares Outstanding | Ownership Components |

|---|---|---|---|

| Dec 22, 2021 | 71,689,106 | 22.2% | Not broken out in this table |

| Mar 28, 2025 | 117,987,093 | 28.78% (377,580,152 o/s) | 70,214,444 direct; 13,572,649 trusts; 1,850,000 retirement; 32,350,000 options exercisable within 60 days |

| Sept 5, 2025 | 117,987,093 | 28.00% (389,080,152 o/s) | Same component breakdown as above |

Options position and exercisability

| As-of | Options Exercisable | Strike | Expiration | In/Out of the Money |

|---|---|---|---|---|

| Dec 31, 2024 | 32,350,000 | $0.028 | Dec 6, 2028 | Not disclosed |

Hedging/pledging, guidelines, and policies

- Hedging prohibited for employees, officers, and directors; derivative transactions require pre-clearance and may be subject to blackout; margin accounts generally prohibited except by written approval; 10b5-1 plans allowed under policy .

- Stock ownership guidelines: not disclosed. Pledging policy: explicit prohibition on margin accounts (a form of pledging); no separate pledging disclosure for Smith found .

Employment Terms

| Term | Detail |

|---|---|

| Agreement | Consulting agreement dated Dec 30, 2016 (effective Jan 1, 2017) |

| Term/renewal | One-year term extended by amendment on Sept 1, 2017; auto-renews in one-year increments unless either party gives 30 days’ notice prior to year-end . |

| Base salary | $1.00 per year . |

| Target/actual bonus | 2.5% of aggregate value of any application sale/license executed during the term; actual payouts not disclosed . |

| Severance (no cause) | $100,000 per year of service (pro rata for partial years) . |

| Change in control | Upon termination “upon a change of control event”: $100,000 per year of service plus 2.5% of the aggregate transaction value (single-trigger economic benefit tied to CoC event wording) . |

| Equity acceleration | 2021 replacement options include immediate vesting acceleration prior to change in control; 2022 replacement options were fully vested when granted . |

| Non-compete/non-solicit | Not disclosed. |

| Clawback/tax gross-ups | Not disclosed. |

Board Governance

- Board service: Smith served as Director since June 1, 2014 and as Chairman/CEO/President from Feb 19, 2015 until his death; on Nov 16, 2025, sole remaining director appointed Michael Guzzetta as Chairman, President, and CEO (also CFO) .

- Committee structure: No separately designated audit, compensation, or nominating committees; the full Board performs these functions; no independent compensation consultant retained .

- Independence: Only one independent director (Edward P. McDonough) per SEC Rule 10A-3(b)(1) at the time of the 2024 10-K .

- Meetings/attendance: The Board held no formal meetings in 2020 or through the 2021 proxy date; acted by unanimous written consent 15 times in 2020 and 12 times in 2021 .

- Dual-role implications: Combined Chair/CEO and a majority insider board raised independence concerns and concentrated control (risk factor notes insider control at ~34.3% group voting power; Smith ~28.8%) .

Director Compensation

| Fiscal Year | Director | Cash Fees ($) | Stock Awards ($) | Option Awards ($) | Total ($) |

|---|---|---|---|---|---|

| 2020 | Edward P. McDonough | — | — | 682,091 | 682,091 |

Notes: Employee directors typically do not receive separate board retainers; only non-employee director option compensation disclosed in 2020 table . No director cash retainers or guideline disclosures found .

Performance & Track Record

Financial profile and stock trading ranges

| Metric | FY 2022 | FY 2023 | FY 2024 |

|---|---|---|---|

| EBITDA ($) | -1,848,859* | -367,221* | -311,318* |

Values marked with an asterisk were retrieved from S&P Global.

OTC trading ranges

| Year | Low ($) | High ($) |

|---|---|---|

| 2023 | 0.010 | 0.035 |

| 2024 | 0.008 | 0.0235 |

Observations

- PKTX operated with negative EBITDA and no reported revenues (recent years) under Smith’s leadership, consistent with a pre-revenue clinical-stage profile .

- Insider control: Directors and officers held ~34.3% voting power as of March 28, 2025; Smith alone ~28.8%—potentially deterring change-in-control transactions and concentrating decision-making .

Vesting Schedules and Insider Selling Pressure

Outstanding and historical option schedules for Smith (illustrative awards)

| Grant | Shares | Strike | Vesting | Expiration |

|---|---|---|---|---|

| Nov 9, 2018 | 5,000,000 | $0.09 | 1,250,000 every three months beginning Mar 31, 2019 | Nov 8, 2023 |

| Jul 15, 2019 | 5,000,000 | $0.26 | 1,250,000 every three months beginning Oct 13, 2019 | Jul 14, 2024 |

| Nov 18, 2018 | 5,000,000 | $0.11 | 1,250,000 every three months beginning Feb 18, 2020 | Nov 17, 2024 |

| Mar 25, 2020 | 10,000,000 | $0.14 | Fully vested at grant | Mar 25, 2026 |

| Aug 4, 2021 (cancel/replace + new) | 27,600,000 | $0.11 | Acceleration prior to CoC | Aug 3, 2028 |

| Dec 7, 2022 (cancel/replace) | 32,350,000 | $0.028 | Fully vested at grant | Dec 6, 2028 |

Implications

- Cancel-and-regrant at lower strikes in 2021 and 2022 reduced performance risk and may be viewed as shareholder-unfriendly if not tied to performance outcomes; however, they aligned exercise prices with market realities for retention .

- Fully vested 2022 options create potential selling capacity, though insider trading policies impose pre-clearance and blackout constraints .

Related Party Transactions and Compliance

- 2024 related party disclosures include CFO consulting and rent reimbursements; Smith’s securities purchases in 2024 are referenced elsewhere (Recent Sales of Unregistered Securities) without detail in the executive compensation section .

- Section 16(a) compliance: one late Form 4 filing by Smith for two transactions in 2024 .

Say-on-Pay & Peer Group

- Say-on-Pay: 2021 proxy sought advisory approval of NEO compensation and frequency (Board recommended triennial). Vote outcomes not disclosed in materials reviewed .

- Peer group/consultant: Company disclosed no independent compensation consultant and no separate compensation committee; no peer group disclosure found .

Board Service History, Committee Roles, and Dual-Role Implications

- Smith served as combined Chair/CEO, with only one independent director on the Board and no standing committees—raising independence and oversight concerns typical of micro-cap governance structures .

- The Board frequently acted by unanimous written consent rather than formal meetings, which can limit deliberative oversight; no committee-level attendance data is disclosed .

Investment Implications

- Alignment and control: Smith’s ~28–29% ownership strongly aligned his incentives with equity value, but also concentrated control and potentially deterred strategic alternatives; risk factors explicitly highlight insider control dynamics .

- Incentive design: Heavy reliance on options—including cancel-and-regrant at lower strikes in 2021 and 2022—reduced performance linkage versus PSUs/TSR-based awards; the only explicit cash metric is a deal-contingent 2.5% bonus for IP monetization events, which did not yield disclosed payouts .

- Retention and transition: Auto-renewing contract with single-trigger economic benefits upon change of control (including 2.5% of transaction value) and fully vested options supported retention but posed potential golden parachute optics; Smith’s death in November 2025 introduces leadership continuity risk and elevated execution risk during transition to Michael Guzzetta (now also Chair/CEO/CFO) .

- Execution risk: Persistent negative EBITDA and going-concern risk underscore dependence on external financing and clinical milestones; absence of revenue-tied metrics and limited board independence amplify governance and performance risk considerations .

Sources: SEC filings and company documents as cited above.