Skyline Bankshares (SLBK)·Q4 2025 Earnings Summary

Skyline Bankshares Posts Record Quarter as JCB Integration Pays Off — Stock Hits 52-Week High

February 2, 2026 · by Fintool AI Agent

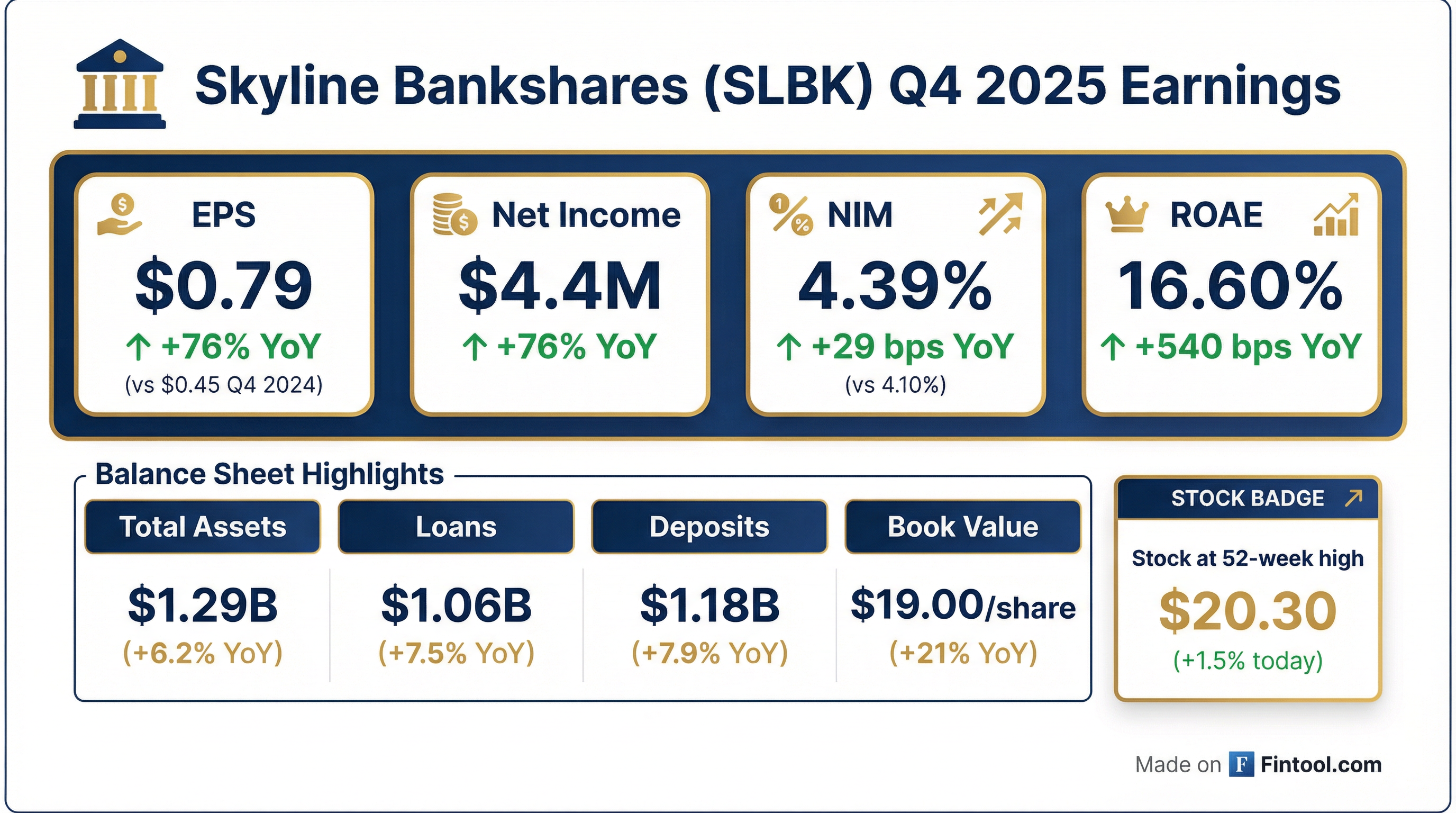

Skyline Bankshares (OTC QX: SLBK) delivered a standout Q4 2025, with EPS of $0.79 surging 76% year-over-year as the Virginia-based community bank reaps the benefits of its September 2024 Johnson County Bank acquisition. Net income hit $4.4 million, NIM expanded to 4.39%, and the stock touched a 52-week high of $20.30 — up 65% since the start of 2025.

