Sportradar Group (SRAD)·Q4 2024 Earnings Summary

Sportradar Q4 2024 Earnings

Executive Summary

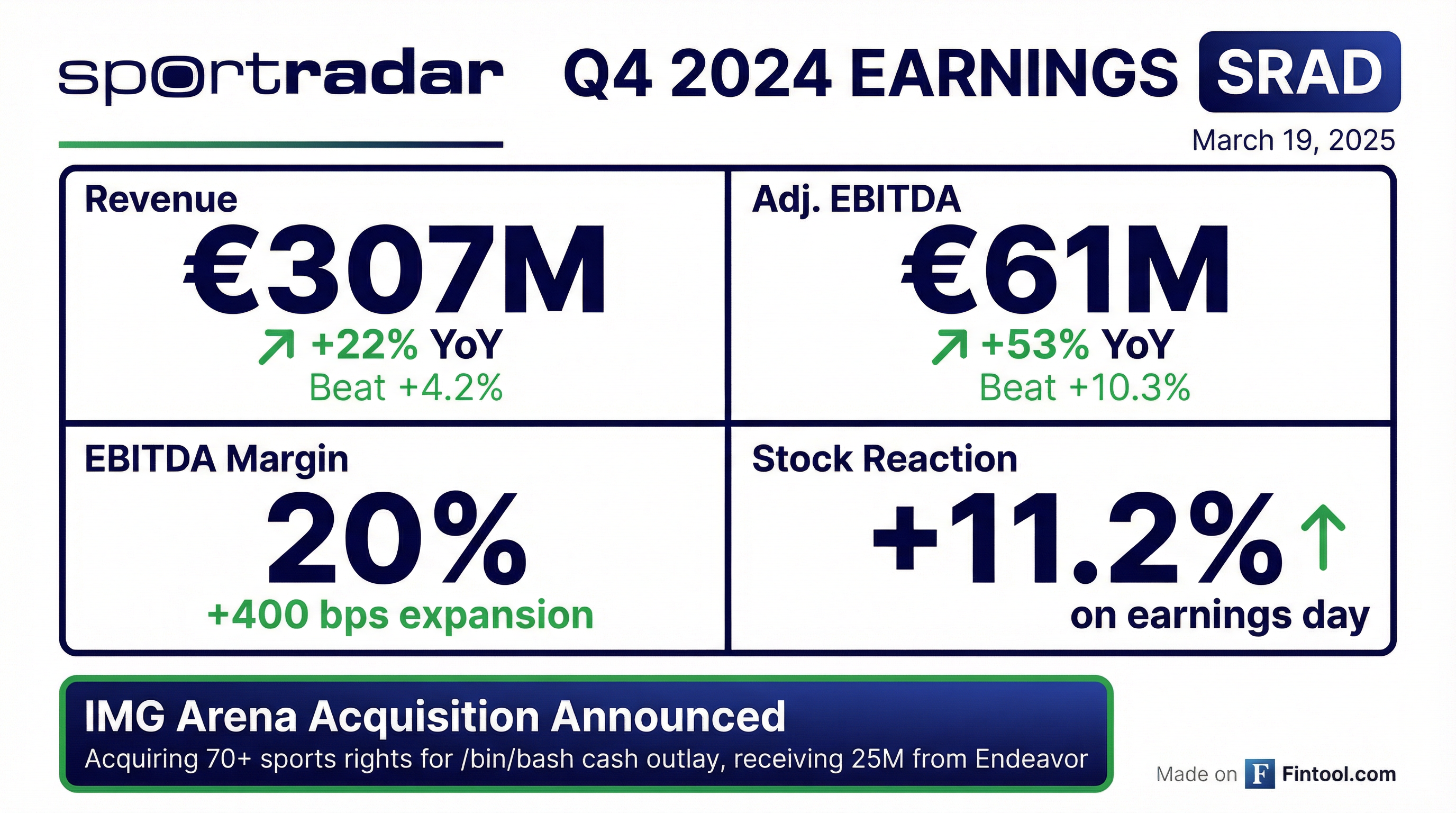

Sportradar delivered a blowout Q4 2024, capping a transformational year with record revenue, accelerating margin expansion, and a blockbuster M&A announcement. The stock surged +11.2% on earnings day as the company exceeded expectations and unveiled plans to acquire IMG Arena's sports betting rights portfolio for effectively negative consideration.

Key Highlights:

- Revenue: €307M (+22% YoY) — Beat consensus by 4.2%

- Adj. EBITDA: €61M (+53% YoY) — Beat consensus by 10.3%

- EBITDA Margin: 20% — Expanded 400 bps sequentially

- IMG Arena Deal: Acquiring 70+ sports rights, receiving $225M from Endeavor

Financial Results

Quarterly Performance

Full Year 2024 Performance

Segment Performance

Geographic Mix

Beat/Miss History

Estimates vs. Actuals — Q4 2024

Note: EPS miss driven by €65M unrealized FX losses on USD-denominated sports rights, not operational.

What Went Well

1. Margin Inflection Point Achieved

"We have clearly reached an inflection point with strong top-line growth translating into margin expansion and cash flow generation." — Craig Felenstein, CFO

The company delivered 400+ bps of EBITDA margin expansion in Q4, demonstrating operating leverage as sports rights costs normalize after the ATP and NBA deals.

2. IMG Arena Acquisition — Game-Changing Deal Structure

"If we are sitting here in one year's time, I think we will realize how great of a deal that was. It is a milestone for Sportradar." — Carsten Koerl, CEO

Deal Highlights:

- Acquiring 70+ sports rights covering 39,000 data events and 30,000 streaming events

- No cash payment to Endeavor — Instead receiving $225M ($125M cash + $100M in prepaid rights)

- 70% of rights in top 3 sports: basketball, soccer, tennis

- Includes 3 of 4 Grand Slam tennis tournaments (Wimbledon, US Open, Roland Garros)

- Expected to close Q4 2025 pending UK regulatory approval

3. U.S. Revenue Acceleration

U.S. revenues grew 58% YoY and now represent 24% of total revenue (up 500 bps vs. prior year) . Q4 U.S. growth was 41% .

4. MTS Trading Excellence

Managed Trading Services (MTS) reached €35B turnover with 10.7% margin (vs. 9.8% in 2023) . This AI-driven trading platform now serves 250+ sportsbooks across 500+ brands .

5. Brazil Expansion

- Opened São Paulo office

- Signed 35 new MTS clients

- Launched iGaming pilot with 360-degree solution

- Signed integrity partnership with Brazilian Soccer Confederation

What Went Wrong

1. Q4 Net Loss Due to FX

The €1M net loss was driven by €65M unrealized currency losses on USD-denominated sports rights . This is non-cash and timing-related.

2. Taiwan Lottery Lapping Effect

Managed Betting Services was down slightly YoY due to lapping one-time setup fees from the Taiwan Lottery hardware deployment in Q4 2023 . Excluding this, MTS growth was in the high 20% range .

3. Cash Balance Declined

Cash declined €20M QoQ to €348M due to the XLMedia acquisition and timing of sports rights payments .

2025 Guidance

Important: Guidance excludes IMG Arena contribution. With IMG Arena included, management estimated revenue growth would be in the high 20% range .

Quarterly Cadence

"Margins will be in the high teens in the first half of the year and will accelerate in the second half of the year, with the highest margins in the third quarter." — Craig Felenstein, CFO

Management Commentary Highlights

On IMG Arena Strategic Value

"Looking to the strategic, we scale and we are the premium provider for the B2B sports. That makes us even stronger... We have 800 bookmakers. We have 900 media companies connected to this machine, and this is a well-oiled machine." — Carsten Koerl, CEO

On Margin Expansion Path

"Looking now to our rights going forward for the next six years, this is pretty much fixed... There is not any kind of uncertainty on the sport rights. Having those two elements, that gives us a lot of comfort to show margin leverage in the years going forward." — Carsten Koerl, CEO

On Capital Allocation

"We anticipate significantly accelerating repurchases under our buyback program when our trading window opens." — Craig Felenstein, CFO

Q&A Highlights

IMG Arena Deal Structure

Q: What's included in the acquisition?

A: Craig Felenstein explained they're acquiring the assets and liabilities of IMG Arena, primarily the sports rights. Significant operational synergies expected from technology, scanning, and overhead consolidation.

Revenue Synergies from IMG

Q: Do your revenue estimates include cross-selling?

A: The ~€150M revenue estimate (bringing growth to high 20s) does not include cross-selling and upselling opportunities. Additional upside possible from leveraging Sportradar's broader distribution.

2025 Growth Deceleration

Q: Why is 2025 growth (15%) lower than Q4 2024 (22%)?

A: Craig Felenstein noted 2024 included the ATP and NBA step-ups which won't repeat. 2025 growth is built on market growth (~10% globally) plus Sportradar's continued outperformance through wallet share expansion and in-play betting growth.

Stock Performance

Management Tone Evolution

Q3 2024 (November 2024): Management emphasized being at an "inflection point" for margin expansion and raised guidance twice. Optimistic about MLB deal renewal.

Q4 2024 (March 2025): Tone shifted from "inflection point" to delivered results — 400 bps margin expansion achieved. Announcement of transformational IMG Arena acquisition with exceptional deal structure demonstrated confidence in capital allocation. CEO Koerl called it "a milestone for Sportradar."

Key Takeaways

- Margin expansion delivered — 400 bps in Q4, proving operating leverage thesis

- IMG Arena is a coup — Receiving $225M to acquire premium sports rights portfolio

- U.S. momentum continues — 58% FY growth, now 24% of revenue

- Rights portfolio locked — 6-year average duration on major contracts

- Brazil opportunity emerging — 35 MTS clients, iGaming pilot launched

- Buybacks accelerating — $200M program, shares viewed as undervalued

- 2025 guidance conservative — Excludes IMG Arena, management sees high-20s growth

Links

- Company: /app/research/companies/SRAD

- Transcript: /app/research/companies/SRAD/documents/transcripts/Q4-2024

- Prior Earnings: /app/research/companies/SRAD/earnings/Q3-2024