Ribbon Communications (RBBN)·Q4 2025 Earnings Summary

Ribbon Communications Q4 2025: Non-GAAP EPS Surges 269% But Weak Q1 Guidance Signals Headwinds

February 5, 2026 · by Fintool AI Agent

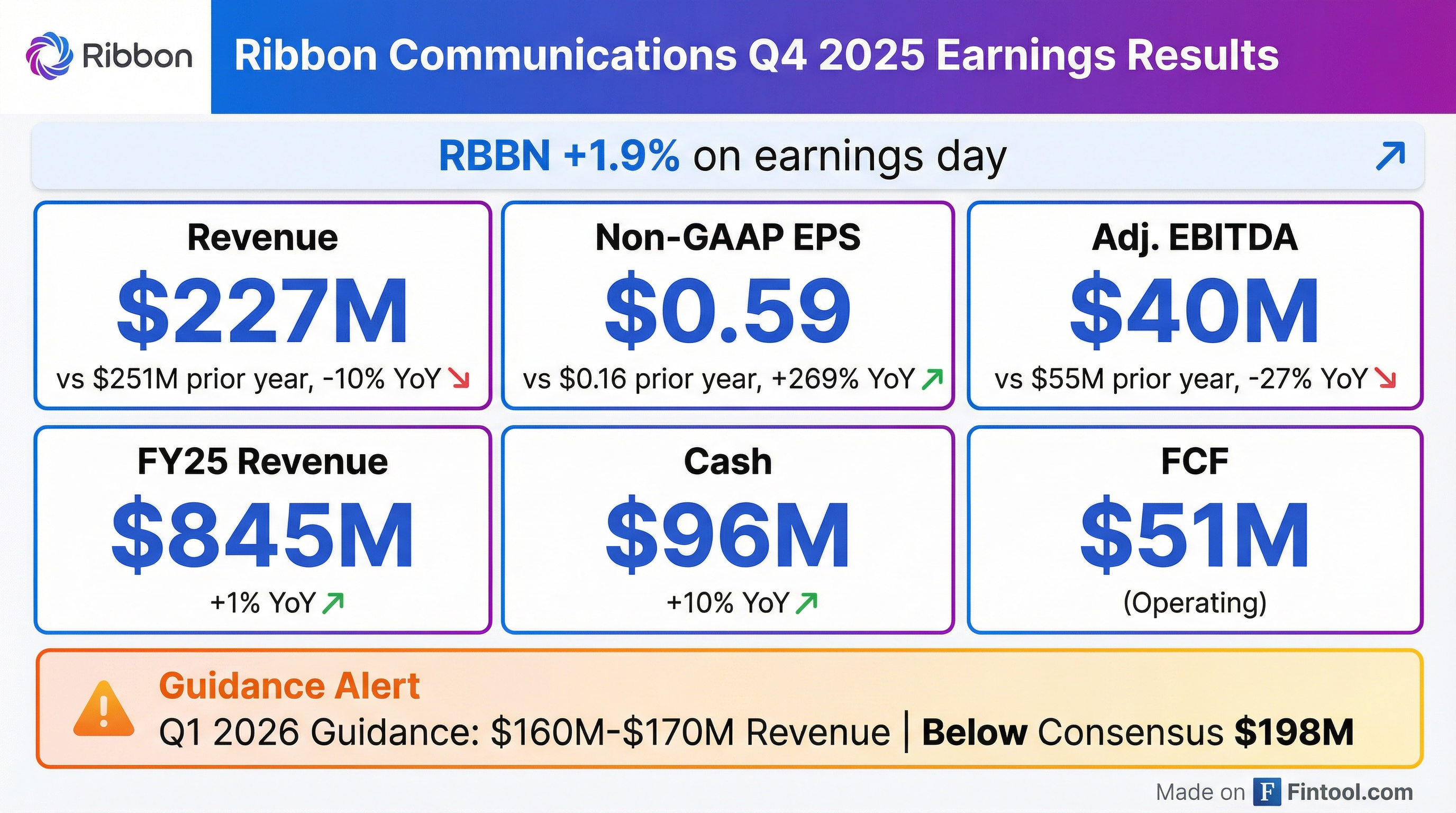

Ribbon Communications (NASDAQ: RBBN) reported Q4 2025 results that delivered a massive Non-GAAP EPS beat—$0.59 vs $0.16 a year ago—but the headline numbers mask underlying challenges. Revenue fell 10% YoY to $227M, and management issued Q1 2026 guidance 17% below Street expectations, citing customer project delays, budget timing issues, and near-term uncertainty from federal spending cuts and industry consolidation.

Did Ribbon Communications Beat Earnings?

The mixed picture: Ribbon beat on profitability metrics but missed on top-line expectations and forward guidance.

The GAAP net income surge to $89M was driven by an $89M income tax benefit recognized in the quarter—a one-time item that management expects will reduce cash tax payments by $15-20M over the next several years.

Full Year 2025 Results:

What Did Management Guide for 2026?

This is where the story gets concerning. Q1 2026 guidance came in significantly below Street expectations:

*Values retrieved from S&P Global.

Full Year 2026 Outlook:

The full-year guide is essentially flat, with a notably weak first half. Management expects improvement in H2 as delayed projects materialize.

What Changed From Last Quarter?

Q4 headwinds explained by management:

-

Customer project delays – About half of the Q4 shortfall (~$6M) came from projects already in backlog where implementation delays pushed out milestones. CEO McClelland noted one primary U.S. customer "where deployments slowed during their recent restructuring." These are deployment delays, not lost deals.

