SILGAN HOLDINGS (SLGN)·Q4 2025 Earnings Summary

Silgan Holdings Surges 8% as Dispensing Segment Delivers Record Year

February 4, 2026 · by Fintool AI Agent

Silgan Holdings (SLGN) reported Q4 2025 results that sent shares up 8% as the packaging company demonstrated resilience across its portfolio despite a challenging consumer environment. Net sales of approximately $1.5 billion increased 4% year-over-year, while adjusted EPS of $0.67 declined from $0.85 in the prior year period due to higher interest expense and tax headwinds . More importantly, management delivered 2026 guidance at or above 2025 levels and confirmed the successful integration of the Weener acquisition with full run-rate synergies achieved .

Did Silgan Beat Earnings?

Q4 2025 results came in largely in line with expectations, with several bright spots that drove the positive stock reaction:

*Values retrieved from S&P Global

The EPS decline was not operational—it was driven by higher interest expense from the Weener acquisition financing and a higher tax rate in Q4 (negatively impacted by ~3% from non-recurring, non-cash tax items) . At the adjusted EBIT level, the business was flat, with Metal Containers segment gains offsetting higher corporate expense.

Full Year 2025 Highlights:

- Second highest adjusted earnings and free cash flow in company history

- Returned approximately $160 million in capital to shareholders

- Returned to within target leverage range just over a year after closing the Weener acquisition

- Dispensing & Specialty Closures delivered record sales, adjusted EBIT, and adjusted EBITDA

What Did Management Guide for 2026?

Management provided guidance that slightly exceeds 2025 levels at the midpoint, demonstrating confidence despite macro uncertainty:

Q1 2026 Guidance: EPS of $0.70-$0.80, below Q1 2025's $0.82, primarily due to:

- Year-over-year impact of selling through lower-cost prior year inventory in 2025 (inflationary benefit) versus higher-cost inventory in 2026

- Limited pre-buy volume in Q4 2025 that pulled volume forward from Q1 2026

- Carryover of destocking activity in Custom Containers into January

Volume Expectations by Segment:

How Did the Stock React?

SLGN surged +8.0% on the earnings release, trading at $47.25 versus the prior close of $43.76. This marked the strongest earnings-day reaction in recent memory for the stock.

Why the rally?

- Weener integration complete: Full run-rate synergies achieved just 15 months post-acquisition

- Customer bankruptcy resolved: The bankruptcy of a major customer (likely Senomyx-related vegetable business) saw favorable auction outcomes with assets going to existing customers Silgan already supplies

- Fragrance & beauty momentum: Double-digit growth continued in Q4 with multi-year development pipeline visibility

- Pet food strength: 7% growth in Q4 with continued mid-single digit growth expected in 2026

- Guidance confidence: At the midpoint, 2026 will exceed prior year adjusted EBIT and EBITDA levels

Trading Context:

- 52-week high: $57.04

- 52-week low: $36.15

- Current price: $47.25 (17% below 52-week high)

What Changed From Last Quarter?

Several important developments emerged compared to Q3 2025:

Positive Changes:

- Destocking complete in DSC: Personal care and home care destocking that impacted Q4 is now finished and will not affect Q1 2026 volumes

- Bankruptcy clarity: The customer bankruptcy situation is now resolved with auction winners announced—broth and fruit businesses going to existing Silgan customers, vegetable business to a new player where Silgan is co-located

- Healthcare pipeline accelerating: Management reiterated expectation to double the ~$200M healthcare business over the next 3-5 years with a pipeline "as strong as at any time since the WestRock acquisition"

Ongoing Challenges:

- Custom Containers destocking extending: Unlike DSC, the distribution channel (10-15% of Custom Containers business) typically sees destocking start later and end later—some carryover into January

- Interest expense headwind: The April maturity of 1.4% senior secured notes will increase interest expense in 2026

- Raw material inflation: Steel and aluminum tariffs continue to pressure costs, though these are contractually passed through

