Wallbox (WBX)·Q3 2025 Earnings Summary

Wallbox Q3 2025 Earnings: Revenue Misses on AC Weakness, but Margins Hit Record High

Executive Summary

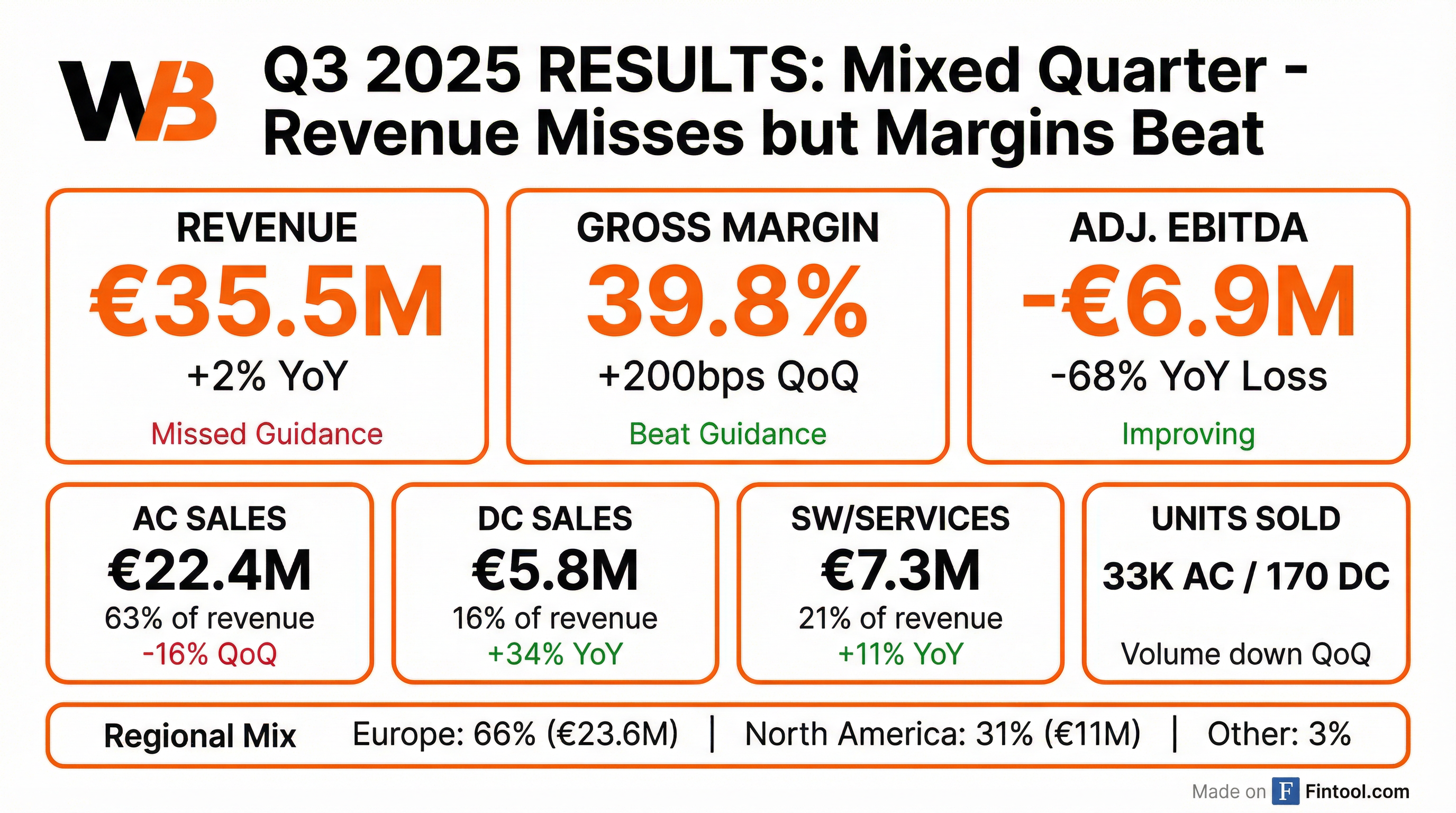

Wallbox reported mixed Q3 2025 results on November 5, 2025. Revenue of €35.5M fell short of guidance (€38-41M) and consensus expectations, down 8% sequentially but up 2% YoY. The miss was driven by weak AC charger sales across all regions due to product transitions and regulatory changes in Europe. However, the company exceeded expectations on gross margin (39.8%) and showed improving EBITDA losses. DC fast charging remained a bright spot with 34% YoY growth.

Key concern: A standstill agreement with banking partners expires December 9, 2025, creating near-term capital structure uncertainty.

Financial Results

Revenue & Margin Trend

Beat/Miss History

Track record: 2 beats / 6 misses over the last 8 quarters. Q3 2025 marked a return to missing consensus after two consecutive beats.

What Went Well ✓

DC Fast Charging Momentum (+34% YoY)

"DC sales have been the highlight of this quarter, reflecting the ongoing strong recovery we have seen during 2025. This category is showing strong growth compared to both last quarter, up 40%, and last year, up 34%." — Enric Asunción, CEO

- 170 DC units delivered in Q3, up from 140 in Q2

- New partnerships with SureCharge Corp (Canada) and Hera Group (Italy)

- New revolutionary DC product announcement coming soon

Gross Margin Expansion

- 39.8% gross margin beat guidance of 37-39%

- Drivers: Improved BOM costs, higher prices, carbon credits

- Inventory down 34% YoY to €50.8M, enabling more efficient replenishment

Cost Discipline Continues

- Labor + OpEx down 28% YoY (-€9M)

- Cash costs down 34% YoY

- CapEx down 82% YoY to €0.3M

What Went Wrong ✗

AC Sales Weakness (-16% QoQ)

"The largest offender has been AC sales across all global regions. In the case of Europe, there have been operational headwinds and changing product regulation creating delivery challenges." — Enric Asunción, CEO

- AC sales of €22.4M down 16% QoQ and 5% YoY

- Radio Equipment Directive in EU forced product transition to higher-priced units

- Pulsar Max platform transition created delivery delays

- Canada EV sales down 49% YoY due to tariffs on Chinese EVs and end of iZEV incentives

Revenue Miss vs Guidance

- Revenue of €35.5M missed guidance of €38-41M

- Also missed consensus of $44.9M (€40.8M equivalent) by ~9%

Balance Sheet Concerns

- Cash position declined to €27.7M

- Total debt of €179M (€67M long-term, €112M short-term)

- Standstill agreement with majority of banking pool expires December 9, 2025

Segment Performance

Stock Price Performance

Q4 2025 Guidance

Guidance implies sequential revenue improvement of 1-10% and continued margin stability.

Management Commentary Evolution

Q2 2025 Tone (Optimistic)

"We may print a stronger second half of the year... I strongly believe that the global platform we have built with an innovative product portfolio is leading the industry."

Q3 2025 Tone (Cautious)

"Q3 revenue landed at EUR 35.5 million, below our expectations... Even though we are not yet where we want to be, the positive trend is clearly visible, and we make incremental steps each quarter."

Notable shift: Management has pivoted from optimism about H2 growth to acknowledging execution challenges while emphasizing steady progress toward profitability.

Q&A Highlights

On European Market Share (George Gianarikas, Canaccord Genuity)

"In countries like Spain, France, Belgium, the U.K., and Germany, our market share remains stable or trending up. And markets like Netherlands, Italy, and the Nordics, we've seen this quarter a trend going down."

On Debt Restructuring Timeline

Q: "When should we expect a formal announcement on the €179M in debt?" A: "The standstill matures as of the 9th of December, and so that's what we're working towards." — Luis Boada, CFO

Key Takeaways

- Revenue disappointed but primarily due to temporary factors (regulatory transitions, product platform switches)

- Margins are at record highs and sustainable with BOM improvements and carbon credits

- DC fast charging is the growth engine, with partnerships and new product pipeline

- Balance sheet is the key risk — banking standstill expires Dec 9, 2025

- Path to profitability is visible but requires revenue recovery to accelerate

Related Links

Data sources: Company filings, earnings call transcript, S&P Global. All EUR figures as reported by the company; USD conversions where applicable.