-

Budget timing issues – The remaining gap was from customers impacted by year-end budget constraints, including an IP optical project "still waiting for BEAD funding to be distributed."

-

Federal spending decline – U.S. federal agency sales dropped from ~$20M in Q4 2024 to ~$10M in Q4 2025—a $10M YoY headwind.

-

Verizon comparison – Q4 2024 included "record" Verizon equipment shipments at project launch; timing creates tough YoY comp.

Recovery timing: Management expects ~$6M of the Q4 shortfall to hit Q1, with the rest spread linearly into future quarters. Deployment-related delays won't fully "catch up" unless customers accelerate timelines.

Positive developments:

- Record bookings (all non-Verizon) – The $50M+ in voice modernization bookings came from about a dozen customers, separate from the Verizon program. Roughly 25% shipped in Q4; the rest converts over the next ~15 months. Some customers are "large names" with multi-year potential comparable to Verizon.

- Verizon program on track – Business with Verizon grew 27% YoY in FY25, and the first phase (covering ~1/3 of their network) is now ~35% complete. Frontier acquisition integration creates significant expansion opportunity.

- Cost actions – Ribbon completed a restructuring eliminating ~85 positions, lowering annual expenses by $10M+.

- Tax benefit – Recognized ~$90M deferred tax benefit related to ECI investment, with $15-20M annual cash tax savings over coming years.

How Do the Business Segments Look?

