TEXTRON (TXT)·Q4 2025 Earnings Summary

Textron Q4 2025 Earnings: Revenue Beats, Leadership Transition, Stock Down 4%

January 28, 2026 · by Fintool AI Agent

Textron (NYSE: TXT) reported Q4 2025 results that beat on revenue but disappointed on forward guidance, sending shares down over 4% to $90.19. Total revenue of $4.18 billion exceeded consensus estimates by 0.8%, while adjusted EPS of $1.73 came in essentially flat vs. the $1.74 Street expectation .

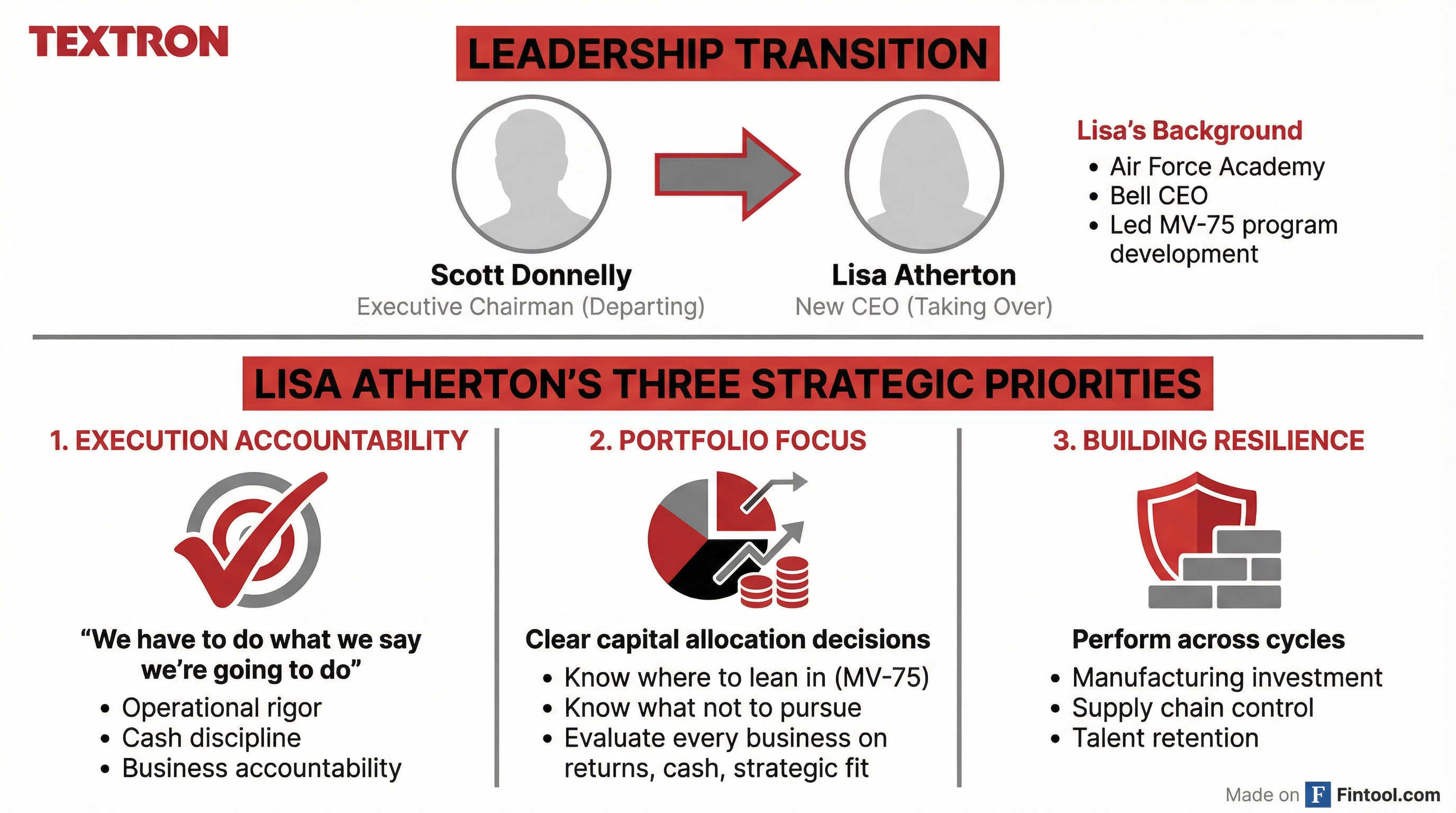

This was also a leadership transition moment—Scott Donnelly's final earnings call as Executive Chairman, with Lisa Atherton formally taking over as CEO after running Bell Helicopter .

