South Bow (SOBO)·Q4 2024 Earnings Summary

South Bow Q4 2024 Earnings

Executive Summary

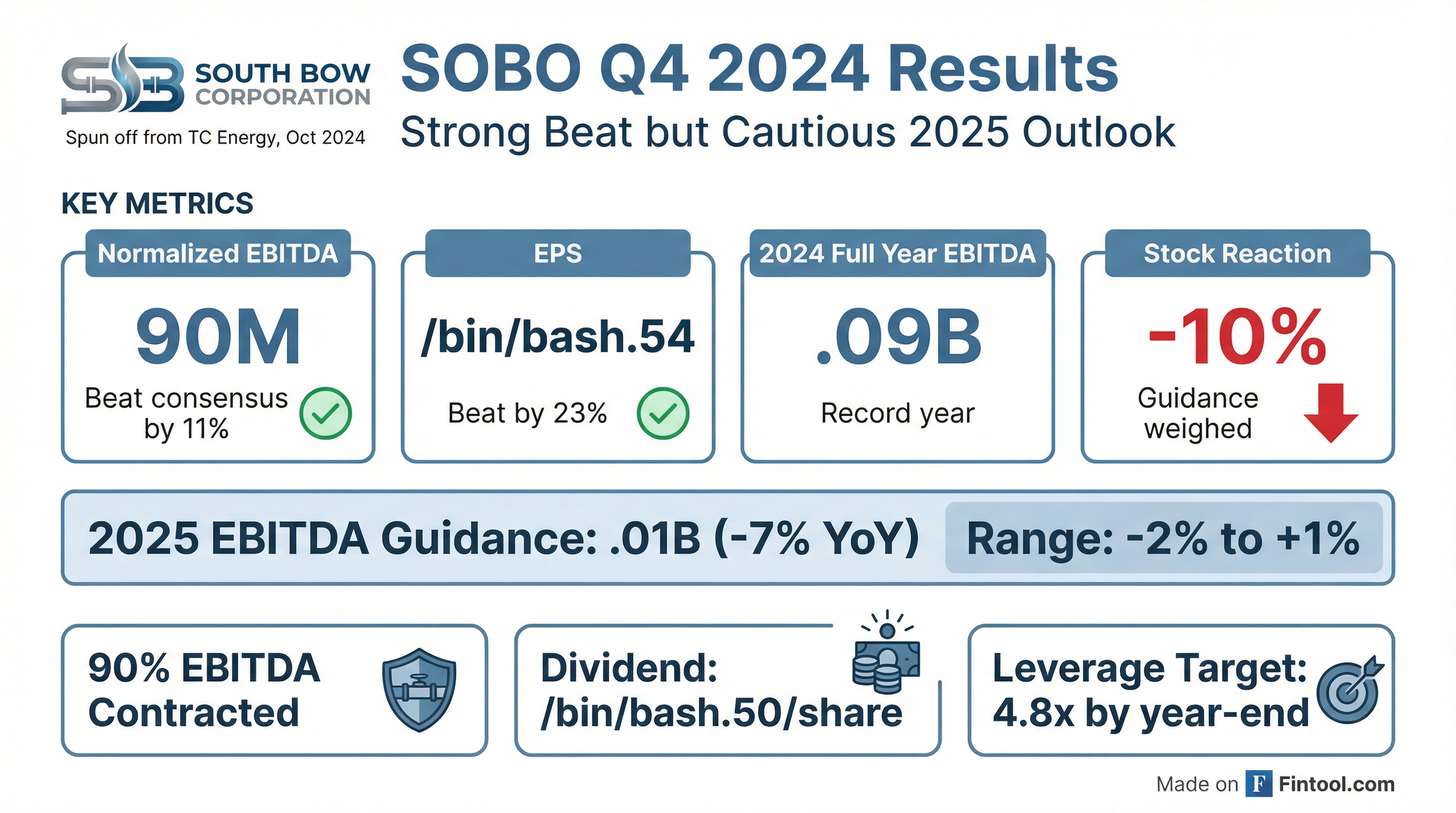

South Bow Corporation (SOBO) delivered strong Q4 2024 results, beating EPS estimates by 23%, but the stock fell 10% as management guided 2025 EBITDA down 7% year-over-year due to tariff uncertainty and tighter egress spreads.

Key Highlights:

- Normalized EBITDA: $290M (beat consensus ~$260M)

- EPS: $0.54 vs $0.44 estimate (+22.6% beat)

- FY 2024 EBITDA: $1.09B — record year

- 2025 Guidance: $1.01B EBITDA (-7% YoY)

- Stock Reaction: -10% on earnings day

Stock Performance vs Earnings

Despite consistently beating earnings estimates, SOBO stock has been volatile due to:

- 2025 guidance cut from ~$1.09B to $1.01B EBITDA

- Tariff uncertainty creating headwinds for uncommitted volumes

- TMX competition — Trans Mountain expansion added egress capacity, tightening spreads

- Milepost 171 incident (Q1 2025) added operational uncertainty

Beat/Miss History

South Bow has beaten EPS estimates in all 4 quarters since its October 2024 spin-off from TC Energy.

Financial Results

*Values from S&P Global. **Full year distributable cash flow

2025 Guidance

Guidance Bridge: 2024 → 2025

CFO Van Dafoe provided the EBITDA walk:

- Uncommitted capacity headwind: -$40M (TMX competition, tariff uncertainty)

- Marketing segment reduction: -$30M (de-risking strategy)

- Run-rate basis: Q3 2024 annualized (~CAD 360M/quarter)

What Went Well

Record Safety & Operational Performance

"2024 was a record year for both occupational and process safety performance, and we delivered record operational results with strong system availability and throughput across our systems." — Bevin Wirzba, CEO

PHMSA Pressure Restriction Lifted

"Earlier this week, we received approval from PHMSA to lift the pressure restrictions on the affected segment of the Keystone system." — Richard Prior, COO

Strong Contracted Base

- 90% of EBITDA secured through committed arrangements

- Minimal commodity price or volumetric risk

- 7+ year average contract duration

Blackrod Project On Track

- Pipeline connection project advancing on schedule

- 40,000 bpd of long-term contracted production

- Cash flows begin 2026, full contribution 2027

What Went Wrong

2025 Guidance Below Expectations

The market sold off on guidance, not the Q4 beat. Key drivers:

- Uncommitted capacity weakness: TMX expansion in May 2024 added egress, tightening the arb spread

- Tariff uncertainty: Even before implementation, tariff threats caused customer nomination volatility

- Marketing de-risking: Shift from merchant to contracted strategy reduces upside but limits risk

Leverage Increasing Near-Term

"We expect our leverage to increase modestly through 2025 as we advance the Blackrod Connection Project and incur one-time costs." — Bevin Wirzba, CEO

Management Commentary

On Capital Allocation Priorities

"In addition to paying a sustainable dividend with an attractive yield, we are keenly focused on strengthening our investment-grade financial position... Our target of getting down to 4.0x is not going to be jeopardized by us advancing any other projects." — Bevin Wirzba, CEO

On Growth Strategy

"Our base guidance of 2%-3% EBITDA growth really is underpinned by around $400-$500 million of US dollars being spent over a four- to five-year period. So around $100 million a year at our build multiples, that creates that base 2%-3% growth." — Bevin Wirzba, CEO

On Tariff Impact

"With what we see today, we believe we can manage the balance of the uncertainty on tariffs within that 3% range on our guidance... Fortunately for us, we have such a strong contracted base." — Bevin Wirzba, CEO

On Recontracting Risk

"We do have a very unique corridor that we believe has attributes that will still be very compelling when we go to the recontracting of our base asset... the most direct route on our base system with the fastest transit times with the only batch system." — Bevin Wirzba, CEO

Q&A Highlights

Big Sky Pipeline Project

Q: Can you discuss the open season inbounds and timing?

A: "We're very encouraged by the basic fundamentals within the basin... We've seen supply growth also exceed expectations... We don't talk about commercial interest on any open seasons. It's a confidential process."

Deleveraging Timeline

Q: Any change to the debt-to-EBITDA target timeline?

A: "We're laser-focused... on getting down to that four times, and we see that in that 2028 timeframe... we would never sacrifice that."

Variable Toll Complaint

Q: What's the status of the customer complaint?

A: "On the Canadian side, the CER hearing process has been completed, and we're awaiting a decision... On the US side with FERC, decisions have been made but are being appealed. South Bow would accrue up to 14% with a cap at CAD $30 million."

Analyst Sentiment

Consensus: Hold (1 Buy, 5 Hold, 2 Sell)

Key Takeaways

- Beat the quarter, missed on guidance — Q4 results were strong but 2025 outlook disappointed

- Contracted base provides stability — 90% of EBITDA locked in for 7+ years

- Tariffs are a headwind, not a crisis — Impact limited to uncommitted 6% of volumes

- Deleveraging on track — 4.0x target by 2028 remains intact

- Growth catalysts ahead — Blackrod (2026), Big Sky potential, Gulf Coast expansion

Subsequent Developments

Since Q4 2024 earnings:

- April 2025: Milepost 171 pipeline incident in North Dakota; line returned to service in 7 days

- May 2025: Q1 2025 earnings reaffirmed full-year guidance despite incident

- Stock performance: +14% from post-earnings low ($24.05) to current ($28.05)