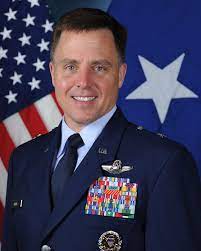

John F. Givens II

About John F. Givens II

John F. Givens II is Chairman and Chief Executive Officer of VirTra, Inc. (VTSI). He has served as a director since November 2, 2020, was named Co-CEO on April 11, 2022, became sole CEO on August 15, 2023, and was appointed Chairman effective July 12, 2024 . He holds a B.S. in Computer Science from the Florida Institute of Technology and served in the U.S. Army, with 20+ years of leadership in simulation/training, including building BISim’s U.S. business; he has been recognized with industry honors and service on the National Center for Simulation’s board of directors . Under his leadership, VirTra consolidated production into a state-of-the-art facility, advanced military end-market capture, and launched the V-XR headset-based training platform; he previously helped start, grow, and sell a simulation company for $200 million . The company’s 2025 annual meeting re-elected Givens with 4,434,960 votes for vs. 71,529 withheld, indicating strong shareholder support .

Past Roles

| Organization | Role | Years | Strategic Impact |

|---|---|---|---|

| VirTra, Inc. | Co-CEO | Apr 11, 2022 – Aug 15, 2023 | Transition leadership; launched performance-based equity framework continuation . |

| VirTra, Inc. | Chief Executive Officer | Aug 15, 2023 – Present | Consolidated production, progressed military end-markets, introduced V-XR platform . |

| VirTra, Inc. | Director | Nov 2, 2020 – Present | Board leadership culminating in appointment as Chairman in July 2024 . |

| Bohemia Interactive Simulations (U.S.) | Founder/President (U.S. business) | 2010 – (prior to VirTra) | Took military simulations from inception to production; scaled U.S. operations . |

External Roles

| Organization | Role | Years | Notes |

|---|---|---|---|

| Bohemia Interactive Simulations (BISim) | Military Board Advisor | Current | Advisor to global defense simulation software developer . |

| National Center for Simulation (NCS) | Director (appointment) | Not specified | Industry association board appointment; “Pioneer Awards” recipient for training innovations . |

Fixed Compensation

| Metric | FY 2023 | FY 2024 |

|---|---|---|

| Base Salary ($) | 349,860 | 354,361 |

| Cash Bonus ($) | 6,943 | 53,286 |

| Employment Agreement Base | Three-year agreement effective Aug 15, 2023; base $349,860 with automatic annual extensions and cost-of-living adjustments | Base increased to $360,499 effective July 1, 2024 (per amendment) |

- The CEO is eligible for an annual cash bonus at Board discretion rather than a fixed target percentage .

Performance Compensation

| Date/Period | Instrument | Performance Metric | Target/Threshold | Actual/Committee Action | Payout/Shares | Vesting/Settlement Notes |

|---|---|---|---|---|---|---|

| Apr 11, 2022 (grant) | Performance-based RSUs (288,889) | Net profit (12 months ending June 30 for 2022, 2023, 2024) | 2022: ≥$2.5m (tranches per +$0.5m); 2023: ≥$3.0m; 2024: ≥$3.5m; caps per year | Committee retains discretion to accelerate within overall cap | N/A (grant terms) | Tranches vest on last business day of August each year (2022-2024) per results . |

| Aug 31, 2022 | RSU vest/settle | Net profit FY trailing June 30, 2022 | ≥$2.5m | Achieved $2,720,015 | 7,407 shares to Givens (before tax withholding of 1,840) | Settled per plan . |

| Aug 2023 (for TTM 6/30/23) | RSU vest/settle | Net profit FY trailing June 30, 2023 | ≥$3.0m | Achieved ≥$4.5m | 29,360 shares to Givens (before 11,394 withheld) | Settled per plan . |

| Oct 2023 | RSU settlement | Committee discretion | N/A | Committee exercised discretion | 133,333 shares issued to Givens | Settlement under Compensation Committee discretionary authority . |

| Aug 2024 (for TTM 6/30/24) | RSU vest/settle | Net profit FY trailing June 30, 2024 | ≥$3.5m | Achieved ≥$6.5m and noted “significant achievements” | 118,519 RSUs vested; 46,367 withheld for taxes; 72,152 shares issued | Settled Aug 2024 per plan and committee . |

| FY 2023 | Stock Awards (grant-date FV) | N/A | N/A | N/A | $617,332 (summary comp table) | Reported compensation value . |

| FY 2024 | Stock Awards (grant-date FV) | N/A | N/A | N/A | $796,448 (summary comp table) | Reported compensation value . |

- Options: Company suspended option grants since Oct 1, 2017 and reported no options outstanding or exercisable as of Dec 31, 2024; CEO had no option awards outstanding .

- Equity Plan mechanics: The 2017 Equity Incentive Plan permits cancellation/exchange of underwater options or cash settlement without further stockholder approval, and provides for change-in-control acceleration for non-employee directors; committee may accelerate vesting for employees at its discretion .

Equity Ownership & Alignment

| As-of Date (Record) | Shares Beneficially Owned | % of Shares Outstanding |

|---|---|---|

| Aug 28, 2023 | 84,772 | <1% |

| Aug 26, 2024 | 236,341 | 2.1% |

| Aug 18, 2025 | 308,493 | 2.7% |

- Ownership trend shows increasing beneficial stake through vesting/settlements during 2023–2024 .

- Options: None outstanding at 12/31/2024 company-wide; CEO had no options .

- Pledging/Hedging: Company maintains an Insider Trading Policy; no specific pledging disclosures are noted in the proxy .

- Director equity pay policy (context): Non-employee directors receive monthly cash retainers and annual RSU grants (2,000 RSUs + 500 per committee; 1,000 per committee chair). Employee-directors historically receive no board compensation .

Employment Terms

- Agreement: Three-year employment agreement effective August 15, 2023; auto-renews for 1-year terms with upward cost-of-living adjustments; eligible for discretionary annual cash bonus and equity participation .

- Severance (outside Change-in-Control): If terminated without cause or resigns for good reason (non-CIC), severance equals 3x base salary (using the greater of current base or prior-12-month base) per precedent agreement; Givens’ agreement states termination/non-compete/indemnification terms are identical to Ferris’ .

- Change-in-Control (CIC) Economics: If within 36 months post-CIC the executive is terminated (other than death/disability/for cause) or resigns for any reason, severance equals 4x base salary (as defined); stock options vest immediately upon a CIC (plan also allows acceleration of awards; automatic for non-employee directors) .

- Restrictive Covenants: Two-year non-compete and non-solicitation post-termination under precedent terms (identical to Ferris’) .

- Clawbacks/Gross-ups: Not disclosed in cited documents.

Board Governance

- Roles: Givens serves as Chairman and CEO since July 12, 2024 (Chair) and August 2023 (CEO) .

- Independence: Board determined Ayers, Brown, Johnson, and Lt. Gen.(R) Gervais are independent; Givens is not independent. Majority-independent board .

- Dual-role safeguards: Board notes majority independence and the potential to appoint a lead independent director; executive sessions of independent directors to be held .

- Committees (2025):

- Audit: Ayers, Brown (Chair, “financial expert”), Johnson, Gervais .

- Compensation: Ayers (Chair), Brown, Johnson .

- Nominating & Corporate Governance: Johnson (Chair), Brown, Gervais .

- Attendance: Board held six meetings in FY2024; all incumbent directors attended .

- 2025 Shareholder Vote Results (signal): Givens re-elected with 4,434,960 For vs. 71,529 Withheld; auditors ratified with 7,421,360 For .

Compensation Structure Analysis

- Cash vs Equity Mix: 2024 total comp rose to $1.204m from $0.974m in 2023, with higher stock award value ($796k vs. $617k) and larger cash bonus ($53k vs. $7k), while salary remained roughly flat (cost-of-living increase mid-2024) .

- Performance Orientation: Large 2022–2024 RSU program tied to GAAP net profit thresholds with step-up tranches and committee discretion; 2023 and 2024 settlements were significant (133,333 shares discretionary in Oct 2023; 118,519 RSUs vested in Aug 2024) .

- Award Flexibility/Red Flags: The equity plan permits repricing/exchange/cash-out of underwater options without further shareholder approval; historically, the company ran a cash-redemption program for in-the-money options (now largely moot as options ceased and were eliminated) .

- Option Usage: Options suspended since 2017; as of 12/31/2024 there were no options outstanding, limiting “underwater incentive” risk but shifting emphasis to RSUs .

Performance & Track Record

- Operating/Strategic Execution: Under Givens, VirTra consolidated production into a modern facility, progressed military end-market opportunities, and introduced the V‑XR training platform—key initiatives for growth and margin scale .

- Leadership Capital: Prior to VirTra, Givens helped build and exit a simulation company for $200 million, aligning experience with VirTra’s defense and law enforcement training focus .

- Legal/Controversies: No legal proceedings involving Givens reported in last 10 years .

Director Service History, Committees, and Dual-Role Implications

- Board service since 2020; Chairman since 2024; CEO since 2023 .

- Committee roles: As an executive director/Chair, Givens is not listed on board committees; all committees are composed of independent directors (Audit—Brown Chair; Compensation—Ayers Chair; Nominating—Johnson Chair) .

- Independence: Board majority is independent; the dual CEO/Chair structure is acknowledged with potential for a lead independent director and use of executive sessions, partially mitigating governance risk .

Equity Ownership & Director Compensation (Board Context)

| Item | Policy/Practice |

|---|---|

| Non-employee Director Cash Retainer | $2,500 per month (paid quarterly) covering all meetings |

| Non-employee Director Equity | 2,000 RSUs annually + 500 RSUs per committee; 1,000 RSUs per committee for chairs |

| Employee Directors Board Pay | Historically, no compensation for board service |

Investment Implications

- Alignment: Givens’ stake increased to 308,493 shares (2.7%) as of Aug 18, 2025, reflecting meaningful skin-in-the-game via performance-based RSU settlements—positive for alignment with shareholders .

- Incentive Design and Timing: RSU vesting keyed to GAAP net profit with August settlements (plus committee discretion) concentrates vesting and potential trading windows around late Q3 each year; 2023 discretionary and 2024 performance-driven issuances are notable cadence markers for potential insider activity and share issuance supply (note: 2024 settlement included tax withholding of 46,367 shares, not open-market selling) .

- Governance Risk: Combined CEO/Chair role increases key-person and oversight risk; mitigants include majority-independent board, independent committee chairs, and executive sessions, but absence of a named lead independent director could be a focal point for governance-oriented investors .

- Contractual Economics: Robust severance (3x base) and CIC terms (4x base within 36 months post-CIC; award acceleration features) could be costly in a transaction scenario, but also support retention during strategic initiatives .

- Pay Trajectory: 2024 compensation skewed more to equity and higher cash bonus vs 2023; continued reliance on net profit as the primary performance metric concentrates management focus on profitability, which may be favorable for near-term operating discipline but is less balanced than multi-metric (e.g., revenue growth/TSR/ESG) frameworks used by larger peers .

Notes and sources: All data and statements are sourced from VirTra’s 2023–2025 DEF 14A proxy statements and 8‑K filings as cited: ; ; ; ; .