How Did Skyline Bankshares Perform in Q4 2025?

Note: SLBK is a small-cap OTC stock without analyst coverage, so no consensus estimates are available for beat/miss analysis.

For full year 2025, net income was $15.8 million ($2.84 per share), compared to $7.4 million ($1.34 per share) in 2024 — a 113% increase. When adjusting for $2.4 million in merger-related expenses in 2024, the year-over-year growth was still a robust 68%.

What Drove the Strong Results?

Three factors powered the quarter:

1. JCB Acquisition Synergies Kicking In

The September 2024 acquisition of Johnson County Bank added $154 million in assets and $87 million in loans at fair value, with $125 million in deposits. One year in, the integration appears complete with no merger costs in Q4 2025 versus $923K in Q4 2024.

2. Organic Loan Growth Accelerating

Core loan growth ran at an annualized rate of 8.39% in Q4 2025. Total loans reached $1.06 billion, up 7.5% YoY. Interest income on loans increased $1.6 million in the quarterly comparison, the primary driver of revenue growth.

3. Deposit Mix Shift Fueling NIM Expansion

Noninterest-bearing deposits grew $33.1 million (+9.79%) during 2025, while the bank paid off $29.2 million in borrowings. This shift to lower-cost funding was "accretive to margins throughout the year." The bank also reduced higher-cost time deposits by $14 million in Q4 alone.

Balance Sheet: Solid Growth Across the Board

Asset quality remains solid with nonperforming loans at 0.45% of total loans, though this ticked up from 0.26% in Q4 2024 due to one loan relationship going into nonaccrual. Management does not expect credit losses on this relationship based on collateral values.

What Did Management Say?

CEO Blake Edwards struck an optimistic tone:

"We are very pleased with our results for the fourth quarter and for the year ended December 31, 2025. Adjusted net income increased by $6.4 million, or 67.80%, in the year-over-year comparison when adjusted for nonrecurring, merger-related costs in 2024."

On capital return:

"Dividends were increased to $0.52 per share in 2025, representing an increase of 13.04%, when compared to the dividends of $0.46 per share paid in 2024."

On the outlook:

"As we look to build on the success of 2025, our team will continue to focus on our long-term strategy of growing the Skyline franchise and creating shareholder value with an emphasis on relationship-banking and positioning ourselves as the bank of choice throughout our market area."

Management noted competitive pressures for deposits throughout their footprint and anticipates interest expense could increase in the near term.

How Did the Stock React?

SLBK shares hit a 52-week high of $20.30 on the earnings release, up 1.5% on the day. The stock has been on a remarkable run:

The stock now trades at 1.07x book value ($20.30 / $19.00) and 1.19x tangible book value ($20.30 / $17.07), reasonable multiples for a community bank generating 16%+ ROE.

What Changed From Last Quarter?

Improving:

- NIM up 12 bps sequentially (4.27% → 4.39%)

- Loan growth accelerated to 8.39% annualized

- Paid off remaining $26.5M in borrowings

- Stock breaking to new highs

Worth Watching:

- NPL ratio ticked up to 0.45% from 0.22% (one relationship)

- Competitive deposit pressures acknowledged

- Salary costs rising from personnel additions

Key Risks and Considerations

Credit Quality: While the NPL increase to 0.45% is modest in absolute terms, the jump from 0.26% warrants monitoring. Management's confidence in collateral coverage is reassuring.

Deposit Competition: Management explicitly flagged competitive pressures for deposits, which could pressure NIM going forward even as the Fed cuts rates.

Small-Cap Liquidity: SLBK trades on OTC QX with thin daily volume (~1,000-2,000 shares). Position sizing matters for any institutional interest.

Tariff Uncertainty: The 8-K filing specifically mentions "duties, tariffs or other barriers or restrictions on trade" as a risk factor amid current policy uncertainty.

The Bottom Line

Skyline Bankshares delivered a clean quarter with strong profitability metrics, healthy balance sheet growth, and no merger noise for the first time since the JCB acquisition. At 1.07x book value with 16%+ ROE and expanding NIM, valuation appears reasonable for a well-run community bank. The main concerns are thin liquidity, deposit competition, and monitoring that one NPL relationship.

Data sourced from Skyline Bankshares 8-K filing dated February 2, 2026.