The real story is the 2026 outlook: management guided adjusted EPS of $6.40-$6.60, meaningfully below the $6.84 consensus, as the company accelerates investment in Bell's MV-75 military helicopter program. Adding pressure: a potential $60-110M unfavorable catch-up adjustment when LRIP is awarded .

Did Textron Beat Earnings in Q4 2025?

Revenue increased 16% year-over-year from $3.61B in Q4 2024, driven by Aviation's strong recovery from the 2024 strike and continued military growth at Bell . Adjusted EPS grew 29% from $1.34 in the prior-year quarter .

For the full year 2025:

- Revenue: $14.8B (+8% YoY)

- Adjusted EPS: $6.10 (+11% from $5.48)

- Manufacturing cash flow before pension: $969M (+40% from $692M)

What Did Management Guide for 2026?

This is where the market found disappointment. Textron's 2026 outlook came in below Street expectations on the bottom line:

The EPS guidance miss is notable—management is projecting 5-8% earnings growth in 2026, but the Street had been modeling 12% growth. The gap is explained by accelerated investment in Bell's MV-75 program supporting the Army Transformation Initiative .

CEO Lisa Atherton framed the investment positively: "As we move into 2026, our momentum remains strong supported by significant bookings, healthy demand across our markets, continued program execution, and ongoing operational improvements. We are well positioned to continue investing in our products and capabilities to drive growth and long-term value for our shareholders."

How Did the Stock React?

Textron shares fell 4.3% to $90.19, opening at $94.95 but declining throughout the session as investors digested the below-consensus 2026 guidance.

The decline erases most of the stock's January gains. Heading into earnings, TXT was trading near its 52-week high of $96.98, up significantly from the 52-week low of $57.70. The stock remains above its 50-day average of $87.61 and 200-day average of $80.85.

The negative reaction suggests investors are concerned about the margin compression implied by the MV-75 investment ramp, even as management emphasizes the long-term revenue potential.

Who Is Textron's New CEO?

Lisa Atherton officially took over as CEO, making this Scott Donnelly's final earnings call after years building Textron into a diversified aerospace and defense powerhouse .

Lisa Atherton's Background:

- Air Force Academy graduate; contracts officer and civilian contractor at Air Combat Command

- Joined Textron in 2007, held leadership roles across Systems and Bell

- Previously CEO of Bell, where she led the Future Long-Range Assault Aircraft (now MV-75) program

Her Three Strategic Priorities:

-

Execution accountability: "We have to do what we say we're going to do." Each business must deliver on commitments with operational rigor and cash discipline

-

Portfolio focus: Clear capital allocation with deliberate decisions on where to lean in—like the MV-75 investment—and equally clear on what not to pursue

-

Building resilience: Investing in manufacturability, supply chain control, and talent retention to perform across cycles

On portfolio management, Atherton emphasized this isn't binary: "We have to evaluate every single business against the same criteria—returns, cash generation, and strategic fit for our long-term approach." She highlighted ATAC's success as an example of smart bolt-on growth, expanding from Navy fleet exercises to Air Force, Marines, and now the stand-off jammer contract with $450M+ backlog .

What Changed From Last Quarter?

Positives:

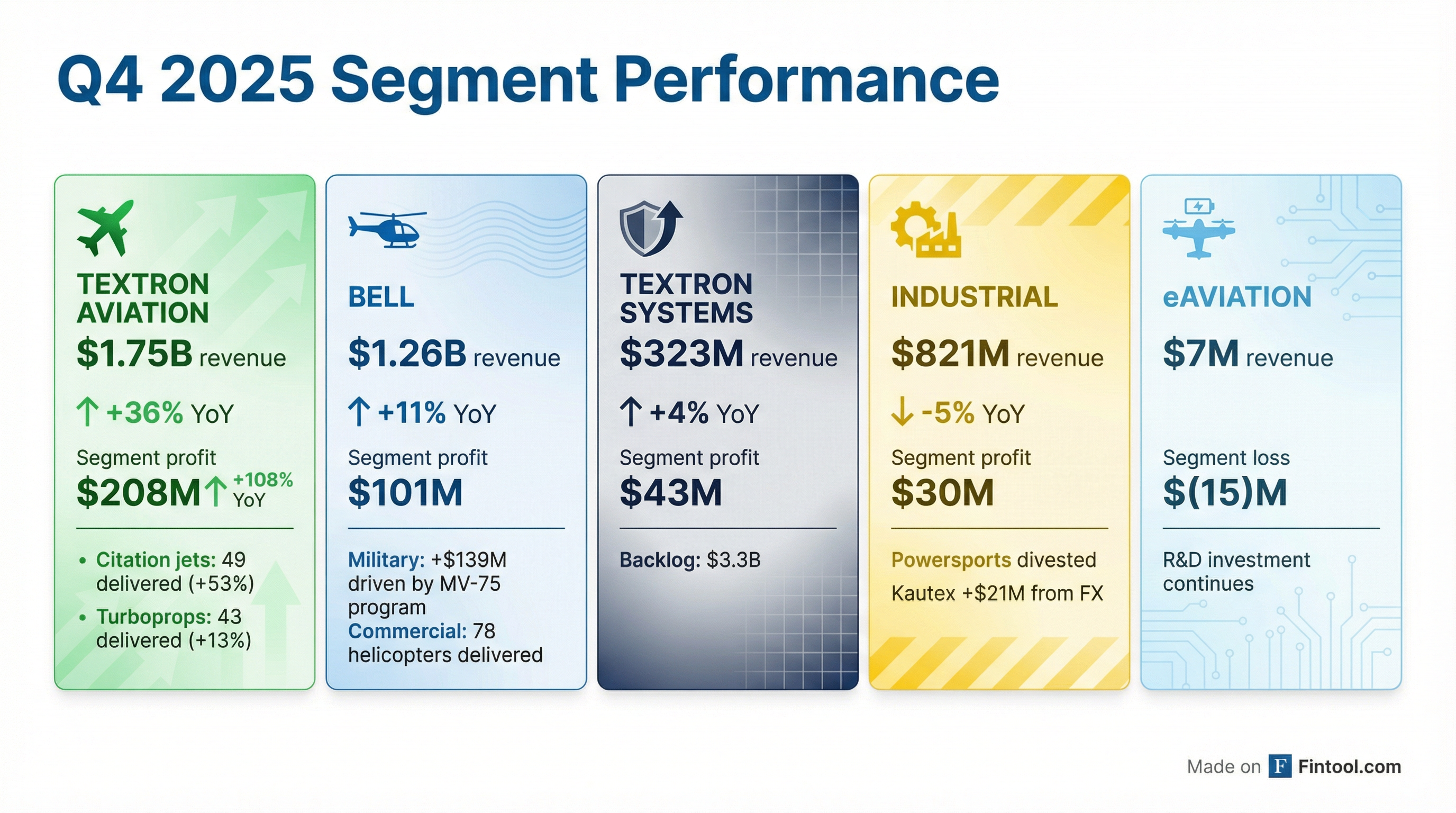

- Aviation delivered a blowout quarter with revenue +36% YoY as strike recovery accelerated

- Bell military revenue grew 20% for the second consecutive year

- Full-year manufacturing cash flow improved $277M year-over-year

- Returned $822M to shareholders through buybacks in 2025

Concerns:

- Industrial segment profit down $18M due to Powersports divestiture effects and higher costs

- 2026 guidance implies margin pressure from MV-75 investment

- Bell segment profit declined $9M despite revenue growth

Segment Performance Deep Dive

Textron Aviation — The Star of the Show

Aviation was the standout performer, recovering strongly from the late-2024 strike:

The segment completed three aircraft certification programs during 2025 while significantly growing volume .

Bell — Military Momentum, Commercial Softness

Military revenue increased $139M driven by the MV-75 program, but commercial revenue declined $11M on mix . The segment profit decline despite revenue growth signals the margin impact of the MV-75 investment ramp.

Textron Systems — Steady Performer

Systems delivered consistent results with "key wins positioning the business for growth" per management .

Industrial — Portfolio Restructuring Impact

The revenue decline was largely due to the Powersports divestiture (-$72M impact), while Kautex gained $21M from favorable FX. On an organic basis, revenue was "up slightly" . The segment profit decline reflects higher S&A costs and unfavorable mix.

What Did Management Say About MV-75 Acceleration?

The MV-75 program received extensive Q&A focus. Key takeaways from Lisa Atherton's detailed commentary:

Timeline Acceleration:

- Program pulled forward 2.5-3 years from original schedule

- Testing on first unit begins later this year; EMD aircraft deliveries through 2027

- LRIP deliveries start 2028—eliminating the original 2-year production gap

- Full-rate production expected within 5-6 years

Tangible Progress:

- 90%+ engineering drawings completed

- Nearly 2,000 Tier One and Tier Two suppliers on contract; 45,000 purchase orders issued

- New manufacturing capacity opened in Wichita (fuselage) and Fort Worth (Advanced Manufacturing Center, Drive Systems Test Lab, Weapon Systems Integration Lab)

- Manufacturing of components for first six aircraft underway

- 100% first-pass yield on parts—"the parts are coming out exactly as designed"

Financial Impact:

- Potential $60-110M unfavorable catch-up adjustment when LRIP contract awarded (expected late 2026/early 2027)

- Program will remain profitable after the adjustment

- CapEx elevated in 2026 and 2027, then normalizes as investment that would have been in 2028-29 is pulled forward

- Bell margins expected to stay "relatively steady" before benefiting from acceleration later in decade

Long-Term Upside:

- Ultimate opportunity is 40-60 units per year

- As program matures into initial production lots, Bell expected to return to double-digit margins

Q&A Highlights: What Else Did Analysts Ask?

On Aviation Supply Chain: Engines remain the key constraint. "Engines, as a key component which you have to have for these aircraft, has been a laggard for us, and we have to keep working with our partners there." Workforce attrition in early-tenure employees (1-2 years) also a challenge—Textron created an in-house training program to address .

On Concurrency Risk: Asked whether moving straight from EMD to LRIP creates risk, Atherton emphasized 15 years of development including 200+ flight hours on the demonstrator and digital engineering yielding 100% first-pass parts quality .

On Space as Growth Area: When asked about defense priorities, Atherton highlighted space as a focus: "The Department of War is also kind of leaning into that, and I would like to see us move into areas of the space side of defense."

On Scorpion Revival: Asked if the jet attack aircraft could return given DOD's new emphasis on commercial practices and affordability, Atherton said she hasn't heard specific demand but: "There is opportunity here, and we are positioned as a company that knows how to respond to that."

On Aviation Margin Cadence: CFO David Rosenberg expects seasonality similar to 2025—100-150 bps below midpoint to start the year, 100-150 bps above by year-end. Incrementals should be 20-25%, though 2025 came in at 15-20% due to factory efficiency gaps .

Capital Allocation and Balance Sheet

Textron continued aggressive capital returns while maintaining a solid balance sheet:

The company added $991M in new long-term debt during 2025, offset by $707M in repayments, ending with net long-term debt of $3.5B .

Forward Catalysts and Risks

Catalysts:

- MV-75 Acceleration: 40-60 units/year potential; Bell expected to return to double-digit margins as program matures

- Flight School Next: Bell selected to proceed to next phase of Army pilot training competition, leveraging 505 helicopter and Bell Training Academy (2,000 pilots/year)

- Japan T-6 Contract: First 2 Beechcraft T-6 aircraft to Japan's Air Self-Defense Force, with additional contracts anticipated; deliveries scheduled for 2029

- Aviation Backlog: $7.7B backlog with strong order flow; Denali program at 3,200+ hours of flight testing

- Systems Backlog Growth: +$700M YoY to $3.3B across ATAC, Marine Systems, and Land Systems

- Continued Buybacks: Diluted shares outstanding declined from 190M to 177M in 2025

Risks:

- LRIP Catch-Up Charge: $60-110M potential adjustment when LRIP awarded in late 2026/early 2027

- Margin Compression: MV-75 investment and higher CapEx ($650M vs $383M in 2025) pressuring near-term profitability

- Supply Chain Constraints: Engines remain a laggard; workforce attrition in early-tenure employees

- Commercial Helicopter Demand: Bell commercial revenue declined in Q4

- Industrial Transition: Powersports exit creating short-term headwinds

Management Credibility Check

Textron has beaten or met EPS estimates in 7 of the last 8 quarters:

The strong track record of meeting or exceeding expectations gives some credibility to management's decision to guide below consensus for 2026—they're signaling real investment rather than setting up an easy beat.

Key Takeaways

- Leadership transition: Lisa Atherton takes over as CEO from Scott Donnelly, bringing deep MV-75 expertise and a focus on execution accountability, portfolio discipline, and operational resilience

- Revenue strong, EPS in-line: Q4 beat on the top line (+16% YoY) but adjusted EPS of $1.73 matched expectations

- Guidance disappointed: 2026 adjusted EPS of $6.40-$6.60 is 4-6% below the $6.84 consensus, with potential $60-110M LRIP catch-up charge not included

- MV-75 accelerating: Program pulled forward 2.5-3 years; 90%+ drawings complete; first testing later this year; LRIP deliveries start 2028

- Aviation recovered: The segment delivered +36% revenue growth as strike impacts faded; Denali at 3,200+ flight test hours

- New wins: Flight School Next selection at Bell; Japan T-6 contract at Aviation; $3.3B Systems backlog (+$700M YoY)

- Stock reaction: Shares down 4.3% on the guidance miss

The question for investors: Is the MV-75 investment a prudent long-term bet worth accepting near-term margin pressure, or is management being too aggressive with growth investments at the expense of shareholder returns? Lisa Atherton's track record running the program at Bell—and her explicit accountability framework—will be tested.

Report updated by Fintool AI Agent on January 28, 2026 with Q&A highlights from earnings call transcript. Data sourced from company filings, S&P Global, and earnings call transcript.