17 Education & Technology Group (YQ)·Q2 2025 Earnings Summary

Executive Summary

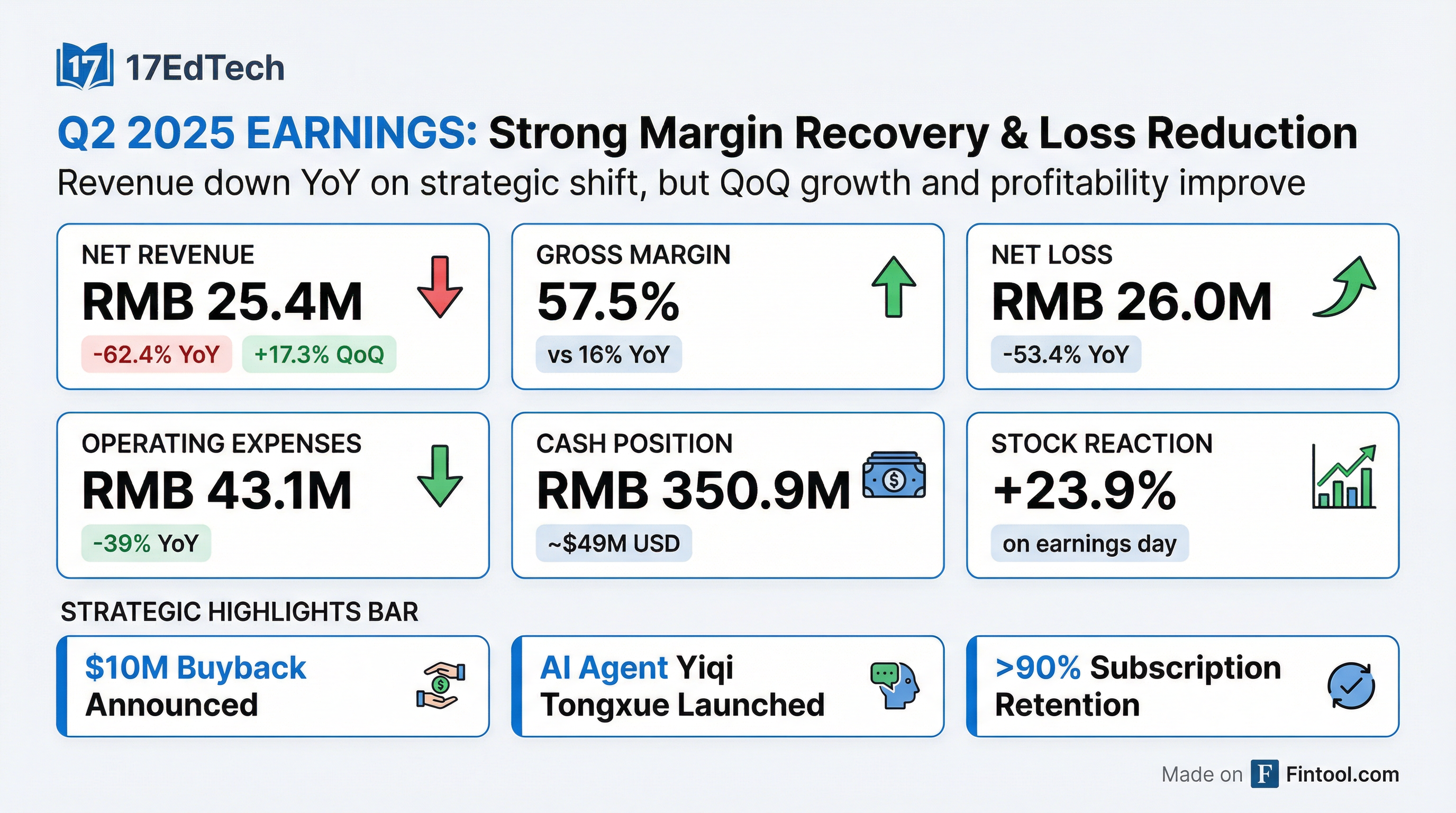

17EdTech (YQ) reported Q2 2025 results on September 4, 2025, with a +23.9% stock surge on the announcement day—the best earnings reaction in at least 5 quarters. While revenue declined 62.4% YoY due to strategic pivot from district-level projects to school-based subscriptions, the company showed dramatic improvement in profitability metrics: gross margin jumped to 57.5% (vs 16% YoY), net loss narrowed by 53.4%, and operating expenses fell 39% YoY.

The company announced a $10 million share buyback program and launched the Yiqi Tongxue AI intelligent agent—signaling confidence in the business transformation and AI-driven growth strategy.

Stock Price & Earnings Reactions

Q2 2025 stood out as a turning point—the first positive earnings reaction since the company's strategic pivot began.

Financial Results

Q2 2025 Key Metrics

*Source: *

8-Quarter Trends (RMB Millions)

Source: Company filings

What Went Well ✓

1. Gross Margin Recovery

"Our commitment to cost control restored the gross margin to a normalized level of 57.5% in quarter two."

The massive margin improvement from 16% in Q2 2024 reflects the shift away from low-margin hardware-heavy district projects toward higher-margin SaaS subscriptions.

2. Operating Efficiency

"As we improved our operating efficiency continuously, operating expenses decreased by 39%, leading to a 53.4% reduction in net loss on a GAAP basis."

3. Subscription Business Momentum

"School-based subscription model has led to an encouraging year-over-year and quarter-over-quarter growth... over 90% of renewal customers opted to continue their subscriptions."

4. AI Product Launch

"We launched the Yiqi Tongxue intelligent agent... built on 14 years of teaching experiences and extensive behavioral data."

5. Share Buyback Announcement

"The company's board of directors has approved a share repurchase program... authorized to repurchase up to $10 million of the company's ADS."

What Went Wrong ✗

1. Revenue Decline

Revenue fell 62.4% YoY due to the deliberate pivot away from district-level projects. While strategic, this creates near-term revenue headwinds.

2. Continued Losses

Despite improvement, the company is still unprofitable with net loss of RMB 26M. At current burn rates, the RMB 350.9M cash position provides ~13 quarters of runway.

3. Revenue Recognition Timing

"The subscription model requires a longer period of revenue recognition."

Management Commentary

Strategic Pivot

"We prioritized our resources on school-based projects and the subscription model... This upward trajectory not only contributes significantly to our revenue, but also enhances customer engagement and loyalty."

AI Integration Strategy

"We strive to upgrade AI capabilities of our product offerings to deliver more efficient, satisfying solutions to customers. We launched the Yiqi Tongxue—an intelligent agent that serves as a teaching assistant that alleviates teachers' workload, a smart learning companion that supports students in targeted learning, and functions as a data intelligent brain that provides data support for managers."

Distribution & Scale Initiative

"We partnered with the National Engineering Research Center for Intelligent Technology and Applications in Internet Education to launch a public welfare initiative: AI Empowerment for Hundreds of Districts, Thousands of Schools, and Tens of Thousands of Teachers."

Outlook

"We are committed to continuously innovating and enhancing our core product portfolio while empowering educational communities through advanced AI-driven content solutions."

Prior Quarter Comparison

Evolution of Management Tone

In Q4 2024, management highlighted margin pressure from a "legacy moral education project" that dragged results.

By Q1 2025, the focus shifted to "AI-powered product upgrades" with trials in 50+ schools.

Q2 2025 represents a clear inflection point with normalized margins, formal AI product launches, and capital return via buybacks.

Q&A Highlights

No questions were asked during the Q&A session.

Key Takeaways

Links

- Company: /app/research/companies/YQ

- Transcript: /app/research/companies/YQ/documents/transcripts/Q2-2025

- Prior Earnings: /app/research/companies/YQ/earnings/Q1-2025