SPIRE (SR)·Q1 2026 Earnings Summary

Spire Beats Q1 on Strong Utility Rates; Adjusted EPS +32% YoY

February 3, 2026 · by Fintool AI Agent

Spire Inc. (NYSE: SR) reported Q1 FY2026 results that exceeded expectations on both the top and bottom line. Adjusted EPS of $1.77 beat the Street by $0.13 (7.9%), while revenue of $762.2M came in $38.3M (5.3%) above consensus. The beat was driven by strong performance in the Gas Utility segment, where new rate structures in Missouri and Alabama are flowing through to earnings.

Did Spire Beat Earnings?

Yes — beat on both EPS and revenue.

*Consensus estimates from S&P Global

This marks a strong start to FY2026 following mixed results in the prior year. The company beat on adjusted EPS for the second consecutive quarter after missing in Q1 and Q2 of FY2025.

Winter Storm Fern: A Stress Test Passed

Before diving into the numbers, CEO Scott Doyle highlighted the company's operational performance during Winter Storm Fern, which hit all of Spire's service territories with extreme cold in January 2026:

"According to the American Gas Association, Winter Storm Fern led to some of the highest demand of natural gas in our nation's history. In fact, at the height of the storm, just our Spire utilities delivered natural gas equivalent to 31 gigawatts of electric generation capacity at a much lower cost to customers."

This underscores the reliability advantage of direct natural gas use for home heating — a key part of Spire's value proposition to regulators and customers.

What Drove the Beat?

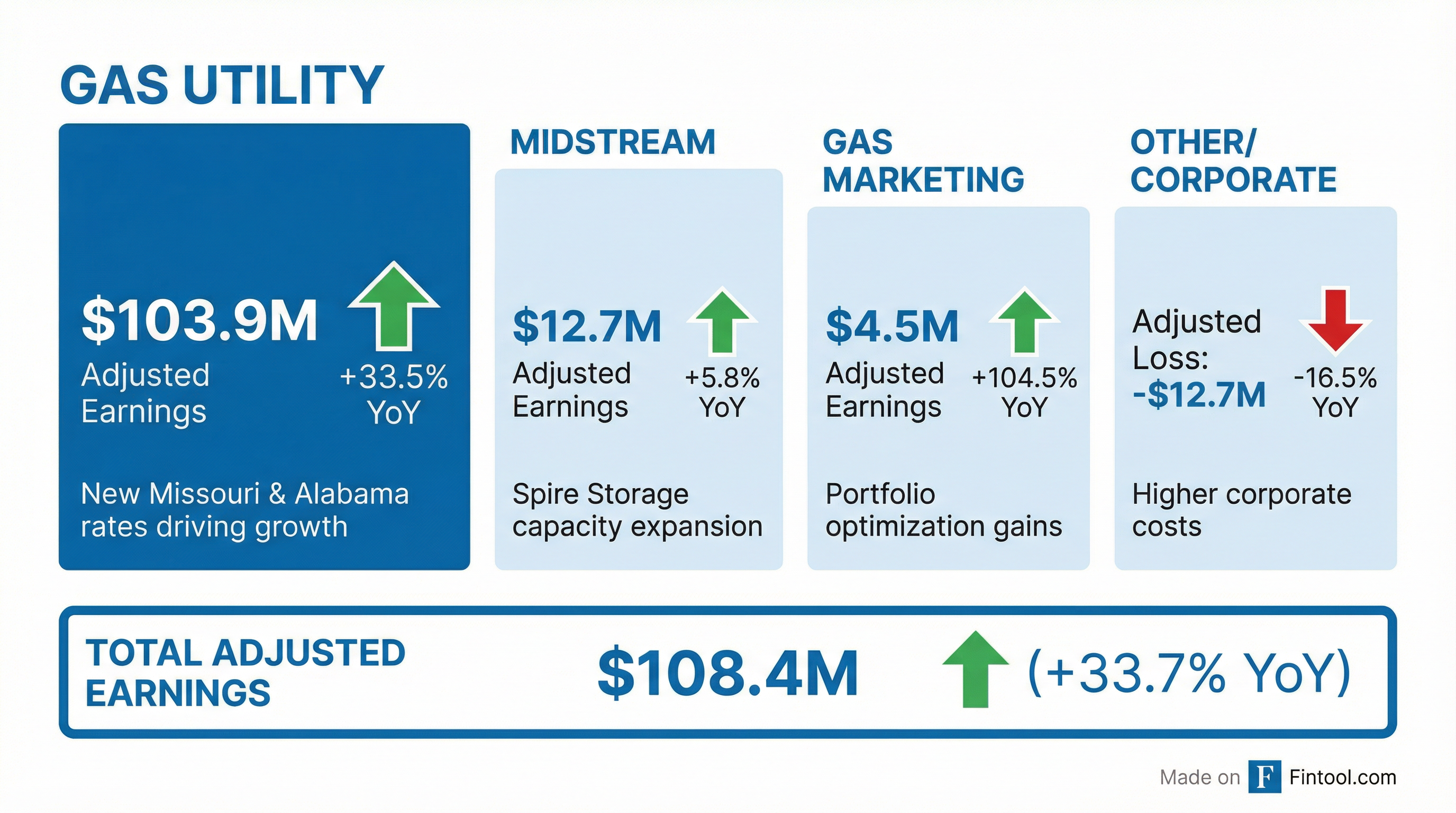

The standout performer was Gas Utility, which delivered adjusted earnings of $103.9M — up 33.5% from $77.8M in the year-ago quarter.

Segment Performance

Gas Utility — Contribution margin increased by $48.0M, primarily driven by:

- New Spire Missouri rates and Infrastructure System Replacement Surcharge (ISRS) revenues

- Higher margins at Spire Alabama under the Rate Stabilization and Equalization (RSE)

- Partially offset by lower volumetric margin in both Missouri and Alabama

Midstream — Benefited from additional capacity at Spire Storage, partially offset by higher depreciation and interest expense.

Gas Marketing — More than doubled YoY due to incremental portfolio optimization.

What Did Management Guide?

Guidance affirmed across the board:

CEO Scott Doyle's tone was confident:

"Our strong first quarter results underscore the effectiveness of our regulatory strategy and the dedication our team delivers every day. By continuing to modernize our systems, strengthen regulatory engagement and maintain disciplined cost management, we are creating meaningful value for our customers and shareholders."

What Changed From Last Quarter?

Key deltas vs. Q4 FY2025:

-

Seasonality tailwind — Q1 is Spire's strongest quarter due to heating demand. The company swung from a GAAP loss in Q4 to strong profitability.

-

Rate case benefits accelerating — New Missouri rates took full effect, driving the contribution margin improvement.

-

Acquisition financing complete — During Q1, Spire completed $900M of Junior Subordinated Notes and secured $825M of Spire Tennessee Senior Notes for the pending Piedmont Natural Gas Tennessee acquisition.

-

Preferred stock redemption planned — In January 2026, Spire issued $200M of Junior Subordinated Notes with proceeds earmarked to redeem $250M of 5.9% preferred stock, improving the capital structure.

Strategic Update: M&A and Divestitures

Two major transactions pending:

Tennessee Acquisition Details

The financing plan is fully in place:

- $900M Junior Subordinated Notes issued (November 2025)

- $825M Spire Tennessee Senior Notes secured (December 2025)

- Minimal common equity needs expected

- Bridge loan available if needed before storage proceeds

Integration timeline: Spire has 100+ employees working on the integration, supported by an 18-month transition services agreement with Duke Energy to ensure seamless continuity for customers and employees.

