Triumph Financial (TFIN)·Q4 2025 Earnings Summary

Triumph Financial Q4 2025: EPS Surges to $0.77 on Asset Sales, Network Momentum Continues

January 26, 2026 · by Fintool AI Agent

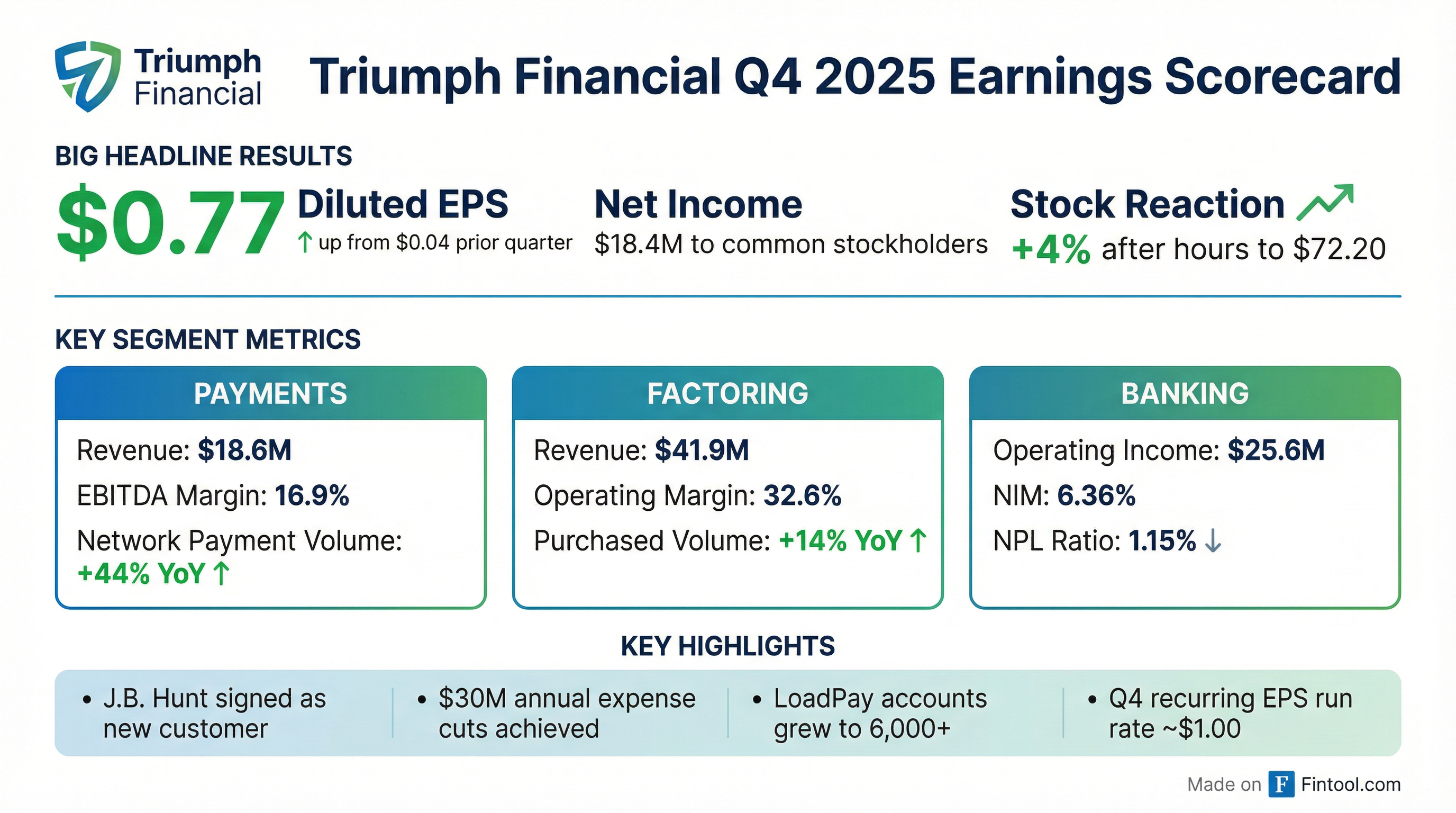

Triumph Financial delivered a standout Q4 2025, reporting diluted EPS of $0.77—up dramatically from $0.04 in Q3—driven by $14.3 million in asset sale gains and continued network expansion . The transportation-focused fintech and bank signed J.B. Hunt as a marquee customer, grew LoadPay to 6,000+ accounts, and achieved $30 million in annualized expense savings . Shares rose ~4% after hours to $72.20 as investors embraced CEO Aaron Graft's outlook for "recurring annualized exit earnings run rate of approximately $1.00 per share" .

Did Triumph Financial Beat Earnings?

EPS: Beat by 122% | Revenue: Slight Miss

Triumph crushed normalized EPS estimates while modestly missing on revenue:

*Values retrieved from S&P Global

The GAAP EPS of $0.77 includes significant one-time items that boosted results :

- Asset sale gains: $14.3 million from selling a Dallas building purchased in 2024 and an aircraft acquired during COVID

- Credit loss benefit: Net benefit of $1.8 million, including a $9.5 million recovery on a non-performing equipment loan

Partially offsetting were $3.9 million in charge-offs from troubled liquid credit loans and various reserves .

What Did Management Guide?

CEO Aaron Graft provided unusually detailed forward guidance, framing 2026 targets as "goals" rather than formal guidance:

Key Quote from CEO Aaron Graft:

"Our goal remains to deliver approximately 20% transportation revenue growth while maintaining expense discipline consistent with that $96.5 million quarterly run-rate target exiting 4Q 2026... Achieving 20% organic growth at our size is an ambitious target–especially while holding expenses flat–but that is the goal and the plan."

The CEO also provided near-term visibility: Q1 Payments revenue growth expected to exceed 5% with EBITDA margin (ex-LoadPay) exceeding 30% based on contractual agreements .

How Did the Stock React?

TFIN shares closed at $70.56 on January 26, 2026, up 2.1% during regular trading, then jumped another ~2.3% after hours to $72.20 following the earnings release. The stock is trading near its 52-week high of $79.86 and well above its 200-day moving average of $57.78.

The positive reaction reflects investor enthusiasm for the earnings trajectory and network momentum despite mixed headline numbers.

What Changed From Last Quarter?

Significant Improvement in Profitability

Q4 2025 marked a dramatic turnaround from the challenging Q3 2025 results:

Key changes driving the improvement:

- Asset monetization: Building and aircraft sales generated $14.3M in gains plus $6M in annual operating expense savings

- Credit recovery: $9.5M recovery on non-performing equipment loan

- Expense discipline: $30M cumulative annual expense reduction achieved

How Is the Network Growing?

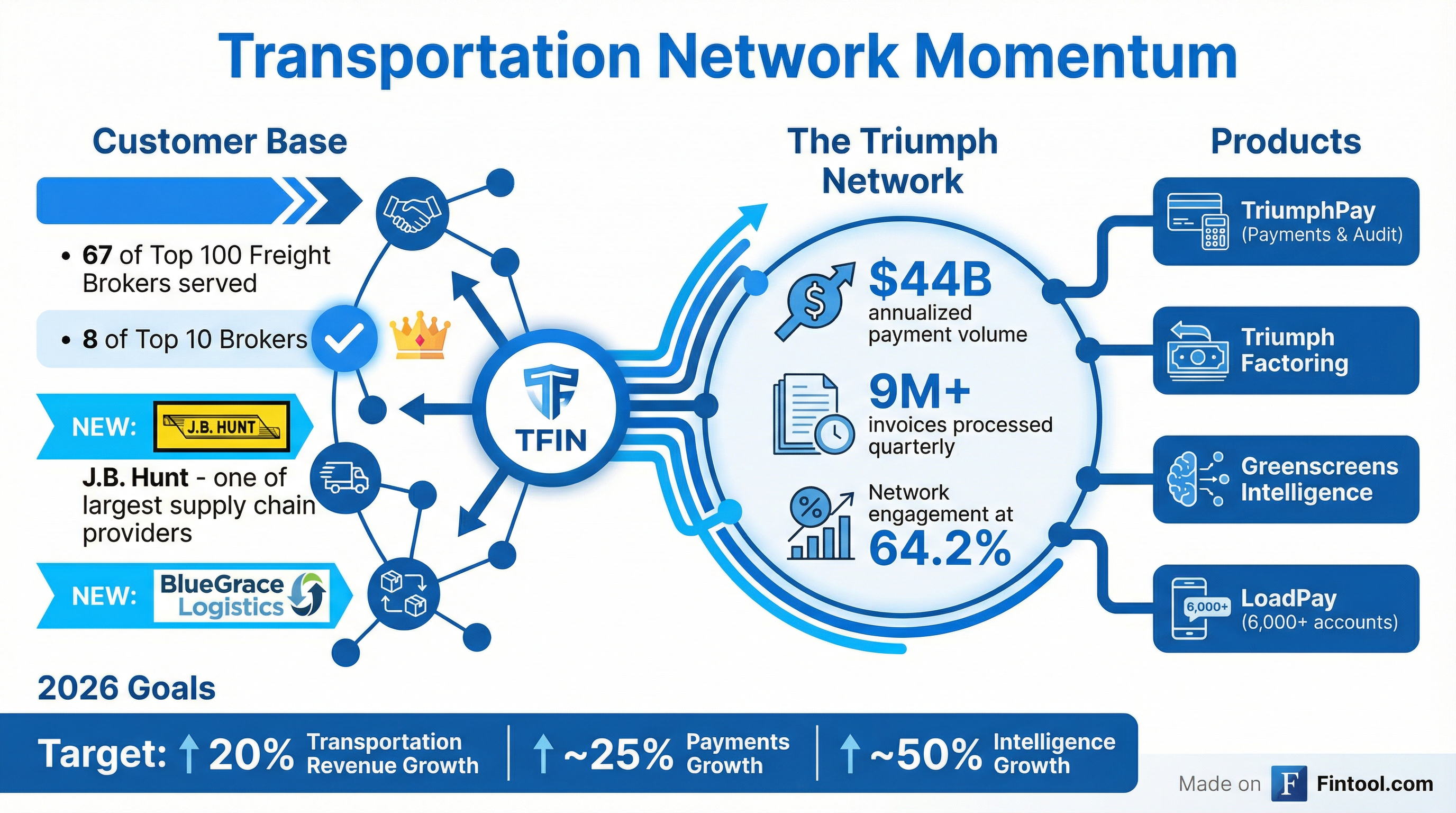

The Triumph Network continues expanding, with two significant customer wins:

New Marquee Customers:

- J.B. Hunt: One of the largest supply chain solutions providers in North America

- BlueGrace Logistics: Added since last earnings release

Network Coverage:

- Now serves 67 of top 100 freight brokers

- Serves 8 of top 10 freight brokers

- 60-70 network factors actively using the platform

Factor Adoption Strategy: When asked if large factors will face pressure to join the network, CEO Graft took a "carrot not stick" approach: "I don't think you build the best business models doing anything with a stick... We have a value proposition we've offered to shippers, brokers, carriers, and other factors" . Management acknowledged the network evolved differently than expected—largest factors consume it differently than originally envisioned, but long-term prospects remain "at least as rosy" as anticipated .

Network Metrics (Q4 2025):

Segment Performance Breakdown

Payments

Revenue grew 0.7% sequentially to $18.6 million annualized, with EBITDA margin improving to 16.9% . Ex-LoadPay, EBITDA margin reached 29.5% .

Monetization Progress: The percentage of invoices for which Triumph charges a fee increased from 31% in Q3 to 35% in Q4, reaching 38% in December . With more contracts taking effect January 1, management expects "significant increases in the first quarter" .

Cross-Sell Opportunity: Only 22% of customers currently use both payments AND audit within TPay, highlighting significant room for deeper penetration .

LoadPay Growth:

- Accounts: 5,892 (up 33% q/q), surpassed 6,000 post-quarter

- 2026 Target: Open 7,000-12,000 new accounts

- Funding Volume: $84.8M (up 60% q/q)

- Revenue Run Rate: $1.5M annualized

- Revenue Per Linked Account: ~$600-750 annually; top 10 accounts tracking to $5,000+/year

Management expects to triple LoadPay revenue in 2026, driven by both account growth and improving "linked and funded" percentages .

Strategic Context: CEO Graft framed LoadPay's current earnings drag in historical context: "LoadPay is once again a drag on earnings, right? Just like back in the day, core payments was a drag on earnings. But LoadPay over the long term and all that connectivity and the source and the type of revenue is really exciting" .

Factoring

Pretax operating income of $13.7 million with 32.6% operating margin . Key metrics:

Long-Term Margin Target: CEO Graft stated the core operating margin in factoring will "eventually be over 40%" . The Q4 improvement came from "getting more efficient" rather than just invoice size growth, with efforts ongoing .

