Expion360 (XPON)·Q4 2025 Earnings Summary

Expion360 Surges 34% After Hours on 71% Revenue Growth in FY 2025

January 28, 2026 · by Fintool AI Agent

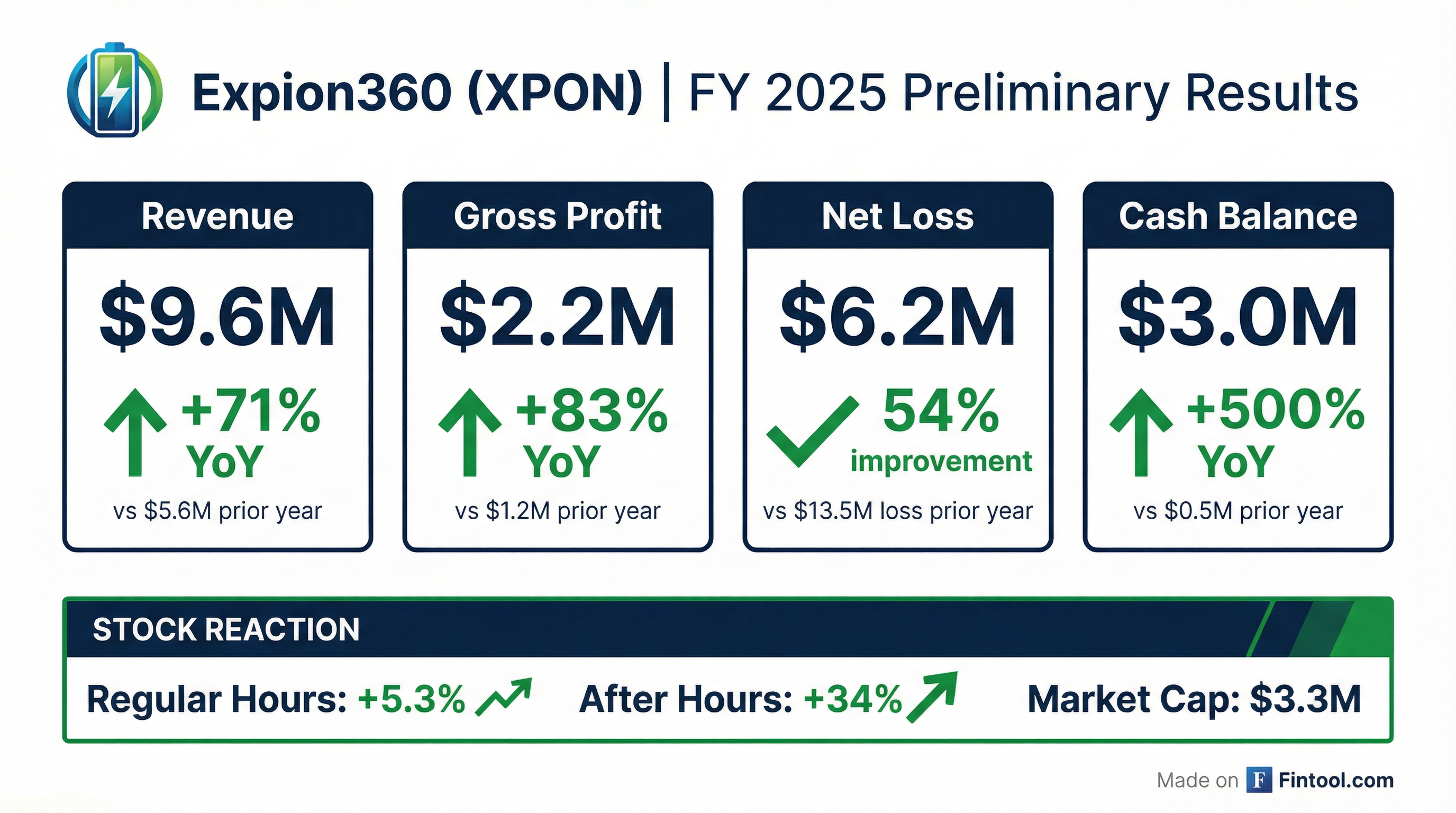

Expion360 (NASDAQ: XPON), the lithium-ion battery storage company, announced preliminary FY 2025 results showing revenue of approximately $9.6 million—a 71% surge from $5.6 million in 2024—while cutting its net loss by more than half. The microcap stock jumped 5.3% in regular trading and then rocketed another 34% in after-hours to $1.21 as investors reacted to the RV market recovery and improved financial trajectory.

Did Expion360 Beat Expectations?

With limited analyst coverage (only one analyst tracking revenue estimates), there's no meaningful consensus to judge a "beat" or "miss." However, the magnitude of improvement speaks for itself:

The gross margin expansion is particularly notable—gross profit grew 83% on 71% revenue growth, suggesting improved unit economics and pricing power.

Important caveat: These are preliminary, unaudited figures subject to change after year-end accounting procedures and audit completion.

What's Driving the Growth?

CEO Joseph Hammer attributed the results to three factors:

- RV Market Recovery — The recreational vehicle market, a core end market, has rebounded

- OEM Expansion — Expanded outreach to original equipment manufacturers

- Product Sales Focus — Emphasis on direct product sales growth

The company currently sells through more than 300 dealers, wholesalers, private-label customers, and OEMs.

What Did Management Guide?

While the company didn't provide explicit FY 2026 revenue guidance, management outlined several new growth initiatives:

- Industrial & Construction Expansion — New vertical targeting outside traditional RV/marine markets

- Surveillance & Monitoring Solutions — Specialized energy storage for security applications

- Technology Roadmap — Portfolio expansion and new revenue stream development

- Distribution Growth — Continued expansion of OEM and dealer relationships

"As we move into 2026, new initiatives include expansion into the industrial and construction sectors, development of specialized energy storage solutions designed to support surveillance and monitoring applications, and implementation of a technology improvement roadmap to broaden our portfolio and add new revenue streams." — Joseph Hammer, CEO

How Did the Stock React?

The market responded emphatically:

With a market cap of just ~$3.3 million, XPON is a microcap stock subject to high volatility. The stock has traded between $0.60 and $5.50 over the past 52 weeks.

What Changed From Last Quarter?

Comparing the quarterly trajectory reveals consistent improvement:

*Q4 2025 revenue implied from FY guidance (~$9.6M) minus Q1-Q3 reported ($7.4M)

Key observations:

- Revenue doubled YoY — Every 2025 quarter exceeded its 2024 counterpart

- Q3 2025 turned profitable — First profitable quarter with $0.7M net income

- Gross margins stabilized — Consistently in the 20-25% range after Q3 2024 weakness

Risks and Concerns

Investors should note several risk factors:

- Preliminary Data — Figures are unaudited and may change after year-end procedures

- Microcap Volatility — At ~$3.3M market cap, the stock is highly volatile and thinly traded

- Still Unprofitable — Despite improvement, the company lost $6.2M in FY 2025

- Limited Analyst Coverage — No EPS estimates; difficult to benchmark expectations

- End Market Concentration — Heavy reliance on RV market, which is cyclical

- Competitive Pressure — Larger players (Tesla Energy, Enphase, etc.) dominate the broader energy storage market

The Bottom Line

Expion360's preliminary FY 2025 results show a small company executing a turnaround: revenue up 71%, losses cut in half, and a cash position that's no longer existential. The 34% after-hours move suggests the market believes this trajectory can continue.

The key questions for 2026: Can the company sustain this growth as it expands beyond RV into industrial applications? And can it reach profitability before needing additional capital?

Watch for the audited results and full 10-K filing in the coming months for confirmation of these preliminary figures.

Related Resources: