RAVE RESTAURANT GROUP (RAVE)·Q2 2026 Earnings Summary

RAVE Restaurant Group Posts 23rd Straight Profitable Quarter as Pizza Inn Comps Rise 2.5%

February 5, 2026 · by Fintool AI Agent

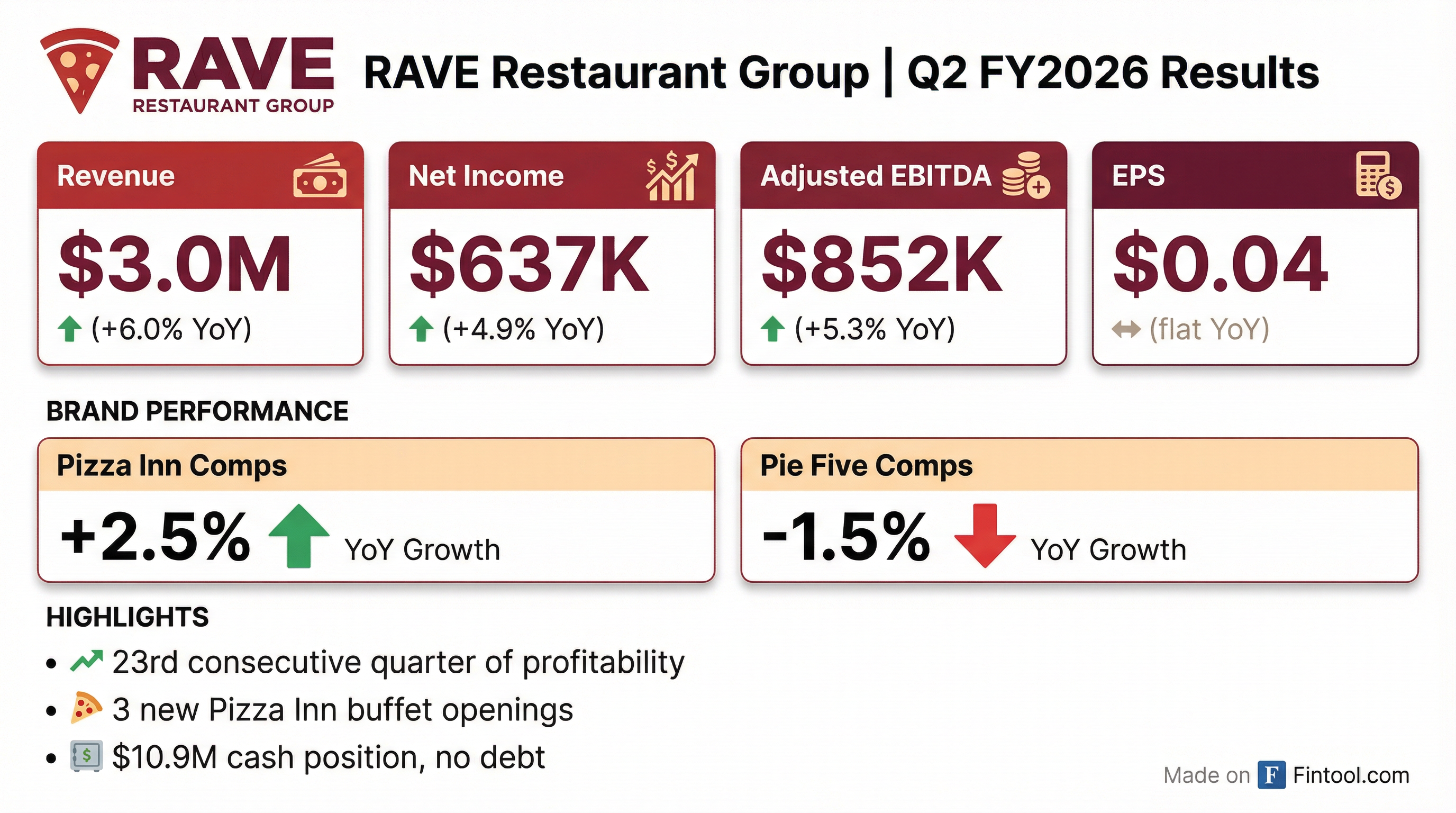

RAVE Restaurant Group (NASDAQ: RAVE) delivered another solid quarter, reporting its 23rd consecutive quarter of profitability with revenue up 6% to $3.0 million and net income rising 4.9% to $637,000. The Pizza Inn franchisor opened three new buffet locations during the quarter—the most in over 20 years within a three-week period—signaling improved development execution.

Did RAVE Beat Earnings?

RAVE delivered across all key financial metrics, extending its profitability streak in a challenging restaurant environment:

The company's pre-tax income grew at more than double the rate of net income (+12.1% vs +4.9%), reflecting higher operating leverage before tax impacts.

How Did Pizza Inn and Pie Five Perform?

The two brands continued their divergent paths:

Pizza Inn (Core Brand)

- Domestic comparable store retail sales: +2.5%

- Following +8.1% comps in Q1 FY2026

- Unit count: 97 domestic (82 buffet locations) + 19 international

- Three new buffet openings during the quarter

Pie Five (Fast-Casual)

- Domestic comparable store retail sales: -1.5%

- Improved from prior trend but still negative

- Unit count: 16 domestic locations

CEO Brandon Solano noted that Pizza Inn continues to grow both unit count and same-store sales while the broader restaurant industry faces "sluggish growth and pressure on sales and traffic."

What's Driving Pizza Inn's Momentum?

Management highlighted several factors behind Pizza Inn's outperformance:

-

Value Promotions: The "All You Can $8" promotion (formerly "I $8 at Pizza Inn") ran at over half of buffet locations in January, with some restaurants extending through Q3.

-

Development Execution: Three buffet openings in a three-week span—something Pizza Inn hadn't accomplished in over 20 years—demonstrates improved operational capabilities.

-

Mission 2030 Strategy: The company continues executing on its long-term profitable growth plan.

CFO Jay Rooney noted the quality of earnings driven by Pizza Inn sales growth, while acknowledging Pie Five's declining impact on overall results. Management is addressing Pie Five through "new advertising, product innovation, operational efficiency, and pricing initiatives."

How Strong is RAVE's Balance Sheet?

RAVE maintains a fortress balance sheet unusual for micro-cap restaurants:

The shift from cash to short-term investments reflects active treasury management to generate interest income. Interest income contributed $91K in Q2 FY2026.

How Did the Stock React?

RAVE shares closed at $3.27 on February 5, 2026, with after-hours trading showing the stock at $3.21. The stock trades near its 52-week high of $3.75, significantly above its 52-week low of $2.01.

The stock has appreciated approximately 55% from its 52-week low, reflecting improved fundamentals and the profitability streak.

What Changed From Last Quarter?

The sequential revenue decline reflects normal seasonality. The Pizza Inn comps moderation from +8.1% to +2.5% was expected after an exceptionally strong Q1. The key development is the three new unit openings, signaling franchise pipeline conversion.

What Are the Forward Catalysts?

-

Unit Growth Acceleration: Management expressed confidence in opening restaurants "at scale" going forward after the Q2 development success.

-

Q3 Value Promotions: The "All You Can $8" promotion continues into Q3 at select locations.

-

Pie Five Turnaround: New advertising, product innovation, and pricing initiatives are in progress.

-

Mission 2030: Long-term strategic plan focused on profitable growth.

Key Risks

- Pie Five Drag: The fast-casual concept continues to underperform with negative comps

- Micro-Cap Liquidity: Low trading volume (~10K shares/day) limits institutional participation

- Franchisee Concentration: Development depends on franchisee capital and execution

- Consumer Environment: Restaurant industry facing broad traffic and spending pressure

The Bottom Line

RAVE Restaurant Group delivered exactly what shareholders want: another profitable quarter, positive Pizza Inn comps, unit growth, and a strengthening balance sheet. The 23 consecutive quarters of profitability is a testament to disciplined management of the franchise model. While Pie Five remains a headwind, its diminishing contribution limits downside. The three Q2 buffet openings suggest development is finally accelerating, which could drive meaningful growth if sustained through Mission 2030.

Data sourced from RAVE Restaurant Group 8-K filed February 5, 2026. Market data as of February 5, 2026.