Tenon Medical (TNON)·Q4 2025 Earnings Summary

Tenon Medical Posts 90% Revenue Surge in Q4 2025, Beats Consensus

February 6, 2026 · by Fintool AI Agent

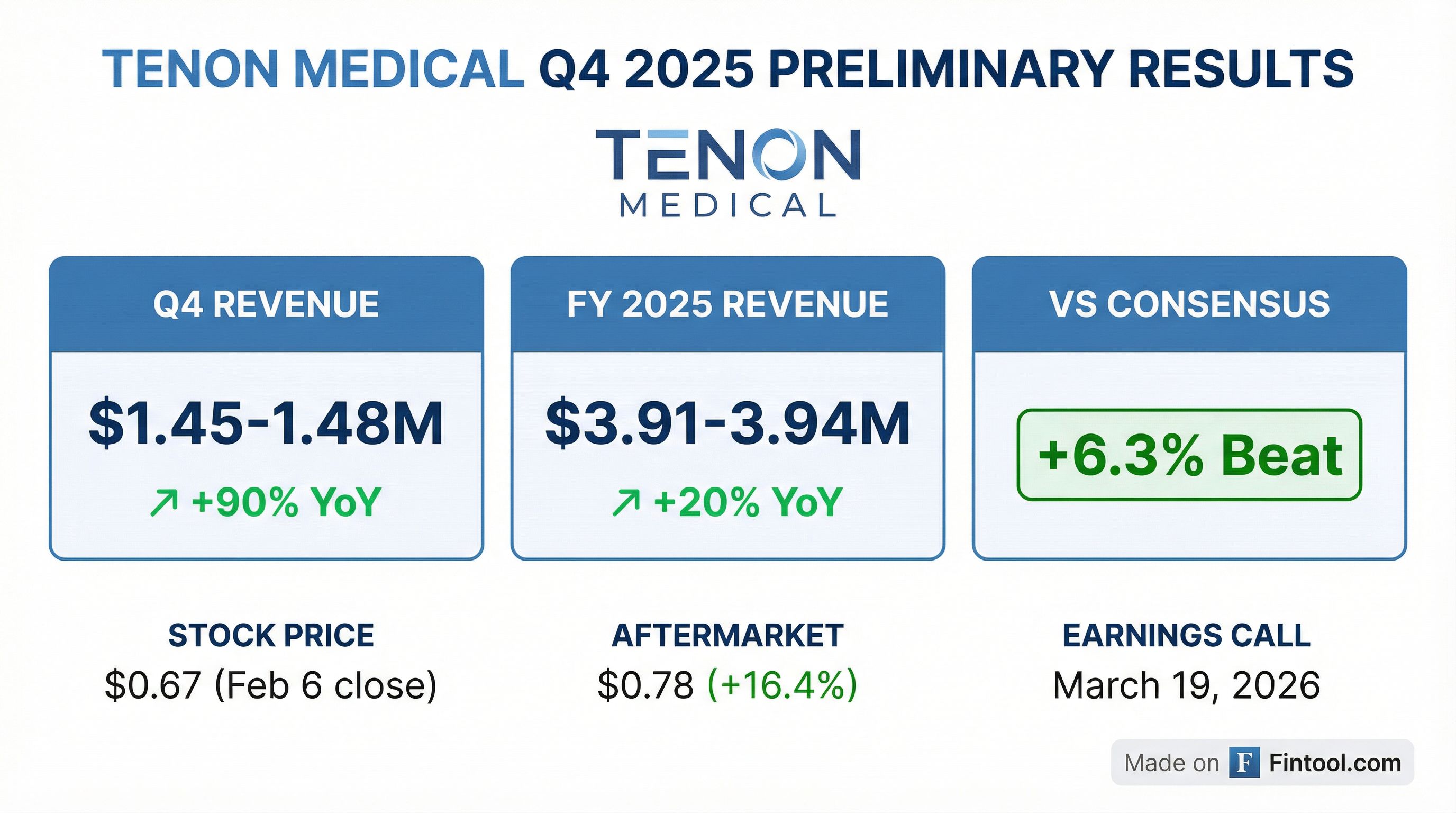

Tenon Medical (NASDAQ: TNON), a medical device company specializing in sacro-pelvic disorder treatments, announced preliminary Q4 2025 revenue of $1.45-1.48 million, representing approximately 90% year-over-year growth and beating the consensus estimate of $1.38 million by roughly 6.3% . The company also reaffirmed full-year 2025 revenue of $3.91-3.94 million, up approximately 20% from FY 2024. This is a preliminary announcement; full financial results will be released on March 19, 2026.

Did Tenon Medical Beat Earnings?

Revenue Beat: Tenon Medical's preliminary Q4 2025 revenue of $1.45-1.48M (midpoint: $1.465M) exceeded the consensus estimate of $1.38M by approximately 6.3% .

*Values retrieved from S&P Global

EPS: The company did not disclose preliminary EPS figures. Full earnings details will be provided on March 19, 2026 .

What Changed From Last Quarter?

Q4 2025 marked a significant acceleration in Tenon Medical's revenue trajectory:

Key observations:

- Q4 2025 represents the second consecutive quarter of strong growth following a difficult Q2 2025

- Revenue more than doubled from the Q2 2025 trough of $0.56M

- The 90% YoY growth rate is the highest in the company's recent history

What Is Tenon Medical's Cash Position?

As a pre-profit medical device company, cash runway is a critical metric. Based on the most recent Q3 2025 filing:

*Values retrieved from S&P Global

Cash declined from $7.85M in Q2 2025 to $3.44M in Q3 2025, reflecting continued operating losses despite revenue growth. The company's cash burn rate of ~$3-4M per quarter suggests limited runway without additional financing.

How Did the Stock React?

Despite the positive preliminary results, TNON shares traded lower following the announcement:

The muted initial reaction may reflect:

- The preliminary nature of the announcement (full financials pending)

- Ongoing concerns about cash burn and dilution risk

