Tonix Pharmaceuticals Holding (TNXP)·Q4 2025 Earnings Summary

Tonix Pharmaceuticals Posts 30% Revenue Growth as TONMYA Launch Generates $1.4M in First Six Weeks

February 3, 2026 · by Fintool AI Agent

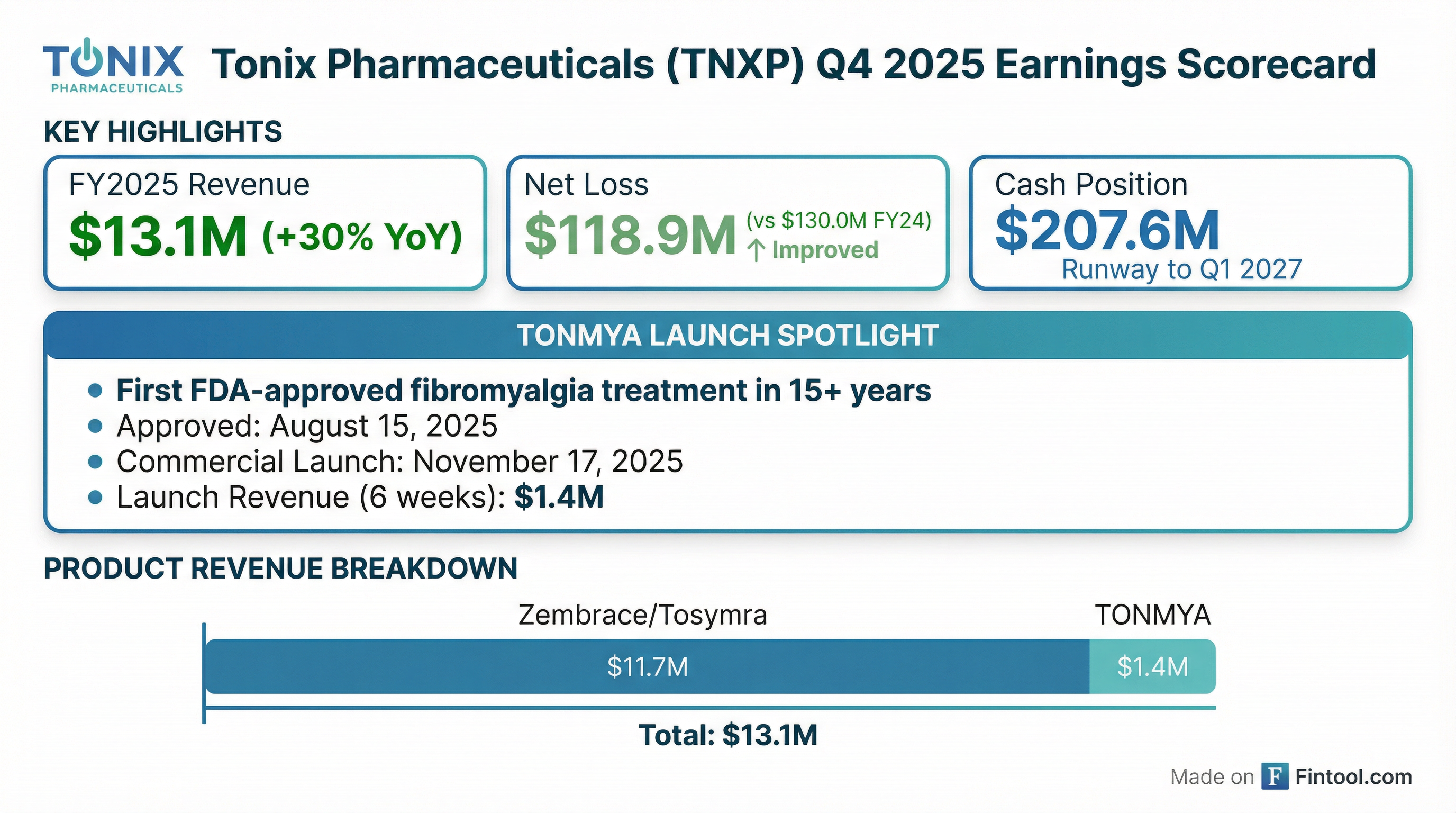

Tonix Pharmaceuticals (NASDAQ: TNXP) released preliminary Q4 and full-year 2025 results today, highlighting a milestone year that saw the launch of TONMYA—the first FDA-approved treatment for fibromyalgia in more than 15 years. The stock traded essentially flat at $17.21, down 0.17%, as investors digested the early commercial metrics.

Did Tonix Beat Expectations?

Tonix reported preliminary FY2025 revenue of approximately $13.1 million, a 30% increase from $10.1 million in FY2024. Given limited analyst coverage on this small-cap biotech (~$220M market cap), direct consensus comparisons are difficult—but the trajectory is clearly positive.

The improvement in net loss ($130.0M → $118.9M) despite significantly higher SG&A spending for the TONMYA launch suggests operating leverage is beginning to emerge as revenue scales.

How Is the TONMYA Launch Progressing?

The headline number: TONMYA generated $1.4 million in net revenue in just six weeks (November 17 – December 31, 2025).

This is a meaningful early signal for several reasons:

- First-mover advantage: TONMYA is the first FDA-approved fibromyalgia therapy in over 15 years, addressing an estimated 10 million adults in the U.S.

- Commercial infrastructure in place: 90 sales representatives were deployed ahead of the launch , with contracts established across wholesalers and specialty pharmacies

- Non-opioid positioning: As a centrally acting, non-opioid analgesic taken once daily at bedtime, TONMYA fills a clear unmet need

For context, Tosymra also secured preferred exclusive placement on a payer formulary covering approximately 16 million lives effective January 1, 2026.

What Changed From Last Quarter?

Q3 2025 vs. Q4 2025 Preliminary:

*Q4 implied by subtracting Q1-Q3 from FY2025 total ($13.1M - $7.7M)

The sequential jump in implied Q4 revenue (~64% Q/Q) reflects TONMYA contributions. The cash build (+$17.5M) came despite higher operating expenses, supported by Q4 equity offerings that raised $34.7 million in net proceeds.

How Did the Stock React?

TNXP traded essentially flat at $17.21, down just 0.17% on the day. The muted reaction suggests the preliminary results were largely in-line with investor expectations, with the TONMYA launch metrics providing validation rather than upside surprise.

The stock has recovered significantly from its 52-week low of $6.76 but remains well below its high of $69.97, reflecting the inherent volatility in small-cap biotech investing.

What Is the Cash Runway?

Tonix ended 2025 with $207.6 million in cash and cash equivalents, with management stating that current resources will fund operations into the first quarter of 2027.

The increase in operating cash burn ($60.9M → $99.0M) reflects the substantial investment in TONMYA commercialization, including:

- 90 sales representatives fielded ahead of launch

- Market access and patient access infrastructure

- Brand awareness and launch preparation

What's in the Pipeline?

Beyond TONMYA, Tonix has several programs advancing:

The TNX-102 SL program leverages the same cyclobenzaprine sublingual tablet formulation as TONMYA, potentially creating manufacturing and regulatory synergies.

Forward Catalysts

- TONMYA ramp trajectory: Q1 2026 will provide the first full quarter of TONMYA sales, giving investors a clearer read on commercial uptake

- 10-K filing: Full audited financials expected around March 16, 2026

- TNX-102 SL for MDD: Phase 2 initiation expected mid-2026

- Tosymra formulary expansion: New preferred placement on 16M lives effective January 2026

Key Takeaways

- Revenue growth accelerating: FY2025 revenue +30% YoY to $13.1M, driven by TONMYA launch

- TONMYA early signal positive: $1.4M in 6 weeks represents meaningful traction for first fibromyalgia drug in 15+ years

- Cash position strong: $207.6M provides runway into Q1 2027

- Net loss improving: Despite launch investment, loss narrowed from $130M to $119M

- Stock flat: Results appear in-line with expectations; execution matters from here

Note: These are preliminary, unaudited results. Final figures in the 10-K (expected ~March 16, 2026) may differ materially.