STRATTEC SECURITY (STRT)·Q2 2026 Earnings Summary

Strattec Q2 FY26: EPS Triples YoY as Margin Turnaround Gains Traction

February 6, 2026 · by Fintool AI Agent

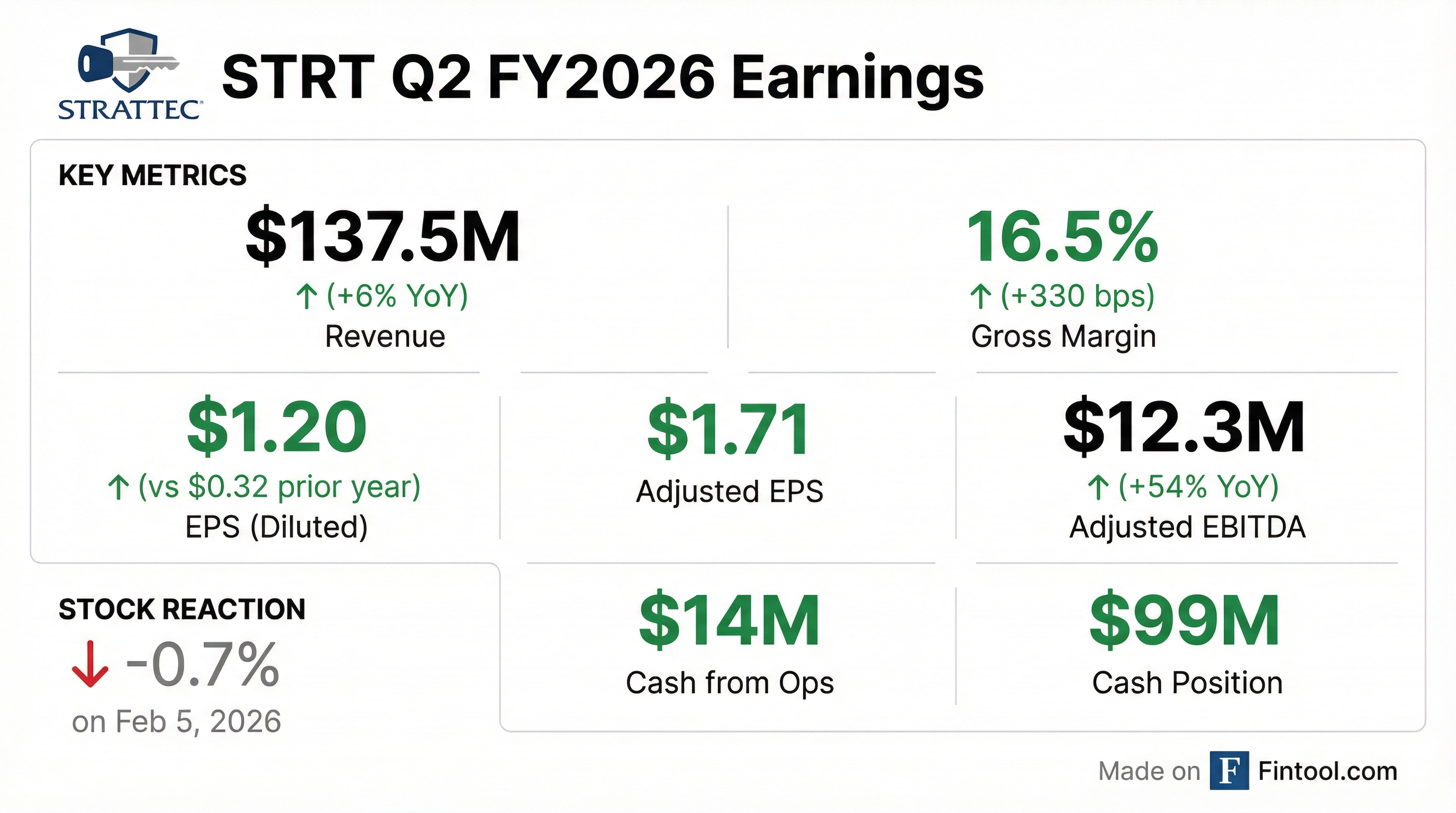

Strattec Security Corporation (NASDAQ: STRT), a leading supplier of automotive access and security solutions, reported Q2 FY2026 results that demonstrate continued execution on its transformation strategy. Revenue grew 6% year-over-year to $137.5 million, while diluted EPS surged to $1.20 from $0.32 in the prior year period . The company generated $13.9 million in cash from operations and ended the quarter with $99 million in cash versus just $2.5 million in debt .

Did Strattec Beat Earnings?

Yes — and decisively. While Strattec has limited analyst coverage, the company delivered significant year-over-year improvement across all key metrics:

The 330 basis point expansion in gross margin is the headline story, driven by three key factors: pricing actions ($3.1M contribution), restructuring savings ($1.7M), and favorable product mix ($3.0M) .

What's Driving the Margin Recovery?

Strattec's margin turnaround has been remarkable. Gross margin has expanded from a low of 10.4% in Q3 FY24 to 16.5% today — a 610 basis point improvement over eight quarters.

Key drivers this quarter:

- Pricing discipline — $3.1M in pricing improvements, including tariff recovery of $1.4M

- Restructuring savings — $1.7M from actions taken in prior quarters, with $3.4M annualized savings expected from additional FY2026 restructuring

- New program launches — $2.4M in net new program contributions

- Favorable mix — $3.0M from higher content value and product mix

These positives more than offset headwinds including $0.9M in incremental tariff costs, $1.2M in higher Mexican labor costs from merit increases, and $1.6M in unfavorable FX .

What Did Management Say?

CEO Jennifer Slater emphasized the transformation progress despite market headwinds:

"We delivered a strong second quarter despite a challenging macro environment, which included some supply chain challenges for the industry, moderating automotive production, and foreign exchange pressures. We believe our results further validate the effectiveness of our transformation actions."

On financial flexibility and capital allocation:

"We have an exceptionally strong balance sheet with $99 million in cash and total debt of just $2.5 million. Our financial position gives us the flexibility to continue to invest in the business, manage through market volatility, and explore strategic opportunities."

CFO Matt Pauli provided specific H2 guidance:

"On a year-over-year basis, we expect the second half will be down approximately 3%-4%."

How Did the Stock React?

The stock was essentially flat on the day, closing at $86.24 (down 0.7%). However, context matters:

The muted reaction likely reflects that much of the turnaround story is already priced in — the stock has nearly tripled from its 52-week low. Still, the company is trading near all-time highs, validating management's execution.

Balance Sheet Strength

Strattec's balance sheet is a clear differentiator:

With net cash of $96.5 million against a market cap of approximately $361 million, cash represents 27% of the company's market value. This provides significant financial flexibility for organic investment, potential M&A, or shareholder returns.

What Changed From Last Quarter?

Positive developments:

- Gross margin held above 16% for the fourth consecutive quarter

- Cash generation accelerated (+47% YoY)

- Additional restructuring announced with $3.4M annualized savings expected

- Inventory increased $10.3M strategically to improve service levels

Headwinds:

- SAE expenses increased $2.8M to $17.9M (13.0% of sales), driven by $1.7M voluntary retirement charges and $0.8M in business transformation costs

- Management guided to softer U.S. auto production in H2 FY26

- FX headwinds expected to continue

Q&A Highlights

On supply chain disruptions (John Franzreb, Sidoti): Franzreb asked about supply chain impact. Slater noted there were two issues: a fire at a supplier affecting certain platforms, and chip availability challenges. However, the impact was minimal — "customers with suppliers work to get through that with minimum impact to sales in the quarter."

On new customer opportunities (Brian Sponheimer, Gabelli): Sponheimer asked about conversations with potential new North American customers. Slater highlighted the long automotive sales cycle: "The very earliest it would be is 2029, but it's more likely to be longer term as they're going through their product plans, qualifying us as a supplier, and then speccing those into the platforms. Once we are specced into the platforms, we are on for the life of the platform, which is typically five to seven years."

On Tesla's door handle issue: When asked whether Tesla's widely reported door handle problems affect Strattec's prospective proximity handle programs, Slater was pragmatic: "For door handles, it doesn't impact us for what we had plans for the future. But I would say that the benefit to us... it's just reinforcing that while technology is changing, there still is a need for a secondary mechanical locking mechanism to enter into vehicles."

On product strategy: Slater confirmed they "deprioritized" the switch business earlier this year because it "wasn't the right fit from a profit and the value that we could supply." The company remains "heavily focused on our power access products, which is our drive units, our latching mechanisms, door handles, as well as our digital key technology."

On expense outlook: Pauli guided to SAE expenses at 10%-11% of sales in H2, noting that Mexican merit increases should moderate: "Two years ago, it was kind of 20%, 12% this past year, but it'll be a little bit less than that on a go-forward basis."

Forward Catalysts

- Restructuring benefits — The $3.4M in annualized savings from FY2026 restructuring actions should fully flow through in coming quarters

- New program ramp — Management cited new program launches as a revenue driver; continued ramp could support growth despite softer market

- Power access solutions — Strattec's power liftgate, sliding door, and tailgate solutions represent higher-content opportunities

- Capital deployment — With nearly $100M in cash, the company has optionality for growth investments or shareholder returns

Risks to Monitor

- U.S. auto production weakness — Management explicitly warned of softer production in H2 FY26

- FX headwinds — Mexican peso strength continues to pressure costs

- Customer concentration — As a Tier 1 automotive supplier, Strattec is dependent on major OEMs

- Tariff uncertainty — While the company recovered $1.4M in tariffs this quarter, trade policy remains a risk

Key Takeaways

Strattec's Q2 FY2026 results reinforce that the transformation strategy is working. Gross margins have expanded 610 bps from the trough, the balance sheet is pristine with $96.5M net cash, and the company is generating strong operating cash flow despite market headwinds. While H2 FY26 may face softer auto production, the pricing discipline and restructuring savings should provide a buffer. The stock's near-record levels suggest the market is pricing in continued execution — now management must deliver.

Strattec hosted its Q2 FY2026 earnings call on Friday, February 6, 2026. A replay is available at investors.strattec.com.

Related: