TWO HARBORS INVESTMENT (TWO)·Q4 2025 Earnings Summary

Two Harbors Announces UWMC Merger, Posts 3.9% Economic Return in Q4

February 3, 2026 · by Fintool AI Agent

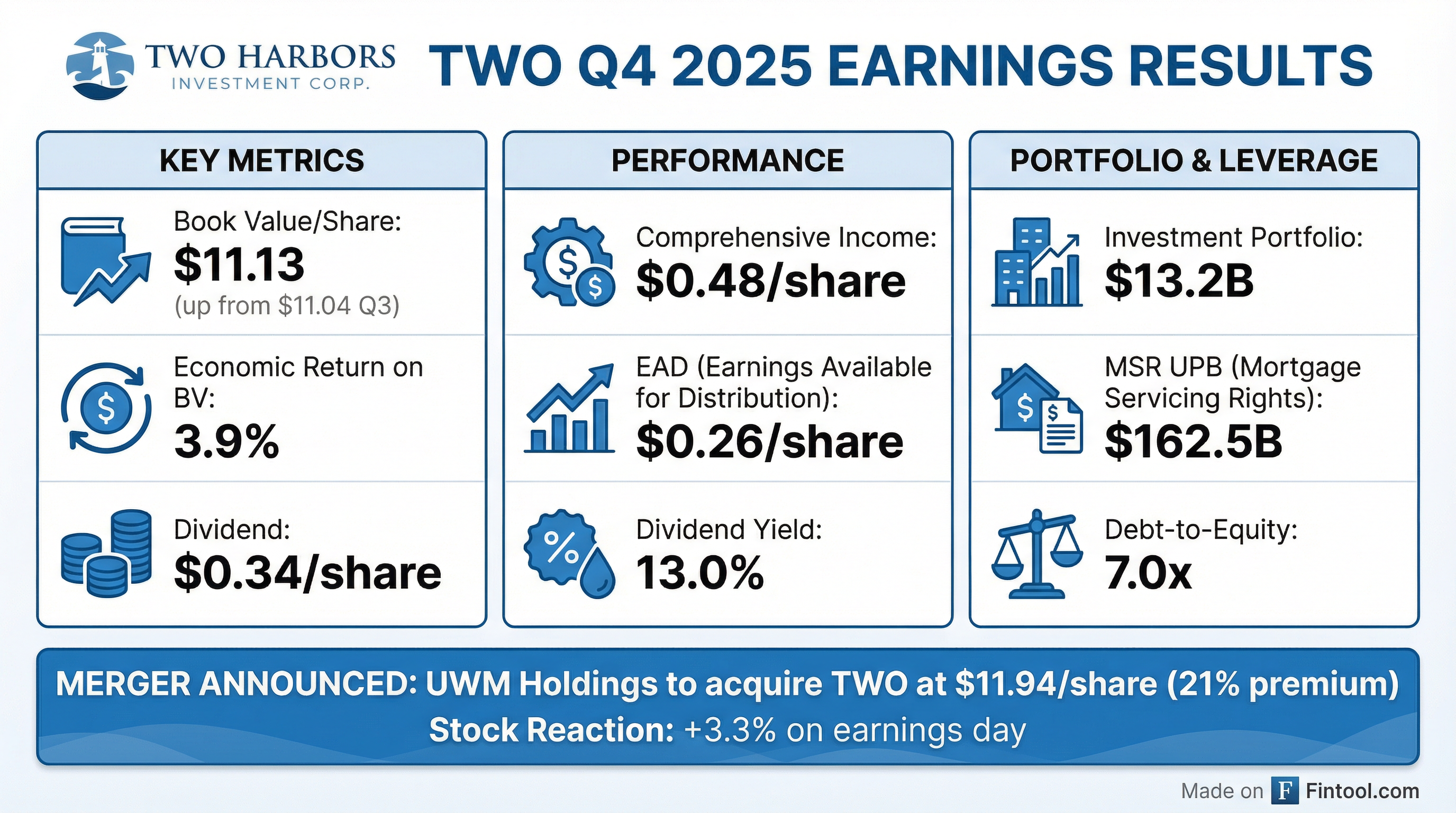

Two Harbors Investment Corp (NYSE: TWO) reported Q4 2025 results alongside the headline announcement: UWM Holdings Corporation will acquire the MSR-focused REIT in an all-stock transaction valued at $11.94 per share—a 21% premium to the 30-day volume-weighted average price.

The quarter marked a return to positive performance after a challenging 2025, with economic return on book value of 3.9% compared to -6.3% in Q3. Comprehensive income swung to $0.48 per share from a loss of $0.77 in the prior quarter.

Did Two Harbors Beat Earnings?

For mortgage REITs, traditional EPS metrics are less meaningful than book value changes and economic returns. Here's how TWO performed on the key metrics:

Earnings Available for Distribution (EAD) came in at $0.26/share, below the $0.36 consensus, primarily due to MSR sales that reduced servicing income. However, the 3.9% quarterly economic return—driven by RMBS performance in a lower-volatility environment—represents a meaningful improvement.

What Is the UWMC Merger Deal?

The transformative announcement: UWM Holdings Corporation—the nation's #1 mortgage originator—will acquire Two Harbors in an all-stock transaction.

Deal Terms:

- Exchange Ratio: 2.3328 shares of UWMC Class A common stock per TWO share

- Implied Value: $11.94/share based on UWMC's December 16, 2025 closing price

- Premium: 21% to TWO's 30-day VWAP ending December 16, 2025

- Tax Treatment: Intended to be tax-free to TWO stockholders

- Expected Close: Q2 2026, subject to TWO stockholder approval and regulatory approvals

- Preferred Stock: TWO preferred shares convert to equivalent UWMC preferred shares

Strategic Rationale: The combination creates a pro-forma MSR portfolio of approximately $400 billion UPB, doubling TWO's current scale. CEO Bill Greenberg called it "a very powerful strategic alignment" that "positions the combined company for accelerated growth."

Dividend Policy: TWO intends to continue regular quarterly dividends through merger close. No partial dividend will be paid for the quarter in which closing occurs.

How Did the Stock React?

TWO shares closed at $11.85 on February 2, up 3.3% on the earnings release. The stock is trading above book value ($11.13) but below the merger implied value ($11.94), reflecting typical merger arbitrage spread.

The stock has been volatile since the merger announcement in mid-December, with the arb spread narrowing as deal certainty increases.

What Changed From Last Quarter?

Improved:

- Economic Return: Swung from -6.3% to +3.9% quarterly return

- RMBS Performance: Lower realized and implied volatility drove positive returns across the Agency stack

- Leverage: Economic debt-to-equity declined to 7.0x from 7.2x

- Convertible Notes: $261.9M repaid in full on January 15, 2026 maturity

Deteriorated:

- EAD: Fell to $0.26 from $0.36, driven by lower MSR income post-sales

- MSR Portfolio: UPB declined to $162.5B from $175.8B after $9.6B sale

- Operating Expenses: Higher compensation and loan-level expenses

Portfolio Composition and Strategy

MSR Portfolio Characteristics:

- Weighted Average Gross Coupon: 3.55%

- 60+ Day Delinquencies: 0.9%

- 3-Month CPR: 6.4% (up from 6.0% in Q3)

- Only 3% of UPB has 50+ bps refinance incentive

What Did Management Say?

Bill Greenberg, CEO, on the merger:

"The acquisition of TWO by UWMC joins us with the country's number one mortgage originator and doubles the size of the MSR portfolio to a pro-forma $400 billion. This transaction creates, I believe, a very powerful strategic alignment of two high-quality organizations, and positions the combined company for accelerated growth and meaningful upside for shareholders."

Nick Letica, CIO, on portfolio performance:

"Our portfolio performed well in the fourth quarter, as RMBS returns benefited from lower realized and implied volatility as well as the re-emergence of the GSEs as a source of demand. Our MSR portfolio performed as it was designed to do and earned its carry."

On the market outlook:

"With the significant mortgage spread tightening realized in the fourth quarter and continuing into this quarter, spreads and volatility are back to pre-COVID levels, which makes the risk of owning RMBS more two-sided going forward and highlights the benefits of owning a portfolio of hedged MSR which is less sensitive to those spread movements."

Full Year 2025 Summary

The $375 million litigation settlement with the former external manager (PRCM Advisers) was the major drag on 2025 results. Excluding this one-time charge, the company generated solid double-digit returns.

Market Environment

The Fed delivered two 25 basis point rate cuts in Q4, in line with expectations. Key market developments:

- Yield Curve: Steepest since January 2022, with 2-year Treasury down 14 bps and 10-year up 2 bps

- Mortgage Spreads: Current coupon OAS tightened 23 bps; spreads now at pre-COVID levels

- GSE Support: Administration mandated GSEs to buy $200B of RMBS to tighten spreads

- Volatility: 2yr/10yr swaption implied vol fell to 79 bps, 4 bps below 10-year average

Risk Sensitivities

Book value exposure to rate and spread movements:

The company maintains hedged positioning that limits book value sensitivity to parallel rate shifts, though spread exposure remains meaningful.

Q&A Highlights

On Portfolio Strategy Post-Merger (Rick Shane, J.P. Morgan): CEO Greenberg confirmed they are "operating as an independent company" and "managing our portfolio as we normally would in the ordinary course." No tactical shifts due to the pending merger—investment decisions remain consistent with historical approach.

On Leverage and Mortgage Risk (Doug Harter, UBS): CIO Letica acknowledged the administration's clear intent to tighten spreads: "We have become a little more defensive this quarter... We have reduced our leverage a little bit, as well as our mortgage risk." He noted spreads are now "symmetric in terms of risks" or even "asymmetric" toward widening.

On GSE LLPA/G-Fee Changes (Bose George, KBW): Letica sees "a reasonable chance that there will be some changes on the LLPA grid" and believes the market has partially priced this in, though "it's a lot for the market to digest."

On Post-Quarter Book Value (Rick Shane, J.P. Morgan):

"We are up about 1.5%-2% as of Friday, January 30th."

On Dividend and Return Outlook (Trevor Cranston, Citizens JMP): CFO Dellal noted it's "too early to say what the trend will be on the dividend." Spreads have tightened ~5 bps since quarter end, marginally reducing return potential. Letica clarified that prospective returns would be "a little marginally lower" from the December 31st levels.

On Rate Volatility and New Fed Chair (Harsh Hemnani, Green Street): Letica expects "a mild amount of increase in volatility" as the new Fed chair nominee takes office: "It'll take a little bit of time to fully assess what he wants to do at the Fed." This supports their defensive positioning. Funding markets remain "stable" with no disturbances on the horizon.

On Coupon Positioning Post-GSE Announcement (Trevor Cranston): Year-to-date, lower coupons have seen the biggest positive impact from GSE buying, followed by current coupons. Higher coupons have actually widened slightly—"Some of the higher coupons are actually now wider on the year."

Direct-to-Consumer Platform Update

The DTC lending platform had a record quarter:

- Funded $94 million in first and second liens (up 90% from Q3)

- Additional $38 million in pipeline at quarter end

- Brokered $58.5 million in second liens (flat QoQ)

Despite its small size, management noted the platform is "punching above its weight"—critical for recapture capabilities in the MSR strategy.

Forward Outlook

Prospective Static Return: Management estimates quarterly static returns of $0.16-$0.31 per common share, translating to 5.8%-11.1% annualized return to common equity.

Post-Quarter Update: As of January 30, 2026, book value is up 1.5%-2% from quarter-end, driven by continued RMBS outperformance on GSE support announcements.

Key Catalysts:

- UWMC merger approval and closing (expected Q2 2026)

- Fed policy trajectory and mortgage spread dynamics

- Housing market activity and prepayment speeds

- Integration planning with UWM's origination platform

Key Takeaways

-

Merger transforms the story: The UWMC acquisition at a 21% premium is the headline—shareholders get exposure to the #1 mortgage originator with a $400B pro-forma MSR portfolio.

-

Solid Q4 recovery: 3.9% economic return after a brutal Q3, with RMBS benefiting from lower volatility and spread tightening.

-

Dividend maintained: $0.34/share quarterly dividend continues through merger close, providing 13% yield while waiting for deal completion.

-

MSR portfolio right-sized: Sold $9.6B UPB on subservicing-retained basis, reducing MSR exposure while maintaining servicing economics.

-

Balance sheet improved: Repaid $261.9M convertible notes, reduced leverage to 7.0x debt-to-equity.

View TWO Company Profile | Read Full Earnings Transcript | View Q3 2025 Earnings