Segment Deep Dive

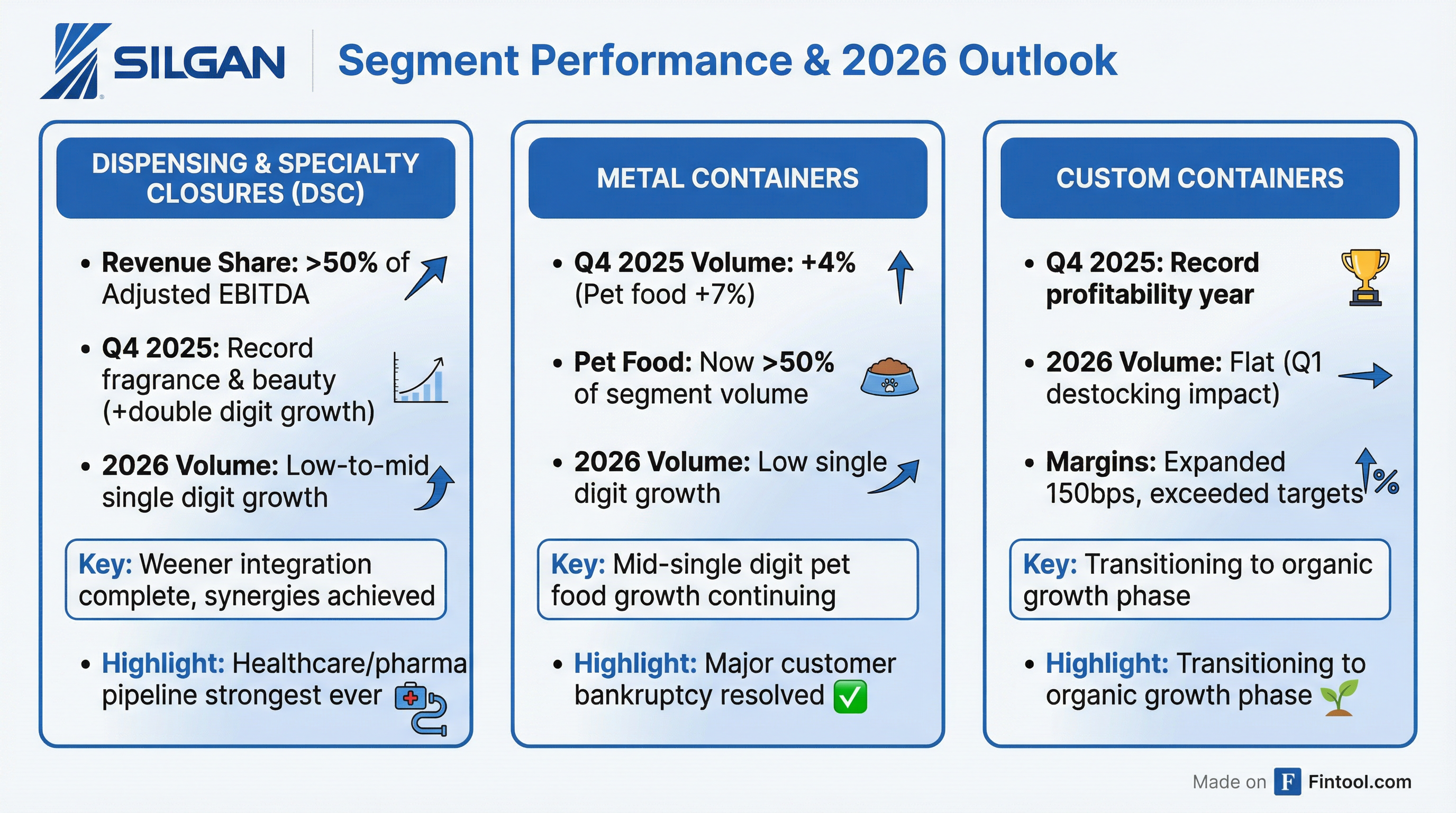

Dispensing & Specialty Closures (DSC)

Now representing more than half of adjusted EBITDA, DSC continues to be the growth engine:

- Q4 2025 sales +1% YoY (4% favorable FX translation)

- Adjusted EBIT comparable to record Q4 2024 level

- Double-digit growth in fragrance and beauty offset personal care/home care destocking

- Combined innovation engine with Weener yielding additional contractual business wins

2026 Outlook: Low-to-mid single digit volume growth driven by mid-single digit dispensing product growth and improved mix

Metal Containers

Strong operational execution drove better-than-expected results:

- Q4 2025 sales +11% YoY (raw material pass-through + 4% volume growth)

- Pet food volumes +7% in Q4, now >50% of segment volume

- Adjusted EBIT +5% YoY from strong cost management

- ~$2M benefit from limited pre-buy volumes ahead of 2026 raw material inflation

2026 Outlook: Low single digit volume growth driven by mid-single digit pet food growth

Custom Containers

Record profitability despite volume challenges:

- Q4 2025 sales -8% YoY (exited lower-margin business from footprint optimization)

- Excluding exits, volume +1%

- Adjusted EBIT comparable to prior year

- Adjusted EBIT/EBITDA margins expanded 150 basis points to levels "well above the target laid out about a decade ago"

2026 Outlook: Flat volumes as Q1 destocking (from distribution channel) offsets growth in Q2-Q4

Key Q&A Highlights

On managing DSC's different business model (George Staphos, Bank of America):

"We had some learnings from 2025... taking a broader view of risk as we've come out with our guidance now for Q1 and also for 2026, to try to take into account some of the unknown risks that maybe we hadn't included in guidance before." — Adam Greenlee, CEO

On fragrance & beauty sustainability (Matt Roberts, Raymond James):

"All of this volume that we're going to deliver in 2026 has really been in the innovation pipeline for us for several years... we're working right now on '27 and '28 product launches and have a pretty good feel for what that's gonna look like at this point." — Adam Greenlee, CEO

On the customer bankruptcy outcome (Mike Roxland, Truist):

"The broth and the fruit are going to our customers that we supply today... The veg business is a new player into canned vegetables, but a prominent player in the fresh category... we are co-located. We are incredibly well-positioned to continue to supply all of the can requirements." — Adam Greenlee, CEO

On wet pet food stickiness (Arun Viswanathan, RBC):

"Once pet owners feed their animals wet pet food, it is very rare that they move out of the category in a cat or a small dog... we've seen the stickiness of that product with pet owners and with the consuming animals for a very, very long period of time." — Adam Greenlee, CEO

On tariff absorption (Anthony Pettinari, Citi):

"Our contracts are designed to make sure we are insulated from those kinds of activities. We contractually pass through those costs and those tariffs on to our customers... I do think the market has absorbed those costs." — Adam Greenlee, CEO

Capital Allocation & Balance Sheet

Strong free cash flow generation enabled rapid deleveraging:

*Values retrieved from S&P Global

2025 Capital Returns:

- ~$160 million returned to shareholders

- Leverage returned to target range just 15 months post-Weener close

2026 CapEx of ~$310M (up from ~$300M) to support investments in:

- Future growth in dispensing products

- Pet food capacity under long-term agreements

Forward Catalysts

Near-term (Q1-Q2 2026):

- Q1 earnings in late April—watch for destocking normalization

- Customer bankruptcy procedural completion

- Food and beverage innovation year (zero-calorie, better-for-you products)

Medium-term (2026-2027):

- Healthcare/pharma pipeline commercialization (targeting doubling of ~$200M business)

- M&A opportunities with balance sheet now within target leverage

- FDA protein guidelines potentially benefiting metal can demand

Management Commentary on Opportunities:

"The opportunities for organic and inorganic growth for Silgan are probably as great as at any time in my 21 years that I've been with the company." — Adam Greenlee, CEO

Risks & Concerns

- Interest expense step-up: April maturity of 1.4% notes will increase 2026 interest costs

- Tin plate supply constraints: U.S. is a net importer with limited domestic high-quality capacity

- Consumer spending volatility: GLP-1 drugs, affordability, and population trends remain overhangs

- Food & beverage uncertainty: Volumes expected flat as innovation may cannibalize existing products

The Bottom Line

Silgan delivered a solid Q4 that capped a strong 2025—the company's second-best year ever for adjusted earnings and free cash flow. The 8% stock surge reflects investor relief on multiple fronts: Weener synergies achieved, customer bankruptcy resolved favorably, and 2026 guidance at or above 2025 levels despite macro uncertainty.

The thesis remains intact: Silgan's portfolio evolution toward higher-margin dispensing products (now >50% of EBITDA) positions the company for sustainable growth, while the pet food tailwind in Metal Containers provides visibility and the Custom Containers turnaround is entering its growth phase.

At $47.25 (7.6x estimated 2026 EBITDA), the stock trades at a discount to packaging peers, though the yield on free cash flow (~9%) provides downside support. The key debate is whether Silgan can sustain low-to-mid single digit growth while expanding margins—Q1 2026 results will be the first test.

Read the full Q4 2025 earnings transcript | View SLGN company page