"This is a company, Spire, that has a long history of doing this, and has a lot of well-developed muscles regarding this. So I feel very confident in our ability to do this." — CEO Scott Doyle

Storage Sale Update

CFO Adam Woodard confirmed an announcement is expected later this quarter ahead of the Tennessee close. Key color from management:

- Strong interest in the assets from potential buyers

- Assets can be evaluated together or separately — Spire is taking time to maximize value

- Assets performed well operationally during Winter Storm Fern, meeting all customer obligations

- If storage sale isn't complete before Tennessee closes, bridge financing is available

"We've had very good interest in these assets... our desire at this time is to make sure that we're getting good value for both or each." — CEO Scott Doyle

Other Corporate Updates

- MoGas Pipeline Merger completed January 1, 2026 — the merged STL and MoGas pipelines now operate as "Spire MoGas Pipeline"

- Preferred Stock Redemption — Spire will use $200M of January 2026 Junior Subordinated Notes plus other funds to redeem all outstanding preferred stock

Q&A Highlights: What Analysts Asked

On Gas Market Volatility (Gabe Moreen, Mizuho)

Q: How was the gas marketing segment positioned during January's market volatility?

A: "It's a little early to describe them quantitatively at this time... one thing we do know, we met all of our customer obligations. The market itself performed very well both from the supply side, but even just the way the markets worked during those times."

On utility hedging, management confirmed customers were protected through Spire's in-house asset management for both Missouri and Alabama.

On Tennessee Integration Timeline (Ross Fowler, Bank of America)

Q: How do you think about the integration timeline — it never looks like a lot of work on paper but must be significant?

A: "A lot of work takes place post-close... we'll have transition services for a period of 18 months. So our job will be to work to make sure that both for employees and customers, as we transition those services and bring them under the Spire umbrella of serving them, that we do that in a way that is methodical, but also brings value to the organization."

On Missouri Rate Case Timing (Bill Appicello, UBS)

Q: Can you walk through the regulatory calendar for Missouri?

A: Filing expected October–November 2026 (after fiscal year-end but before Thanksgiving), following the same pattern as the prior case. This will be Missouri's first future test year rate case under new legislation — "a case of first impression" that will require working through details with the commission.

On Post-Close Strategic Direction (Ross Fowler, Bank of America)

Q: After Tennessee closes, how do you think about scale and potential to add more utilities?

A: "Our primary focus right now is closing the transaction and integrating Tennessee and making sure that we have a seamless transition for our customers there. And so our plate is really full right now with regard to executing on that priority."

Management emphasized the scale benefits for customers — spreading shared services costs over a larger customer base.

How Did the Stock React?

The stock's muted aftermarket reaction (+1.2%) suggests the beat was modestly positive but not surprising given the company's track record of beating in fiscal Q1 quarters (heating season). The stock has been on a steady uptrend over the past year.

Balance Sheet and Cash Flow Highlights

Long-term debt increased by ~$1.1B sequentially, reflecting the acquisition financing. The company's dividend of $0.825/share was declared, up from $0.785/share in the year-ago quarter (+5.1%).

Forward Catalysts

Key Risks to Monitor

-

Volumetric margin pressure — Lower volumetric margins in Missouri and Alabama partially offset rate increases. Warmer-than-normal winters could pressure this further.

-

Integration risk — The Tennessee acquisition adds execution complexity. Management has 18 months of transition services but must successfully integrate systems, employees, and customers.

-

Interest expense — Interest expense increased YoY due to higher long-term debt balances. With ~$1.7B of new debt issued for the acquisition, this headwind will persist.

-

Regulatory execution — Missouri's upcoming rate case will be the first future test year filing in the state — a "case of first impression" requiring commission coordination.

-

Storage sale execution — Timeline has extended beyond initial expectations. Failure to achieve target valuation could pressure financing plans.

The Bottom Line

Spire delivered a clean beat in Q1 FY2026, with the Gas Utility segment firing on all cylinders as new rate cases take effect. The +32% YoY adjusted EPS growth demonstrates the earnings power of the company's regulatory strategy. With guidance affirmed and two strategic transactions progressing, the setup for the remainder of FY2026 looks solid.

Key numbers to remember:

- Adjusted EPS: $1.77 (beat by 7.9%)

- Revenue: $762.2M (beat by 5.3%)

- FY26 guidance: $5.25–$5.45 (affirmed)

- Tennessee acquisition and storage sale on track

Conference call held February 3, 2026 at 10:00 AM CT. View SR company page | View Q1 2026 transcript