Factoring as a Service (FaaS): Despite 136% Q4 growth, FaaS contribution to 2026 Load team revenue is "immaterial" per CEO Graft: "It is growing way faster than everything else, but you're talking about growth off of a very low revenue base" . The 2026 guidance assumes organic growth through widening customer base and deeper penetration.

AI-Driven Efficiency: 60%+ of owner-operator invoices are now instantly verified by AI, with 20%+ proceeding through purchase and funding without human intervention . Average approval time: 12 seconds .

Banking

Operating income decreased 5.6% to $25.6 million, impacted by lower interest rates and one-time items .

Strategic Shift: Triumph is winding down ABL and liquid credit portfolios to reduce earnings volatility and focus on transportation . Management candidly admitted the ABL business "did expect to have strategic benefit to transportation" but "in practice, that hasn't really played out" and left the company with non-transportation-related exposure .

Credit Quality Improving:

Intelligence (Greenscreens)

Revenue of $2.3 million with 88% gross margin . The segment contracted over $1 million of additional annualized revenue in Q4, with Q4 bookings already showing up in Q1 numbers (generally 30 days from booking to billing) .

TFX vs Cross-Sell: While Trusted Freight Exchange (TFX) is expected to contribute to 2026 growth, management emphasized the larger opportunity is cross-selling to existing customers: "Only 14% of our current audit and payment customers are also using our intelligence solution. So that's really where we see the largest opportunity" .

Freight Market Commentary

Management provided detailed freight market analysis, noting:

December Anomaly: Unusually strong December with van and reefer rates up 5-10% YoY, driven by CDL enforcement uncertainty and seasonal factors .

Broker Margin Compression: Median broker gross margins fell to multi-year lows, with margins well below $200 per load across all transport types .

Cautious Outlook: Despite December strength, CEO Graft noted it's "too early to call" a market recovery: "A great reset in trucking markets may be right in front of us, but because of ongoing and unknown policy changes ahead, it is too early to call" .

2026 Guidance Assumptions: For projections, management "assumed the market stayed as it finished Q4" with no freight recovery baked in. CEO Graft cautioned that Q1 will see seasonal decline: "In Q1, you will see, I very much expect you will see a decline over where we ended the year because of normal seasonality in our business" .

Positive for carriers: Spot rates have steadily climbed since September while diesel prices fell. Diesel as percentage of all-in rates declined from 30.4% to 26.2% .

The Role of AI

Triumph highlighted AI as a "durable source of operating leverage" :

- Document processing: AI-powered audit platforms

- Instant decisioning: Automated invoice purchases (12-second approval)

- Lane rate prediction: Greenscreens Intelligence integration

- Customer service: Improved response times with cost savings

- Result: Invoice volume up 29% since June 2024 while headcount decreased 25%

New AI models will enhance customer offerings and streamline internal operations throughout 2026 .

Key Risks and Concerns

- Freight Market Uncertainty: Extended trucking recession and unknown policy impacts from tariffs and CDL enforcement

- Interest Rate Sensitivity: Banking segment faces headwinds in falling rate environment

- Execution Risk: 20% revenue growth target is "ambitious" per CEO

- Portfolio Wind-Down: ABL and liquid credit exit may create near-term earnings drag

- Tricolor Exposure: Monitoring bankruptcy proceedings on ABL exposure

Forward Catalysts

- Q1 2026 Earnings: Test of 5%+ Payments revenue growth and 30%+ EBITDA margin guidance

- J.B. Hunt Ramp: Contribution from marquee customer throughout 2026

- LoadPay Monetization: Target to triple revenue from $1.5M run rate

- Freight Market Inflection: Potential industry recovery could accelerate volume growth

- Intelligence Cross-Sell: Expanding from 14% penetration among existing customers

- FaaS Growth: Factoring-as-a-Service volume grew 136% in Q4

Bottom Line

Triumph Financial's Q4 2025 results showcase a company at an inflection point. While one-time gains inflated the headline EPS, the underlying business fundamentals improved meaningfully: network engagement at all-time highs, LoadPay scaling rapidly, AI-driven efficiency gains taking hold, and major customer wins with J.B. Hunt and BlueGrace.

The question for 2026 is whether management can deliver on the ambitious 20% transportation revenue growth target while maintaining expense discipline. With 67 of the top 100 freight brokers now on the platform and a recurring EPS run rate that CEO Graft estimates at ~$1.00, the pieces are in place for sustained earnings growth—assuming the freight market cooperates.

Updated January 27, 2026 with Q&A highlights from the earnings call.

Related Links: