Solo Brands (SBDS)·Q4 2025 Earnings Summary

Solo Brands Stock Surges 46% as Cost Cuts Drive EBITDA Turnaround

January 27, 2026 · by Fintool AI Agent

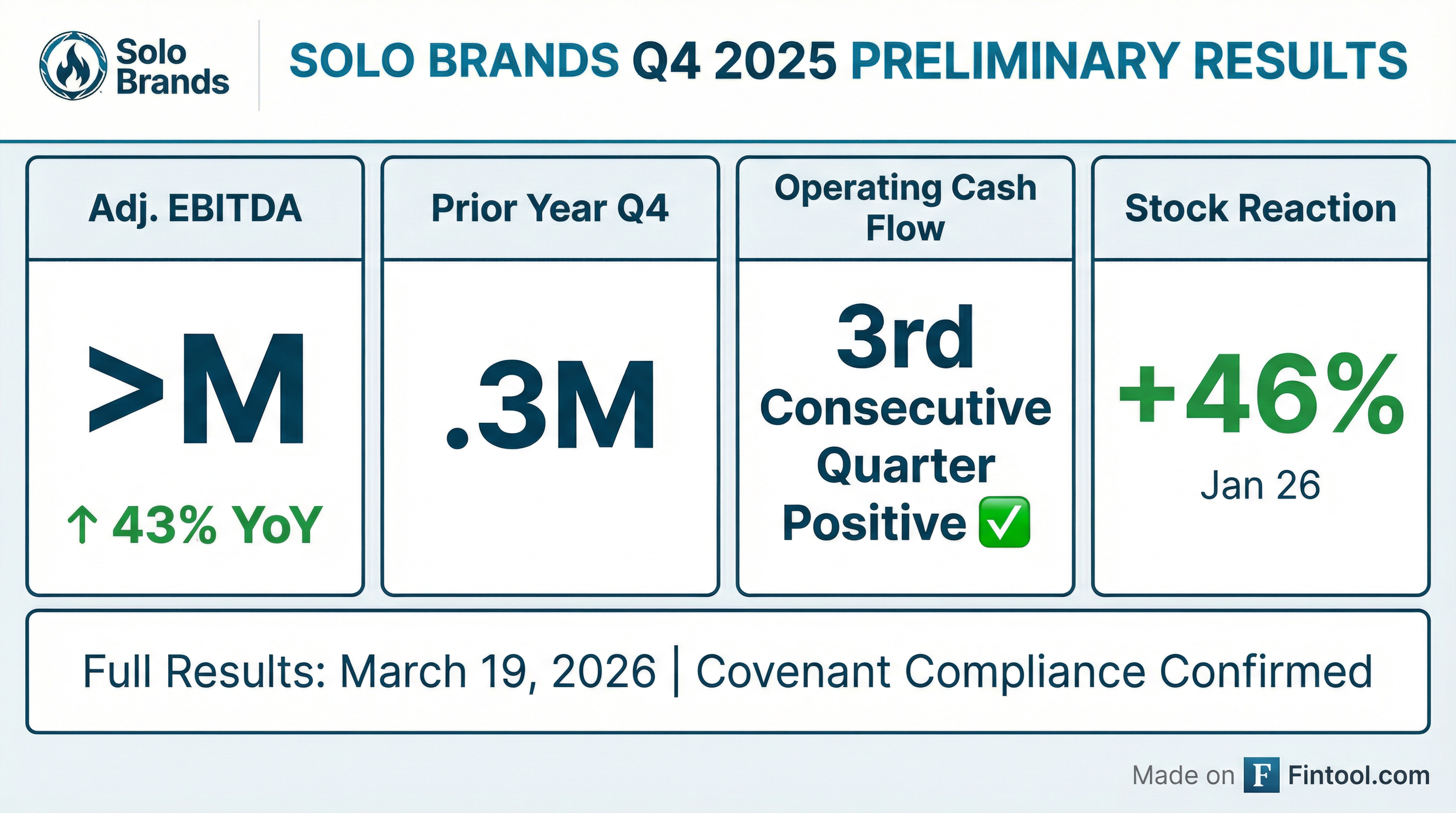

Solo Brands (NYSE: SBDS) stock exploded 46% on January 26 after the company announced preliminary Q4 2025 results showing its aggressive restructuring is finally paying off. Adjusted EBITDA is expected to exceed $9 million—up 43% from Q4 2024's $6.3 million—and marks the third consecutive quarter of positive operating cash flow.

The results validate CEO John Larson's turnaround strategy after a brutal 2025 that saw the stock collapse from ~$43 to under $1, a reverse stock split, and going concern warnings.

Did Solo Brands Beat Earnings?

Yes—decisively on profitability. While Solo Brands did not release specific revenue figures in this preliminary announcement, the EBITDA result signals a dramatic improvement from Q3 2025's Adjusted EBITDA of $(5.1) million.

The company emphasized this performance "demonstrates the impact of decisive cost restructuring actions alongside solid execution on new product launches."

How Did the Stock React?

SBDS stock surged 46.1% on January 26, 2026, closing at $8.90—the biggest single-day gain in months. The stock traded as high as $8.90 on the day, up from an open of $6.09.

The reaction reflects relief that the company: (1) maintained covenant compliance, (2) returned to positive EBITDA after Q3's miss, and (3) demonstrated cost discipline is working despite persistent top-line headwinds.

What Changed From Last Quarter?

Q3 2025 was ugly. Revenue crashed 43.7% YoY to $53 million, Adjusted EBITDA was negative $(5.1) million, and management acknowledged "challenging" conditions as retail partners worked through excess inventory.

The swing from Q3 to Q4 shows the restructuring cadence is accelerating:

Historical EBITDA Trend

The Q4 2025 result breaks a pattern of deteriorating profitability through 2025:

*Values retrieved from S&P Global

What Drove the Turnaround?

Management cited two key drivers:

- Cost restructuring actions — The company closed three distribution centers, executed multiple layoffs, renegotiated vendor contracts, and reduced SG&A by 35.4% in Q3 alone

- New product launches — Initial response to Summit 24" and Infinity Flame firepits has been "quite favorable"

The cost actions documented in the 10-Q through September 2025:

What About Revenue?

Here's the elephant in the room: management did not disclose preliminary revenue, noting only "continued revenue pressure during the quarter."

Given the Q4 2024 revenue of $143.5M and the trajectory through 2025, investors should expect significant YoY revenue decline when full results are released. The trailing revenue picture:

The stabilization question is whether Q4's holiday season and new product launches stemmed the decline.

Balance Sheet Snapshot

The company's liquidity position as of Q3 2025:

*Values retrieved from S&P Global

The debt load has increased as the company drew on credit facilities to fund restructuring, but the covenant compliance confirmed in the preliminary release is critical—it means lenders aren't accelerating maturities.

Forward Catalysts

CEO John Larson outlined the 2026 focus:

"As we enter 2026, we are focused on building a leaner, more profitable, and resilient platform, supported by meaningful new product launches this spring across Solo Stove, Chubbies, and our Watersports portfolio."

Key dates:

- March 19, 2026: Full Q4 2025 and FY 2025 results, 9:00 a.m. ET conference call

- Spring 2026: New product launches across all major brands

Risks to Watch

The forward-looking statements highlight ongoing concerns:

- Going concern risk — Still cited as a factor

- Tariff exposure — Manufacturing is mostly outside the U.S.

- Limited liquidity — Despite positive cash flow, the cushion is thin

- NYSE listing standards — Reverse split was completed in July 2025 to maintain compliance

- Covenant compliance — Must be maintained quarter-to-quarter

The Bottom Line

Solo Brands delivered exactly what the market needed: proof that the restructuring is working. A 43%+ YoY EBITDA improvement and third straight quarter of positive cash flow suggest the company has right-sized its cost structure. The revenue question remains unanswered until March 19, but for a stock that traded under $1 less than a year ago, the +46% reaction signals investors are willing to give management credit for execution.

The turnaround is real. The question now is whether revenue can stabilize in 2026.