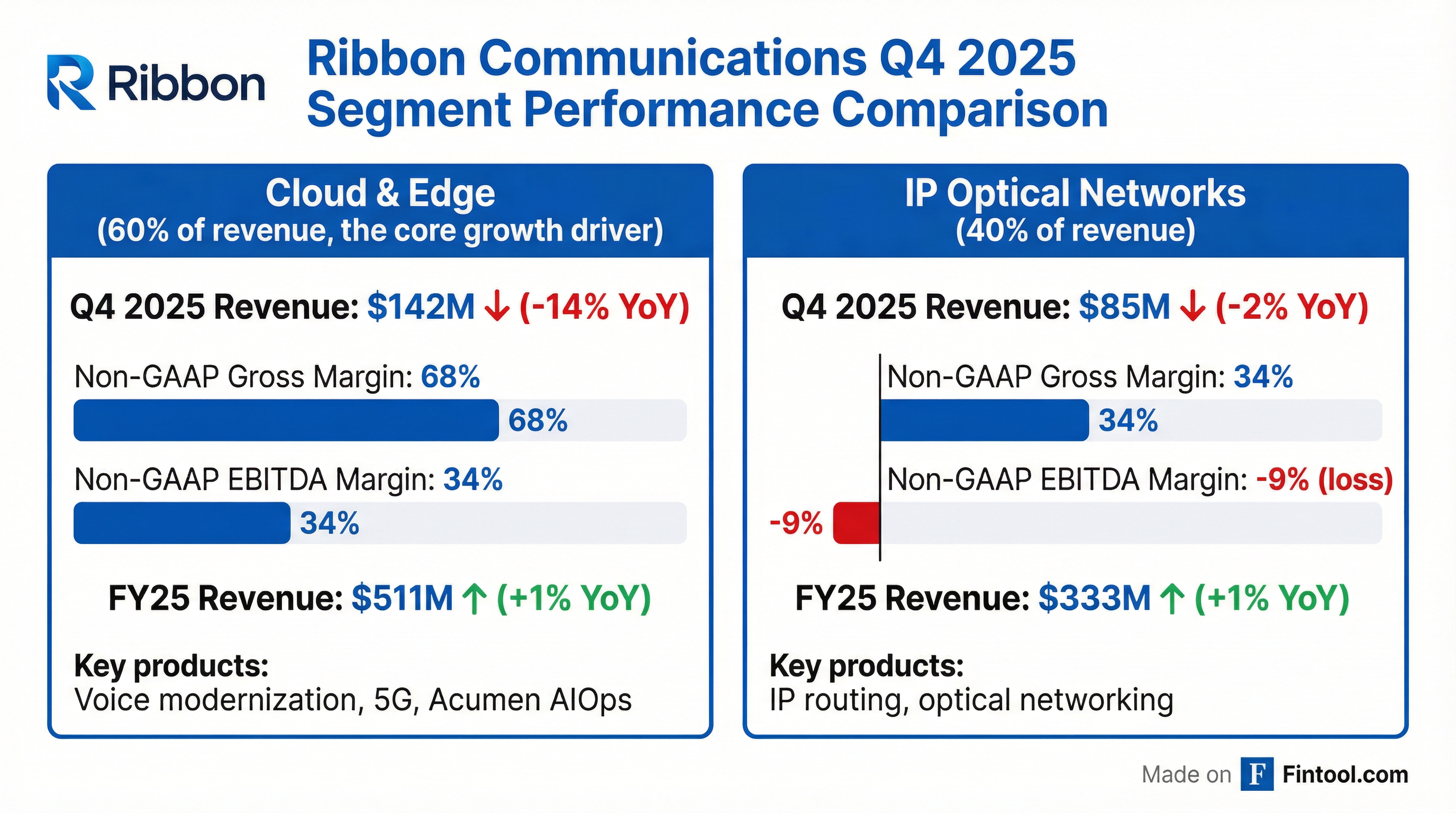

Cloud & Edge (Core Growth Driver – 63% of revenue):

IP Optical Networks (37% of revenue):

The IP Optical segment continues to drag on profitability with negative EBITDA margins, though management sees this improving as AI data center interconnect opportunities materialize. IP Optical bookings-to-revenue was 1.1x in Q4 (highest of the year), while Cloud-and-Edge hit a record 1.5x.

Geographic Performance:

Customer Mix (FY25): Global service providers 70% (+5% YoY), Enterprise 21% (+2% YoY), Government/Defense 9% (-23% YoY).

What Are Ribbon's Growth Vectors?

Management outlined several mid-term growth drivers in the 2026 operating environment:

1. AI & Automation

- Acumen AIOps platform for network automation—Optimum is lead customer with ~12 additional POCs planned for H1 2026 and "modest revenue" expected in H2

- Enabling voice connectivity to AI agents at scale

- Partnerships to voice-enable Agentic AI platforms

2. Network Modernization

- Legacy TDM voice switch replacement

- Migration to cloud-native architectures

- 5G and edge computing deployments

3. Government & Defense

- Expanding U.S. and European defense relationships

- Mission-critical transport networks

- Voice modernization for government agencies

4. Fiber/Data Center Investment

- BEAD funding driving FTTH and middle-mile investment ($42B U.S. federal funding)

- AI data center interconnect using 800G optical portfolio

Recent Business Wins:

- AWS Partnership – Multi-year collaboration to simplify transition of critical network services to public cloud; two significant customer wins in Q4 based on AWS integration

- U.S. Tier 1 win – New cloud-native migration program with a U.S. Tier 1 carrier for SBC and routing workloads

- European railways – Major wins with Banedanmark (Denmark) and Deutsche Bahn (pan-European)

- U.S. electric cooperative – First win with one of the largest power generation/distribution cooperatives covering nine states

- India expansion – Strong Bharti deployments; first shipments for new world broadband deployment

How Did the Stock React?

RBBN shares closed at $2.72 on earnings day, up +1.9% intraday. The muted reaction likely reflects the mixed picture: strong profitability offset by weak forward guidance.

Recent stock performance:

- 1 month: -5.5% (from $2.88 on Jan 2)

- YTD: -5.5%

- Since Q3 2025 earnings (Oct 22): +0.7%

The stock trades near 52-week lows, reflecting ongoing uncertainty around the revenue trajectory and competitive pressures in the optical networking space.

Balance Sheet & Cash Flow

Ribbon maintains a stable balance sheet with improving cash generation. The company repurchased ~972K shares for $3.3M in Q4 and 2.5M shares for $9M in FY25. Management expects CapEx to return to ~$15M annually and lower cash taxes to improve cash generation in coming years.

Forward Catalysts

Near-term events:

- Mobile World Congress – Barcelona

- OFC (Optical Fiber Communication Conference) – Los Angeles, March

Key questions for investors:

- When will the delayed Q4 projects convert to revenue?

- Can the Acumen AIOps platform gain traction vs larger competitors?

- Will BEAD funding translate to meaningful optical network orders?

- Can IP Optical return to positive EBITDA margins?

Q&A Highlights

On the $50M voice modernization bookings (Michael Genovese, Rosenblatt):

"The $50 million of new bookings that I mentioned were non-Verizon... about a dozen different customers... There was a couple of reasonably large ones and then a longer list of more single-digit million sort of thing... about 25% [shipped in Q4]. And then the rest... plays out over the next, say, 15 months."

On Verizon trajectory (Tim Savageau, Northland):

"The contract we have in place for the first 3 years [covers] a third of their footprint... We're about a year and a half since we initiated the program. And we estimate we're 35% or so through that effort... We think there's likely a second phase and then Frontier on top of that."

On BEAD funding timing (Tim Savageau, Northland):

"We think that segment of our business grows reasonably significantly this year... I'm a little frustrated because we expected it to get started in Q4... But I think we've got a really nice funnel of opportunities in that space for us."

On enterprise SBC market (Ryan Koontz, Needham):

"It's a great business for us... We have now Tier 1 carriers in all regions migrating their traditional SBC infrastructure into a true cloud-native implementation... Our SBC sales in Q4 were up pretty considerably. It was one of the big growth areas."

On Acumen AIOps pipeline (Rustam Kanga, Citizens):

"We're in the heavy lifting getting into deployment with our lead customer, Optimum... we've probably got about a dozen other POCs lined up for the next few months... the next six months is really focused on these POCs so that we can start to turn that into real revenue in the second half of the year."

The Bottom Line

Ribbon's Q4 2025 shows a company in transition—record bookings and strong EPS masked by revenue headwinds and a notably weak Q1 guide. The 17% guidance miss on Q1 revenue signals that near-term challenges (customer delays, budget constraints, federal spending cuts) are more persistent than transitory. Management's focus on AI, defense, and voice modernization presents compelling mid-term opportunities, but execution will need to improve for the stock to re-rate. Watch for Q1 2026 results to see if delayed projects start converting.