- The stock's significant decline over the past year (~82% from 52-week high)

The aftermarket move to $0.78 suggests some investors are positioning ahead of the full earnings release.

What Are the Key Revenue Drivers?

Tenon Medical's Catamaran SI Joint Fusion System is the company's primary commercial product, targeting three market opportunities :

- Primary SI Joint Procedures - First-line treatment for sacroiliac joint dysfunction

- Revision Procedures - Repair of failed SI joint implants from other manufacturers

- Spinal Fusion Augmentation - Complementary procedure with lumbar fusion surgeries

The company launched the Catamaran system nationally in October 2022 and has been focused on building surgeon adoption and expanding its commercial footprint.

What to Watch at the Full Earnings Call

The March 19, 2026 earnings call will be critical for understanding :

- Full financials - Gross margins, operating expenses, and cash flow details

- Cash runway - Any updates on financing plans or cash preservation measures

- Procedure volume - Underlying case volume driving the revenue growth

- Commercial expansion - Updates on surgeon recruitment and territory coverage

- 2026 outlook - Whether management provides formal guidance

Earnings Call Details:

- Date: Thursday, March 19, 2026

- Time: 4:30 PM Eastern Time

- Dial-in: 1-877-407-0792 (US) / 1-201-689-8263 (International)

Investment Considerations

Bull Case:

- Strong revenue momentum with 90% YoY growth suggests commercial traction

- Differentiated technology in a growing SI joint market

- Revenue acceleration from Q2 2025 trough demonstrates product-market fit

Bear Case:

- Significant cash burn (~$3-4M/quarter) with only $3.4M cash as of Q3 2025

- Micro-cap status ($5.8M market cap) limits institutional interest

- Stock down ~82% from 52-week high signals market skepticism

- Dilution risk if equity financing is needed

This analysis covers Tenon Medical's preliminary Q4 2025 revenue announcement. Full financial results will be available after March 19, 2026.

Related Links: