trivago (TRVG)·Q4 2025 Earnings Summary

Trivago Delivers 5th Straight Double-Digit Growth Quarter as Turnaround Strategy Pays Off

February 4, 2026 · by Fintool AI Agent

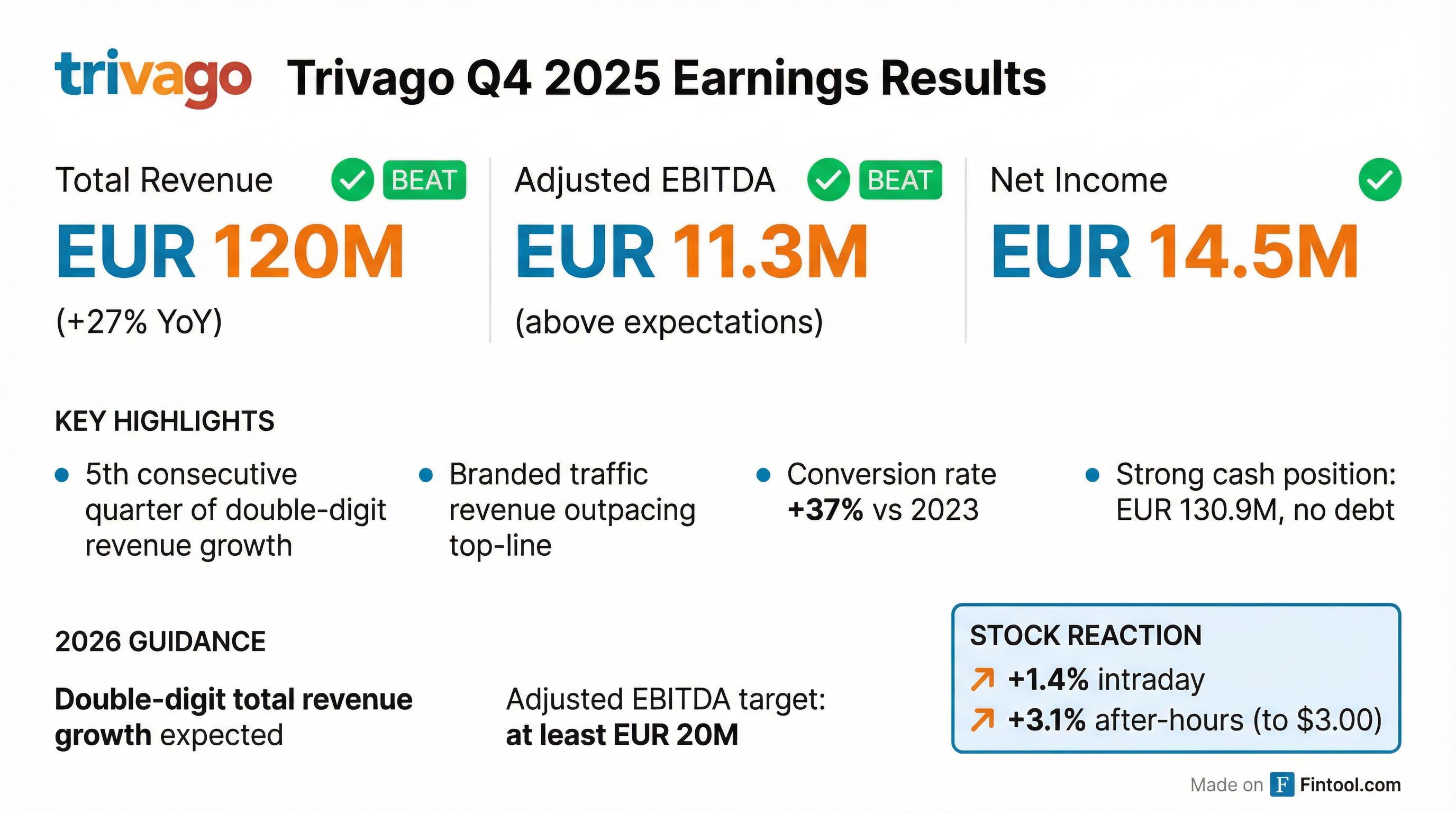

Trivago reported Q4 2025 results that exceeded expectations on both revenue and profitability, marking its fifth consecutive quarter of double-digit revenue growth. The company's turnaround strategy—centered on brand marketing investments, product improvements, and AI-powered features—is delivering tangible results, with management now targeting at least EUR 20M in adjusted EBITDA for 2026.

Did Trivago Beat Earnings?

Yes — convincingly. Trivago delivered a double beat with significant margin:

Revenue and EBITDA estimates converted from USD consensus. Values retrieved from S&P Global.

Total revenue of EUR 120M represented a 27% year-over-year increase, driven by strong branded channel traffic growth across all geographic segments. This marks the company's fifth consecutive quarter of double-digit top-line growth—a remarkable streak given tough comparables from early 2025.

The bottom line was equally impressive: net income of EUR 14.5M and adjusted EBITDA of EUR 11.3M came in "better-than-expected" according to management.

Revenue Growth by Segment

All three geographic segments delivered double-digit referral revenue growth despite ~5% FX headwinds:

Advertising spend increased across all segments as Trivago continued scaling its brand marketing investments—+43% in Americas, +31% in Rest of World, and +18% in Developed Europe.

What Did Management Guide?

For 2026, management provided confidence-inspiring guidance:

Management expects Q1 2026 to mark its sixth consecutive quarter of double-digit total revenue growth, with improved profitability compared to prior years.

Critically, the pace of brand marketing spend growth will slow in 2026. CEO Johannes Thomas noted the company is "getting closer to target brand marketing investment levels," meaning the compounding effects of past investments should drive progressively better margins.

"Unlike prior years, when profitable regions subsidized newly activated markets to a greater extent, we expect this slower growth in incremental brand marketing spend, combined with compounding effects of the past investments, to make us progressively more profitable in 2026 and beyond."

What Changed From Last Quarter?

Several key developments signal the turnaround is maturing:

1. ROAS Declined, But Strategically

Global return on ad spend fell from 162.9% to 147.9% as Trivago leaned into Latin American markets with different seasonality (peak travel in Q4) and opportunistically invested in new markets. This was intentional—management sees attractive returns from these investments.

2. Conversion Rate Hitting Records

Conversion is up 37% versus 2023, driven by AI-powered features and hundreds of experiments per quarter. This materially improves unit economics and makes marketing more effective.

3. Member Revenue Surge

Revenue from "locked-in members" now exceeds 25% of referral revenue—a 93% increase versus Q4 2023. Exclusive partner rates and personalized search are driving retention.

4. Trivago Book & Go Scaling

Revenue through the Book & Go funnel increased 137% versus Q4 2023, enabling a more seamless booking experience and higher conversion rates.

5. CPA Model Broad Adoption

Over 140 partners have adopted the transaction-based CPA model, now representing 25%+ of referral revenue. This helps smaller partners compete more effectively in Trivago's auction.

How Did the Stock React?

TRVG gained 1.4% intraday on February 4 and jumped an additional 3.1% after-hours to $3.00. The stock remains well off its 52-week high of $5.83 but has found support around the $2.70-$3.00 range.

AI Strategy: "Operate with 600 People as if We Were 6,000"

CEO Johannes Thomas was notably enthusiastic about AI's role in amplifying Trivago's capabilities:

"Our vision is to operate with 600 people as if we were 6,000. We are a fast, nimble team adopting AI in every possible way, using it to amplify our marketing impact with previously unimaginable features for our users and boost our team's productivity day by day."

Key AI initiatives now in production:

- AI Highlights: Summarize key hotel attributes

- AI Review Summaries: Synthesize user reviews at a glance

- AI Smart Search: Natural language hotel search (launched Q4 2024, first in the industry)

These features are "changing how people discover and evaluate hotels in every search on Trivago today."

Balance Sheet: Fortress Position

Trivago ended the year with an exceptionally strong balance sheet:

With no debt and substantial cash reserves, Trivago has ample flexibility to continue investing in growth while self-funding the turnaround.

Q&A Highlights

On guidance methodology change: CFO Wolf Schrömgens explained that Trivago will now only guide on total revenue (not referral revenue separately) because the Trivago Deals acquisition and Book & Go growth distort the referral revenue picture.

On aspirational targets: Management still aspires to approach pre-COVID revenue levels (~EUR 700-800M) but views this as an outcome of disciplined execution rather than a hard goal. The near-term focus is reaching ~10% adjusted EBITDA margin.

On travel trends: ADRs were positive in Rest of World, slightly negative in Americas and Developed Europe. Booked average values were positive except in Americas. The company noted a continued shift toward domestic travel for U.S. travelers and double-digit declines in inbound U.S. travel from Canada, Germany, and France.

On Trivago Deals/Holisto: The focus is on Book & Go as a conversion-driving channel, not white-labeling the tech stack to other OTAs.

Key Risks and Concerns

- Decelerating ROAS: While strategic, the declining return on ad spend (162.9% → 147.9%) could pressure margins if brand investments don't compound as expected

- FX Headwinds: ~5% global FX impact in Q4 could persist given EUR reporting

- U.S. Travel Weakness: Declining inbound travel to the U.S. and domestic-focused U.S. travelers may limit upside in the Americas segment

- Tough Comps Ahead: Management acknowledged Q1 and Q2 2026 face "tough comps" from strong prior-year periods

Forward Catalysts

- Q1 2026 earnings: Potential 6th consecutive double-digit growth quarter

- Brand marketing efficiency: Compounding effects as incremental spend slows

- Margin expansion: Path to ~10% adjusted EBITDA margin

- AI feature adoption: Continued rollout and optimization of AI-powered search

The Bottom Line

Trivago's Q4 2025 results validate the turnaround thesis that began when the leadership team returned in mid-2023. Five consecutive quarters of double-digit growth, improving unit economics, and a path to meaningful profitability make this a compelling transformation story. The EUR 20M+ EBITDA target for 2026 (vs EUR 15.8M in 2025) suggests management sees significant operating leverage ahead as brand marketing investments mature. The stock's muted reaction (+4.5% total) may reflect skepticism about sustainability—but the trajectory is undeniably positive.

Data sourced from Trivago Q4 2025 Earnings Call Transcript and S&P Global.

Related Links: